Trends in activity of the largest companies of the real economy sector of Sverdlovsk region

Information Agency Credinform Credinform has prepared the review of trends in activity of the largest companies of the real economy sector of Sverdlovsk region.

The largest enterprises (TOP-10 and TOP-1000) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2014-2016). The analysis was based on data of the Information and Analytical system Globas.

Net assets are the indicator, reflecting the real value of company’s property. It is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

| Position in ТОP-1000 | Name, activity | Net asset value, bln RUB* | Solvency index Globas | ||

| 2014 | 2015 | 2016 | |||

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1. | NAO EVRAZ NIZHNY TAGIL METALLURGICAL PLANT Manufacture of crude iron, ferroalloy, steel |

118,1 | 161,0 | 175,1 | 198 High |

| 2. | JOINT STOCK COMPANY FEDERAL FREIGHT Renting and leasing of railway transport and equipment |

81,9 | 73,3 | 79,1 | 211 Strong |

| 3. | NAO URAL ELECTROCHEMICAL INTEGRATED PLANT Processing of nuclear fuel |

57,8 | 63,8 | 70,6 | 145 Superior |

| 4. | NAO EVRAZ KACHKANARCKY ORE MINING AND PROCESSING PLANT Opencast mining of iron ores |

73,6 | 67,7 | 67,5 | 233 Strong |

| 5. | PAO Enel Russia Production of electricity by heat power plants, including activities on the ensuring availability of power plants |

61,7 | 57,0 | 62,1 | 182 High |

| 996. | THE URALMASHPLANT JOINT-STOCK COMPANY Manufacture of machinery for mining and construction |

0,8 | -1,7 | -2,7 | 298 Medium |

| 997. | NAO SVERDLOVSK SUBURBAN COMPANY Passenger rail transport, interurban and international |

-3,1 | -2,9 | -2,9 | 266 Medium |

| 998. | LLC HOTEL DEVELOPMENT COMPANY Hotels and similar accommodation |

-3,8 | -4,2 | -4,2 | 316 Adequate |

| 999. | PAO NADEZHDINSKII METALLURGICHESKII ZAVOD Manufacture of sectional hot-rolled steel and wire rods |

-3,3 | -5,4 | -6,6 | 248 Strong |

| 1000. | UMMC-STEEL CORPORATION Manufacture of sectional hot-rolled steel and wire rods |

-12,4 | -20,8 | -21,7 | 327 Adequate |

* — growth/decline indicators in comparison with prior period are marked green and red in columns 4 and 5 respectively.

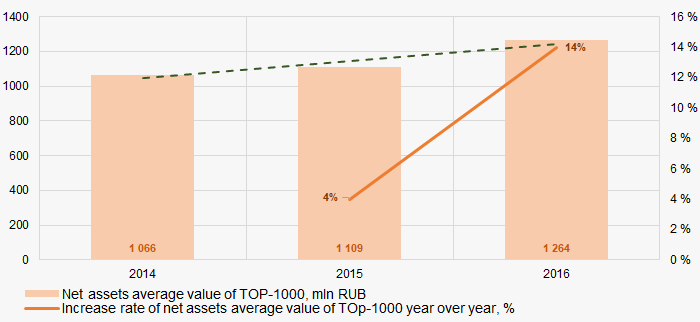

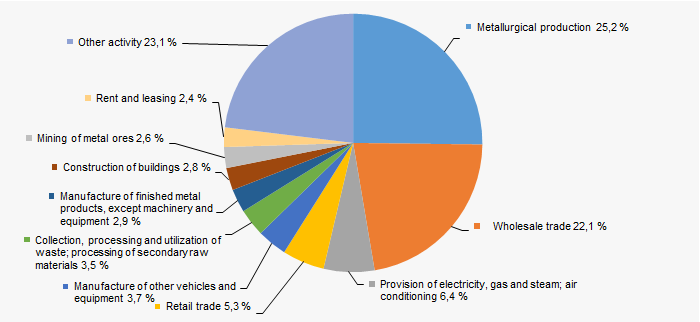

Picture 1. Change in average net assets value of the largest companies of the real economy sector of Sverdlovsk region in 2014 — 2016

Picture 1. Change in average net assets value of the largest companies of the real economy sector of Sverdlovsk region in 2014 — 2016Sales revenue

In 2016 total revenue of 10 largest companies amounted to 26% from TOP-1000 total revenue (Picture 2).

