Current ratio of Russia’s coal mining companies

Credinform Information Agency is coming with the ranking release of coal mining companies upon their current ratio (liquidity ratio). Ten Russian companies of coal mining industry with the largest sales revenue (as by Statistics Register 2011) were selected. They were first ranged upon the turnover and then upon their current ratios.

The current ratio shows which part of current assets is to be taken to discharge current liabilities, and is calculated as current assets/liabilities correlation. This ratio helps investors to evaluate and to expect certain business performance as well as the chance of getting bankrupt. The ideal ratio value is between 2 to 3 but when analyzing, it is better to consider the current ratio together with other financial indicators such as liquidity ratio and insolvency level.

| № | Company Tax-number (INN) | Region | Turnover in 2011, mln RUB | Current ratio, % | GLOBAS-i® solvency index |

|---|---|---|---|---|---|

| 1 | "Chernigovets" JSC INN: 4203001913 | Kemerovo Region | 16 320,19 | 4,65 | 193 (highest) |

| 2 | OJSC "Mine "Zarechnaya" INN: 4212005632 | Kemerovo Region | 18 717,93 | 2,63 | 257 (high) |

| 3 | CJSC "Stroyservis" INN: 4234001215 | Kemerovo Region | 43 169,13 | 2,28 | 202 (high) |

| 4 | JSC Obyedinennaya Ugol’naya companiya Uzhkuzbasugol’INN: 4216008176 | Kemerovo Region | 43 169,13 | 2,28 | 202 (high) |

| 5 | JSC Vorkutaugol INN: 1103019252 | The Komi Republic | 35 167,76 | 2,15 | 209 (high) |

| 6 | OJSC "Kuzbasskaya Toplivnaya Company" INN: 4205003440 | Kemerovo Region | 20 683,52 | 1,51 | 176 (high) |

| 7 | Vosibuglesbyt LLC INN: 3808168112 |

Irkutsk region | 13 949,18 | 1,3 | 272 (high) |

| 8 | OJSHC Yakutugol INN: 1434026980 | The Sakha (Yakutia) Republic | 34 558,49 | 0,64 | 242 (high) |

| 9 | JSC "Coal company "Kuzbassrazrezugol" INN: 4205049090 | Kemerovo Region | 60 858,94 | 0,6 | 210 (high) |

| 10 | OJSC SUEK-Kuzbass INN: 4212024138 | Kemerovo Region | 33 306,46 | 0,41 | 265 (high) |

"Chernigovets" JSC holds the top line, with current ratio 4,65% higher than the ideal value – current assets exceed current liabilities here. The greatest deal of current assets goes for financial investments and receivables, i.e. liquid real assets. This is a clear sign that the company has a positive financial result – a proof comes from GLOBAS-i® highest solvency index, too.

Four companies – OJSC "Mine " Zarechnaya ", CJSC "Stroyservis", JSC Obyedinennaya Ugol’naya companiya Uzhkuzbasugol’ and JSC Vorkutaugol – made their current ratio reach the ideal value – they also got GLOBAS-i® high solvency index.

Five companies – OJSC "Kuzbasskaya Toplivnaya Company", Vosibuglesbyt LLC, OJSHC Yakutugol, JSC "Coal company "Kuzbassrazrezugol" and OJSC SUEK-Kuzbass – have their current ratio lower than the ideal value – current assets either do not exceed current liabilities – in case they do, the difference is rather small. However, OJSC "Kuzbasskaya Toplivnaya Company" got GLOBAS-i® highest solvency index, while the rest of the companies got high index. It is therefore absolutely necessary to take a comprehensive approach in order to make a right evaluation of company’s financial stability – relying on one indicator will most certainly make the evaluation go false.

Net profit ratio of cereals and leguminous plants suppliers of Russia.

Credinform Information Agency is coming with ranking release of Russian cereals and leguminous plants suppliers. The ranking list includes industry's largest companies and is based on net profit ratio as stated in Statistics register, with the reference period of 2011.

