Stress test for the Russian agricultural sector

The crisis makes it clear that the break of the agricultural products supply chain leads to overproduction in one region and to deficit in another.

Closing borders forces farmers in many countries to dispose of excess products, such as milk in the UK or citrus fruits in Spain.

At the same time, countries dependent on food imports find themselves in the most distressing situation, depriving of supply channels.

According to the United Nations World Food Programme’s forecasts, 265 million people will face acute food shortages by the end of 2020 that is twice as many as in 2019.

Will the Russian agricultural sector stand the test of crisis?

Production of agricultural products grows and becomes monopolized by large holdings

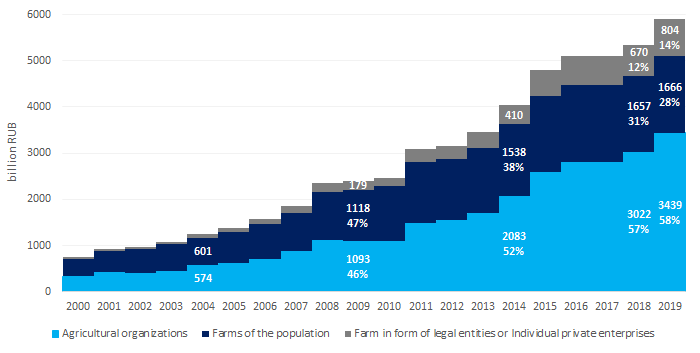

According to the results of 2019, production of agricultural products in Russia reached the record of 5,9 trillion RUB and demonstrated the annual growth by 10,5%. Growth by 3% more was recorded in the I quarter of 2020.

Data as of April 2020 indicate the increase in accordance with 2019: - production of flour grew by 14,2%, - cattle meat and pork by 6,2%, - meat semi-finished products by 3,2%, - milk by 4,6%, - butter by 8,1%, - cheese by 1,4%.

10 year ago most of the agricultural products were produced by the household sector, but today large companies produce almost 60% of livestock and crop products (see Picture 1). This is indicative of monopolization of the market by vertically-integrated holdings. On the one hand, this will lead to further intensification and increase in industrial production, and on the other hand, to decrease in the naturalness of the product through the use of chemical components in production and gene technology.

Picture 1. Dynamics of agricultural production by types of farming, billion RUB

Picture 1. Dynamics of agricultural production by types of farming, billion RUBRussia does not depend on imports of main food products

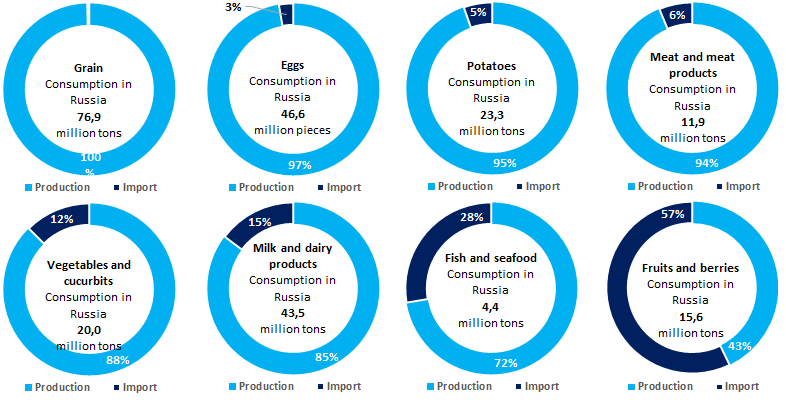

Local farmers almost completely provide for the needs of domestic consumption in the most important commodity groups. More recently, we were critically dependent on imports of meat, vegetables, milk, and grain. A large share of imports today remains only in the segment of fruits and berries, as well as fish and seafood (see Pictures 2-9).