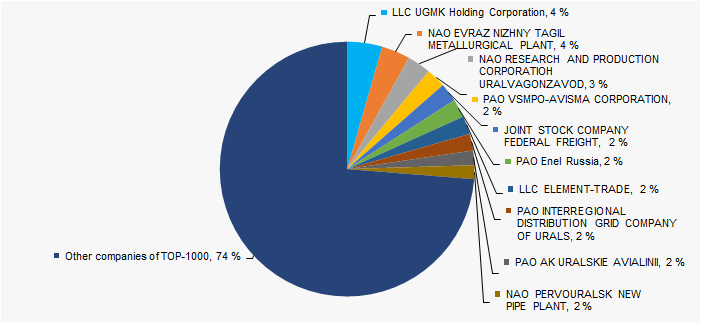

Picture 2. Shares of TOP-10 companies in TOP-1000 total revenue for 2016

Picture 2. Shares of TOP-10 companies in TOP-1000 total revenue for 2016The increase in sales revenue is observed (Picture 3).

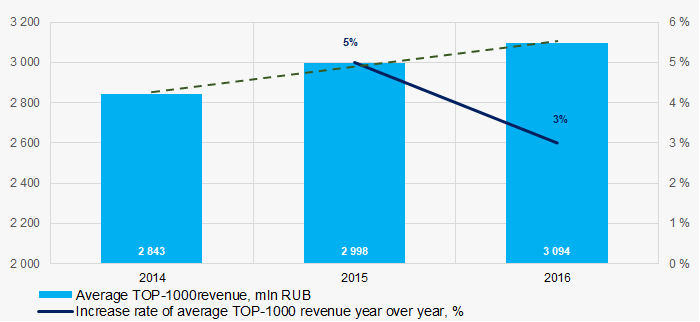

Picture 3. Change in average revenue of the largest companies of the real economy sector of Sverdlovsk region in 2014 — 2016

Picture 3. Change in average revenue of the largest companies of the real economy sector of Sverdlovsk region in 2014 — 2016Profit and loss

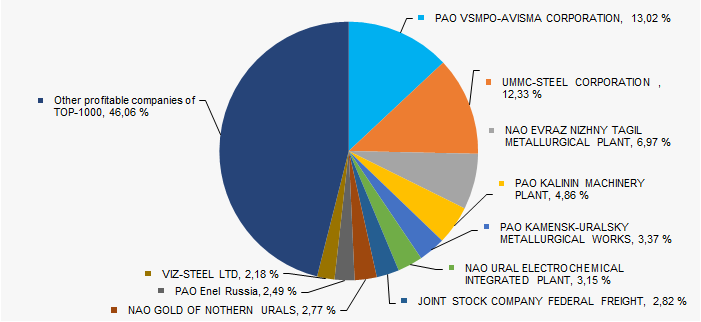

In 2016, profit of 10 largest companies amounted to 54% from TOP-1000 total profit (Picture 4).

Picture 4. Shares of TOP-10 companies in TOP-1000 total profit for 2016

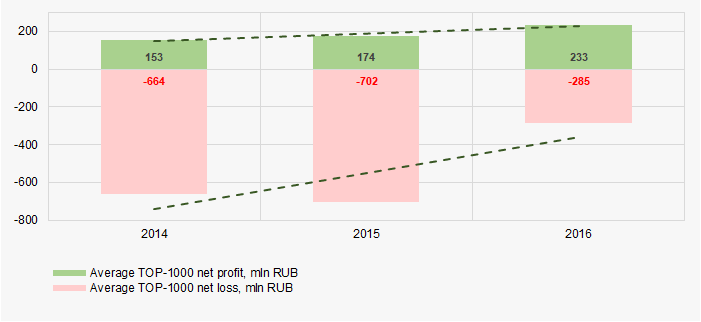

Picture 4. Shares of TOP-10 companies in TOP-1000 total profit for 2016For the three-year period, the average revenue values of TOP-1000 companies show the growing tendency and the average net loss decreases (Picture 5).

