Russia has joined a convention against offshore profit shifting

The Government of Russia by its decree No. 963-r of 23.05.2017 On signing the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting has approved Russia’s joining the multilateral convention of the Organisation for Economic Co-operation and Development (OECD). The draft has been prepared by the Ministry of Finance of the Russian Federation and has been approved by the Ministry of Foreign Affairs, the Ministry of Economic Development, the Ministry of Justice and the Federal Tax Service.

The Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting of 24.11.2016 was developed by the member countries of the Special Group of the OECD as a part of the Action Plan on Base Erosion and Profit Shifting (BEPS). The Convention has been opened for signature since December 31, 2016. With Russia having joined the Convention, the number of BEPS member countries has totaled 67.

The provisions of the Convention are intended to prevent offshore profit shifting and help to coordinate work on implementation of the BEPS Action Plan via multilateral approval of changes in the ways of implementation of existing agreements on avoidance of double taxation. This also eliminates the need for bilateral negotiations on each of these agreements taken separately.

This, in its turn, helps the members to provide flexibility during fulfilment of their obligations, and to create conditions for high transparency of activity both of countries themselves and of their tax authorities and taxpayers.

The application of the Convention will affect 63 agreements on double taxation avoidance between the Russian Federation and foreign countries, except countries that are not members of the Special Group of the OECD for development of the Convention. The exception also applies to Sweden and Japan due to extended negotiations on conclusion of new agreements that take into account the provisions of the Convention.

The Convention does not contradict the Treaty on the Eurasian Economic Union, and other previous international treaties of the Russian Federation.

The Organisation for Economic Co-operation and Development is an international economic organisation of developed countries that have united based on market economy and democracy. The OECD was founded in 1948 as Organisation for European Economic Co-operation (OEEC) in order to coordinate European economic recovery projects under the Marshall Plan. Organisation’s headquarters are located in Château de la Muette, Paris. José Ángel Gurría Treviño has been its Secretary-General since 2006. The Council of representatives of member countries governs the OECD, and the decisions are based on general consensus. At present, the organization includes 35 countries, with the most of the EU member countries among them. The European Commission, as an institution of the European Union, is also a separate member of the organization. The share of the OECD member countries in the gross world product amounts to 60%.

Just to remind you, according to the Federal Tax Service, treaties on avoidance of double taxation are applied by the Russian Federation with the following countries:

| No. | Country | Date of conclusion of treaty | Effective date | Applied since | Applied since |

| 1. | Albania | 11.04.1995 | 09.12.1997 | 01.01.1998 | |

| 2. | Algeria | 10.03.2006 | 18.12.2008 | 01.01.2009 | |

| 3. | Argentina | 10.10.2001 | 15.10.2012 | 01.01.2013 | |

| 4. | Armenia | 28.12.1996 | 17.03.1998 | 01.01.1999 | |

| 5. | Australia | 07.09.2000 | 17.12.2003 | 01.01.2004 (Russia) | 01.07.2004 (Australia) |

| 6. | Austria | 13.04.2000 | 30.12.2002 | 01.01.2003 | |

| 7. | Azerbaijan | 03.07.1997 | 03.07.1998 | 01.01.1999 | |

| 8. | Belgium | 16.06.1995 | 26.01.2000 | 01.01.2001 | |

| 9. | Botswana | 08.04.2003 | 23.12.2009 | 01.01.2010 (Russia) | 01.07.2010 (Botswana) |

