Moratorium on bankruptcy and its consequences

The Russian economy will face a wave of bankruptcies in the next six months. There is only one reason: the end of the moratorium on bankruptcy. The postponement was introduced on April 1, 2020 by the Federal Law No. 127 "On Insolvency (Bankruptcy)", Article 9.1 "Moratorium on initiating bankruptcy proceedings". The reason is a decrease in business activity because of the risk of the spread of Covid-19 in Russia. Realizing the scale of future damage, the Government of Russia suspends the initiation of insolvency proceedings of legal entities for six months in order to avoid mass liquidations.

However, along with the moratorium, restrictions are introduced that directly affect the growth of companies liquidated due to insolvency, namely: businesses are prohibited from selling assets, illiquid property, making changes to the shareholder structure, distributing profits and paying dividends. On the one hand, this measure will prevent unscrupulous debtors from withdrawing assets and selling property, but on the other hand, it puts the owners of companies in a difficult situation where they are obliged to maintain unprofitable assets, pay costs and accumulate debts.

The State can postpone the wave of bankruptcies. The Federal Bankruptcy Law regulates the duration of the moratorium, which can be extended by a decision of the Government of Russia, if there are enough reasons. According to the Ministry of Health and the Russian Federal Service for Surveillance on Consumer Rights Protection and Human Wellbeing (Rospotrebnadzor), the second wave of Covid-19 will begin in Russia in autumn. Hence, we should expect an extension of restrictive measures not only among the population, but also in the business environment. Again, most companies will be forced to suspend economic activity. The first lockdown has been too expensive for business, and not every company can survive in the second lockdown.

Despite this fact, we cannot insist that Covid-19 is the main cause of massive insolvency.

According to the Information and Analytical system Globas, today there are 3.6 million legal entities operating in Russia, 2 million companies have submitted financial statements for 2019 to the Federal Tax Service of Russia, of which 30% have problems with solvency and financial stability. The total share of legal entities capable of withstanding a short-term economic crisis or recession without significant losses does not exceed 15%.

It turns out that already in 2019, every third company have experienced financial problems.

First of all, small business with lack of administrative resources suffered. Tourism, hotel business, public catering, consumer services and the beauty industry, leisure and entertainment were on the verge of ruin. Small businesses with one or two cafes or beauty salons are in the most dangerous position.

According to a survey of micro-, small- and medium-sized enterprises conducted by the National Agency for Financial Research (NAFI) in June 2020, many entrepreneurs noted the negative effects of the pandemic: 76% reported a decrease in revenue, 66% - a decrease in demand for goods or services, 36% - a decrease in the number of suppliers, 24% - a decrease in the number of branches / sale offices. Every third entrepreneur (34%) put employees on unpaid vacation, and every fifth (18%) had to pay off employees. Most entrepreneurs do not expect a return to pre-crisis indicators in the short term.

The coronavirus pandemic has become a catalyst in bankruptcies, but by no means the main factor. Incorrect strategy, lack of technological equipment, financial reserves accelerated the life cycle of the most companies and brought it to its logical end.

TOP-10 educational organizations

Information agency Credinform has prepared a ranking of the Russian commercial educational organizations. Educational organizations (TOP-10) with the largest annual revenue were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available accounting periods (2018 - 2019). Then they were ranked by the net profit ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Net profit ratio (%) is a relation of net profit (loss) to sales revenue. The ratio characterizes the level of profit on sales.

There is no standard value for this ratio. It is recommended to compare companies of the same industry, or change in the ratio of the specific company. Negative value of the ratio is indicative of the net loss, and the high one means the efficiency of the company.

In order to get the most comprehensive and fair picture of the financial standing of an enterprise, it is necessary to pay attention to all combination of financial indicators and ratios.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Net profit ratio,% | Solvency index Globas | |||

| 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| MOSCOW UNIVERSITY OF FINANCE AND LAW MFUA INN 7725082902 Moscow |

1 349,0 1 349,0 |

1 692,0 1 692,0 |

113,9 113,9 |

336,9 336,9 |

8,44 8,44 |

19,91 19,91 |

210 Strong |

| TSOO NETOLOGIYA-GRUPP INN 7715964180 Moscow |

737,5 737,5 |

1 052,9 1 052,9 |

-136,0 -136,0 |

44,2 44,2 |

-18,44 -18,44 |

4,20 4,20 |

222 Strong |

| NON-STATE SAKHALIN TECHNICAL TRAINING CENTRE INN 6501160976 Sakhalin region |

496,9 496,9 |

1 077,2 1 077,2 |

14,0 14,0 |

44,9 44,9 |

2,82 2,82 |

4,17 4,17 |

263 Medium |

| PEI of higher education Medical Institute REAVIZ INN 6317006620 Samara region |