Picture 5. Change in average profit/loss of the largest companies of the real economy sector of Sverdlovsk region in 2014 — 2016

Picture 5. Change in average profit/loss of the largest companies of the real economy sector of Sverdlovsk region in 2014 — 2016Main financial ratios

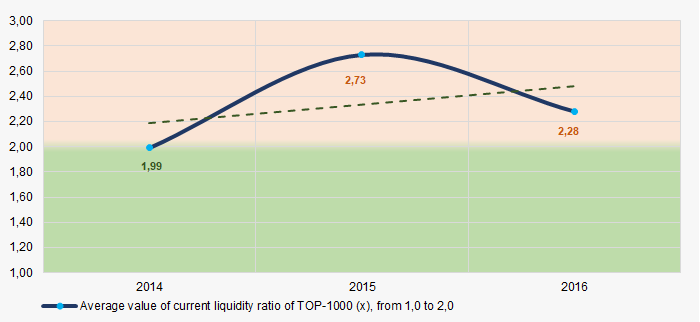

Current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

For 2015 — 2016 period the average values of current liquidity ratio of TOP-1000 were higher than recommended values — from 1,0 to 2,0 with the growing tendency (Picture 6).

Picture 6. Change in average values of current liquidity ratio of the largest companies of the real economy sector of Sverdlovsk region in 2014 — 2016

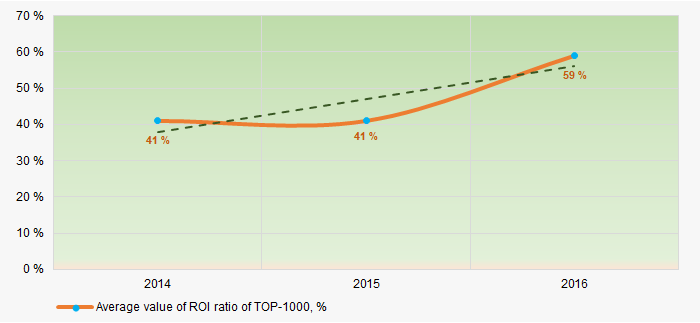

Picture 6. Change in average values of current liquidity ratio of the largest companies of the real economy sector of Sverdlovsk region in 2014 — 2016The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

For the three-year period, the increasing tendency of ROI ratio is observed (Picture 7).

Picture 7. Change in average values of ROI ratio of the largest companies of the real economy sector of Sverdlovsk region in 2014 — 2016

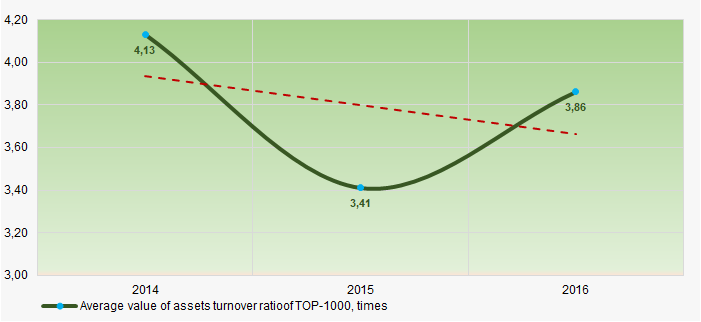

Picture 7. Change in average values of ROI ratio of the largest companies of the real economy sector of Sverdlovsk region in 2014 — 2016Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the three-year period, this business activity ratio demonstrated the downward trend (Picture 8).

Picture 8. Change in average values of assets turnover ratio of the largest companies of the real economy sector of Sverdlovsk region in 2014 — 2016

Picture 8. Change in average values of assets turnover ratio of the largest companies of the real economy sector of Sverdlovsk region in 2014 — 2016Production and services structure

The largest share in TOP-1000 total revenue take companies engaged in metallurgical production and wholesale trade (Picture 9).

Picture 9. Distribution of activities in TOP-1000 total revenue, %

Picture 9. Distribution of activities in TOP-1000 total revenue, %53% of TOP-1000 companies are registered in the Register of Small and Medium-Sized Business Entities of Federal Tax Service of the Russian Federation, among them 26% have status of medium-sized enterprises, 27% are classified as small enterprises and less than 1% are referred to microenterprises.