| 10. | Bulgaria | 08.06.1993 | 24.04.1995 | 01.01.1996 | |

| 11. | Canada | 05.10.1995 | 05.05.1997 | 01.01.1998 | |

| 12. | Chile | 19.11.2004 | 23.03.2012 | 01.01.2013 | |

| 13. | China | 27.05.1994 | 10.04.1997 | 01.01.1998 | |

| 14. | Croatia | 02.10.1995 | 19.04.1997 | 01.01.1998 | |

| 15. | Cuba | 14.12.2000 | 15.11.2010 | 01.01.2011 | |

| 16. | Cyprus | 05.12.2008 | 17.08.1999 | 01.01.2000 | |

| 17. | Czech Republic | 17.11.1995 | 18.07.1997 | 01.01.1998 | |

| 18. | Denmark | 08.02.1996 | 27.04.1997 | 01.01.1998 | |

| 19. | Egypt | 23.09.1997 | 06.12.2000 | 01.01.2001 | |

| 20. | Finland | 04.05.1996 | 14.12.2002 | 01.01.2003 | |

| 21. | France | 26.11.1996 | 09.02.1999 | 01.01.2000 | |

| 22. | Germany | 29.05.1996 | 30.12.1996 | 01.01.1997 | |

| 23. | Greece | 26.06.2000 | 20.12.2007 | 01.01.2008 | |

| 24. | Hungary | 01.04.1994 | 03.11.1997 | 01.01.1998 | |

| 25. | Iceland | 26.11.1999 | 21.07.2003 | 01.01.2004 | |

| 26. | India | 25.03.1997 | 11.04.1998 | 01.01.1999 (Russia) | 01.04.1999 (India) |

| 27. | Indonesia | 12.03.1999 | 17.12.2002 | 01.01.2003 | |

| 28. | Iran | 06.03.1998 | 05.04.2002 | 01.01.2003 | |

| 29. | Ireland | 29.04.1994 | 07.07.1995 | 01/06.04.1996 (Ireland) | 01.01.1996 (Russia) |

| 30. | Israel | 25.04.1994 | 07.12.2000 | 01.01.2001 | |

| 31. | Italy | 09.04.1996 | 30.11.1998 | 01.01.1999 | |

| 32. | Japan | 18.01.1986 | 27.11.1986 | 01.01.1987 | |

| 33. | Kazakhstan | 18.10.1996 | 29.07.1997 | 01.01.1998 | |

| 34. | Kuwait | 09.02.1999 | 03.01.2003 | 01.01.2004 | |

| 35. | Kyrgyz Republic | 13.01.1999 | 05.07.2000 | 01.01.2001 | |

| 36. | Latvia | 20.12.2010 | 06.11.2012 | 01.01.2013 | |

| 37. | Lebanon | 07.04.1997 | 16.06.2000 | 01.01.2001 | |

| 38. | Lithuania | 29.06.1999 | 05.05.2005 | 01.01.2006 | |

| 39. | Luxembourg | 28.06.1993 | 07.05.1997 | 01.01.1998 | |

| 40. | Macedonia | 21.10.1997 | 14.07.2000 | 01.01.2001 | |

| 41. | Malaysia | 31.07.1987 | неизвестно | 01.01.1989 | |

| 42. | Mali | 25.06.1996 | 13.09.1999 | 01.01.2000 | |

| 43. | Malta | 24.04.2013 | 22.05.2014 | 01.01.2015 | |

| 44. | Mexico | 07.07.2004 | 02.04.2008 | 01.01.2009 | |

| 45. | Mongolia | 05.04.1995 | 22.05.1997 | 01.01.1998 | |

| 46. | Morocco | 04.09.1997 | 31.08.1999 | 01.01.2000 | |

| 47. | Namibia | 30.03.1998 | 23.06.2000 | 01.01.2001 | |

| 48. | Netherlands | 16.12.1996 | 27.08.1998 | 01.01.1999 | |

| 49. | New Zealand | 05.09.2000 | 04.07.2003 | 01.01.2004 (Russia) | 01.04.2004 (New Zealand) |

| 50. | North Korea | 26.09.1997 | 30.05.2000 | 01.01.2001 | |

| 51. | Norway | 26.03.1996 | 20.12.2002 | 01.01.2003 | |

| 52. | Philippines | 26.04.1995 | 12.12.1997 | 01.01.1998 | |

| 53. | Poland | 22.05.1992 | 22.02.1993 | 01.01.1994 | |

| 54. | Portugal | 29.05.2000 | 11.12.2002 | 01.01.2003 | |

| 55. | Qatar | 20.04.1998 | 05.09.2000 | 01.01.2001 | |

| 56. | Republic of Belarus | 21.04.1995 | 21.01.1997 | 01.01.1998 | |

| 57. | Republic of Moldova | 12.04.1996 | 06.06.1997 | 01.01.1998 | |

| 58. | Romania | 27.09.1993 | 11.08.1995 | 01.01.1996 | |

| 59. | Saudi Arabia | 11.02.2007 | 01.02.2010 | 01.01.2011 | |

| 60. | Serbia, Montenegro | 12.10.1995 | 09.07.1997 | 01.01.1998 | |

| 61. | Singapore | 09.09.2002 | 16.01.2009 | 01.01.2010 | |

| 62. | Slovakia | 24.06.1994 | 01.05.1997 | 01.01.1998 | |

| 63. | Slovenia | 29.09.1995 | 20.04.1997 | 01.01.1998 | |

| 64. | South Africa | 27.11.1995 | 26.06.2000 | 01.09.2000 (South Africa) | 01.01.2001 (Russia) |

