System of stars for hotels

The Government of the RF adopted the Order №158 «On Approval of the Regulation on the Classification of Hotels» dated 16.02.2019 for the implementation of the Federal Law №16-FZ «On Amendments to the Federal Law «On the Fundamental Principles of Tourist Activities in the Russian Federation» and the Code of the Russian Federation on Administrative Offenses in order to improve the legal regulation of the provision of hotel services and the classification of objects of the tourist industry» dated 05.02.2018.

According to the Regulation, all types of hotels are classified according to the system of stars, which provides for 6 categories: from five stars - to no stars. The highest category is five stars.

Until now, this system has been voluntary. By the end of 2018, more than 13,800 hotels were awarded qualifying stars.

The Regulation applies to almost all types of hotels, with the exception of organizations, specializing in rest and recreation for children, social and medical services, as well as sports and religious organizations, camping sites, hostels and others, where hotel services are not provided.

The Regulation establishes following:

- the procedure for the classification of hotels, including the procedure for making a decision to refuse to classify a hotel, to suspend or terminate a certificate of assignment of a category;

- types of hotels, categories of hotels, requirements for categories of hotels;

- certificate form for assigning of a category to a hotel;

- requirements for informing of consumers about the category assigned to a hotel, including the requirements for the placement, content and form of the information mark about the category assigned;

- procedure for submission of information on hotels classified by an accredited organization and copies of certificates of assigning of hotels of certain categories to the Ministry of Economic Development of Russia;

- stages of hotels’ classification;

- procedure for appealing of results of the classification in the appeals commission;

- grounds for the suspension and termination of the certificate;

- procedure for conducting of an expert assessment.

Accreditation of organizations that classify hotels is conducted by the Ministry of Economic Development of Russia.

According to the Information and Analytical system Глобас currently there are more than 33 000 active companies in Russia, providing services for the provision of part-time residence. Information about them and their business activities can be obtained by subscribing to Globas.

Trends in the work of Altai companies

Information agency Credinform represents an overview of activity trends of the largest companies in the real sector of the economy of Altai territory.

The enterprises with the largest volume of annual revenue of the real sector of the economy in Altai territory (TOP-1000) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2012-2017). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net asset value is an indicator, reflecting the real value of the property of an enterprise. It is calculated annually as the difference between assets on the balance sheet of the enterprise and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

| №, Name, INN, type of activity |

Net asset value, billion RUB | Solvency index Globas | ||||

| 2013 | 2014 | 2015 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 1 PKF MARIYA-RA LLC INN 2225021331 Lease and management of own or leased non-residential real estate Negative signs of "fly-by-night" and unreliable company are detected |

2,1 2,1 |

5,0 5,0 |

12 459,9 12 459,9 |

16 328,6 16 328,6 |

20 556,8 20 556,8 |

550 Insufficient |

| 2 ROZNITSA K-1 LLC INN 2225074005 Retail trade in non-specialized stores |

31,5 31,5 |

22,5 22,5 |

11 893,6 11 893,6 |

14 524,9 14 524,9 |

15 435,9 15 435,9 |

187 High |

| 3 EVALAR NJSC INN 2227000087 Manufacture of drugs |

8 200,7 8 200,7 |

10 032,4 10 032,4 |

12 828,9 12 828,9 |

13 421,4 13 421,4 |

14 109,3 14 109,3 |

179 High |

| 4 PKF DIPOS LLC INN 7726044240 Wholesale of wood products, construction materials and technical equipment |

2 508,8 2 508,8 |

2 788,2 2 788,2 |

3 140,2 3 140,2 |

4 139,4 4 139,4 |

4 891,8 4 891,8 |

200 Strong |

| 5 ALTAI-KOKS PJSC INN 2205001753 Coke production |

5 181,2 5 181,2 |

4 629,4 4 629,4 |

5 532,2 5 532,2 |

4 197,0 4 197,0 |

4 668,0 4 668,0 |

181 High |

| 996 PAVLOVSKAYA PTITSEFABRIKA NJSC INN 2261003521 Poultry breeding Process of being wound up 04.12.2014 |

27,2 27,2 |

20,9 20,9 |

-346,0 -346,0 |

-496,7 -496,7 |

-578,4 -578,4 |

600 Insufficient |

| 997 PLANETA DETSTVA BR LLC INN 2224133018 Wholesale of toys and games Process of being wound up 22.04.2016 |

