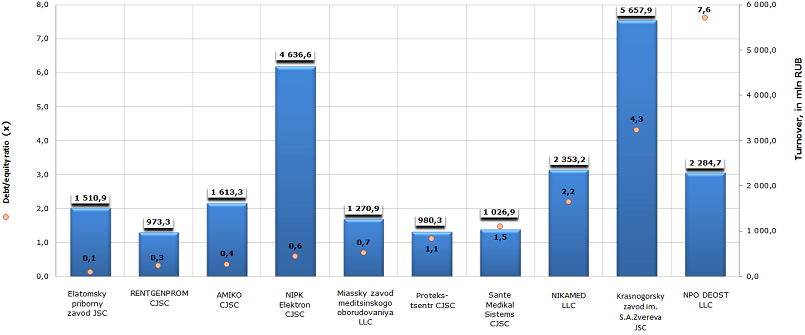

Debt/equity ratio of medical equipment manufacturers

Information agency Credinform prepared a ranking of enterprises manufacturing different medical equipment and items.

The companies with highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). These enterprises were ranked by increase in debt/equity ratio.

Debt/equity ratio (х) shows the ratio between borrowed and own sources of company financing.

Mentioned index is interesting first of all for the analysis of the long-term solvency of creditors.

The higher is the ratio above 1, the more depends an enterprise on borrowed funds.

Permissible level is often determined by working conditions of each company, first of all by the rate of working capital turnover. That is why it is necessary to determine extra the rate of inventories turnover and of accounts receivable turnover for the analyzed period. Because by a high rate of inventories turnover and a still higher rate of accounts receivable turnover the debt/equity ratio can be much more than 1.

Therefore, for the getting of more comprehensive and fair picture of financial standing of an enterprise it is necessary to pay attention not only to average values of the analyzed ratio industrywide, but also to all presented summation of financial indicators and ratios of a company.

| № | Name | Region | Turnover for 2012, in mln RUB | Debt/equity ratio (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Elatomsky priborny zavod JSC INN: 6204001412 |

Ryazan region | 1 510,9 | 0,1 | 171 (the highest) |

| 2 | RENTGENPROM CJSC INN: 5017031616 |

Moscow region | 973,3 | 0,3 | 169(the highest) |

| 3 | AMIKO CJSC INN: 7726005851 |

Moscow | 1 613,3 | 0,4 | 146(the highest) |

| 4 | NIPK Elektron CJSC INN: 7827012767 |

Saint-Petersburg | 4 636,6 | 0,6 | 191(the highest) |

| 5 | Miassky zavod meditsinskogo oborudovaniya LLC INN: 7415058730 |

Chelyabinsk region | 1 270,9 | 0,7 | 217(high) |

| 6 | Proteks-tsentr CJSC INN: 5022005643 |

Moscow region | 980,3 | 1,1 | 185(the highest) |

| 7 | Sante Medikal Sistems CJSC INN: 7734111726 |

Moscow | 1 026,9 | 1,5 | 210 (high) |

| 8 | NIKAMED LLC INN: 7713046956 |

Moscow | 2 353,2 | 2,2 | 230(high) |

| 9 | Krasnogorsky zavod im. S.A.Zvereva JSC INN: 5024022965 |

Moscow region | 5 657,9 | 4,3 | 208 (high) |

| 10 | NPO DEOST LLC INN: 5039003073 |

Moscow region | 2 284,7 | 7,6 | 200(high) |

Picture. Rating of the debt/equity ratio of medical equipment manufacturers (TOP-10)

Cumulative turnover of TOP-10 the largest medical equipment manufacturers at year-end 2012 reached 22 307,8 mln RUB, increased by 32,5% in comparison with the year 2011. Cumulative net profit of enterprises of the mentioned branch is 1 156,2 mln RUB, total financial result also showed double-digit rate of growth - 22,1% to the level of 2011.

The average value of debt/equity ratio of TOP-100 organizations is 2,6.

It can be stated, that the situation in the sphere of medical equipment production is favorable enough, especially if considering the substantial economic growth rate reduction. This circumstance is explained mainly by a growing demand for high quality medical equipment and devices from the side of either private clinics, or governmental.