Net profit ratio (%) is a relation of overall net profit (loss) to net sales, and it is used to analyze company’s annual financial results. It shows how profitable were sales and how effective was financial management of a company, as well marketing and logistics policies. The higher is net profit ratio, the more profitable business is. Worth mentioning, however – agriculture companies do usually have a lower net profit ratio than the companies in other sectors; net profit ratio here is heavily dependent on climatic factors such as drought, torrential rains etc. that are hard to predict.

| № | Company | Taxpayer identification number | Region | Turnover in 2011, mln RUB | Net profit ratio (%) | GLOBAS-i® Solvency index |

|---|---|---|---|---|---|---|

| 1 | Zolotaya Niva Limited Liability Company | 2635049370 | Stavropol Territory | 1 886,6 | 23,67 | 208(high) |

| 2 | AVANGARD-AGRO-Voronezh Limited Liability Company | 3666128249 | Voronezh region | 1 389,2 | 23,31 | 276(high) |

| 3 | Agrotechnologii Limited Liability Company | 6803120472 | Tambov region | 1 484,3 | 16,33 | 289(high) |

| 4 | Krasnoyaruzhskaya Zernovaya Closed Joint Stock Company | 3113001402 | Belgorod region | 2 115,7 | 13,27 | 267(high) |

| 5 | Agroobyedinenie Kuban Joint Stock Company | 2356045713 | Krasnodar Krai | 2 479,9 | 10,24 | 258(high) |

| 6 | Dobrynya Limited Liability Company | 4804005574 | Lipetsk region | 1 491,3 | 9,83 | 243(high) |

| 7 | Joint Stock Foreign Trade Company Exima | 7703011680 | Moscow | 2 914,9 | 6,16 | 213(high) |

| 8 | Closed Joint Stock Company "Vostok Zernoprodukt" | 1659041882 | The Republic of Tatarstan | 1 455,8 | 5,21 | 246(high) |

| 9 | Agropromyshlennaya korporatsiya AST Company M, Limited Liability Company | 7721147115 | Moscow | 3 454,2 | 0,28 | 238(high) |

| 10 | Pochaevo Agro Limited Liability Company | 3108007208 | Belgorod region | 1 903,6 | 0,02 | 319(sufficient) |

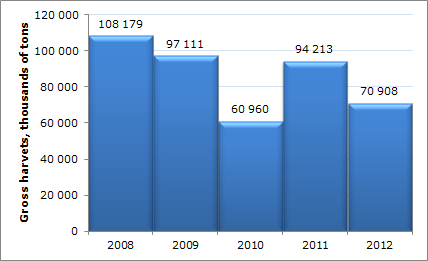

Diagram. Gross harvest of cereals and leguminous plants in Russia, thousands of tons

If we look at the gross harvest of cereals and leguminous plants over the last 5 years, we find 2008 was a year of an absolute yield bumper with more than 108 mln tons of crops – for the first time in Russia’ modern history. At the same time, the industry now is more dependent on climate factors rather than economic factors as it used to be in the 1990s (47,8 mln tons of crop in 1998). Heat and drought of summer 2010 was the main reasons why companies produced 1,8 times less grain (61 mln tons) than in 2008. The same situation, although not that rough, took place in 2012.

The quantity of gathered grains is important to companies’ profitability and income, as well as overall food security of Russia.

Credinform Information Agency experts say 2013 cereals harvest is likely to reach 91-92 mln tons – these expectations are based on of gross harvest dynamics over the last 15 years; favourable climate conditions in grains-growing regions are important to take into account, too.

Industry biggest companies are listed in the table above. The top-10 total turnover following 2011 financial results reached 20 575,5 mln rubles. The average value of net profit ratio is 10,8%.

All companies have their net profit ratio above zero-line. Agropromyshlennaya korporatsiya AST Limited Liability Company M (0,03%) and Pochaevo Agro Limited Liability Company (0,02%) got their net profit ration coming close zero-line, with profit hardly exceeding the losses.

Zolotaya Niva Limited Liability Company (Stavropol Territory) and AVANGARD-AGRO-Voronezh Limited Liability Company hold the biggest net profit ration value – 23,7% and 23,3%respectively, with profit made up of more than 20% of net sales. Besides, both companies got one of the highest scores in independent solvency and financial stability Globas-i® index of Credinform – that means they are able to pay off their liabilities, duly and in time, while the risk of default and bankruptcy is rather low.

Two companies – Agrotechnologii Limited Liability Company (16,3%) and Krasnoyaruzhskaya Zernovaya Closed Joint Stock Company (13,3%) – got a higher-than-average ratio. The solvency index Globas-i® of these companies is high enough and varies generally from 200 to 299 scores. The rest of the listed companies have their index gone lower than 10,8%.

Top-10 worst performer, Pochaevo Agro Limited Liability Company, made the sufficient solvency index which means there is a little guarantee it will pay its liabilities duly and in time; it also means the company lacks financial stability to adapt to economic situation in change.

To sum up, one can say that many factors influence financial results of agricultural companies: costs for transportations by rail, tariffs for energy resources, changing world prices for agriculture production, condition of technological equipment in use, quality of winter crops etc. Besides, the climate factor is important here – it is able to shape analytical reviews and evaluations of overall cereals and leguminous plants gross considerably, no matter of how developed are these industries.