The country provides itself with grain at 100%, holding 1-2 places in the world in exports for several years in a row. The paradoxical situation is in the sugar market: after the dissolution of the Soviet Union, domestic production of sugar beets provided only 20% of consumption, the rest was imported mainly from Ukraine. Overproduction is now observed, and together with low prices, it forces the factories to reduce output, and the relatively high cost of growing beet sugar does not allow increasing exports compared to other regions where warm-weather and unpretentious cane sugar is growing.

Picture 2-9. Domestic consumption, share of own production and import of key agricultural commodity groups. 2018-2019, %

Picture 2-9. Domestic consumption, share of own production and import of key agricultural commodity groups. 2018-2019, %High dependency on import of supplementary agricultural goods

With all the successes of domestic agriculture, there are obvious shortcomings, associated primarily with the means of production. According to the Ministry of Agriculture of the Russian Federation, in 2019 the share of imported vaccines and veterinary drugs was about 65%, feed additives - 60%. Import of sugar beet seeds amounted to 99% of the needs, potatoes - 90%, sunflower - 74%, spring rape - 68%. A positive situation was observed only in seed production of winter and spring wheat, where the share of imported seeds is 10% and 18%, respectively.

In Russia, there is almost no industry for the manufacture of food ingredients: stabilizers, additives, dyes, preservatives. There is still a dependence on the import of technological equipment for the food industry and agricultural machinery.

Conclusion

In order for Russian agriculture to withstand any crisis stress test, further development of agroleasing, expansion of the credit line for farmers, and an increase in subsidies for constantly rising fuel and lubricants are necessary. Palm oil, 4-5 grade wheat (feed grain) for bakery products, aggressive chemicals, unfortunately, have been widely used in domestic production. It requires a transition to extensive forms of farm management, and improving the quality of products.

Now, anti-crisis support measures are targeted mainly at large agricultural holdings with multi-billion revenue. Small regional companies and peasant farm enterprises, even with the maximum turnover for their segment, will never fall into the list of systemically important companies. However, maintaining such enterprises is equally important. If production is monopolized by large holdings, it is enough for one of them to leave the market - and the industry itself will suffer damage, as well as related sectors - equipment manufacturers, transport, retail, and restaurants.

Import of important products for the agriculture, such as vaccines, seeds and agrochemicals, plays a considerable role in reaching high production figures of the sector. In case of the next rouble devaluation or imposition of sanctions affecting the agricultural sector, Russia may face problems from rising prices to the exhaustion of the seed fund, and this will directly affect the country's food security. Avoiding seed dependence, developing and supporting ancillary industries is an important task that requires a prompt solution.

Agriculture is one of the few sectors of the Russian economy in which record growth has occurred in recent years. In 2019, agricultural products export amounted to 25.5 billion USD that is 1,7 times more than arms export. With the elimination of shortcomings and competent government support, the industry is able to become one of the drivers of the economy in times of crisis.

TOP-10 foreign-owned companies in Russia by revenue

Over 1,2 foreign-owned companies operate in Russia. Using the Information and Analytical system Globas, the experts of the Information agency Credinform have analyzed TOP-10 foreign companies by revenue operating in Russia.

