Equity turnover ratio of the largest Russian wholesalers of information technology and telecommunications equipment

Information agency Credinform prepared a ranking of the largest Russian wholesalers of information technology and telecommunications equipment. Companies with the highest volume of revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (2016 and 2015). The enterprises were ranked by equity turnover ratio (Table 1). The analysis was based on data from the Information and Analytical system Globas.

Equity turnover ratio (times) is calculated as a relation of revenue to annual average sum of equity and demonstrates the company’s usage rate of all available assets.

Equity turnover ratio reflects the turnover rate of own capital. High value of the indicator shows the effectiveness of use of own funds. Accordingly, low ratio value indicates idleness of the part of own funds.

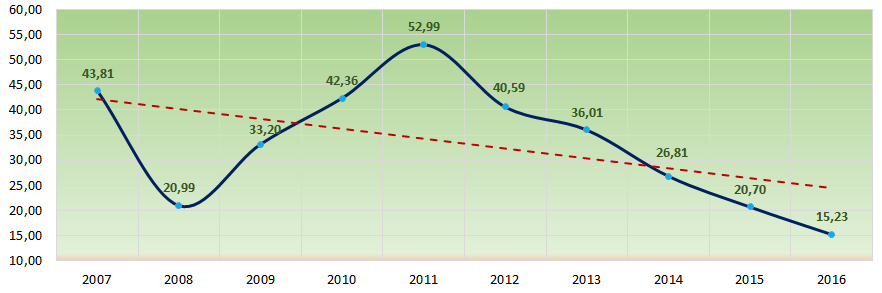

Taking into account the actual situation both in economy in general and in the sector, the experts of the Information agency Credinform have developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios, which can be recognized as normal for a particular industry. The practical value of assets turnover ratio for wholesalers of information technology and telecommunications equipment in 2016 is from 15,23 times.

For the most complete and objective view of the financial condition of the enterprise it is necessary to pay attention to the complex indicators and financial ratios of the company.

| Name, INN, region | Revenue, mln RUB | Net profit, mln RUB | Equity turnover ratio, times | Solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| LLC MADZHESTIK INN 7701621619 Moscow |

15 981,6 | 11 867,4 | 1,7 | 4,5 | 2 946,74 | 1 390,11 | 213 Strong |

| LLC BERKS INN 7743856281 Moscow |

8 770,5 | 29 988,3 | 12,8 | 20,4 | 730,08 | 710,45 | 240 Strong |

| LLC SOYUZUNIVERSAL INN 7701153505 Moscow |

27 374,7 | 25 208,6 | 200,0 | -68,3 | 203,83 | 125,95 | 550 Insufficient (bankruptcy case is considering) |

| LLC MARVEL KT INN 7811365157 Moscow |

28 674,9 | 63 877,9 | 122,1 | 2 407,6 | 223,32 | 64,85 | 211 Strong |

| LLC O-C-S-TSENTR INN 7701341820 Moscow |

73 934,8 | 92 616,8 | 773,5 | 999,6 | 18,75 | 19,99 | 213 Strong |

| LLC APPLE RUS INN 7707767220 Moscow |

74 520,9 | 123 565,1 | 7,2 | 6 452,2 | 14,08 | 9,98 | 196 High |

| JSC JET INFOSYSTEMS INN 7729058675 Moscow |

10 204,5 | 13 443,2 | 542,5 | 1 338,5 | 12,55 | 7,98 | 162 Superior |

| JSC CROC INCORPORATED INN 7701004101 Moscow |

23 090,1 | 24 095,8 | 383,2 | 353,1 | 7,06 | 7,24 | 188 High |

| JSC ASTEROS INN 7721163646 Moscow |

9 383,8 | 10 556,6 | 252,2 | 269,4 | 6,42 | 6,42 | 212 Strong |

| LLC MARVEL COMPANY INN 7811070820 Moscow |

12 646,2 | 11 147,5 | 9,4 | -1 081,6 | 39,53 | -51,55 | 600 Insufficient (in process of liquidation, 01.06.2017) |

| Total for TOP-10 | 284 582,1 | 406 367,0 | 2 304,6 | 10 695,4 | |||

| Average value for TOP-10 companies | 28 458,2 | 40 636,7 | 230,5 | 1 069,5 | 420,24 | 229,14 | |

| Average value for industry | 161,1 | 155,1 | 0,7 | 23,7 | 19,70 | 11,91 | |

Average value of equity turnover ratio for TOP-10 is notably higher than the industry average. Compared to the previous period, two companies in TOP-10 have increased revenue and net profit figures (marked with green in columns 2 – 5 Table 1). The rest of companies decreased revenue or net profit, or have losses (filled with red in columns 2 – 5 Table 1).