Financial position score

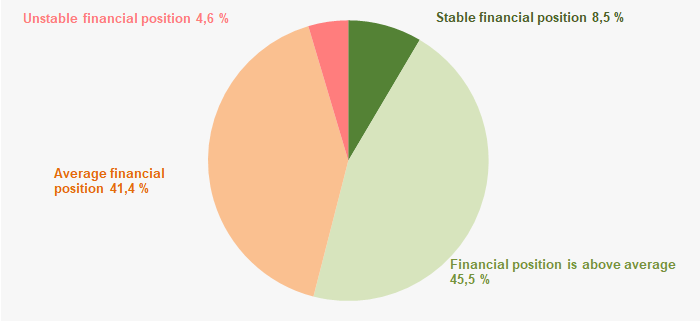

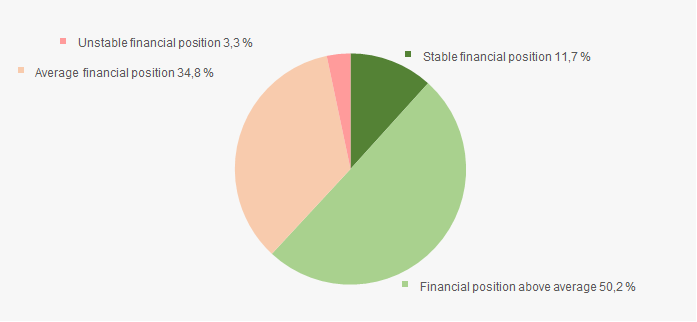

The assessment of company’s financial position shows that more than a half of companies have stable or above average financial position (Picture 10).

Picture 10. Distribution of TOP-1000 companies by financial position score

Picture 10. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

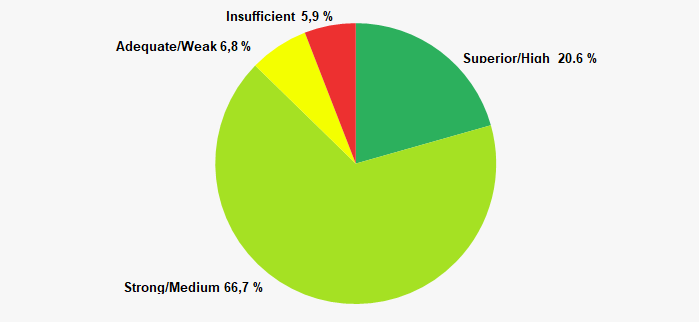

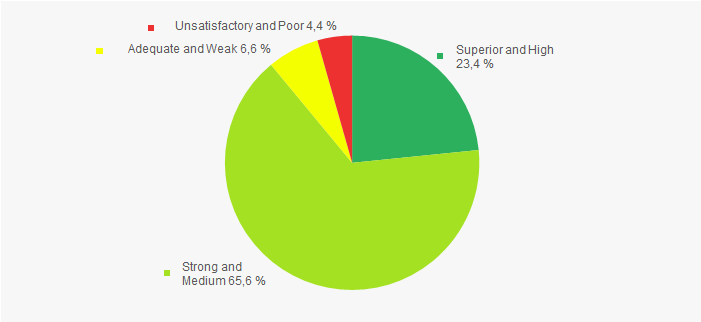

The majority of TOP-1000 companies have superior/high or strong/medium solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 11).

Picture 11. Distribution of TOP-1000 companies by solvency index Globas

Picture 11. Distribution of TOP-1000 companies by solvency index GlobasConclusion

Hereby, the complex assessment of the largest real economy companies of Sverdlovsk region, taking into account main indexes, financial ratios and indicators, demonstrates the denomination of favorable trends.

Activity trends of the largest companies of the Rostov region

Information agency Credinform represents an overview of activity trends of the largest companies in the real sector of the economy of the Rostov region.

Enterprises with the largest volume of annual revenue of the Rostov region (TOP-10 and TOP-1000), were selected for the analysis, according to the data from the Statistical Register for the latest available periods (2014 — 2016). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets are the indicator, reflecting the real value of company’s property. It is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

| № in TOP-1000 | Name, INN | Net assets value, mln RUB* | Solvency index Globas | ||

| 2014 | 2015 | 2016 | |||

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1. | ROSTOV HELICOPTER PRODUCTION COMPLEX ROSTVERTOL PUBLIC LIMITED COMPANY INN 6161021690 Manufacture of helicopters, airplanes and other aircraft |

14 694 | 20 745 | 34 756 | 163 Superior |

| 2. | GLORIA JEANS CORPORATION JSC INN 6166034397 Manufacture of other overclothes |