7,3 7,3 |

8,3 8,3 |

-405,7 -405,7 |

-674,5 -674,5 |

-634,3 -634,3 |

600 Insufficient |

| 998 NK ROSNEFT – ALTAINEFTEPRODUKT PJSC INN 2225007351 Retail sale of motor fuel in specialized stores |

-190,3 -190,3 |

-632,4 -632,4 |

-875,3 -875,3 |

-951,5 -951,5 |

-1 095,4 -1 095,4 |

290 Medium |

| 999 ALTAIMYASOPROM LLC INN 2277011020 Breeding of pigs Сase on declaring the company bankrupt (insolvent) is proceeding |

8,4 8,4 |

9,8 9,8 |

-1 328,2 -1 328,2 |

-2 163,0 -2 163,0 |

-2 688,0 -2 688,0 |

550 Insufficient |

| 1000 YUG SIBIRI LLC INN 2224148021 Production of oils and fats Process of being wound up 04.07.2018 |

1,2 1,2 |

5,8 5,8 |

-34,1 -34,1 |

-1 443,1 -1 443,1 |

-2 987,6 -2 987,6 |

600 Insufficient |

— growth of the indicator to the previous period,

— growth of the indicator to the previous period,  — decline of the indicator to the previous period.

— decline of the indicator to the previous period.

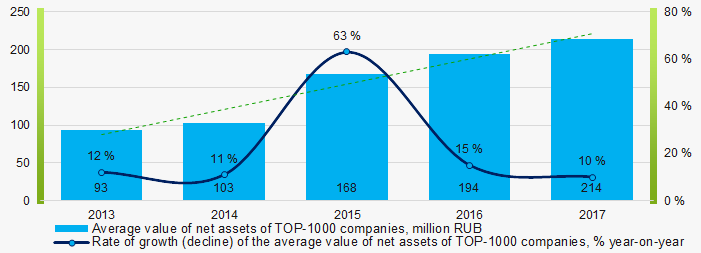

The average values of net assets of TOP-1000 enterprises tend to increase over the five-year period (Picture 1).

Picture 1. Change in the average indicators of the net asset value of TOP-1000 enterprises in 2013 – 2017

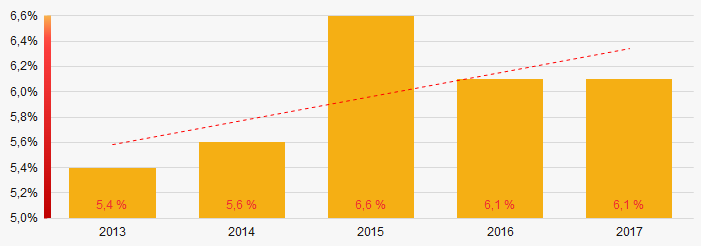

Picture 1. Change in the average indicators of the net asset value of TOP-1000 enterprises in 2013 – 2017The shares of TOP-1000 enterprises with insufficiency of assets have a tendency to increase in the last five years (Picture 2).

Picture 2. Shares of enterprises with negative values of net assets in TOP-1000

Picture 2. Shares of enterprises with negative values of net assets in TOP-1000Sales revenue

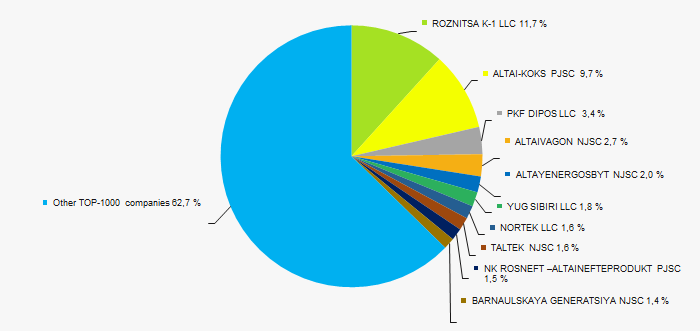

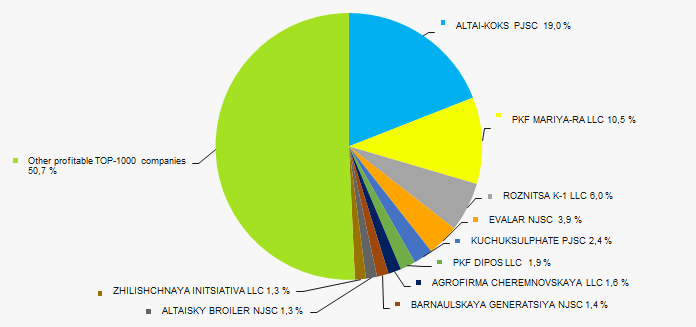

The revenue volume of 10 leading companies of the region made 37% of the total revenue of TOP-1000 in 2017 (Picture 3). It points to a high level of concentration of production in the Altai territory.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2017

