Profit level of microfinance companies

Information agency Credinform has prepared a ranking of the largest Russian microfinance companies. The largest enterprises (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the available periods (2016-2018). Then the companies were ranged by net profit ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Net profit ratio (%) is calculated as a ratio of net profit (loss) to sales revenue. The ratio reflects the company’s level of sales profit.

The ratio doesn’t have the standard value. It is recommended to compare the companies within the industry or the dynamics of a ratio for a certain company. The negative value of the ratio indicates about net loss. The higher is the ratio value, the better the company operates.

For the most full and fair opinion about the company’s financial position the whole set of financial indicators and ratios should be taken into account.

| Name, INN, region | Revenue, billion RUB | Net profit (loss), billion RUB | Net profit ratio, % | Solvency index Globas | |||

| 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| LLC MKK MOL BULAK INN 7728744752 Moscow |

1,448 1,448 |

na |  0,452 0,452 |

na |  31,23 31,23 |

na | 219 Strong |

| LLC MKK SIBIRINVEST INN 5408271207 Novosibirsk region |

0,070 0,070 |

na |  0,011 0,011 |

na |  15,98 15,98 |

na | 228 Strong |

| ANO RRAPP INN 6164109350 Rostov region |

0,094 0,094 |

na |  0,011 0,011 |

na |  11,28 11,28 |

na | 239 Strong |

| LLC MFK PROSTODENGI INN 4205219217 Novosibirsk region |

1,350 1,350 |

1,451 1,451 |

0,132 0,132 |

0,355 0,355 |

9,81 9,81 |

na | 211 Strong |

| LLC MKK KASSA №1 INN 274169217 The Republic of Bashkortostan |

0,360 0,360 |

0,455 0,455 |

0,013 0,013 |

0,051 0,051 |

3,48 3,48 |

11,30 11,30 |

227 Strong |

| LLC MFK 4FINANS INN 7724351447 Moscow In process of reorganization in the form of acquisition of other legal entities, 17/07/2019 |

0,876 0,876 |

na |  0,021 0,021 |

na |  2,39 2,39 |

na | 284 Medium |

| LLC MONEY MAN INN 7704784072 Moscow |

4,457 4,457 |

na |  0,041 0,041 |

na |  0,93 0,93 |

na | 257 Medium |

| LLC MFK VEBBANKIR INN 7733812126 Moscow |

1,332 1,332 |

na |  0,000 0,000 |

na |  -0,02 -0,02 |

na | 279 Medium |

| LLC MKK DZHET MANI MIKROFINANS INN 5042119198 Moscow |

2,019 2,019 |

1,114 1,114 |

-0,709 -0,709 |

-0,113 -0,113 |

-35,13 -35,13 |

-10,14 -10,14 |

336 Adequate |

| NAO MKK DENGI SRAZU INN 6454074861 Saratov region |

0,144 0,144 |

0,101 0,101 |

-0,078 -0,078 |

0,004 0,004 |

-53,96 -53,96 |

4,45 4,45 |

230 Strong |

| Total for TOP-10 companies |  12,151 12,151 |

-0,106 -0,106 |

|||||

| Average value for TOP-10 companies |  1,215 1,215 |

-0,011 -0,011 |

-1,40 -1,40 |

||||

| Average industry value |  0,016 0,016 |

0,013 0,013 |

81,74 | ||||

growth of indicator in comparison with prior period,

growth of indicator in comparison with prior period,  decline of indicator in comparison with prior period.

decline of indicator in comparison with prior period.

In 2017, the average value of net profit ratio for TOP-10 companies is lower than average industry value: four companies improved the results.

*) 2018 data is for the reference.

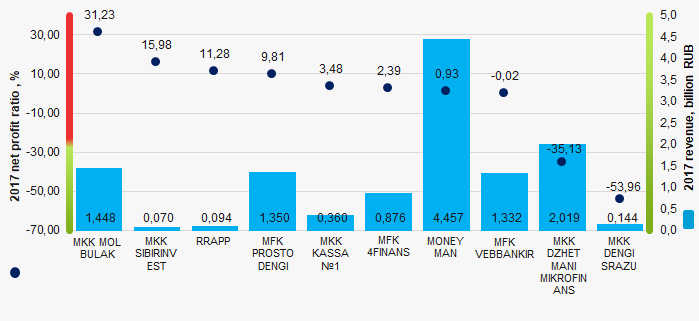

Picture 1. Net profit ratio and revenue of the largest microfinance companies (ТОP-10)

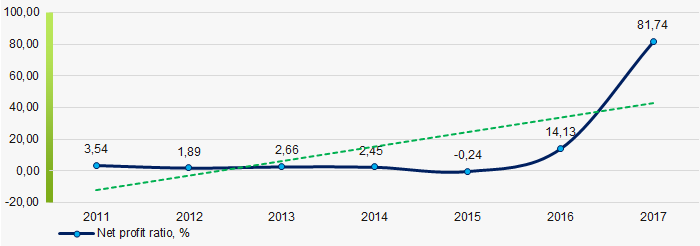

Picture 1. Net profit ratio and revenue of the largest microfinance companies (ТОP-10)Within 7 years, the average industry indicators of the net profit ratio showed the growing tendency. (Picture 2).

