Activity trends of companies that received support from the Government

Information agency Credinform has prepared a review of trends of the largest companies of the real sector of economy that have received support from the Government (subsidies, subventions, budget investments, inter-budget transfers, independent guarantees, sureties and training events of the SME Corporation).

Companies with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2014 - 2019). They were ranked by the liabilities to assets ratio (Table 1). The analysis was based on the data of the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company in term of net assets is JSC RUSSIAN RAILWAYS, INN 7708503727, Moscow. In 2019, net assets of the company amounted to 4,5 trillion RUB.

The lowest net assets value among TOP-1000 belonged to JSC ANTIPINSKY REFINERY, INN 7204084481, Tyumen region. The legal entity is declared insolvent (bankrupt) and bankruptcy proceedings are initiated as of January 4, 2020. In 2019, insufficiency of property of the organization was indicated in negative value of -223 billion RUB.

Covering the ten-year period, the average net assets values of TOP-1000 companies have a trend to decrease with a decreasing growth rate (Picture 1).

Picture 1. Change in industry average net assets value in 2014 – 2019

Picture 1. Change in industry average net assets value in 2014 – 2019Over the past six years, the share of companies with insufficient property had a trend to decrease (Picture 2).

Picture 2. Shares of TOP-1000 companies with negative net assets value in 2014-2019

Picture 2. Shares of TOP-1000 companies with negative net assets value in 2014-2019Sales revenue

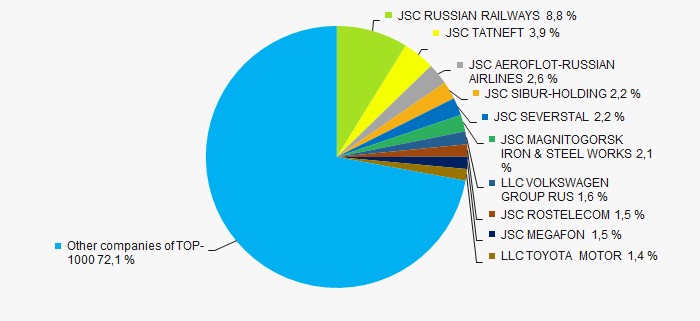

In 2019, the revenue volume of 10 largest companies of the industry was 28% of total TOP-1000 revenue (Picture 3). This is indicative of relatively high level of aggregation of capital among the companies that have received support from the Government.

Picture 3. The share of TOP-10 companies in total 2019 revenue of TOP-1000

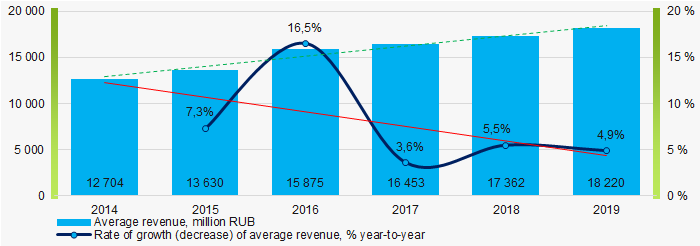

Picture 3. The share of TOP-10 companies in total 2019 revenue of TOP-1000In general, there is a trend to increase in revenue with the decreasing growth rate (Picture 4).

Picture 4. Change in industry average net profit in 2014 – 2019

Picture 4. Change in industry average net profit in 2014 – 2019Profit and loss

The largest organization in term of net profit is JSC TATNEFT, INN 1644003838, Republic of Tatarstan. The company’s profit for 2019 amounted to 156 billion RUB.

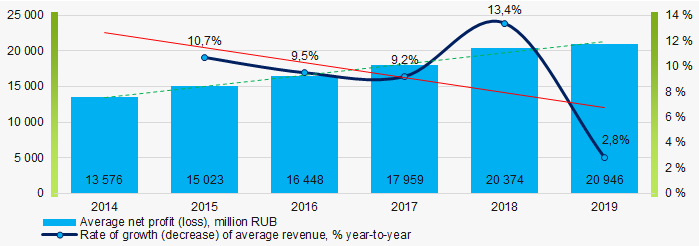

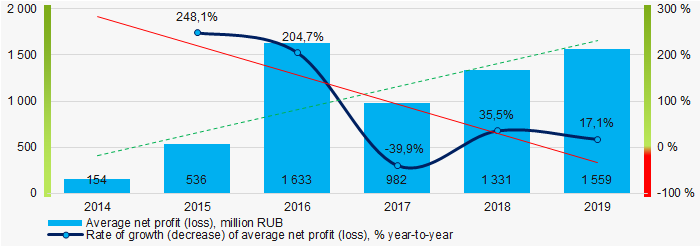

Covering the six-year period, there is a trend to increase in average net profit with the decreasing growth rate (Picture 5).