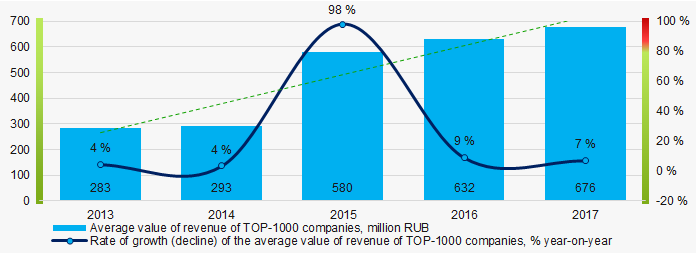

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2017In general, there is a trend towards an increase in revenue volume (Picture 4).

Picture 4. Change in the average revenue of TOP-100 enterprises in 2013 – 2017

Picture 4. Change in the average revenue of TOP-100 enterprises in 2013 – 2017Profit and losses

The net profit volume of 10 industry leaders of the region made 49% of the total profit of TOP-1000 companies in 2017 (Picture 5).

Picture 5. Shares of participation of TOP-10 companies in the total volume of net profit of TOP-1000 enterprises for 2017

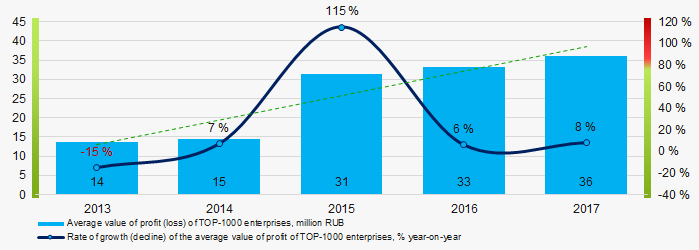

Picture 5. Shares of participation of TOP-10 companies in the total volume of net profit of TOP-1000 enterprises for 2017In general, the average profit of TOP-1000 enterprises trends to increase over the five-year period (Picture 6).

Picture 6. Change in the average values of profit of TOP-1000 enterprises in 2013 – 2017

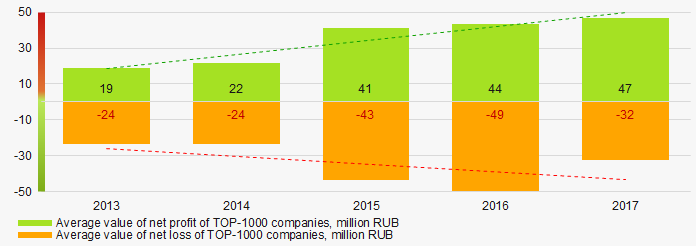

Picture 6. Change in the average values of profit of TOP-1000 enterprises in 2013 – 2017Average values of net profit’s indicators of TOP-1000 companies increase for the five-year period, at the same time also the average value of net loss increases. (Picture 7).

Picture 7. Change in the average values of indicators of net profit and net loss of TOP-1000 companies in 2013 – 2017

Picture 7. Change in the average values of indicators of net profit and net loss of TOP-1000 companies in 2013 – 2017Key financial ratios

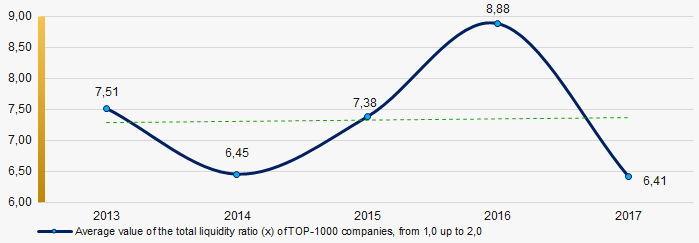

Over the five-year period the average indicators of the total liquidity ratio of TOP-1000 enterprises were above the range of recommended values - from 1,0 up to 2,0, with a tendency to increase (Picture 8).

