TOP 10 microfinance organizations

According to the Central Bank of the Russian Federation, during first 9 months of 2021, microfinance organizations issued microloans for a total of 440 billion RUB, which is 53% more than during first 9 months of 2020. This is a very high growth since the pandemic 2020, when the market of microcredit companies was virtually shrinking with a growing unprofitability. The restriction of microloan marginal rates planned in 2022 may lead to a reduction in the number of players in the market, which at the end of 2021 had just over 1,000 companies.

For this ranking the Information agency Credinform using the Globas System selected the largest microcredit companies (TOP 100 and TOP 10) in terms of annual revenue for the last reporting periods available in the state statistics bodies and the Federal Tax Service (2018 - 2020). They were ranked by net profit ratio (Table 1).

Net profit ratio (%) is calculated as the ratio of net profit (loss) to sales revenue and shows the level of profit from sales.

There is no standard value for this indicator. It is recommended to compare companies in the same industry, or to analyze changes in the coefficient over time for a specific company. Negative value of the indicator shows the presence of net loss, high value indicates effectiveness of the company's work.

It is necessary to pay attention to the entire set of indicators and financial ratios to get the most complete and fair presentation of enterprise's financial condition.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Net profit ratio, % | Globas Solvency Index | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| MICROCREDIT COMPANY NALICHNYE ZAJMY LLC INN 1903023650 Republic of Khakassia |

25,8 25,8 |

34,5 34,5 |

1,5 1,5 |

1,7 1,7 |

5,65 5,65 |

5,07 5,07 |

271 Medium |

| MICROCREDIT COMPANY EXPRESS FINANCE LLC INN 2801155708 Primorsk territory |

32,9 32,9 |

29,9 29,9 |

1,9 1,9 |

1,5 1,5 |

5,63 5,63 |

4,93 4,93 |

292 Medium |

| MICROCREDIT COMPANY AGAR LLC INN 5957017522 Perm territory |

41,7 41,7 |

36,2 36,2 |

0,9 0,9 |

1,4 1,4 |

2,15 2,15 |

5,07 5,07 |

246 Strong |

| MICROCREDIT COMPANY TOYAN LLC INN 7017444751 Tomsk region |

14,1 14,1 |

34,3 34,3 |

-2,5 -2,5 |

0,6 0,6 |

-17,90 -17,90 |

1,85 1,85 |

316 Adequate |

| MICROCREDIT COMPANY DAYTONA GROUP LLC INN 3123399990 Belgorod region |

21,8 21,8 |

20,7 20,7 |

1,1 1,1 |

0,3 0,3 |

4,94 4,94 |

1,36 1,36 |

363 Adequate |

| MICROCREDIT COMPANY CYBERIAN GOLD LLC INN 5405992480 Novosibirsk region |

25,2 25,2 |

20,2 20,2 |

0,8 0,8 |

0,3 0,3 |

3,18 3,18 |

1,26 1,26 |

282 Medium |

| POKOLENIE LLC INN 9710060106 Moscow |

0,0 0,0 |

40,1 40,1 |

0,1 0,1 |

-0,1 -0,1 |

1 233,33 1 233,33 |

-0,18 -0,18 |

382 Weak |

| MICROCREDIT COMPANY FASTMONEY.RU LLC INN 7805714988 Saint Petersburg |

258,1 258,1 |

116,2 116,2 |

-9,7 -9,7 |

-3,6 -3,6 |

-3,75 -3,75 |

-3,11 -3,11 |

365 Adequate |

| MICROCREDIT COMPANY SIMPLEFINANCE LLC INN 7703381419 Moscow |

829,2 829,2 |

647,7 647,7 |

3,0 3,0 |

-136,6 -136,6 |

0,36 0,36 |

-21,09 -21,09 |

324 Adequate |

| MICROCREDIT COMPANY DELOVOE RESHENIE LLC INN 9701118335 Moscow |

8,0 8,0 |

19,1 19,1 |

0,3 0,3 |

-8,3 -8,3 |

3,82 3,82 |

-43,45 -43,45 |

384 Weak |

| TOP 10 average value |  125,7 125,7 |

99,9 99,9 |

-0,3 -0,3 |

-14,3 -14,3 |

123,74 123,74 |

-4,94 -4,94 |

|

| TOP 100 average value |  15,7 15,7 |

12,4 12,4 |

0,1 0,1 |

-1,6 -1,6 |

-16,64 -16,64 |

-47,82 -47,82 |

|

| Industry average value |  10,0 10,0 |

11,3 11,3 |

3,7 3,7 |

-4,4 -4,4 |

37,40 37,40 |

-38,79 -38,79 |

|

indicator improvement for the previous period,

indicator improvement for the previous period,  indicator deterioration for the previous period