899,6 899,6 |

994,8 994,8 |

66,5 66,5 |

31,9 31,9 |

7,39 7,39 |

3,21 3,21 |

233 Strong |

| MOSCOW UNIVERSITY FOR INDUSTRY AND FINANCE SYNERGY INN 7729152149 Moscow |

3 468,2 3 468,2 |

4 049,5 4 049,5 |

33,3 33,3 |

43,2 43,2 |

0,96 0,96 |

1,07 1,07 |

243 Strong |

| ANO SBERBANK UNIVERSITY INN 7736128605 Moscow |

3 444,7 3 444,7 |

3 554,5 3 554,5 |

20,8 20,8 |

34,4 34,4 |

0,60 0,60 |

0,97 0,97 |

266 Medium |

| NGEI THE BRITISH INTERNATIONAL SCHOOL INN 7713004522 Moscow |

1 335,8 1 335,8 |

1 366,8 1 366,8 |

-664,7 -664,7 |

5,4 5,4 |

-49,76 -49,76 |

0,39 0,39 |

240 Strong |

| ANO Russian University of Co-operation INN 5029088494 Moscow region |

1 546,6 1 546,6 |

1 538,7 1 538,7 |

2,4 2,4 |

4,2 4,2 |

0,15 0,15 |

0,27 0,27 |

224 Strong |

| MOSCOW SCHOOL OF MANAGEMENT SKOLKOVO INN 5032180980 Moscow region |

2 332,8 2 332,8 |

3 441,0 3 441,0 |

-129,2 -129,2 |

-120,6 -120,6 |

-5,54 -5,54 |

-3,50 -3,50 |

293 Medium |

| OTS EF ENGLISH FIRST CIS INN 7707082829 Moscow |

1 427,1 1 427,1 |

1 429,5 1 429,5 |

-105,0 -105,0 |

-138,9 -138,9 |

-7,36 -7,36 |

-9,72 -9,72 |

316 Adequate |

| Average value for TOP-10 |  1 703,8 1 703,8 |

2 019,7 2 019,7 |

-78,4 -78,4 |

28,6 28,6 |

-6,07 -6,07 |

2,10 2,10 |

|

| Average industry value |  7,9 7,9 |

15,3 15,3 |

0,2 0,2 |

-1,1 -1,1 |

3,05 3,05 |

-7,33 -7,33 |

|

improvement compared to prior period,

improvement compared to prior period,  decline compared to prior period

decline compared to prior period

Average value of net profit ratio of TOP-10 is higher than the average industry value. Eight companies have improved their values in 2019 comparing to the previous period.

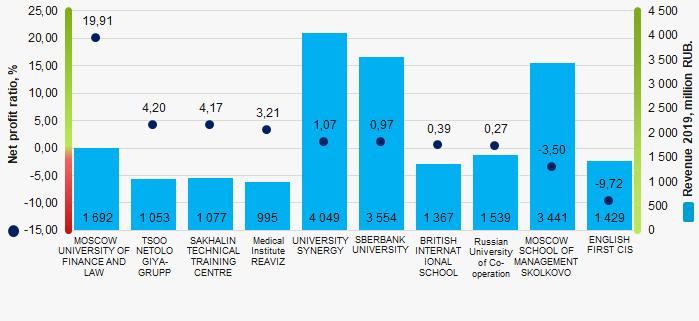

Picture 1. Net profit ratio and revenue the largest commercial educational organizations in Russia (TOP-10)

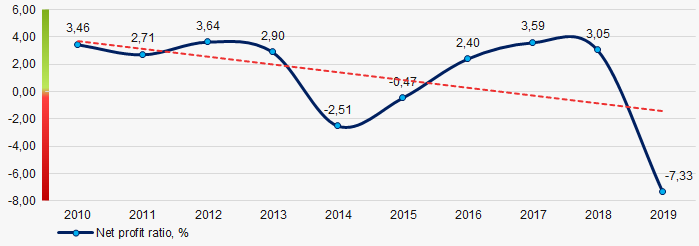

Picture 1. Net profit ratio and revenue the largest commercial educational organizations in Russia (TOP-10)During the decade, average industry values of net profit ratio had a tendency to decrease. (Picture 2).

Picture 2. Change of industry average values of net profit ratio of commercial educational organizations in Russia in 2010 – 2019

Picture 2. Change of industry average values of net profit ratio of commercial educational organizations in Russia in 2010 – 2019