| 65. | South Korea | 19.11.1992 | 24.08.1995 | 01.01.1996 | |

| 66. | Spain | 16.12.1998 | 13.06.2000 | 01.01.2001 | |

| 67. | Sri Lanka | 02.03.1999 | 29.12.2002 | 01.01.2003 (Russia) | 01.04.2003 (Sri Lanka) |

| 68. | Sweden | 14.06.1993 | 03.08.1995 | 01.01.1996 | |

| 69. | Switzerland | 15.11.1995 | 18.04.1997 | 01.01.1998 | |

| 70. | Syria | 17.09.2000 | 31.07.2003 | 01.01.2004 | |

| 71. | Tajikistan | 31.03.1997 | 26.04.2003 | 01.01.2004 | |

| 72. | Thailand | 23.09.1999 | 15.01.2009 | 01.01.2010 | |

| 73. | Turkey | 15.12.1997 | 31.12.1999 | 01.01.2000 | |

| 74. | Turkmenistan | 14.01.1998 | 10.02.1999 | 01.01.2000 | |

| 75. | Ukraine | 08.02.1995 | 03.08.1999 | 01.01.2000 | |

| 76. | United Kingdom | 15.02.1994 | 18.04.1997 | 01.01.1998 (Russia) | 01./06.04.1998 (United Kingdom) |

| 77. | USA | 17.06.1992 | 16.12.1993 | 01.01.1994 | |

| 78. | Uzbekistan | 02.03.1994 | 27.07.1995 | 01.01.1996 | |

| 79. | Venezuela | 22.12.2003 | 19.01.2009 | 01.01.2010 | |

| 80. | Vietnam | 27.05.1993 | 21.03.1996 | 01.01.1997 |

Return on equity of the largest Russian credit institutions

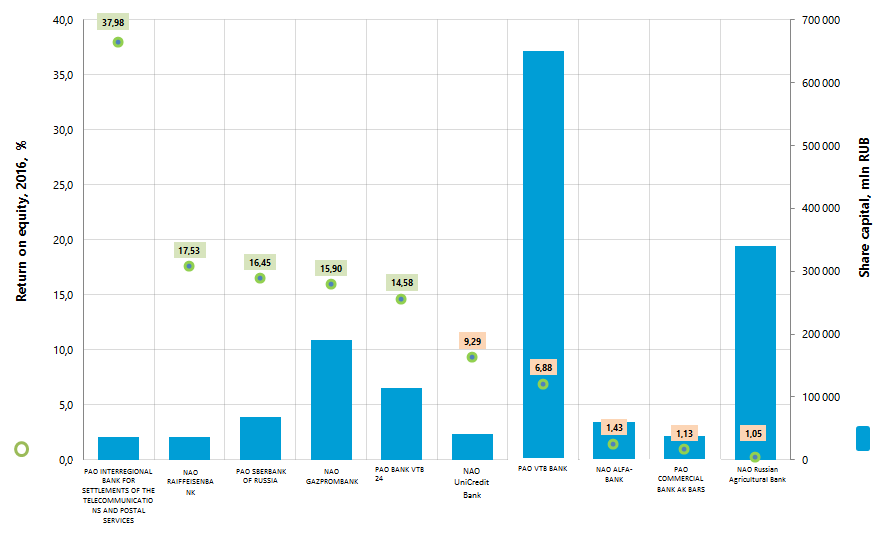

Information agency Credinform offers the ranking of the largest Russian credit institutions. The largest Russian credit institutions with the largest size of equity were selected for the ranking, according to the data of the Central Bank of Russia (CBR) for the reporting period of 2016 (TOP-10). Then they were ranked by the return on equity ratio in 2016 (Table 1).

