Profit level of alcohol wholesale

Information agency Credinform represents the ranking of the largest Russian wholesalers of alcoholic beverages. Companies with the largest volume of annual revenue (TOP-10), specializing in the wholesale of alcoholic beverages, were selected for the ranking, according to the data from the Statistical Register for the latest available periods (for 2016 - 2018). Then they were ranked by the net profit ratio (Table 1). The analysis was made on the basis of the data of the Information and Analytical system Globas.

The net profit ratio (%) is calculated as the relation of net profit (loss) to sales revenue and characterizes the level of sales profit.

A normative value for the indicator is not specified. For comparison the enterprises of one industry are recommended, or the dynamics of the ratio for a particular company. A negative value of the indicator points to a net loss. A high value of the indicator points to the efficient operation of an enterprise.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, have developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For wholesalers of alcoholic beverages the practical value of the net profit ratio were from 0,70% in 2018.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| Name, INN, region | Revenue, billion RUB | Net profit (loss), billion RUB | Net profit ratio, % | Solvency index Globas | |||

| 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| P.R.ROUSS NJSC INN 7729104184 Moscow |

17413,95 17413,95 |

18344,66 18344,66 |

1108,38 1108,38 |

517,17 517,17 |

6,36 6,36 |

2,82 2,82 |

214 Strong |

| KOMPANIYA SIMPL LLC INN 7711078582 Moscow |

10663,69 10663,69 |

12227,83 12227,83 |

410,14 410,14 |

308,25 308,25 |

3,85 3,85 |

2,52 2,52 |

189 High |

| ORBITA LLC INN 7449096660 Chelyabinsk region in process of reorganization in the form of acquisition of other legal entities, 13.08.2019 |

13847,88 13847,88 |

36861,07 36861,07 |

565,77 565,77 |

511,14 511,14 |

4,09 4,09 |

1,39 1,39 |

242 Strong |

| ALCOHOL SIBERIAN GROUP LLC INN 5506207263 Omsk region |

15108,11 15108,11 |

20046,34 20046,34 |

-723,67 -723,67 |

247,55 247,55 |

-4,79 -4,79 |

1,23 1,23 |

277 Medium |

| LUDING LLC INN 7730107662 Moscow |

14775,01 14775,01 |

15725,57 15725,57 |

117,96 117,96 |

146,11 146,11 |

0,80 0,80 |

0,93 0,93 |

164 Superior |

| NJSC WITH 100% FOREIGN INVESTMENTS ROUST INCORPORATED INN 7703058663 Saint-Petersburg |

17375,41 17375,41 |

19906,47 19906,47 |

13,34 13,34 |

135,92 135,92 |

0,08 0,08 |

0,68 0,68 |

200 Strong |

| LUDING-TRADE LLC INN 7705444495 Moscow |

9670,79 9670,79 |

9107,44 9107,44 |

0,00 0,00 |

49,76 49,76 |

0,00 0,00 |

0,55 0,55 |

192 High |

| TRADING HOUSE ALVISA LLC INN 7730614662 Moscow region |

7311,21 7311,21 |

9384,76 9384,76 |

86,24 86,24 |

48,61 48,61 |

1,18 1,18 |

0,52 0,52 |

229 Strong |

| TRADING HOUSE RUSSIAN ALCOHOL - MOSCOW LLC INN 7716679026 Moscow |

24211,47 24211,47 |

35186,54 35186,54 |

-143,42 -143,42 |

85,13 85,13 |

-0,59 -0,59 |

0,24 0,24 |

273 Medium |

| ROUST RUSSIA NJSC INN 7705492717 Moscow |

35983,89 35983,89 |

51061,70 51061,70 |

-1603,70 -1603,70 |

-1529,88 -1529,88 |

-4,46 -4,46 |

-3,00 -3,00 |

298 Medium |

| Total by TOP-10 companies |  166361,41 166361,41 |

227852,37 227852,37 |

-168,96 -168,96 |

519,76 519,76 |

|||

| Avearge value by TOP-10 companies |  16636,14 16636,14 |

22785,24 22785,24 |

-16,90 -16,90 |

51,98 51,98 |

0,65 0,65 |

0,79 0,79 |

|

| Industry average value |  332,64 332,64 |

356,17 356,17 |

0,90 0,90 |

2,51 2,51 |

0,27 0,27 |

0,70 0,70 |

|

improvement of the indicator to the previous period,

improvement of the indicator to the previous period,  slowdown in the indicator to the previous period.

slowdown in the indicator to the previous period.

The average value of the net profit ratio of TOP-10 enterprises in 2018 is above industry average and practical values. Six companies improved the results in 2018.

