Russian travel industry shows increase

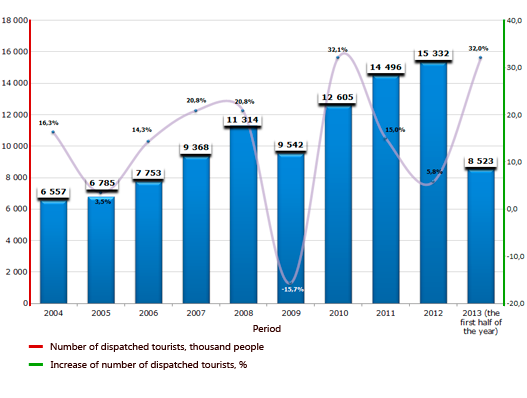

According to Federal tourism agency in the first half of 2013 Russian travel companies (tour operators and travel agencies) has sent 8 million 523 thousand of tourists abroad. This number is 32% higher as compared with the same period of 2012.

Russian international tourism market shows good growth rate. The single exception was 2009, when number of tourists sent abroad shortened on 15,7%. This situation might be connected with financial crisis, when personal income declined and for many people a trip abroad came under the notion of “deferred demand”. In the next two years (2012, 2011) increase of tourist movement amounted to 32,1% (to 12,6 million people) and 15% (to 14,5 million people) respectively. It fully compensated the fall of 2009 and significantly exceeded the index of historical maximum of 2008, when 11,3 million fellow citizens went abroad. Despite relative stabilization of economic situation, the riots in Egypt – the second popular country among our tourists after Turkey, have mildly dampened the market: according to results of 2012 it showed modest rise of 5,8%. However, in 2013 we observe yet another revival in overseas tourist trip demand.

Diagram 1. Dynamic of Russian international tourism, thousand people, %

In whole, taking into account growth in prosperity of citizens, prospects of Russian international tourism market are quite hopeful, considering that the total number of citizens, having spent holidays abroad, still accounts for only 11% of the country’s population.

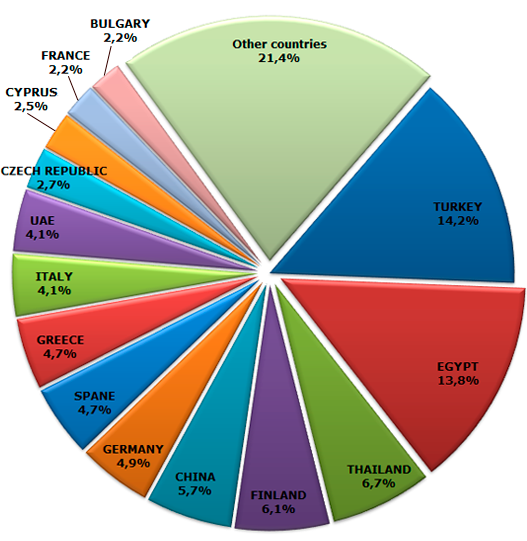

Diagram 2. Main countries that accommodate Russian tourists in the first half 2013, % of the total flow

The structure of Russian international tourism market by countries is displayed on the figure 2. Thus, according to results of the first half of 2013 Turkey maintains the top position with interest of 14,2% of the total tourist movement. All in all 1 213 thousand people visited this country. Then with a slender underrun goes Egypt - 13,9% (1 178 thousand people), Thailand occupies 6,7% of market (571 thousand people), Finland – 6,1% (524 thousand people) and China completes the list of five leaders with interest of 5,7 % (484 thousand people).

At the same time we may see the next tendencies: the number of visits of Turkey during the first half of 2013 in relation to the same period of the preceding year increased on 30%, and of Egypt – on 47%. It may be assumed that such a rapid increase of tourist movement is above all connected to recovery after a sharp slowdown of 2012, when many fellow citizens didn’t take a shot at resting in a popular but riot-hit country. It is safe to say that Egypt may become the first in number of Russians having visited this country according to 2013 results.

Observing tendencies in other directions, one may see that most of the number of tourists visiting Finland has increased on 114% (to 524 thousand people) and Greece – on 96% (to 400 thousand people) all over an analyzable period. In the first case, it is related to growth of interest to “city break tours” to neighboring European country. First of all, among Saint Petersburg residents. In the second case, Greece resorts went down in value after recent economic shocks and became more attractive for our citizens.