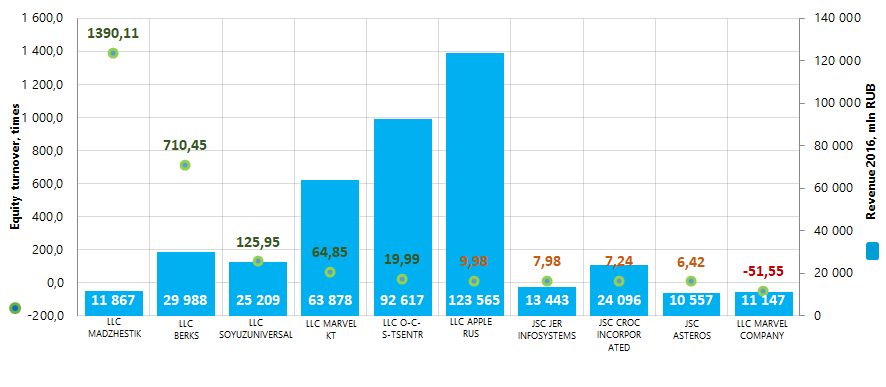

Picture 1. Equity turnover ratio and revenue of the largest Russian wholesalers of information technology and telecommunications equipment (TOP-10)

Picture 1. Equity turnover ratio and revenue of the largest Russian wholesalers of information technology and telecommunications equipment (TOP-10)The average industry indicators of equity turnover ratio over the past 10 years were above practical value of 2016 with trend to decrease (Picture 2).

Picture 2. Change in average industry values of equity turnover ratio of the largest Russian wholesalers of information technology and telecommunications equipment in 2007 – 2016

Picture 2. Change in average industry values of equity turnover ratio of the largest Russian wholesalers of information technology and telecommunications equipment in 2007 – 2016Trends in activity of the largest companies of the real economy sector of Leningrad region

Information Agency Credinform has prepared the review of trends in activity of the largest companies of the real economy sector of Leningrad region.

The largest enterprises (TOP-10 and TOP-1000) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2014 – 2016). The analysis was based on data of the Information and Analytical system Globas.

Net assets

Indicator of real cost of corporate assets, which is annually calculated as the difference between assets of the company and its debt liabilities. If the company’s debts exceed net worth value, net assets indicator is considered negative (insufficiency of property).

| Position in ТОP-1000 | Name, activity | Net asset value, bln RUB* | Solvency index Globas | ||

| 2014 | 2015 | 2016 | |||

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1. | LLC KINEF Manufacture of refined petroleum products |

18,4 | 7,5 | 41,0 | 253 Medium |

| 2. | TRANSNEFT-PORT PRIMORSK, LTD Other cargo handling |

19,9 | 23,6 | 26,1 | 184 High |

| 3. | NAO PHILIP MORRIS IZHORA Manufacture of tobacco products |

19,4 | 23,0 | 25,8 | 173 Superior |

| 4. | NOKIAN SHINA LTD Sale of motor vehicle parts and accessories |

13,7 | 21,7 | 23,3 | 148 Superior |

| 5. | LLC NOVATEK-UST'-LUGA Manufacture of refined petroleum products |

20,3 | 33,7 | 23,2 | 193 High |

| 996. | LLC STROILES-2 Logging In process of reorganization in the form of accession |

-1,5 | -1,8 | -1,4 | 600 Insufficient |

| 997. | PAO LENINGRAD SHIPYARD PELLA Building of ships and floating structures |

0,4 | -0,9 | -1,5 | 275 Medium |

| 998. | YURA CORPORATION RUS LLC Manufacture of other electrical equipment |

-1,1 | -2,3 | -2,0 | 290 Medium |

| 999. | LLC MLP-KAD Renting and operating of own or leased untenanted real estate |

-4,6 | -6,5 | -5,1 | 264 Medium |

| 1000. | LLC EUROPEAN SULFUR TERMINAL Other cargo handling |

-8,9 | -10,8 | -7,2 | 257 Medium |

*) – growth/decline indicators in comparison with prior period are marked green and red in columns 4 and 5 respectively.