indicator deterioration for the previous period

In 2020, average values of the net profit ratio of the TOP 10 companies exceed values of the TOP 100 companies and average industry values. Only three companies of TOP 10 improved their performance in 2020, while there were five such companies in 2019.

4 out of 10 companies increased revenue and/or net profit in 2020. At the same time, the average revenue of TOP 10 and TOP 100 decreased by 21%, and the industry average increased by 13%. The average loss of TOP 10 increased almost 48 times, for TOP 1000 it increased 17 times. On average, the industry's loss grew more than twice.

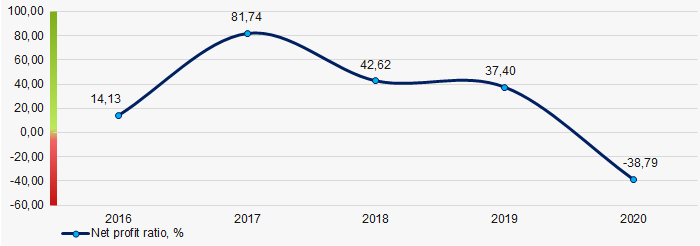

During the past 5 years, average industry values of the net profit ratio have deteriorated over three periods. The best value was achieved in 2017, and the worst result was shown in 2020. (Picture 1).

Picture 1. Change in average industry values of the net profit ratio in the market of loans provision in 2016-2020.

Picture 1. Change in average industry values of the net profit ratio in the market of loans provision in 2016-2020.Changes in legislation

Starting from January 1st, 2022, the following amendments were introduced to the Part One of the Tax Code of Russia by the Federal Law as of 29.11.2021 №380-FL: strengthening of the administrative liability of financial market participants for the data filed by them, specification of entities, having direct or indirect control over clients or beneficiary, update of the item “financial assets”.

In particular, the new edition of the article 129.7 of the Tax Code of Russia is represented as follows:

| Violation by financial market participants | Fine sanctions |

| Failure to file the data on tax residents of foreign countries or territories; | RUB 300 thousand; |

| Failure to include the data in relation to a single nonresident-client | RUB 50 thousand for each violation; |

| Presentation of incomplete or unreliable data on a nonresident-client | RUB 25 thousand for each act; |

| Willful failure to include or misrepresent the data | RUB 100 thousand for each act. |

Moreover, the liability for presentation of incomplete or unreliable data by the client is introduced by the new article 129.7-1 of the Tax Code of Russia

| Violation by clients of financial market participants | Fine sanctions |

| Presentation of incomplete or unreliable data in relation to themselves, beneficiaries of entities, having direct or indirect control over them; | RUB 25 thousand for each violation in relation to each contract concluded between the client and the financial market participant; |

| Willful presentation of incomplete or unreliable data in relation to themselves, beneficiaries of entities, having direct or indirect control over them. | for an individual - RUB 20 thousand, for a legal entity - RUB 50 thousand for each violation in relation to each contract, concluded between the client and the financial market participant. |

Besides, the amendments specify the list of entities, having direct or indirect control over a client or beneficiary. The new statement states that they are individuals that control clients or beneficiary directly, indirectly or through the third parties (hold more than 25% interest in the capital) or are able to control their activities.

The item “financial assets” is updated. Now it also includes other assets, being the subject matter of the contract, providing financial services between the client and the financial market participant. At the same time, the following assets are not identified as financial ones for the purposes of the Chapter 16 of the Tax Code of Russia: immovable, precious metals (except for the precious metals kept on accounts, deposits or deposited for exoneration) and objects of value kept in safe deposit box.

Users of the Information and Analytical system Globas can get all the available information on all the financial market participants, both banking and nonbanking institutions.