According to the debt/equity ratio of TOP-10 the largest manufacturers in the branch, five from ten enterprises showed the value less than 1, in other words - borrowed funds value is no more than equity capital; companies carry out a balanced financial policy, without any risks. To such enterprises belong amongst others:

Elatomsky priborny zavod JSC (0,1) – produces medical apparatus for magnetic therapy and heat treatment, composite treatment apparatus;

RENTGENPROM CJSC (0,3) – manufactures and works out medical X-ray equipment;

AMIKO CJSC (0,4) - medical X-ray diagnostic units and equipment for X-ray diagnostic;

NIPK Electron CJSC (0,6) – X-ray diagnostic units;

Miassky zavod meditsinskogo oborudovaniya LLC (0,7) - aseptic laminar techniques for highly effective cleaning and sterilization of air in healthcare facilities, clinics.

The ratios of the rest participants of the analyzed TOP-10 are more than 1, and it means that credit resources are higher than the equity capital of the company. Such financial strategy seems to be risky enough. On the other side, development and introduction of hi-tech machinery and equipment in the sphere of medicine require significant material costs. This practice can be justified on the basis of well-thought-out business plan, targeted on future benefit from committed investments and gaining a foothold on the market. Organizations, rounding out the ranking - Krasnogorsky zavod im. S.A.Zvereva JSC and NPO DEOST LLC - showed the debt/equity ratio even more than by 100 the largest enterprises in the mentioned branch on the average – 4,3 and 7,6 respectively.

Taken as a whole, according to the independent estimation of solvency, developed by the Agency Credinform, all market leaders, including those who lives on credit, have the highest and a high solvency index GLOBAS-i®, that can be considered as a guarantee they will pay off their debts, while risk of default is minimal or below average. From investment point of view the business cooperation with participants of the rating looks attractive.

Inflation in Russia: results of 2013 and forecasts for 2014

According to the date of the Federal State Statistics Service (Rosstat), the inflation in Russia following the results of 2013 was 6,5%. As a reminder, the Bank of Russia planned to hold back the inflation in the range of 5-6% at the beginning of the year, but rapid increase in food products prices in last months of the year made it impossible to stay within this range.

The inflation in December 2013 was 0,5% and that agreed with analysts’ expectations, but as to the annual figure, so experts' estimations were more optimistic. So that, MEDT of Russia forecasted total growth of prices by 6,2-6,3%. Just a two-tenths (0,2%) deviation from the projected value could seem to be insignificant only at first sight.

There is a so-called «inflation for poor», officially nowhere registered, but hits hard the low-class citizens in the wallet. Many experts note that poor social groups mustn’t be placed into headline inflation, because their consumption structure has an imbalance toward food products. If one man with good income spends on food about 30% in national average (and in developed countries not more than 15%), then poor people – more than 50% from their salaries. Therefore, rapid increase in food products prices dents «inflation for poor», that in fact happens.

According to the date of Rosstat, in 2013 food products and services became more expensive most of all, by 7,3 and 8% respectively. Nonfood goods got more expensive by 4,5%.

The list of non-record holders following the results of 2013 is topped by hen's eggs, which got up practically by one third, more exactly by 28,8% (from December 2013 to December 2012). They are followed by butter (18,6%), alcoholic drinks (14,6%), milk and dairy products (13,1%).

Housing maintenance and utilities services got more expensive for Russian by 9,8% in 2013, medical service — by 9%, telecommunications service — by 2,2%, nursery education services — by 9,9%. Passenger transportation got up by 8,9% in 2013.

Regarding forecasts for 2014, all experts predict the slowing of inflation, because of the freezing of tariffs on natural monopolies' services. According with the official forecast of the Government of the RF for the year 2014, it should be expected the inflation in the range of 4,5-5,5%, while the prediction of the MEDT of Russia — 4,8%.

The Central Bank of the RF (the CB) targets the purpose on inflation at the level of 5% for 2014. Thus in the middle of December the CB informed, that predicts the achievement of inflation goals in the second half of 2014. Also in its statement official regulator noted, that nowadays the deterrents for improvement of inflation dynamics are slow recovery of external demand and weak investment activity. By that, of greater importance needed to reach inflation target values in the medium term, according to the CB, is the formation of positive tendencies in dynamics of inflationary expectations.