Picture 5. Change in industry average net profit (loss) values in 2014 – 2019

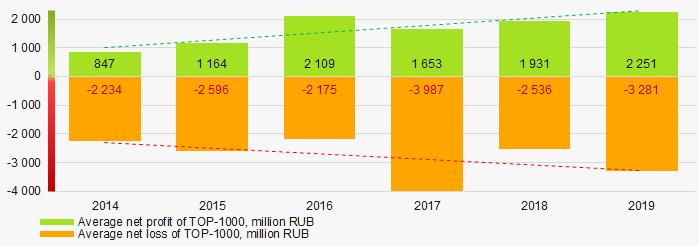

Picture 5. Change in industry average net profit (loss) values in 2014 – 2019For the six-year period, the average net profit values of TOP-1000 have the increasing trend with the increasing net loss (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP-1000 in 2014 – 2019

Picture 6. Change in average net profit and net loss of ТОP-1000 in 2014 – 2019Key financial ratios

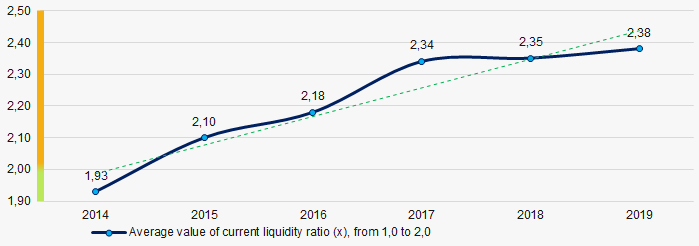

Covering the six-year period, the average values of the current liquidity ratio were mainly above the recommended one - from 1,0 to 2,0 with a trend to increase (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in industry average values of current liquidity ratio in 2014 – 2019

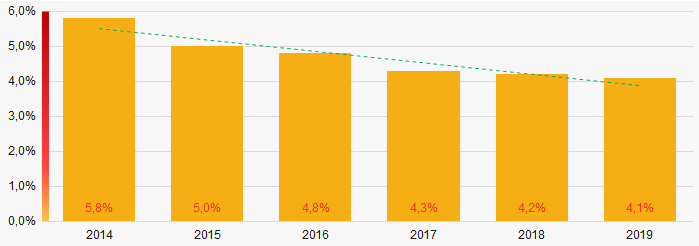

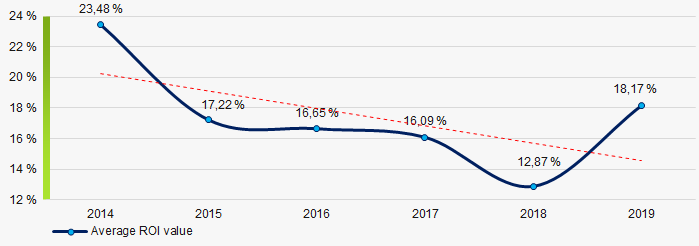

Picture 7. Change in industry average values of current liquidity ratio in 2014 – 2019Covering the six-year period, the average values of ROI ratio have a trend to decrease (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in industry average values of ROI ratio in 2014 – 2019

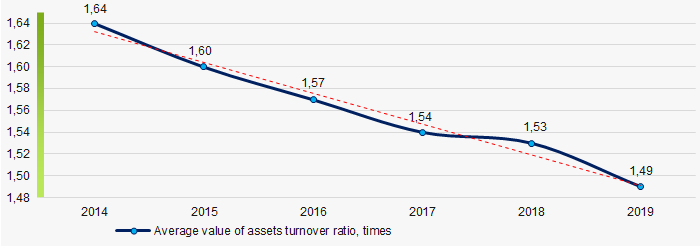

Picture 8. Change in industry average values of ROI ratio in 2014 – 2019Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Covering the six-year period, business activity ratio demonstrated the decreasing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2014 – 2019

Picture 9. Change in average values of assets turnover ratio in 2014 – 2019Small business

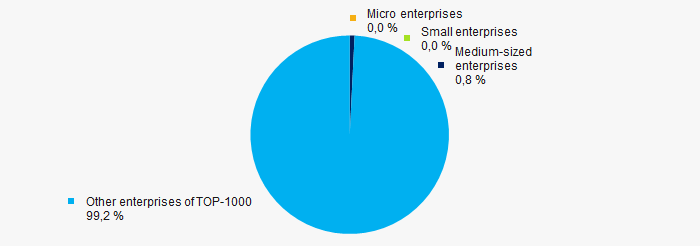

11% of TOP-1000 organizations are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. Their share in total revenue of TOP-1000 is less than 1% that is significantly lower than the national average in 2018-2019 (Picture 10).