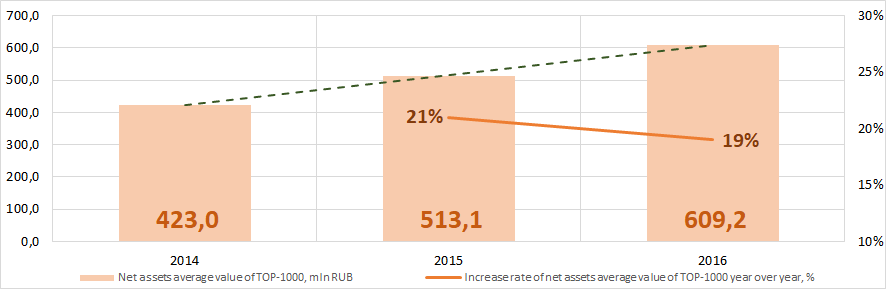

Picture 1. Change in average net assets value of the largest companies of the real economy sector of Leningrad region in 2014 – 2016

Picture 1. Change in average net assets value of the largest companies of the real economy sector of Leningrad region in 2014 – 2016Sales revenue

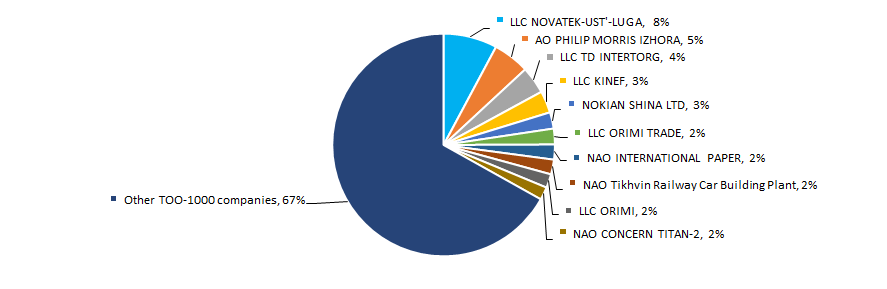

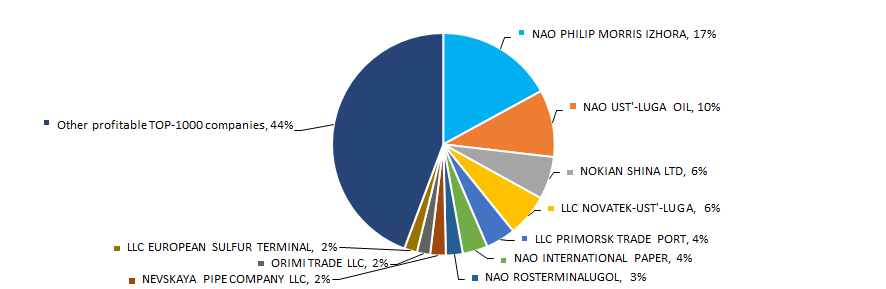

In 2016 total revenue of 10 largest companies amounted to 33% from TOP-1000 total revenue (Picture 2).

Picture 2. Shares of TOP-10 companies in TOP-1000 total revenue for 2016

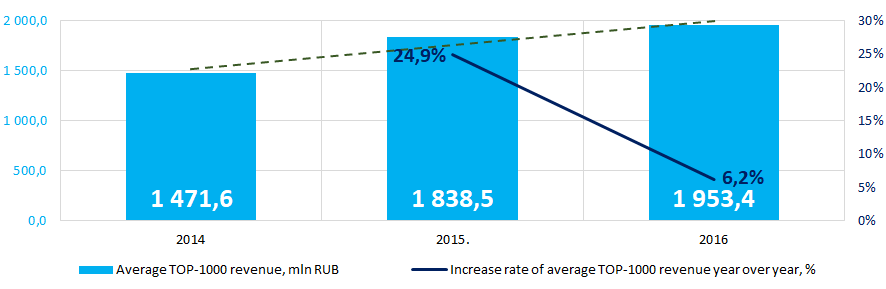

Picture 2. Shares of TOP-10 companies in TOP-1000 total revenue for 2016The increase in sales revenue is observed (Picture 3).

Picture 3. Change in average revenue of the largest companies of the real economy sector of Leningrad region in 2014 – 2016

Picture 3. Change in average revenue of the largest companies of the real economy sector of Leningrad region in 2014 – 2016Profit and loss

In 2016, profit of 10 largest companies amounted to 56% from TOP-1000 total profit (Picture 4).

