Thousands of Russian enterprises are under sanctions. For participants in international transactions, cooperation with such companies implies the emergence of a compliance risk and may lead to the blocking of the transaction by foreign banks. At the same time, restrictions are also applied to companies controlled (more than 50%) by an entity under sanctions, even if the companies are not directly included in the list of sanctions.

When checking the counterparty, it is important to make sure that the transaction with a Russian business partner does not carry risk and will not lead to fines or even criminal liability.

Given the scale of the restrictions applied, compliance with sanctions imposes a serious burden on business. Therefore, in the current conditions, when developing Globas, we focused on the operational implementation of tools that will help to support your business and remove routine work from specialists conducting counterparty checks.

A new report, Sanctions risks, has been added to Globas. The report helps to automate the sanctions verification processes.

New tools allow to:

- verify legal entities, sole proprietors, divisions and persons for entry into the sanctions lists of the UN Security Council, Russia, the USA, the European Union, Great Britain, Switzerland, Canada, Japan, Australia, Ukraine;

- check companies for secondary sanctions (50 Percent Rule);

- check whether the company has managers and shareholders under sanctions and restrictions;

- verify affiliated companies for sanctions risk;

- get a printed report and set of documents on the performed check.

Our experts have already installed all the necessary settings for the Sanctions risks report in users' accounts. Optionally, you can adjust the verification criteria, activities, sources, summary and final Report type in accordance with corporate regulations.

Currently, connecting to the service does not require any extra fee or the need to enter into an additional agreement. The report on Sanctions risks is available as the part of the current subscription to Globas, including for new subscribers.

In our Newsletter you can find answers for questions: what sanctions are mandatory for Russian entities? Which countries are beneficiaries of the introduction of new restrictions?

Sanctions in numbers

The Russian entities are obliged to comply only with the sanctions of Russia itself and of the UN Security Council, of which Russia is a permanent member, thereby coordinating the introduction of restrictions.

At the same time, depending on the specifics of the business, it is necessary to take into account the presence of sanctions risks for many companies and individuals. For branches of foreign entities, banks, non-residents of the Russian Federation and companies that have contracts with foreign partners and conduct settlements in foreign currency, checking for sanctions risks becomes a necessary measure.

Since the end of 2021, the global sanctions rhetoric has been gaining momentum.

Currently, the most discussed types of sanctions are blocking and sectoral. Blocking sanctions prohibit any trade transactions with specific individuals and legal entities. All property of legal entities and individuals under blocking sanctions is considered "frozen" and cannot be used.

Sectoral sanctions prohibit transactions in certain sectors of the economy. For instance, a ban on the supply of weapons and dual-use goods, restricting access to the foreign capital market for companies in the energy sector.

The beneficiaries of the introduction of new sanctions and restrictions are the United States, the European Union and the United Kingdom, once in a while introducing new restrictive measures several times a day.

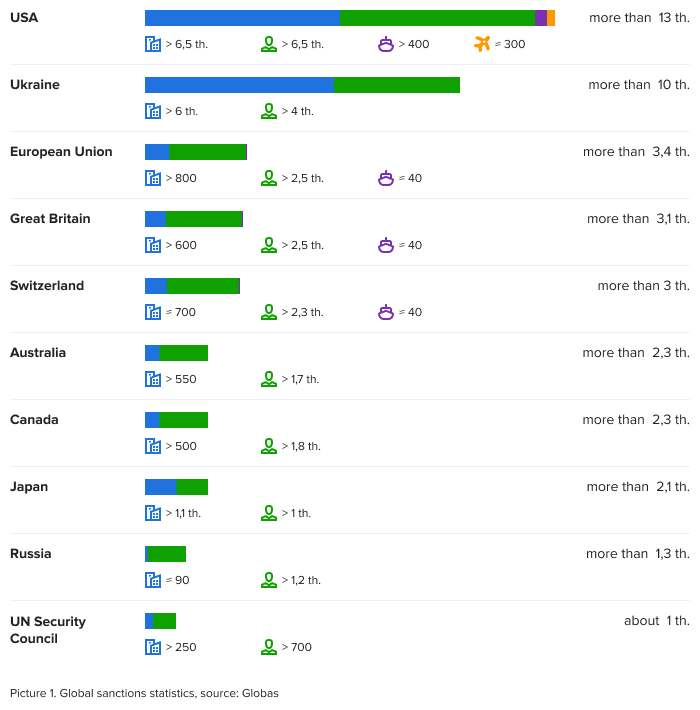

For the entire duration of the sanctions regimes of various countries, the number of companies, persons, air and water transport that have been sanctioned has exceeded 42 thousand. Of these, over 2,6 thousand Russian companies have been directly sanctioned.

