Trends in manufacture of grocery

Information agency Credinform presents a review of the activity trends of the Russian grocery manufacturers.

The largest manufacturers of grits, flour and pasta, sugar and starch, tea and coffee, chocolate, vegetable oil, salt and spices (TOP-1000) in terms of annual revenue were selected for the analysis according to the data from the Statistical Register and the Federal Tax Service for the latest available accounting periods (2014 – 2020*). The selection of companies and the analysis were based on the data from the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest TOP-1000 company in term of net assets is LLC MARS, INN 5045016560, Moscow region, engaged in manufacture of chocolate and sugar confectionery. In 2019, net assets value amounted to more than 65 billion RUB.

The lowest net assets value among TOP-1000 was recorded for JSC NEFIS-BIOPRODUCT, INN 1624012256, Republic of Tatarstan, engaged in manufacture of oils and fats, in process of reorganization in the form of acquisition since 17.03.2021. In 2019, insufficiency of property was indicated in negative value of -7 billion RUB.

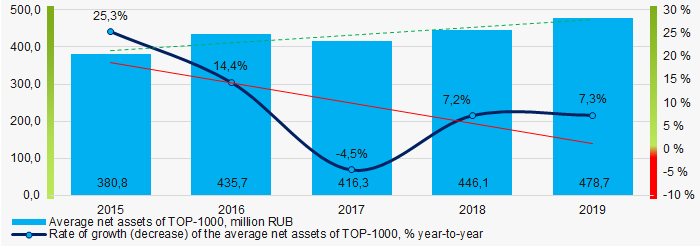

During five-year period, the average net assets values of TOP-1000 have a trend to increase, with the negative growth rates (Picture 1).

Picture 1. Change in average net assets value in TOP-1000 in 2015 - 2019

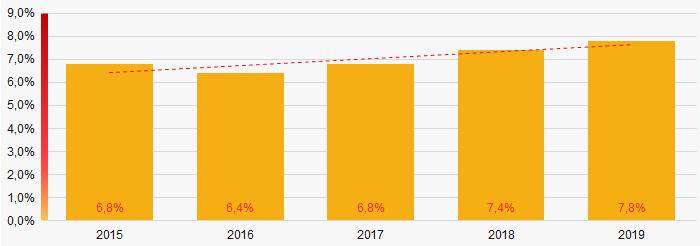

Picture 1. Change in average net assets value in TOP-1000 in 2015 - 2019The shares of TOP-1000 enterprises with insufficient property had negative trend to increase during last 5 years (Picture 2).

Picture 2. Shares of TOP-1000 companies with insufficient property in 2015 - 2019

Picture 2. Shares of TOP-1000 companies with insufficient property in 2015 - 2019Sales revenue

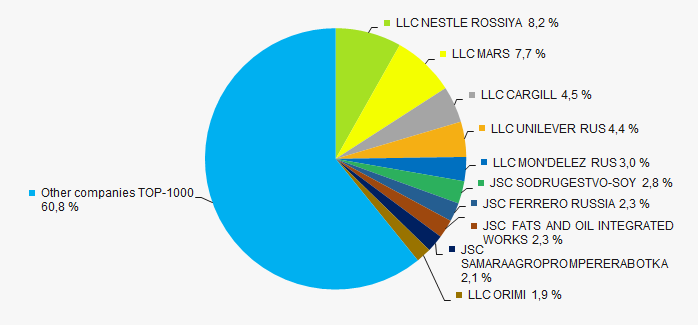

The revenue volume of the ten leading companies amounted to 39% of the total revenue of TOP-1000 companies in 2019 (Picture 3). It gives evidence to relatively high level of the competition in manufacture of grocery products.

Picture 3. Shares of TOP-10 companies in the total revenue of TOP-1000 in 2019

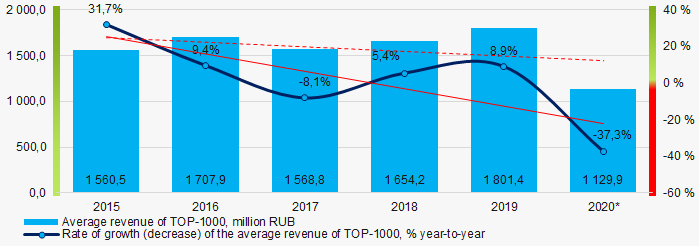

Picture 3. Shares of TOP-10 companies in the total revenue of TOP-1000 in 2019In general, there is a trend to decrease in revenue with decreasing growth rates (Picture 4).

Picture 4. Change in average revenue of TOP-1000 in 2015– 2020

Picture 4. Change in average revenue of TOP-1000 in 2015– 2020Profit and loss

The largest TOP-1000 company in term of net profit is LLC MARS, as well. The company’s profit amounted to 14 billion RUB in 2019.