Picture 4. Shares of TOP-10 companies in TOP-1000 total profit for 2016

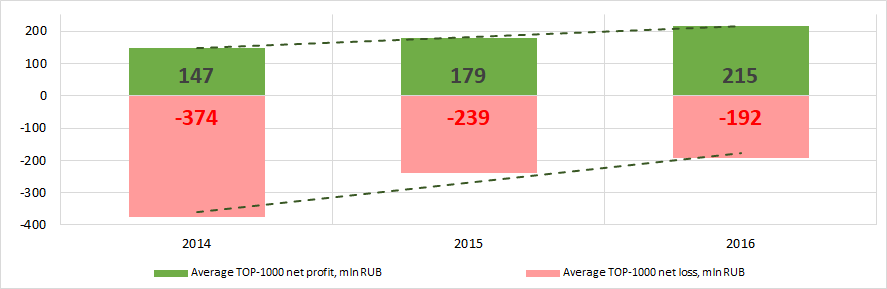

Picture 4. Shares of TOP-10 companies in TOP-1000 total profit for 2016For the three-year period, the average revenue values of TOP-1000 companies show the growing tendency and the average net loss decreases (Picture 5).

Picture 5. Change in average profit/loss of the largest companies of the real economy sector of Leningrad region in 2014 – 2016

Picture 5. Change in average profit/loss of the largest companies of the real economy sector of Leningrad region in 2014 – 2016Main financial ratios

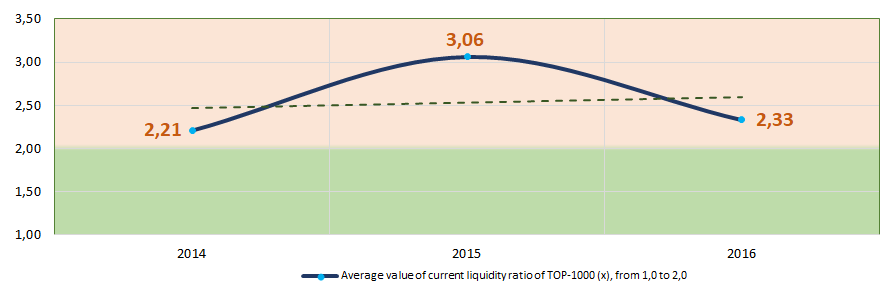

For 2014 – 2016 period the average values of current liquidity ratio of TOP-1000 were higher than recommended values – from 1,0 to 2,0 (Picture 6).

Current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Picture 6. Change in average values of current liquidity ratio of the largest companies of the real economy sector of Leningrad region in 2014 – 2016

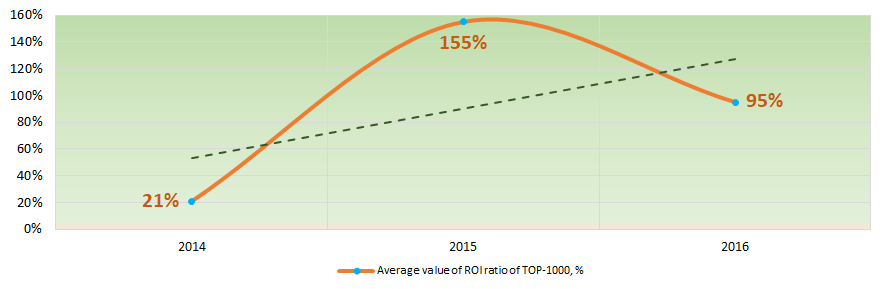

Picture 6. Change in average values of current liquidity ratio of the largest companies of the real economy sector of Leningrad region in 2014 – 2016For the three-year period, the instability of ROI ratio with increasing tendency is observed (Picture 7). The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 7. Change in average values of ROI ratio of the largest companies of the real economy sector of Leningrad region in 2014 – 2016

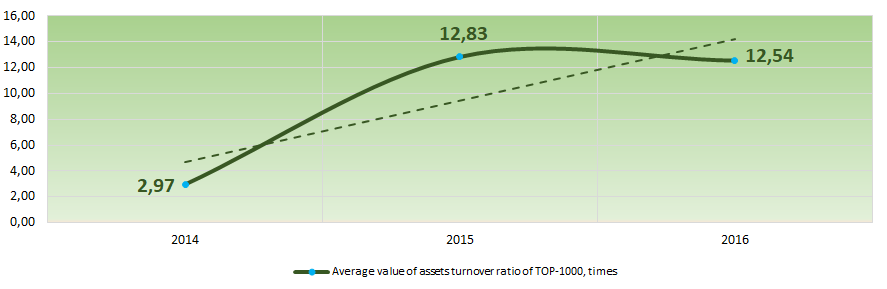

Picture 7. Change in average values of ROI ratio of the largest companies of the real economy sector of Leningrad region in 2014 – 2016Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the three-year period, this business activity ratio demonstrated the upward trend (Picture 8).

