First-time entrepreneurs will be exempted from taxes

The MEDT of Russia has drafted and escalated a proposal on the introduction of «tax holidays» for first-time entrepreneurs to the Government. Based on the results of its consideration it will be given an appropriate order to draft a bill. This action is the answer to an exodus of entrepreneurs from legal field, after a doubling of the premium rate.

According with the mentioned proposals, «tax holidays» will relate to individual entrepreneurs (IE), for the first time registered their business and using simplified or patent tax system. Such measure will be actual for 2 years since the moment of company’s registration and able to be used only once.

Today the IE use special tax treatments, there are some variants to choose: simplified system of taxation (6% from the turnover or 15% from the income), single tax on transitory income, PIT, VAT and patent system. By that, social due fees are paid by all regimes, and they will be saved anyway.

Because the introduction of such allowances is attended with some risks: for example, old companies will re-registered their business, then for testing of the risk minimization mechanisms and tracking of instances of fraud «tax holidays» are planned to be introduced like an experiment (for the period from 2014 to 2016) in some regions. By that, subjects-participants of the experiment will get the right to establish for this period a zero tax rate within the patent or simplified tax system regarding the first-time entrepreneurs. It is not decided yet, exactly which regions will take part in experiment, but Ulyanovsk, Kirovsk and Novosibirsk regions have expressed their wish yet.

However, some experts point out, that such allowance creates discrimination on the market, leaving those people deprived, who has already started up own business, but has not succeeded and wants to try again. Besides that, the mechanisms which will be used to expose the frauds, representing themselves as new entrepreneurs, are not exactly clear. It’s sure, it can be identified the affiliation, if desired, but in this case the allowance creates more reasons for suspicions, than for privileges.

The detailed information on a company or an individual entrepreneur you are interested in can be got from the daily updated data base GLOBAS-i®, developed by the Information Agency Credinform.

Debt/equity ratio of medical equipment manufacturers

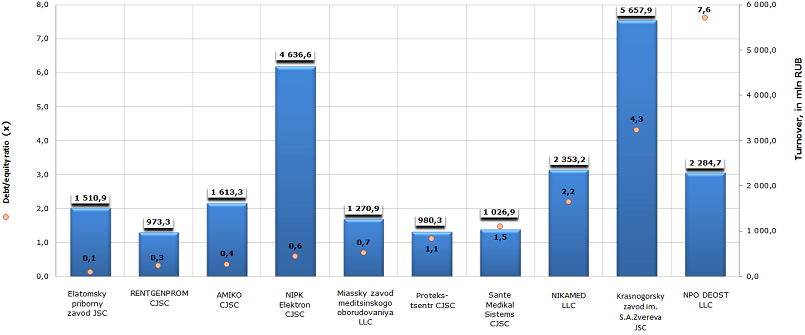

Information agency Credinform prepared a ranking of enterprises manufacturing different medical equipment and items.

The companies with highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). These enterprises were ranked by increase in debt/equity ratio.

Debt/equity ratio (х) shows the ratio between borrowed and own sources of company financing.

Mentioned index is interesting first of all for the analysis of the long-term solvency of creditors.

The higher is the ratio above 1, the more depends an enterprise on borrowed funds.

Permissible level is often determined by working conditions of each company, first of all by the rate of working capital turnover. That is why it is necessary to determine extra the rate of inventories turnover and of accounts receivable turnover for the analyzed period. Because by a high rate of inventories turnover and a still higher rate of accounts receivable turnover the debt/equity ratio can be much more than 1.