Picture 2. Change in average industry values of the net profit ratio of microfinance companies in 2011 – 2017

Picture 2. Change in average industry values of the net profit ratio of microfinance companies in 2011 – 2017Trends in sale of pharmaceutical products

Information agency Credinform represents an overview of activity trends of the largest Russian pharmaceutical wholesalers.

Trading companies with the largest volume of annual revenue (TOP-10 and TOP-1000) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2015 – 2017). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets value is an indicator, reflecting the real value of company’s property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in terms of net assets is OTCPHARM NJSC. In 2018, its net assets amounted to more than 51,4 billion rubles.

The smallest amount of net assets in the TOP-1000 list was hold by NJSC ROSTA. The insufficiency of property of this company in 2017 was expressed as a negative value of -13,5 billion rubles.

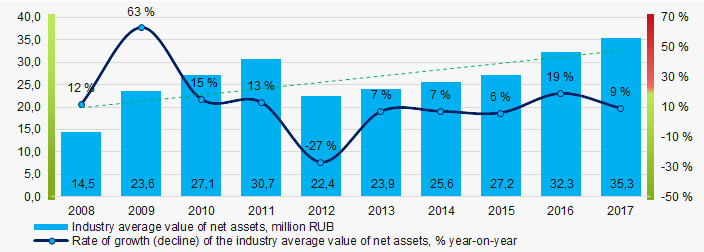

The average values of net assets tend to increase over the ten-year period (Picture 1).

Picture 1. Change in the industry average indicators of the net asset value of pharmaceutical wholesalers in 2008 – 2017

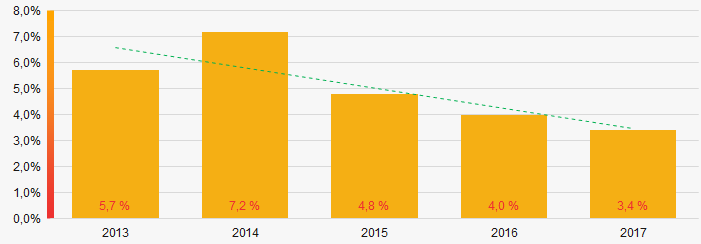

Picture 1. Change in the industry average indicators of the net asset value of pharmaceutical wholesalers in 2008 – 2017The shares of TOP-1000 enterprises with insufficiency of assets have a tendency to decrease in the last five years (Picture 2).

Picture 2. Shares of enterprises with negative values of net assets in TOP-1000 in 2013 – 2017

Picture 2. Shares of enterprises with negative values of net assets in TOP-1000 in 2013 – 2017Sales revenue

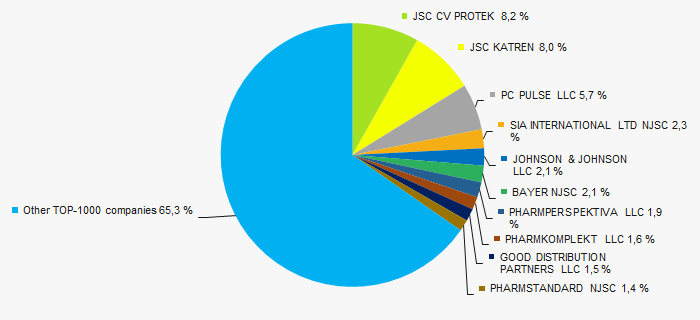

The revenue volume of 10 leading companies of the industry made 35% of the total revenue of TOP-1000 in 2017 (Picture 3). It points to a relatively high level of competition in the industry.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2017

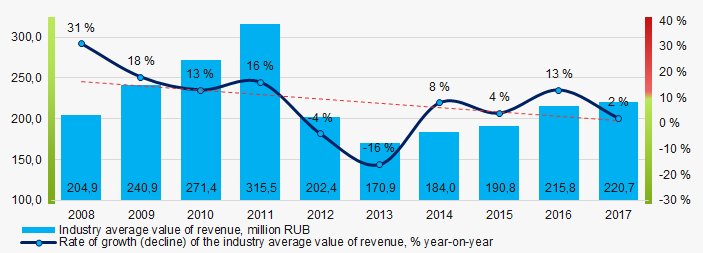

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2017In general, there is a decrease in industry average revenue over the ten-year period (Picture 4).