10 607 | 12 781 | 16 376 | 184 High |

| 3. | GAZENERGOSET ROZNITSA LLC INN 6164317329 Retail sale of motor fuel in specialized stores |

-138 | 15 222 | 16 227 | 228 Strong |

| 4. | COMBINE PLANT ROSTSELMASH LTD. INN 6166048181 Manufacture of machines and agricultural equipment for soil handling |

7 823 | 10 569 | 14 976 | 167 Superior |

| 5. | GAZPROM GAZORASPREDELENIE ROSTOV-NA-DONU PJSC INN 6163000368 Distribution of gaseous fuel through gas distribution networks |

9 523 | 10 602 | 12 432 | 191 High |

| 996. | CONFECTIONERY FACTORY MISHKINO LLC INN 6102032852 Manufacture of cocoa, chocolate and sugar confectionery |

-877 | -1 469 | -2 068 | 324 Adequate |

| 997. | DON-ANTHRACITE PUBLIC COMPANY INN 6144009894 Extraction of anthracite by underground method |

-2 759 | -4 712 | -2 763 | 287 Medium |

| 998. | NORTH-CAUCASIAN PASSENGER SUBURBAN COMPANY JSC INN 6162051289 Transportation of passengers by rail on suburban routes in a regulated sector |

-2 440 | -2 626 | -2 835 | 312 Adequate |

| 999. | PALMALI CO. LTD. INN 6164087026 Activities of sea freight transport Case on declaring the company bankrupt (insolvent) is proceeding |

1 986 | -3 038 | -2 854 | 550 Insufficient |

| 1000. | REMZ LTD INN 6155054289 Manufacture of ingot steel Case on declaring the company bankrupt (insolvent) is proceeding |

1 172 | -1 728 | -3 039 | 550 Insufficient |

* — the indicators of growth or decline to the previous period are marked in columns 4 and 5 with green and red fillings, respectively.

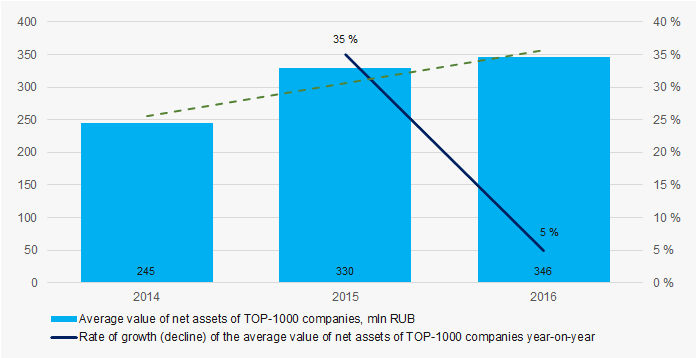

Picture 1. Change in the average indicators of the net asset value of TOP-1000 companies of the Rostov region in 2014 — 2016

Picture 1. Change in the average indicators of the net asset value of TOP-1000 companies of the Rostov region in 2014 — 2016Sales revenue

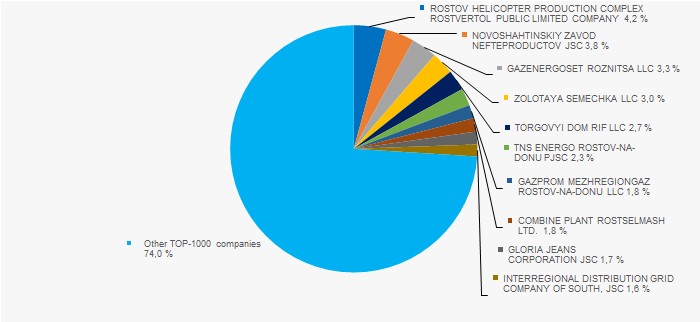

The revenue of 10 industry leaders made 26% of the total revenue of TOP-1000 companies in 2016. It points to the concentration of large companies in the Rostov region (Picture 2).

Picture 2. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2016

Picture 2. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2016In general, there is a trend towards an increase in revenue volume (Picture 3).