The United States lead in the number of restrictions imposed: more than 13 thousand entities are under direct sanctions. Such a large number of restrictions is explained by the fact that in the United States, sanctions and restrictions are imposed by several government departments at once.

This is followed by Ukraine – over 10 thousand restrictions.

Russia has currently imposed restrictions on 1,332 entities.

Sanctions check

There is no unified consolidated global sanctions list. The departments of each country and international organizations make their own list in the national language. Sometimes information is published only in printed pdf format, which makes it difficult to verify. Therefore, an independent search is very labor-intensive and does not guarantee an accurate test result.

At the conclusion of the transaction, high-quality and fast verification of suppliers and manufacturers of goods on the sanctions lists is a necessity. The company's assets can be blocked for a single deal with a company included in one of the sanctions lists.

| Now we can offer you an automated check against global sanctions lists in the Information and Analytical system Globas. All information on sanctions risks is available in the company report. If you do not have Globas access yet, apply for a free trial, and check if your counterparties are in the sanctions lists. Free trial request |

To disclose the financial condition of the organization in dynamics, in order to attract investors and enter the international level, consolidated financial statements (CFS) are provided.

The CFS indicators include systematized information reflecting the results of joint activities and financial situation of a group of companies in accordance with International Financial Reporting Standards / IFRS (cl. 2, art. 1 of the Law dated July 27, 2010 No. 208-FZ).

CFS compilers

As opposed to individual financial statements, consolidated statements are intended to reflect information in relation to several interrelated organizations operating as a single economic unit. The list of legal entities required to provide consolidated reports, in accordance with par.1.2 of Art. 2 of Law No. 208-FZ, includes:

- clearing, credit institutions and insurance companies (except for those operating in the field of compulsory medical insurance);

- non-state pension and investment funds, including their holding companies;

- Joint-stock companies and unitary state-owned enterprises according to the approved government lists;

- companies with securities admitted to organized trading;

- other business entities if there are requirements in legislative acts or constituent documents.

The compilers are holdings and concerns that have subsidiaries, including those abroad. The report contains reliable information about the interrelated group and informs about the interaction between the holding and controlled entities.

Submission and disclosure of information

CFS is provided to shareholders or owners of property assets as prescribed by regulations or constituent documents, as well as to the Central Bank (except for joint-stock companies and unitary enterprises of the non-banking sector) after an audit (Article 4.5 of the Law No. 208-FZ). Reporting deadlines:

- annual - 120 days after the end of the year;

- interrim - 60 days after the end of the reporting period.

Mandatory condition: disclosure of CFS by posting in information systems or publication in the media accessible to all interested users, regardless of the purpose of obtaining information. The placement period is 30 days from the end of the submission period.

Penalties

Officials are brought to administrative responsibility in case of failure to submit reports or revealing misrepresentation of figures (Art. 15.15.6 of the Code of Administrative Offenses of the Russian Federation). Depending on the type and size, penalties from 1,000 RUB are applied for a primary minor violation, for example, for a deviation of any of the figures from 1% to 10% within 100,000 RUB, and up to 50,000 RUB for a repeated gross violation, such as fictitious data in accounting or refusal of audit.

Analysis of financial stability

For owners and investors, the economic stability of the group, which is able to maintain balance in the face of changes in the external and internal environment, is important. In order to check the solvency, the following should be assessed:

- the possibility of timely repayment of obligations;

- the level of provision of reserves and costs with sources of financing;

- availability of hard-to-sell and highly liquid assets;

- debt to equity ratio.

When analyzing the consolidated financial statements, it is necessary to exclude settlement transactions within the group that lead to the distortion of the resulting figures. Proper assessment of counterparties will help in choosing reliable business contacts.