Return on equity, as one of performance ratios, characterizes the return on bank's capital and is calculated as the relation of net profit to equity of a credit institution. The ratio shows the return on investment of shareholders in terms of accounting profit.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of its financial indicators and ratios.

| Name, BIC, PSRN, region, date of establishment | Share capital, mln RUB | Net profit, 2015, mln RUB | Net profit, 2016, mln RUB | Return on equity, 2015, % | Return on equity, 2016, % | Bank’s financial stability index Globas® |

| PAO INTERREGIONAL BANK FOR SETTLEMENTS OF THE TELECOMMUNICATIONS AND POSTAL SERVICES Moscow BIC 044525848 PSRN 1027700159288 19.05.1991 | 36 864,6 | 10 283,3 | 14 073,3 | 21,06 | 37,98 | 175 The highest |

| NAO RAIFFEISENBANK Moscow BIC 044525700 PSRN 1027739326449 09.06.1996 | 36 711,3 | 20 139,1 | 23 933,1 | 16,13 | 17,53 | 216 High |

| PAO SBERBANK OF RUSSIA Moscow BIC 044525225 PSRN 1027700132195 19.06.1991 | 67 760,8 | 236 256,1 | 516 987,8 | 8,82 | 16,45 | 202 High |

| NAO GAZPROMBANK Moscow BIC 044525823 PSRN 1027700167110 22.01.1992 | 190 234,3 | 34 365,3 | 109 685,1 | 5,32 | 15,90 | 226 High |

| PAO BANK VTB 24 Moscow BIC 044525716 PSRN 1027739207462 17.11.1991 | 113 382,9 | 461,2 | 43 126,1 | 0,17 | 14,58 | 236 High |

| NAO UniCredit Bank Moscow BIC 044525545 PSRN 1027739082106 14.11.1991 | 40 438,3 | 6 003,8 | 16 655,1 | 3,45 | 9,29 | 222 High |

| PAO VTB BANK Moscow BIC 044525187 PSRN 1027739609391 16.10.1990 | 651 033,9 | 48 580,7 | 70 006,6 | 4,79 | 6,88 | 210 High |

| NAO ALFA-BANK Moscow BIC 044525593 PSRN 1027700067328 02.01.1991 | 59 587,6 | 49 591,4 | 5 117,6 | 13,79 | 1,43 | 193 The highest |

| PAO COMMERCIAL BANK AK BARS Republic of Tatarstan BIC 049205805 PSRN 1021600000124 28.11.1993 | 38 015,4 | 9 801,6 | 645,7 | 16,74 | 0,90 | 171 The highest |

| NAO Russian Agricultural Bank Moscow BIC 044525111 PSRN 1027700342890 23.04.2000 | 339 848,0 | 69 207,2 | 909,2 | 16,80 | 0,23 | 180 The highest |

| Total in the group of TOP-10 banks | 1 573 877,0 | 484 689,7 | 801 139,6 | |||

| Average value in the group of TOP-10 banks | 48 469,0 | 801 139,6 | 10,71 | 12,12 | ||

| Industry average value | 1 644,1 | 2 250,7 | 12,37 | 13,05 |

The average values of the return on equity ratio in 2015 - 2016 in the group of TOP-10 banks are below the industry average values (in Table 1 and Picture 1 the green and yellow fillings mark the indicators, which are higher and lower than the industry average values, respectively).

Three banks from the TOP-10 reduced net profit in 2016 in comparison with the previous period (are marked with a red filling in Table 1).

Picture 1. The return on equity and the share capital of the largest Russian banks (TOP-10)

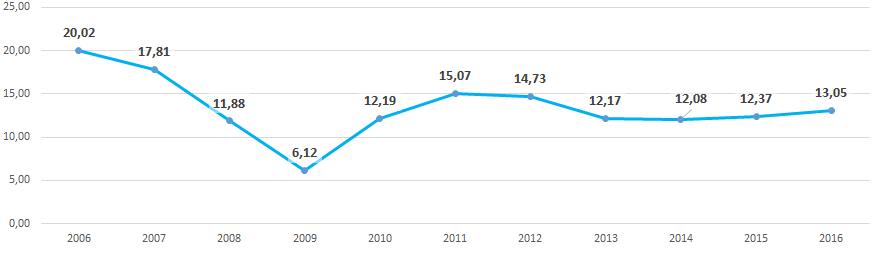

Picture 1. The return on equity and the share capital of the largest Russian banks (TOP-10)The industry average values of the bank's financial stability index (Picture 2) reflect generally the macroeconomic trends. Thus, there is a decrease in ratio values observed in the periods of crisis in the economy in 2007-2009 and in 2013-2014.

Picture 2. Industry average values of the return on equity of the largest Russian banks in 2006 – 2016

Picture 2. Industry average values of the return on equity of the largest Russian banks in 2006 – 2016All TOP-10 banks got the highest and high bank's financial stability index Globas®, that points to their ability to repay their debts in time and fully.