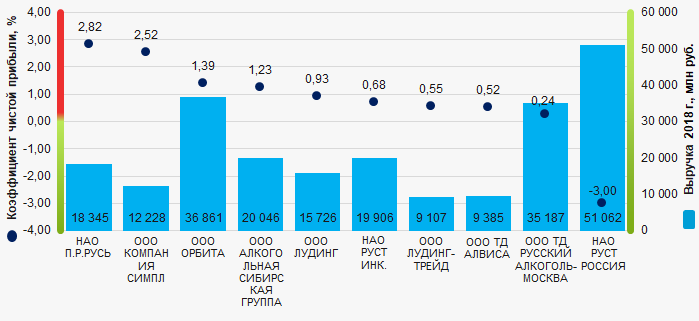

Picture 1. Net profit ratio and revenue of the largest wholesalers of alcoholic beverages (TOP-10)

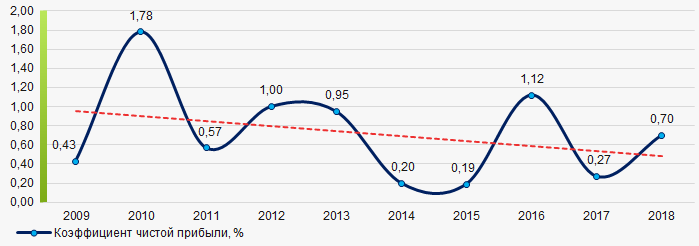

Picture 1. Net profit ratio and revenue of the largest wholesalers of alcoholic beverages (TOP-10)The industry average indicators of the net profit ratio have a downward trend over the course of 10 years (Picture 2).

Picture 2. Change in the industry average values of the net profit ratio of wholesalers of alcoholic beverages in 2009 – 2018

Picture 2. Change in the industry average values of the net profit ratio of wholesalers of alcoholic beverages in 2009 – 2018 Online loans for small businesses

According to the Federal State Statistics Service data, the share of small and medium-sized businesses in Russia’s GDP amounted to 21.9% in 2017. More recent data has not been published yet.

The development of small businesses directly depends on the financing sources. Getting loans is a very complicated procedure for small business. It often happens that the bank credit programs for start-up entrepreneurs are inaccessible due to strict requirements and lack of collateral; they also are too expensive due to high loan rates.

The alternative to bank loans is non-bank lending, the market of which is growing rapidly. Thus, according to the Central Bank of Russia data, the general growth of small businesses lending in 2017 amounted to 15% in comparison with 2016. In 2018, the growth amounted to 11% compared to the previous year.

There are government programs to support and subsidize business and new serious players. Government programs appear to support and subsidize business, as well as new serious players. Banks, in turn, are also creating alternative platforms for financing small businesses.

The development of non-bank lending is also facilitated by the growing financial technologies industry, which helps to get rid of paperwork; save time on visiting banks and receive money in the shortest period.

Further growth of alternative crediting of small business in Russia is predicted.

Under Russian laws, currently the only legal way of non-bank lending of small businesses and entrepreneurship is a microfinance activity. The legal basis of microfinance activity is determined by the Federal Law №151-FZ dated 02 July 2010 «On microfinance activities and microfinance organization». The same law regulates the size, procedure and conditions for granting microloans, the procedure for acquiring the status and activities of microfinance organizations as well as the rights and obligations of the Central Bank of the Russian Federation in this area.

In particular, the Central Bank of the Russian Federation registers the microfinance organizations (MFO) of entrepreneurial financing and maintains the relevant State register. As of 08.11.2019, 210 organizations are registered in the State register. Most of MFO have the relevant on-line services and usually provide loans only up to 100 or 300 thousand RUB. Some organizations offer larger amounts on the basis of assets availability, long-term cooperation and fair fulfillment of debt obligations by the borrower. The potential loan recipients need to meet the minimum requirements, such as:

- Russian citizenship;

- passport and permanent registration on the territory of the Russian Federation;

- age over 18 years;

- provision of well-thought-out business plan;

- the presence of liquid assets and the absence of third-party debt obligations are desirable.

The advantages of applying to MFO:

- short term of collection and submission of necessary documents;

- microloan on business development could be obtained almost in a day of treatment with minimal document package;

- interest rates are maximally open, there are no additional fees, free service is available;

- approval of loan applications is very fast, usually within a day;

- availability of various options for cash withdrawal and repayment of debts (bank cards, payment terminals, E-money, mobile shops etc.).

Among main disadvantages of obtaining microloans in MFO are:

- often higher interest rates in comparison with interest rates of banks;

- limited maximum loan amounts;

- short terms of borrowing.

Among main financing sources of MFO are:

- acceptance of deposits from the population (the minimum deposit from an individual is 1.5 million RUB);

- bond loans (used only by the largest MFO);

- attraction of foreign funds financing (extremely rare);

- raising of funds in cooperation with banks (on the basis of MFO affiliation with a particular bank);

- attraction of private Russian capital (main for 70% of MFO).

According to the Information and Analytical system Globas, currently there are more than 1800 active microfinance and microcredit companies in Russia.

Information about these companies and their activities is available for Globas users.