Picture 10. Shares of revenue of small and medium-sized enterprises in TOP-1000

Picture 10. Shares of revenue of small and medium-sized enterprises in TOP-1000Main regions of activity

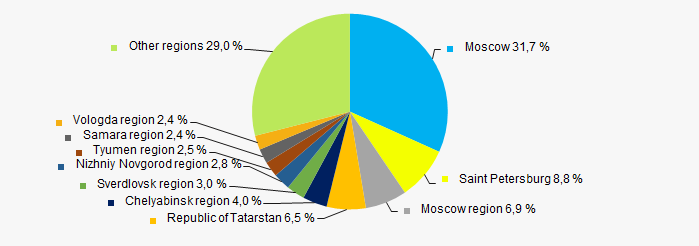

Companies of TOP-1000 are registered in 71 regions of Russia, and unequally located across the country. Almost a third of companies largest by revenue are located in Moscow (Picture 11).

Picture 11. Distribution of TOP-1000 revenue by the regions of Russia

Picture 11. Distribution of TOP-1000 revenue by the regions of RussiaFinancial position score

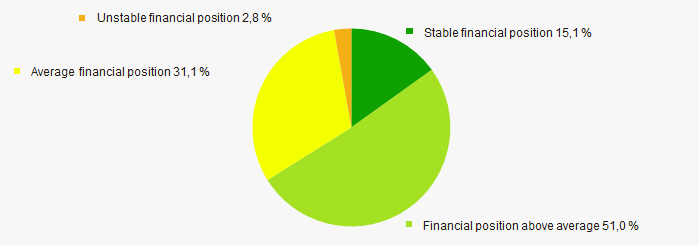

Assessment of the financial position of TOP-1000 companies shows that the majority of them have financial position above average (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

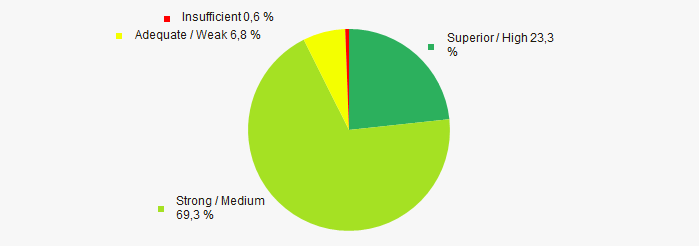

Most of TOP-1000 companies got Superior / High and Strong / Medium index Globas. This fact shows their ability to meet their obligations fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasConclusion

Complex assessment of activity of the largest companies that have received support from the Government, taking into account the main indexes, financial ratios and indicators, demonstrates the absence of clear trends (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Dynamics of the average net assets value |  10 10 |

| Rate of growth (decrease) in the average size of net assets |  -10 -10 |

| Increase (decrease) in the share of enterprises with negative values of net assets |  10 10 |

| Level of competition / monopolization |  5 5 |

| Dynamics of the average revenue |  10 10 |

| Rate of growth (decrease) in the average size of revenue |  -10 -10 |

| Dynamics of the average profit (loss) |  10 10 |

| Rate of growth / decline in average values of companies’ net profit (loss) |  -10 -10 |

| Growth / decline in average values of companies’ net profit |  10 10 |

| Growth / decline in average values of companies’ net loss |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  5 5 |

| Increase / decrease in average values of return on investment ratio |  -10 -10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in terms of revenue being more than 22% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Index of industrial production |  0,0 0,0 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).

New year’s recipe by Credinform

It's time to prepare for the New Year 2021. Due to the closed borders, the upcoming holiday will be truly homely: the nearest and dearest people will gather at the New Year's table with traditional champagne, tangerines and Olivier salad.

On the eve of the holiday, Credinform experts analyzed the largest retail chains where Russians will buy groceries for the New Year's table.

The largest retail grocery chains in Russia

A highly competitive food market has developed in Russia in a relatively short period. It is represented by both “near the house” small chain stores and large hypermarkets.