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 8. Change in the average values of the total liquidity ratio of TOP-1000 enterprises in 2013 – 2017

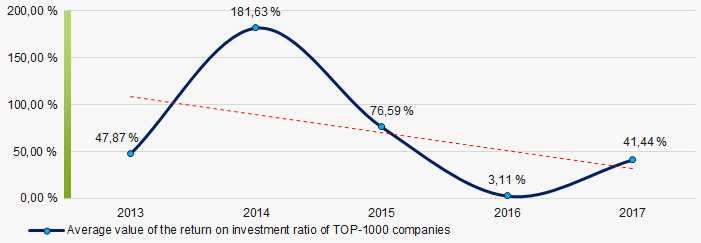

Picture 8. Change in the average values of the total liquidity ratio of TOP-1000 enterprises in 2013 – 2017There has been a high level of average values of the return on investment ratio for five years, with a tendency to decrease (Picture 9).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity of own capital involved in the commercial activity and the long-term borrowed funds of an organization.

Picture 9. Change in the average values of the return on investment ratio of TOP-1000 enterprises in 2013 – 2017

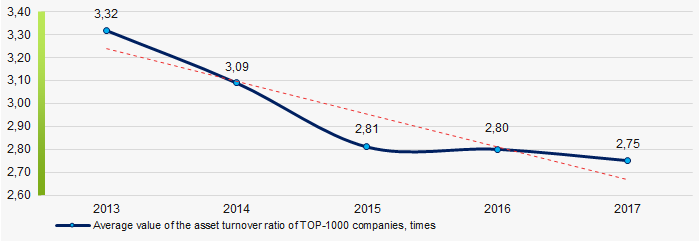

Picture 9. Change in the average values of the return on investment ratio of TOP-1000 enterprises in 2013 – 2017Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction.

The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This ratio of business activity showed a tendency to decrease over the five-year period (Picture 10).

Picture 10. Change in the average values of the asset turnover ratio of TOP-1000 enterprises in 2013 – 2017

Picture 10. Change in the average values of the asset turnover ratio of TOP-1000 enterprises in 2013 – 2017Production and service structure

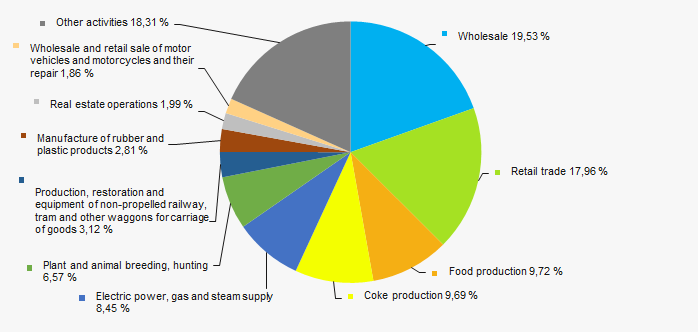

The largest shares in the total revenue of TOP-1000 are owned by companies, specializing in the wholesale and retail trade (Picture 11).

Picture 11. Distribution of types of activity in the total revenue of TOP-1000 companies

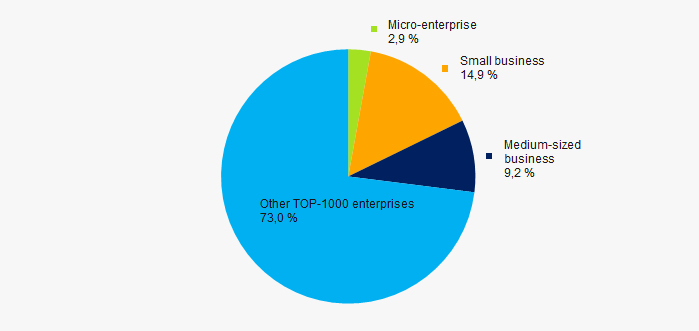

Picture 11. Distribution of types of activity in the total revenue of TOP-1000 companies79% of TOP-1000 companies are registered in the Register of small and medium-sized businesses of the Federal Tax Service of the RF. At the same time, their share in the total revenue of TOP-1000 enterprises amounted to 27%, that is higher than the national average (Picture 12).

