Net profit of dry cleaners and laundries in Russia

Information agency Credinform prepared a ranking of net profit of dry cleaners and laundries in Russia. The companies with highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). Then, the first 10 enterprises selected by turnover were ranked by decrease in net profit.

Net profit is a part of the gross proceeds of a company, which remains at its disposal after payment of taxes, duties, contributions and other obligatory payments to the budget. Organization has control over directions of use of net profit. A part of company’s income, meant for distributions to its members, is distributed pro rata with their shares of the authorized capital of this company. Other part is used for increase of current assets of the enterprise, formation of funds and reserves, as well as for re-investments in production.

| № | Name, INN | Region | Net profit for 2012, in mln RUB | Turnover for 2012, in mln RUB | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | MASTER KLINING LLC INN 7723580853 |

Moscow | 77,85 | 2347 | 283 (high) |

| 2 | Passazhir Servis CJSC INN 7606043703 |

Yaroslavl region | 69,81 | 408 | 176 (the highest) |

| 3 | NEMETSKAYA MARKA LLC INN 7838017478 |

Moscow | 69,55 | 754 | 228 (high) |

| 4 | Monblan LLC INN 7802457059 |

Saint-Petersburg | 56,45 | 135 | 261 (high) |

| 5 | Passazhirservis LLC INN 3662079311 |

Voronezh region | 52,23 | 292 | 171 (the highest) |

| 6 | Eleron LLC INN 7814141042 |

Saint-Petersburg | 31,45 | 108 | 242 (high) |

| 7 | Mehprachechnaya SvZHD LLC INN 6659170630 |

Sverdlovsk region | 1,22 | 794 | 267 (high) |

| 8 | Kombinat bytovogo obsluzhivaniya Novost OJSC INN 7724295418 |

Moscow | 0,94 | 111 | 219 (high) |

| 9 | Fabrika-prachechnaya FANPA OJSC INN 7720039237 |

Moscow | 0,37 | 101 | 192 (the highest) |

| 10 | AVTOVAZtechbytservis OJSC INN 6320003788 |

Samara region | -10,34 | 102 | 235 (high) |

Enterprises, providing their services to government agencies, dominate on the market.

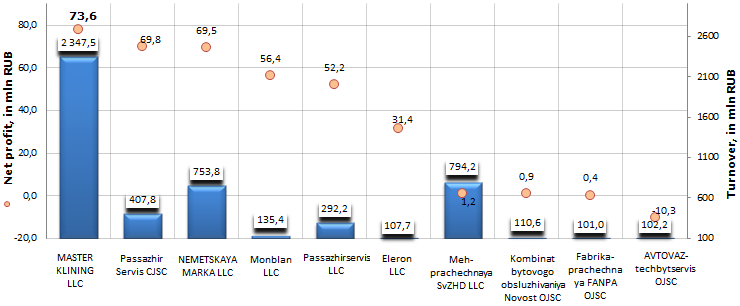

The first place in the ranking list belongs to the company MASTER KLINING LLC, being industry leader on turnover. Good results of its activity are supported by a high solvency index GLOBAS-i®, that characterizes it as financially stable.

The second and the third places of the ranking list belong to Passazhir Servis CJSC and NEMETSKAYA MARKA LLC. In support of good results of their activity companies got the highest and a high solvency index GLOBAS-i® respectively.

Net profit of the largest on turnover dry cleaners and laundries in Russia, TOP-10

All enterprises, presented in the ranking, except AVTOVAZtechbytservis OJSC, showed the value of revenue and net profit at an adequate level. Financial ratios of these companies are also at a good level, that is confirmed by a high and the highest solvency indexes GLOBAS-i®.

Company AVTOVAZtechbytservis OJSC is the only one from the TOP-10 on turnover, which showed negative values of net profit at year end 2012, what means that its management should approach cost planning more rationally. However, to give an estimation of an enterprise, basing only on net profit performances, would be incorrect. Sales profit and before-tax profit are noteworthy for more precise analysis. Basing on a comprehensive assessment, the Agency Credinform assigned a high solvency index GLOBAS-i® to the company.

Now therefore, net profit is the most important indicator for any enterprise. Its value is the result of activity of a business entity. Significant variations of this indicator in dynamics may get investors’ attention. In such case it will be necessary to give detailed explanations about reasons of these changes.

How long will cash circulation exist in Russia?

In spite of late years acquiring onrush in Russia, the volume of cash circulation is not only far from diminishing, but is growing rather fast. As for 1st January 2014, the total amount of circulating bank notes and coins was 8 135,0 bln. RUR. That is 8,3% higher in comparison with the previous year with its 7 675,4 bln. RUR. 99% of the total amount of current money falls to the share of bank notes. Bank note of 1 th. RUR denomination prevails in the total number of bank notes (34% of total). The second is bank note of 100 RUR denomination (18% of total).

All efforts of financial authorities to stimulate the process of transition to electronic payment instruments haven’t brought the desired results yet. Recorded growth of cash circulation is superfluous, given that official inflation for the year was 6,5%.

There are several reasons: the significant part of the population in Russia still has low income (below average) and goes shopping in small retail stores and markets, where cash is the only mean of payment. Moreover, the level of financial awareness in Russia is low. One shouldn’t forget about psychological aspect: the population is used to settle in cash and it will take much time and considerable efforts to redirect it on using electronic payment instruments.

The projects on legal restraint of cash payment within the frame of certain amount are in the talking stage for already several years. But things haven’t budged an inch. Payment for major purchases like apartment or car is made in the same old way – by long-time adding and checking of paper money.

Along with obvious advantages of electronic money, one more utmost importance bars the adoption: card or account is pegged to a servicing bank. Credit institution takes bank’s commission when natural person or legal body draws or transfers money using other bank. This won’t happen still and all in «transference» of cash. The list of claims to digital cash is completed by time of transferring from one account to another and limitations on operations with money on card.

That is why together with the legislative initiative, financial authorities should think over commission banks policy and conditions of clients’ accounting management. The person is hard to see why he is restricted in using his own money, and has to additory pay for converting it to e-money.