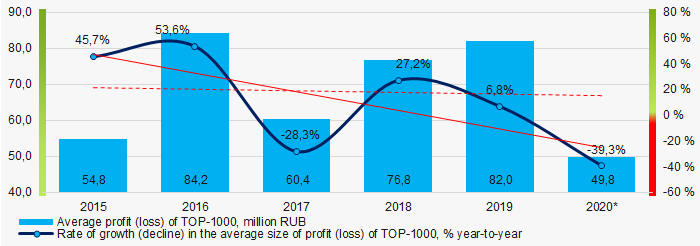

During six-year period, the average profit figures of TOP-1000 have a trend to decrease with decreasing growth rates (Picture 5).

Picture 5. Change in average profit (loss) of TOP-1000 companies in 2015- 2020

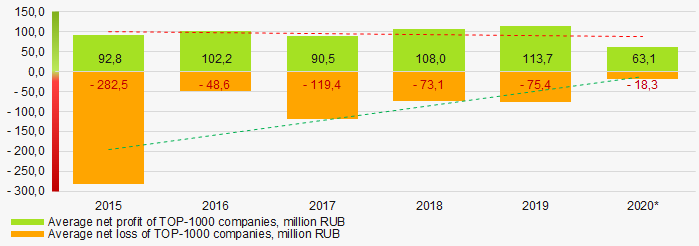

Picture 5. Change in average profit (loss) of TOP-1000 companies in 2015- 2020During six-year period, the average net profit figures of TOP-1000 companies have a trend to decrease with the decreasing average net loss (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP-1000 companies in 2015 – 2020

Picture 6. Change in average net profit and net loss of ТОP-1000 companies in 2015 – 2020Key financial ratios

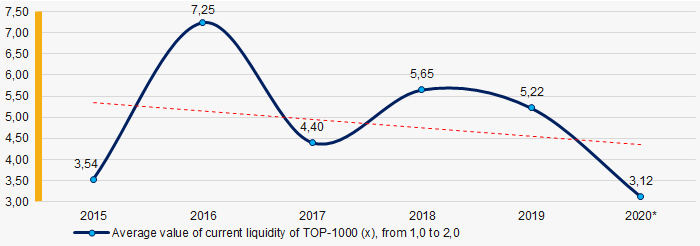

During six-year period, the average values of the current liquidity ratio of TOP-1000 companies were above the recommended one – from 1,0 to 2,0, with a trend to decrease. (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in average values of current liquidity ratio of TOP-1000 in 2015 – 2020

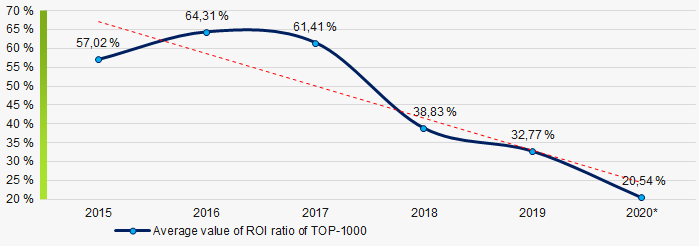

Picture 7. Change in average values of current liquidity ratio of TOP-1000 in 2015 – 2020During six years, there was a trend to decrease in the average ROI values (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio of TOP-1000 in 2015 – 2020

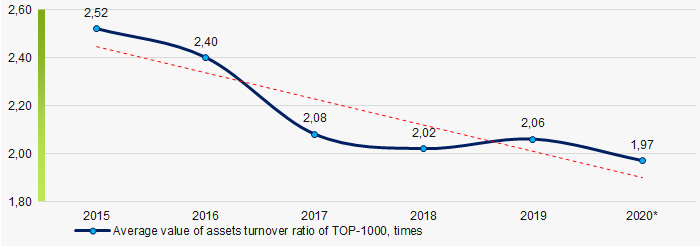

Picture 8. Change in average values of ROI ratio of TOP-1000 in 2015 – 2020Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

During the six-year period, there was a trend to decrease of this ratio (Picture 9).

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2015 – 2020

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2015 – 2020Small enterprises

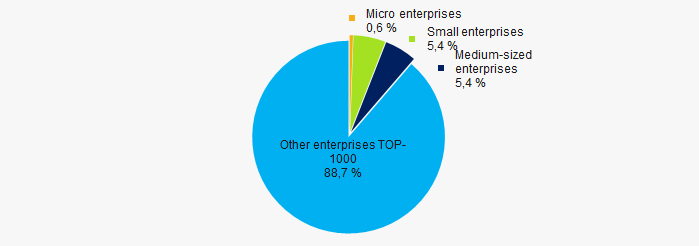

75% companies of TOP-1000 are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. However, their share in total revenue of TOP-1000 in 2019 amounted 11,3%, which is almost twice lower than the average country values in 2018 - 2019 (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in TOP-1000

Picture 10. Shares of small and medium-sized enterprises in TOP-1000Main regions of activity

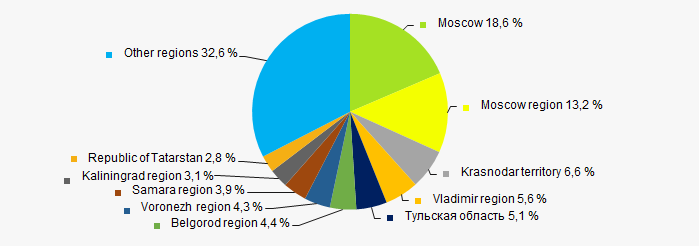

Companies of TOP-1000 are registered in 71 regions of Russia, and unequally located across the country. More than 32% of the TOP-1000 companies’ total revenue consolidate in Moscow and Moscow region (Picture 11).