Picture 4. Change in the industry average revenue of pharmaceutical wholesalers in 2008 – 2017

Picture 4. Change in the industry average revenue of pharmaceutical wholesalers in 2008 – 2017Profit and loss

The largest company in terms of net profit value is JSC PHARMSTANDARD. The company's profit amounted to more than 45,5 billion rubles for 2018.

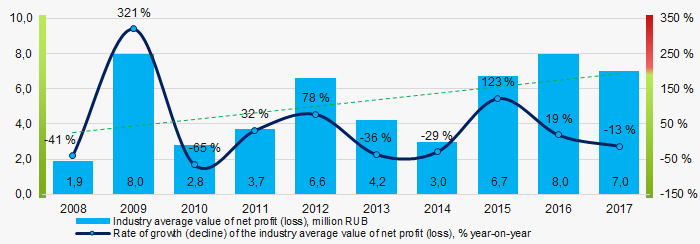

Industry average values of net profit trend to increase over the past ten years (Picture 5).

Picture 5. Change in the industry average indicators of net profit of pharmaceutical wholesalers in 2008 – 2017

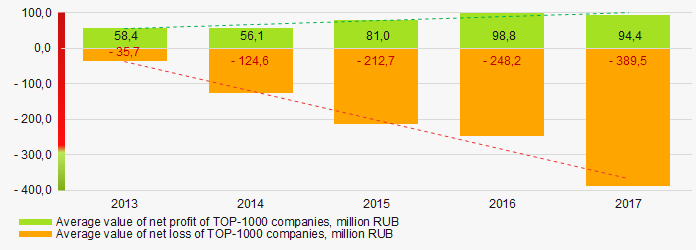

Picture 5. Change in the industry average indicators of net profit of pharmaceutical wholesalers in 2008 – 2017Average values of net profit’s indicators of TOP-1000 companies increase for the five-year period, at the same time the average value of net loss increases significantly. (Picture 6).

Picture 6. Change in the industry average values of indicators of net profit and net loss of TOP-1000 companies in 2015 – 2017

Picture 6. Change in the industry average values of indicators of net profit and net loss of TOP-1000 companies in 2015 – 2017 Key financial ratios

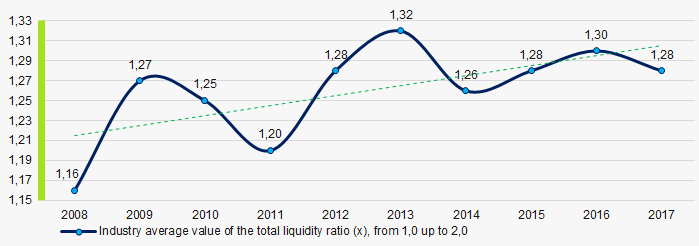

Over the ten-year period the average indicators of the total liquidity ratio of TOP-1000 enterprises were in the range of recommended values - from 1,0 up to 2,0, with a tendency to increase (Picture 7).

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the industry average values of the total liquidity ratio of pharmaceutical wholesalers in 2008 – 2017

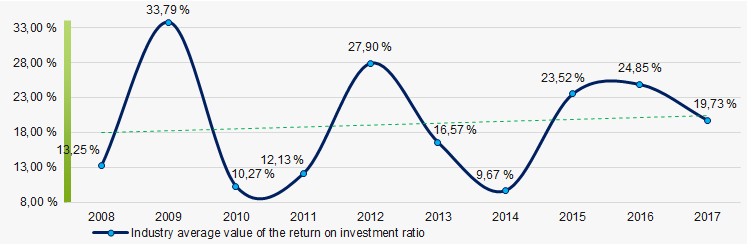

Picture 7. Change in the industry average values of the total liquidity ratio of pharmaceutical wholesalers in 2008 – 2017The average industry values of the return on investment ratio were mainly at a relatively high level with the tendency to increase over the course of ten years (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity of own capital involved in the commercial activity and the long-term borrowed funds of an organization.

Picture 8. Change in the industry average values of the return on investment ratio of pharmaceutical wholesalers in 2008 – 2017

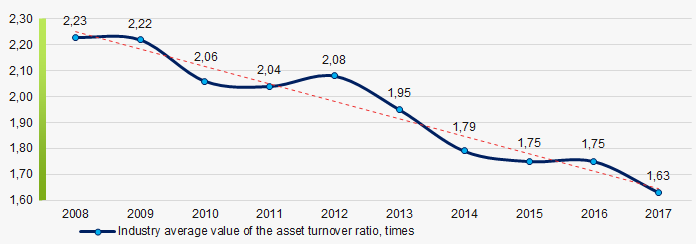

Picture 8. Change in the industry average values of the return on investment ratio of pharmaceutical wholesalers in 2008 – 2017Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This ratio of business activity showed a tendency to decrease over the ten-year period (Picture 9).