Therefore, for the getting of more comprehensive and fair picture of financial standing of an enterprise it is necessary to pay attention not only to average values of the analyzed ratio industrywide, but also to all presented summation of financial indicators and ratios of a company.

| № | Name | Region | Turnover for 2012, in mln RUB | Debt/equity ratio (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Elatomsky priborny zavod JSC INN: 6204001412 |

Ryazan region | 1 510,9 | 0,1 | 171 (the highest) |

| 2 | RENTGENPROM CJSC INN: 5017031616 |

Moscow region | 973,3 | 0,3 | 169(the highest) |

| 3 | AMIKO CJSC INN: 7726005851 |

Moscow | 1 613,3 | 0,4 | 146(the highest) |

| 4 | NIPK Elektron CJSC INN: 7827012767 |

Saint-Petersburg | 4 636,6 | 0,6 | 191(the highest) |

| 5 | Miassky zavod meditsinskogo oborudovaniya LLC INN: 7415058730 |

Chelyabinsk region | 1 270,9 | 0,7 | 217(high) |

| 6 | Proteks-tsentr CJSC INN: 5022005643 |

Moscow region | 980,3 | 1,1 | 185(the highest) |

| 7 | Sante Medikal Sistems CJSC INN: 7734111726 |

Moscow | 1 026,9 | 1,5 | 210 (high) |

| 8 | NIKAMED LLC INN: 7713046956 |

Moscow | 2 353,2 | 2,2 | 230(high) |

| 9 | Krasnogorsky zavod im. S.A.Zvereva JSC INN: 5024022965 |

Moscow region | 5 657,9 | 4,3 | 208 (high) |

| 10 | NPO DEOST LLC INN: 5039003073 |

Moscow region | 2 284,7 | 7,6 | 200(high) |

Picture. Rating of the debt/equity ratio of medical equipment manufacturers (TOP-10)

Cumulative turnover of TOP-10 the largest medical equipment manufacturers at year-end 2012 reached 22 307,8 mln RUB, increased by 32,5% in comparison with the year 2011. Cumulative net profit of enterprises of the mentioned branch is 1 156,2 mln RUB, total financial result also showed double-digit rate of growth - 22,1% to the level of 2011.

The average value of debt/equity ratio of TOP-100 organizations is 2,6.

It can be stated, that the situation in the sphere of medical equipment production is favorable enough, especially if considering the substantial economic growth rate reduction. This circumstance is explained mainly by a growing demand for high quality medical equipment and devices from the side of either private clinics, or governmental.

According to the debt/equity ratio of TOP-10 the largest manufacturers in the branch, five from ten enterprises showed the value less than 1, in other words - borrowed funds value is no more than equity capital; companies carry out a balanced financial policy, without any risks. To such enterprises belong amongst others:

Elatomsky priborny zavod JSC (0,1) – produces medical apparatus for magnetic therapy and heat treatment, composite treatment apparatus;

RENTGENPROM CJSC (0,3) – manufactures and works out medical X-ray equipment;

AMIKO CJSC (0,4) - medical X-ray diagnostic units and equipment for X-ray diagnostic;

NIPK Electron CJSC (0,6) – X-ray diagnostic units;

Miassky zavod meditsinskogo oborudovaniya LLC (0,7) - aseptic laminar techniques for highly effective cleaning and sterilization of air in healthcare facilities, clinics.

The ratios of the rest participants of the analyzed TOP-10 are more than 1, and it means that credit resources are higher than the equity capital of the company. Such financial strategy seems to be risky enough. On the other side, development and introduction of hi-tech machinery and equipment in the sphere of medicine require significant material costs. This practice can be justified on the basis of well-thought-out business plan, targeted on future benefit from committed investments and gaining a foothold on the market. Organizations, rounding out the ranking - Krasnogorsky zavod im. S.A.Zvereva JSC and NPO DEOST LLC - showed the debt/equity ratio even more than by 100 the largest enterprises in the mentioned branch on the average – 4,3 and 7,6 respectively.

Taken as a whole, according to the independent estimation of solvency, developed by the Agency Credinform, all market leaders, including those who lives on credit, have the highest and a high solvency index GLOBAS-i®, that can be considered as a guarantee they will pay off their debts, while risk of default is minimal or below average. From investment point of view the business cooperation with participants of the rating looks attractive.