Picture 8. Change in average values of assets turnover ratio of the largest companies of the real economy sector of Leningrad region in 2014 – 2016

Picture 8. Change in average values of assets turnover ratio of the largest companies of the real economy sector of Leningrad region in 2014 – 2016Production and services structure

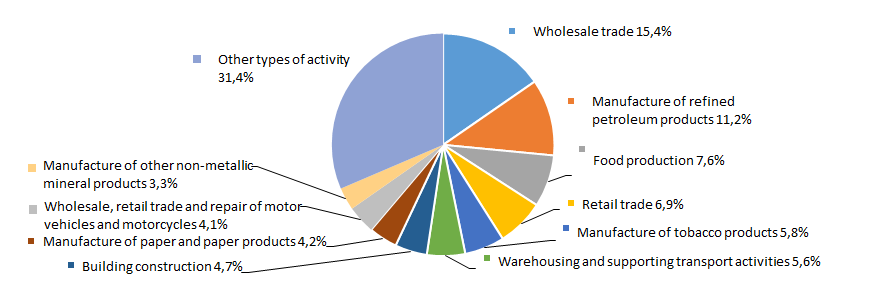

The largest share in TOP-1000 total revenue take companies engaged in wholesale trade and production of petroleum products (Picture 9).

Picture 9. Distribution of activities in TOP-1000 total revenue, %

Picture 9. Distribution of activities in TOP-1000 total revenue, %Financial position score

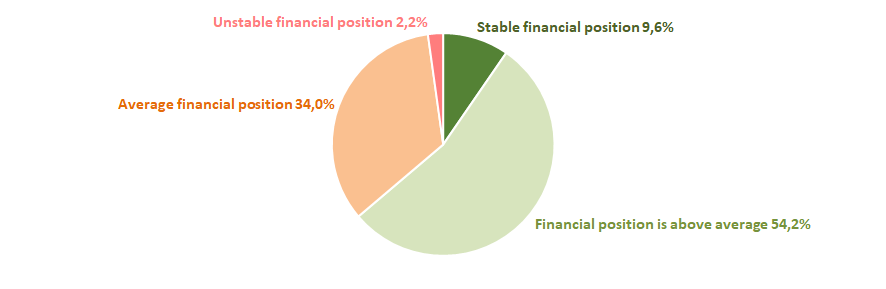

The assessment of TOP-1000 financial position shows that more than a half of companies have stable or above average financial position (Picture 10).

Pictiure 10. Distribution of TOP-1000 companies by financial position score

Pictiure 10. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

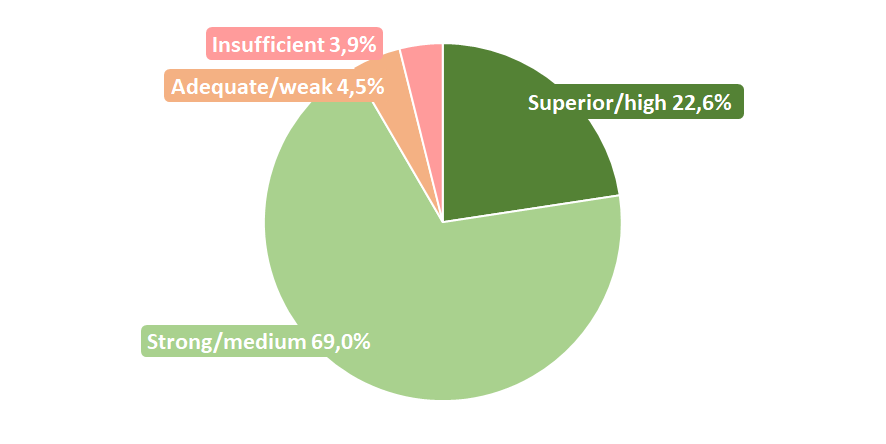

The majority of TOP-1000 companies have superior/high or strong/medium solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 11).

Picture 11. Distribution of TOP-1000 companies by solvency index Globas

Picture 11. Distribution of TOP-1000 companies by solvency index GlobasHereby, the complex assessment of the largest real economy companies of Leningrad region, taking into account main indexes, financial ratios and indicators, demonstrates the denomination of favorable trends.