Picture 11. Distribution of TOP-1000 revenue by the regions of Russia

Picture 11. Distribution of TOP-1000 revenue by the regions of RussiaFinancial position score

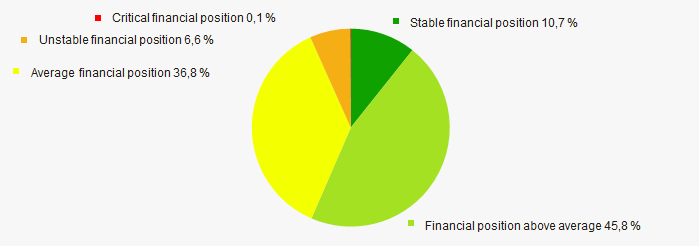

According to the assessment, the financial position of most of TOP-1000 companies is above average (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position score Solvency index Globas

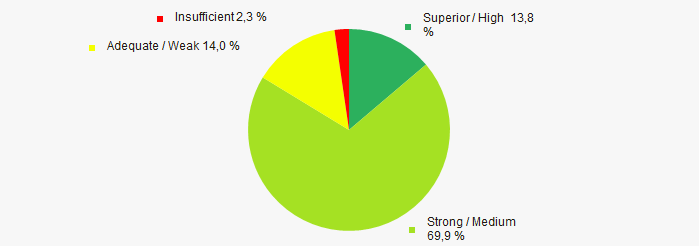

Most of TOP-1000 companies got Superior / High and Strong / Medium index Globas. This fact shows their ability to meet their obligations fully and by the due date (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasConclusion

Complex assessment of activity of the grocery manufacturers, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of negative trends in their activity in 2015- 2020 (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Dynamics of the average net assets value |  10 10 |

| Rate of growth (decline) in the average size of net assets |  -10 -10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  -10 -10 |

| Level of capital concentration |  10 10 |

| Dynamics of the average revenue |  -10 -10 |

| Rate of growth (decline) in the average size of revenue |  -10 -10 |

| Dynamics of the average profit (loss) |  -10 -10 |

| Rate of growth (decline) in the average size of profit (loss) |  -10 -10 |

| Growth / decline in average values of net profit |  -10 -10 |

| Growth / decline in average values of net loss |  10 10 |

| Increase / decrease in average values of current liquidity ratio |  -5 -5 |

| Increase / decrease in average values of return on investment ratio |  -10 -10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in terms of revenue in the region being more than 20% |  -10 -10 |

| Regional concentration |  -5 -5 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  -3,8 -3,8 |

positive trend (factor),

positive trend (factor),  negative trend (factor)

negative trend (factor)

<p >(*) – data for 2020 is given on companies, which reported the financial accounts to the FTS in March 2021.

Legislation amendments

In accordance with the Article 31 of the Tax Code of the Russian Federation, the tax authorities have the right to suspend bank accounts transactions of the taxpayers, the payers of fees, insurance fees or the tax agents in the credit institutions and to seize property in accordance with the procedure provided for in the Article 76 of the Tax Code of the Russian Federation.

The suspension of bank accounts transactions implies termination by banks of all expenditure transactions on specific accounts or within the amounts indicated in the decisions on suspension of operations.

In accordance with the Federal Law of November 9, 2020 No. 368-FZ, the tax authorities have the right to block current accounts in the following cases:

- the requirement for payment of taxes, penalties and fines (item 2 of the Article 76 of the Tax Code of the Russian Federation) is not fulfilled, the block is carried out within the amount of the arrears;

- the tax return or the personal income tax (the 6th form) is not submitted within 20 days (from July 1, 2021, currently – 10 days) after the end of submission period (sub-item 1 of item 3, item 3.2 of the Article 76 of the Tax Code of the Russian Federation), there are no restrictions on block amount; at the same time, it is prohibited to carry out transactions with the funds on the account as well as with the incoming funds (the letter of the Ministry of Finance of the Russian Federation No. 03-02-07/1-182 dated 17.04.2007);/li>

- the e-receipt on accepting requirements or notifications was not sent to the tax office (sub-item 2 of item 3 of the Article 76 of the Tax Code of the Russian Federation).

As amended by the Law No. 368-FZ, from July 1, 2021 the tax authorities will receive the right to inform the taxpayers in advance on upcoming suspension of bank accounts. According to the letter of the Ministry of Finance of the Russian Federation No. 03-02-11/13505 dated 26.02.2021, the decision of tax authorities on suspension of bank accounts and digital cash transactions may be accepted after 14 working days from the date of such notification.

However, it should be noted, that the responsibility of tax authorities for not sending notifications on upcoming blocking is not legally established.

The ability to check information on suspended bank accounts is available in the Information and Analytical system Globas using the appropriate tool in the section «Banks. Extract on suspended bank accounts».