Picture 9. Change in the industry average values of the asset turnover ratio of pharmaceutical wholesalers in 2008 – 2017

Picture 9. Change in the industry average values of the asset turnover ratio of pharmaceutical wholesalers in 2008 – 2017Small business

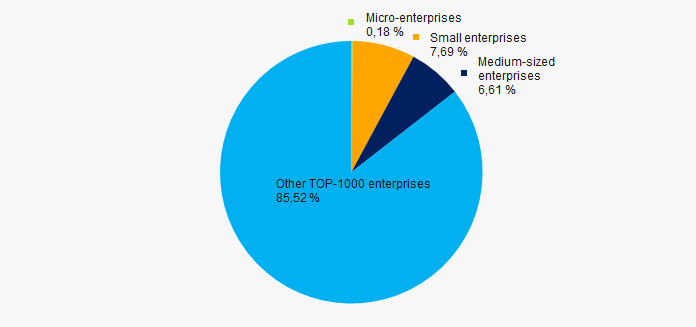

66% of TOP-1000 companies are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the RF. At the same time, their share in the total revenue amounted to 14,5% in 2017, that is significantly lower than the national average (Picture 10).

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-1000 companies, %

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-1000 companies, %Main regions of activity

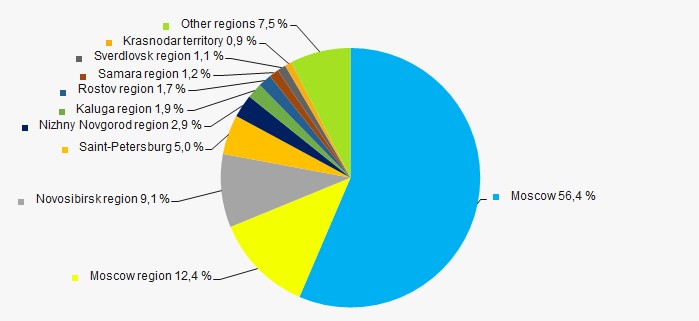

The TOP-1000 companies are distributed highly unequal across Russia and registered in 69 regions. Almost 69% of their revenues are concentrated in Moscow and Moscow region (Picture 11).

Picture 11. Distribution of the revenue of TOP-1000 companies by Russian regions

Picture 11. Distribution of the revenue of TOP-1000 companies by Russian regionsFinancial position score

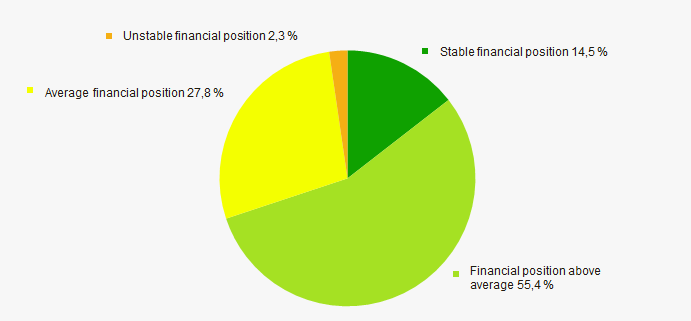

An assessment of the financial position of TOP-1000 companies shows that the financial position of most of them is above average (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

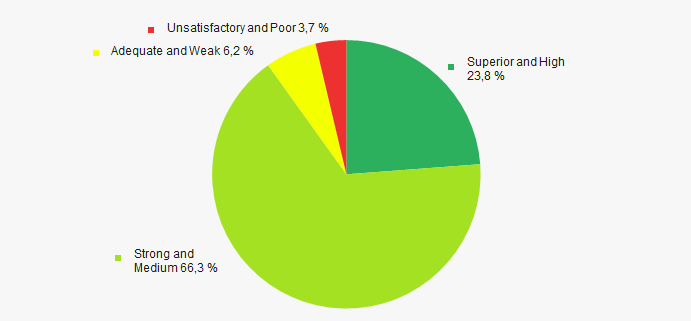

The vast majority of TOP-1000 companies got Superior/High or Strong/Medium Solvency index Globas, that points to their ability to pay off their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasConclusion

A comprehensive assessment of activity of pharmaceutical wholesalers, taking into account the main indices, financial indicators and ratios, points to the prevalence of positive trends in the industry (Table 1).

| Trends and evaluation factors | Specific share of factor, % |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  10 10 |

| Level of competition |  5 5 |

| Rate of growth (decline) in the average size of revenue |  -10 -10 |

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

| Growth / decline in average values of net profit of TOP-1000 companies |  10 10 |

| Growth / decline in average values of net loss of TOP-1000 companies |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  10 10 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio |  -10 -10 |

| Share of small and medium-sized enterprises in the industry in terms of revenue being more than 22% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of factors |  2,5 2,5 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).