Picture 3. Change in the average indicators of revenue of TOP-1000 companies of the Rostov region in 2014 — 2016

Picture 3. Change in the average indicators of revenue of TOP-1000 companies of the Rostov region in 2014 — 2016Profit and losses

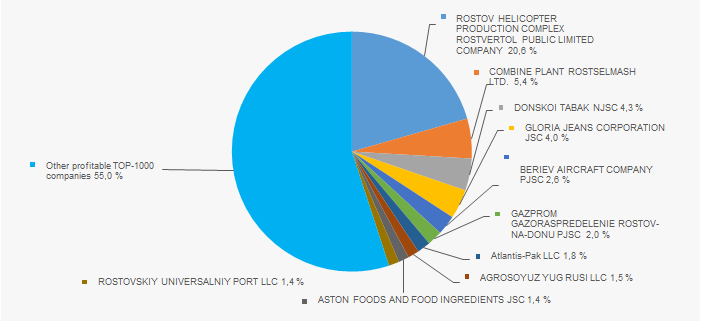

The profit volume of 10 industry leaders made 45% of the total profit of TOP-1000 companies in 2016 (Picture 4).

Picture 4. Share of participation of TOP-10 companies in the total volume of profit of TOP-1000 companies for 2016

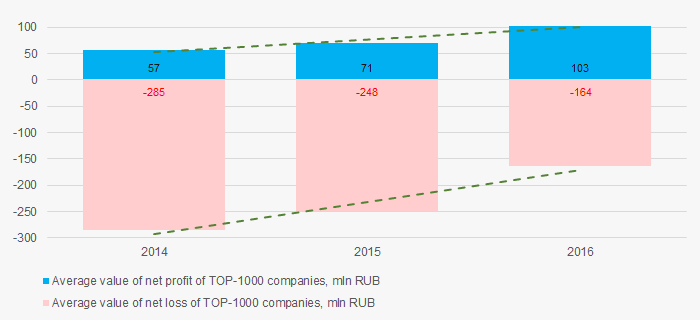

Picture 4. Share of participation of TOP-10 companies in the total volume of profit of TOP-1000 companies for 2016Average values of profit’s indicators of TOP-1000 companies for the three-year period trend to increase, while the average value of net loss decreases (Picture 5).

Picture 5. Change in the average values of profit and loss indicators of TOP-1000 companies of the Rostov region in 2014 — 2016

Picture 5. Change in the average values of profit and loss indicators of TOP-1000 companies of the Rostov region in 2014 — 2016Key financial ratios

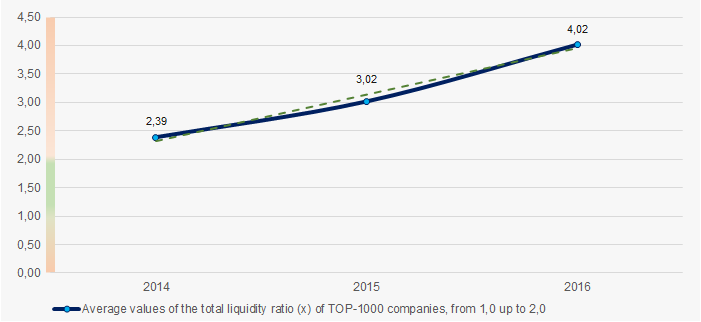

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Over the three-year period the industry average indicators of the total liquidity ratio were above the range of recommended values — from 1,0 up to 2,0 (Picture 6). In general, the ratio indicator tends to increase.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry.

For companies of the Rostov region the practical value of the total liquidity ratio made from 1,79 up to 1,38, respectively.

Picture 6. Change in the average values of the total liquidity ratio of TOP-1000 companies of the Rostov region in 2014 — 2016

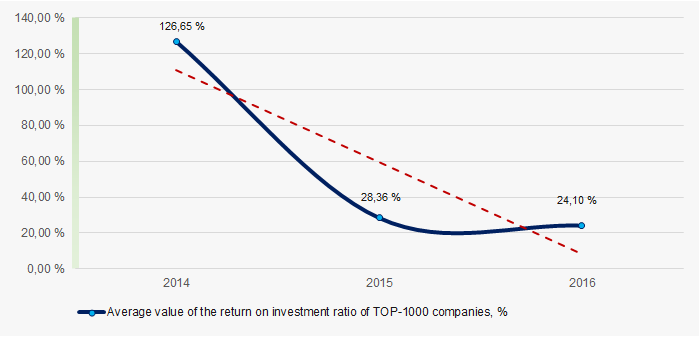

Picture 6. Change in the average values of the total liquidity ratio of TOP-1000 companies of the Rostov region in 2014 — 2016The return on investment ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity of own capital and the long-term borrowed funds of an organization.