| № | Name | Revenue, billion RUB | Activity | |

| 1 | LLC AUCHAN | 327,7 | - 8,6 % | Food retailer |

LLC ATAC |

||||

| 2 | LLC TOYOTA MOTOR |

313,2 | + 15,0 % | Automobile production |

| 3 | LLC J.T.I. RUSSIA |

303,4 | + 4,9 % | Trade with tobacco products |

| 4 | LLC PHILIP MORRIS SALES AND MARKETING |

296,5 | + 7,4 % | Trade with tobacco products |

| 5 | LLC VOLKSWAGEN GROUP RUS |

289,2 | + 22,0 % | Automobile production |

| 6 | LLC LEROY MERLIN VOSTOK |

275,8 | + 22,0 % | DIY retailer |

| 7 | LLC KIA MOTORS RUSSIA & CIS  |

232,4 | + 36,0 % | Automobile production |

| 8 | LLC METRO CASH & CARRY |

217,4 | - 6,1 % | Wholesale |

| 9 | LLC APPLE RUS |

197,2 | + 30,0 % | Trade with technical devices |

| 10 | JSC INTERNATIONAL TOBACCO MARKETING SERVICES |

186,6 | - 7,2 % | Trade with tobacco products |

The ranking is headed by the food retailer LLC AUCHAN (327,7 billion RUB). Consolidated revenue of the company includes income of its subsidiary LLC ATAC. LLC ATAC is a discounter of AUCHAN hypermarket, with the internal brand “Kazhdiy Den” («Каждый день») prevailing in the store.

TOP-10 includes three automobile manufacturers: TOYOTA MOTOR (2nd position, 313,2 billion RUB), VOLKSWAGEN GROUP (5th position, 289,2 billion RUB) and KIA MOTORS (7th position, 232,4 billion RUB). Total turnover of these companies exceeded 834 billion RUB, and the rate of the indicator growth is one of the highest. The increase in revenue is directly related to the growth in passenger car sales. Toyota dealers sell about 108 thousand cars, that is 15% more than in the previous period; Volkswagen sales exceeded 113 thousand cars (+ 18%), and KIA MOTORS ranked the second in 2018 by the number of vehicles sold - over 227 thousand units (+ 25%). High demand was recorded for the following model range: KIA Rio, Volkswagen Polo, Toyota Camry, Kia Sportage, Volkswagen Tiguan and Toyota RAV4. Due to COVID-19 pandemic, all enterprises in Russia suspended the assembly of cars, and by the end of 2020, revenue is expected to drop by the average of 30-40%. From January to May 2020, the global automotive industry produced 32 million cars less than for the same period of 2019.

On the 3rd, 4th and 10th positions of the ranking are tobacco companies. Unfortunately, in 2018 Russia led by the number of cigarettes smoked per capita, or about 300 billion pieces, and according to the data of the Federal State Statistics Service (Rosstat) for 2019, about 22,5% of the country's population smoke daily. Due to the large percentage of smokers and high demand for this type of product, the revenue of tobacco companies has been growing for a long time.

The 6th in the ranking is French company LEROY MERLIN VOSTOK (275,8 billion RUB). The company trades in the DIY sector. Leroy Merlin has about 400 hypermarkets around the world, and over 100 of them are located in Russia. The company continues to gain power in the Russian Federation. In 2018, LEROY MERLIN VOSTOK made one of the largest transactions in this segment of the Russian market by purchasing 12 K-Rauta stores. According to the experts, the value of assets amounted to 12 billion RUB.

Food retailer LLC METRO CASH & CARRY is the 7th in the ranking (217,4 billion RUB). The company is engaged in wholesale and small wholesale of food. In Russia, METRO successfully implements “Fasol” franchise program of convenience stores. This project aims at supporting small and medium-sized enterprises. Under the program, franchisee are exempt from paying royalties and franchise fees, and METRO delivers the majority of goods.

APPLE RUS (197,2 billion RUB) closes the ranking. The company is an official distributor of Apple products (iPhone, iPad, Mac, etc.). For six years, Apple has been recognized as the most expensive brand in the world. The company has a huge influence in the global community and is one of the leaders in the field of information, technological and computer developments.

The results of the ranking showed that automotive industry and retailers are successfully developing in Russia. The growth in revenue from automobile manufacturers is connected with the model range being produced. Cars assembled on the territory of the Russian Federation are in high demand among the population, since import premiums, transportation and other costs are not included in their price. However, in 2020, revenue is expected to decrease for all automobile manufacturers.

Following the results of the ranking, a negative trend of growth of tobacco companies’ revenue was revealed. Unfortunately, most of the population of Russia is nicotine addicted that is why three representatives of tobacco products are included in the TOP.