Retail trade has become one of the most important segments of the domestic economy, which quickly introduced modern technologies in both logistics and customer service: cashless payment, online ordering, various services, loyalty programs, etc. Leading chains are located not only in large cities, but also in small regional centers and countryside.

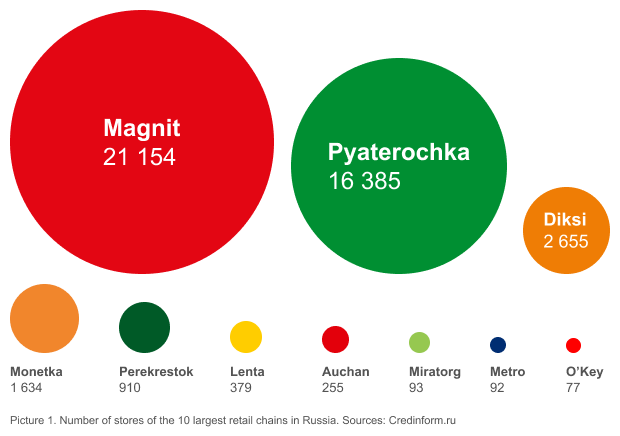

There are 10 retail chains in Russia with annual turnover exceeding 100 billion RUB. The largest ones in terms of the number of stores are: Magnit - 21,154 stores, Pyaterochka - 16,385, Diksi - 2,655, Monetka - 1,634, Perekrestok - 910, Lenta - 379, Auchan - 255, Miratorg - 93, Metro - 92, O'Key - 77. VkusVill healthy food chain with 1,473 stores and turnover of 83 billion RUB, is approaching the TOP-10 leaders.

At the same time, Pyaterochka, Perekrestok, and Karusel are part of the X5 Retail Group Holding. The turnover of the group in 2019 reached 1,7 trillion RUB. The share of X5 in the retail market is 10.5%. The chain of retail stores "Magnit" belongs to the JSC Tander, the main competitor of X5 Retail Group. In 2019, the company received 1,4 trillion RUB of revenue. The market share is about 9%.

Diksi, Krasnoe & Beloe and Bristol are part of the DKBR Mega Retail Group holding having the 4% share in the retail segment. Its revenue in 2019 reached 800 billion RUB.

Picture 1. Number of stores of the 10 largest retail chains in Russia. Sources: Credinform.ru

Picture 1. Number of stores of the 10 largest retail chains in Russia. Sources: Credinform.ruThe cost of a grocery list for Olivier salad by Credinform

Lucien Olivier, who created Olivier salad in the 60s of the 19th century, could hardly have imagined that this dish would be a “must” on the New Year's table in Russia. Since the French chef never revealed the original Olivier recipe, there are about a hundred popular variations of this dish.

Experts of the Information agency Credinform in Saint Petersburg have determined the cost of a grocery list for the "classic" Olivier recipe in various chains of the city, choosing the groceries of the highest quality.

| Weight, kg | O’Key | Pyaterochka | Auchan | Lenta | Magnit | Diksi | |

|

|

|

|

|

|

||

| Boiled sausage | 0,3 | 116,85 | 113,97 | 65,94 | 59,97 | 69,00 | 59,4 |

| Pickled cucumbers | 0,4 | 55,72 | 49,99 | 62,72 | 49,99 | 35,00 | 54,92 |

| Canned peas | 0,4 | 129,9 | 99,99 | 95,49 | 120,89 | 105,00 | 87,54 |

| Chicken eggs | 0,2 (4шт.) | 61,5 | 61,99 | 69,99 | 58,99 | 49,00 | 54,58 |

| Mayonnaise | 0,2 | 47,4 | 56,49 | 46,99 | 49,99 | 50,00 | 36,04 |

| Potato | 0,5 | 15,7 | 34,99 | 19,99 | 19,99 | 7,00 | 10,29 |

| Bulb onion | 0,1 | 1 | 1 | 1 | 1 | 1,00 | 1 |

| Carrot | 0,2 | 1 | 1,4 | 1 | 1 | 1,00 | 1 |

| Olivier | 2,1 | 429,07 | 419,82 | 363,12 | 361,82 | 317,00 | 304,77 |

Thus, the classic Olivier recipe by Credinform will cost on average 365 RUB and 93 kopecks.

Of course, everyone has own recipes for both favorite dishes and business success. May you have all the ingredients for well-being and prosperity in the coming year!

Information agency Credinform wishes you a Happy New Year 2021!

May this year bring you only good events and news, be filled with new plans, creative ideas and financial success!