There has been a trend towards a decrease in indicators of the return on investment ratio for three years (Picture 7).

Picture 7. Change in the average values of the return on investment ratio of TOP-1000 companies of the Rostov region in 2014 — 2016

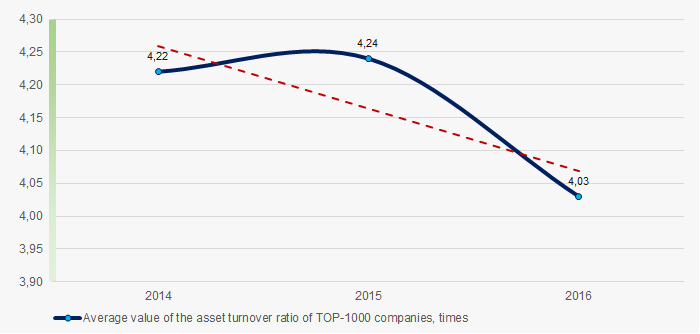

Picture 7. Change in the average values of the return on investment ratio of TOP-1000 companies of the Rostov region in 2014 — 2016Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

As a whole, this ratio of business activity showed a tendency to decrease over the three-year period (Picture 8).

Picture 8. Change in the average values of the asset turnover ratio of TOP-1000 companies of the Rostov region in 2014 — 2016

Picture 8. Change in the average values of the asset turnover ratio of TOP-1000 companies of the Rostov region in 2014 — 2016Production structure

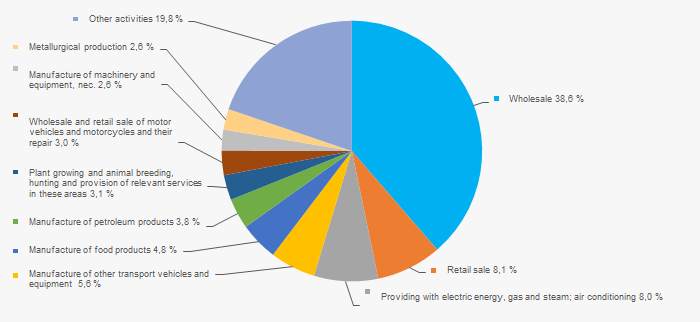

The largest share in the total revenue of TOP-1000 is owned by companies, specializing in whole sale (Picture 9).

Picture 9. Distribution of types of activity in the total revenue of TOP-1000 companies, %

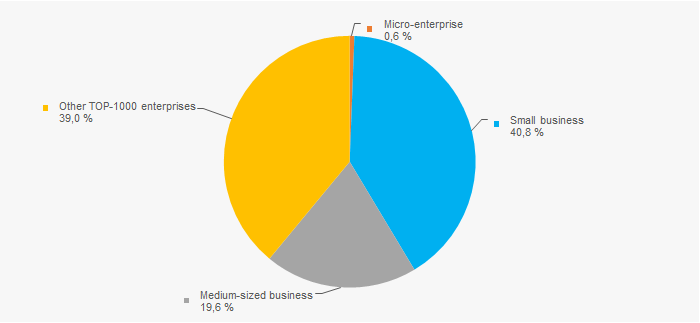

Picture 9. Distribution of types of activity in the total revenue of TOP-1000 companies, %61% of TOP-1000 companies are registered in the Register of small and medium-sized businesses of the Federal Tax Service of the RF (Picture 10).

Picture 10. Shares of small and medium-sized businesses in TOP-1000 companies of the industry, %

Picture 10. Shares of small and medium-sized businesses in TOP-1000 companies of the industry, %Financial position score

An assessment of the financial position of companies in the industry shows that their the largest number are in a stable financial position and above the average (Picture 11).

Picture 11. Distribution of TOP-1000 companies by financial position score

Picture 11. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

Most of TOP-1000 companies got Superior/High or Strong/Medium Solvency index Globas, that points to their ability to pay off their debts in time and fully (Picture 12).

Picture 12. Distribution of TOP-1000 companies by solvency index Globas

Picture 12. Distribution of TOP-1000 companies by solvency index GlobasConclusion

A comprehensive assessment of activity of the largest companies of the real sector of the economy of the Rostov region, taking into account the main indices, financial indicators and ratios, indicates the prevalence of favorable trends in the industry. However declining investment and business activity are alarming factors.