Tourism movement has declined more significantly to Lithuania on 55% (to 5 thousand people) and to Slovakia – 37% (to 1 thousand). Among essential directions the number of trips to China have decreased on 15% (to 484 thousand) and to Croatia 15% (to 28 thousand). Talking about China, fall in demand is probably temporary and as for Croatia after introduction of Schengen visa there this direction doesn’t seems to be competitive in comparison with other countries of Mediterranean world.

According to Information and analytical system GLOBAS-i ® of Credinform, today around two thousand companies work in travel services market. At the same time the number of companies that managed to achieve positive financial results for the preceding year turned out to count just over a thousand.

| № | Name | Tax number | Region | Net income, million rubles., 2012. | Solvency index GLOBAS-i ® |

|---|---|---|---|---|---|

| 1 | LLC Megapolyus Gruppa | 7713308496 | Moscow | 533,0 | 289 (high) |

| 2 | JSC MOSTRANSAGENTSTVO | 7701000280 | Moscow | 251,8 | 203 (high) |

| 3 | JSC Primorsky agentstvo aviatsionnykh kompanii | 2540039013 | Primorsky Territory | 92,1 | 200 (high) |

| 4 | LLC S 7 Tour | 7701607660 | Moscow | 56,1 | 280 (high) |

| 5 | LLC Grand Baikal | 3808079832 | Irkutsk region | 53,3 | 182 (the highest) |

| 6 | CJSC Interconnect Management Corporation | 7728580286 | Moscow | 52,0 | 207 (high) |

| 7 | LLC Company TEZ Tour | 7709297570 | Moscow | 39,8 | 222 (high) |

| 8 | JSC Intur-Khabarovsk | 2702032046 | Khabarovsk Territory | 36,1 | 173 (the highest) |

| 9 | LLC Aero Club Tour | 7702520780 | Moscow | 35,6 | 286 (high) |

| 10 | LLC S 7 BILET | 5406194003 | Moscow | 30,8 | 204 (high) |

The majority of top-10 rating of the most profitable travel companies in 2012 is occupied by companies from Moscow. Corresponding situation may happen due to densely populated areas in the megapolis, wide representation of diplomatic missions and special nature of the traffic streams (one of the largest country’s aviation node is situated in the capital; it dispatches and accommodates most of all international flights on the wide circle of directions).

According to independent estimate of the CredInform agency, all the top-10 companies got high and the highest solvency index GLOBAS-i ®. This fact shows that the companies discharge their obligations in due times and to the full extent. The risk of default of them is inconspicuous. Owing to the fact that bankruptcy of travel agencies became more frequent, corresponding index may be useful when you are planning a journey. Recently, company Roskurort from Ekaterinburg and International tour operator “Asent Travel” from Moscow announced its suspension of activities.

Does The Central Bank of Russian Federation believe in ruble force?

On 21 October the Central Bank of Russian Federation cut the day volume of currency interventions by half – from 120 mln. USD to 60 mln. USD. In other words, the controller will allocate fewer funds for influence on a ruble exchange rate in case of its output from the given interventional corridors of a dual currency basket.

This decision seems to be rather logic continuation of the financial authority’s earlier solution as of 7 October. Then the Bank of Russia expanded boundaries of so-called "neutral range" from 1 RUB to 3,10 RUB. While the basket cost is 34,30-37,40 RUB, the Central Bank won’t make currency interventions in one direction or another.

Thus, new exchange rate policy of mega controller led by recently appointed Elvira Nabiullina, is going to appear. The policy is probably directed on gradual implementation of national currency freely floating rate. However, in long-term perspective, actions made by the Central Bank, in case of current economy structure, can lead to a weakening of the ruble.

Today, while the growth of industry production is about zero values, the state and private debt is increasing and country’s financial position is still largely determined by raw materials prices, such steps of Russian Bank seem to be rather optimistic. On the other hand, the Central Bank, seeing the deterioration of country’s economic situation, may reasonably carry out such practice in life. After all in case of currency intervention reducing and expanding of the "neutral range", the controller will save the part of its forex holdings, which maintenance at "due level" is, if not the primary, but very important task for financial authorities.