Picture 12. Shares of proceeds of small and medium-sized businesses in TOP-1000 companies

Picture 12. Shares of proceeds of small and medium-sized businesses in TOP-1000 companiesMain regions of activity

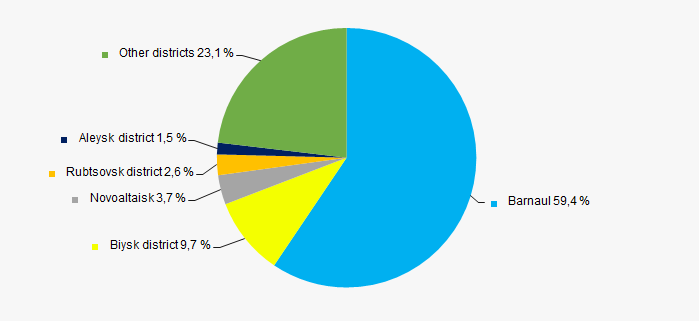

The TOP-1000 companies are distributed unequal across the region. 69% of the largest enterprises in terms of revenue are concentrated in the regional center – in Barnaul and Biysk district (Picture 13).

Picture 13. Distribution of the revenue of TOP-1000 companies by regions of Altai territory

Picture 13. Distribution of the revenue of TOP-1000 companies by regions of Altai territoryFinancial position score

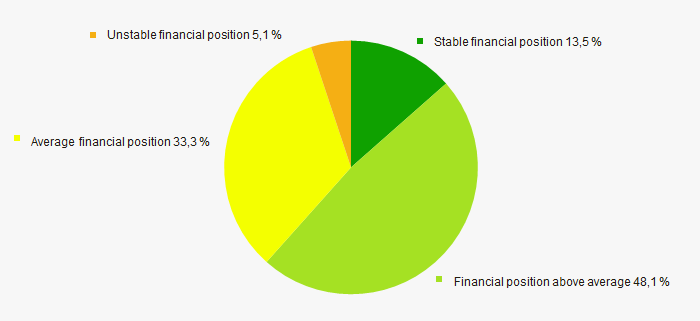

An assessment of the financial position of TOP-1000 companies shows that vast majority of them are in a stable financial position and above average (Picture 14).

Picture 14. Distribution of TOP-1000 companies by financial position score

Picture 14. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

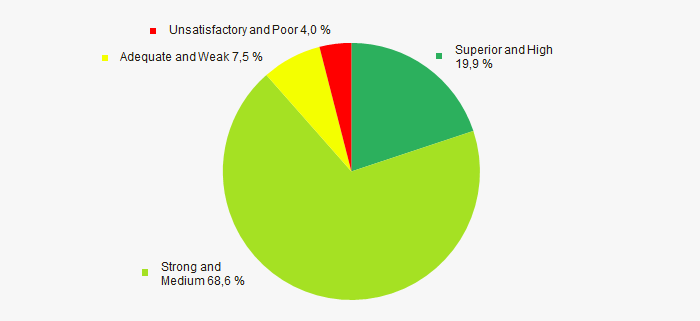

Vast majority of TOP-1000 companies got High or Strong/Medium Solvency index Globas, that points to their ability to pay off their debts in time and fully (Picture 15).

Picture 15. Distribution of TOP-1000 companies by solvency index Globas

Picture 15. Distribution of TOP-1000 companies by solvency index GlobasIndustrial production index

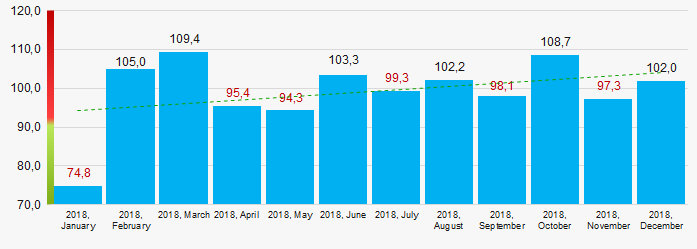

According to the Federal State Statistics Service, there is a tendency towards an increase in indicators of the industrial production index in Altai territory during 12 months of 2018 (Picture 16).

Picture 16. Industrial production index in Altai territory in 2018, month to month (%)

Picture 16. Industrial production index in Altai territory in 2018, month to month (%)According to the same information, the share of enterprises of Altai territory in the amount of revenue from the sale of goods, works, services made 0,43% countrywide for 9 months of 2018.

Conclusion

A comprehensive assessment of activity of the largest companies in the real sector of the economy of Altai territory, taking into account the main indices, financial indicators and ratios, points to the prevalence of positive trends (Table 2).

| Trends and evaluation factors of TOP-1000 enterprise | Specific share of factor, % |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  -10 -10 |

| Concentration level of capital |  -10 -10 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

| Growth / decline in average values of companies’ net profit |  10 10 |

| Growth / decline in average values of companies’ net loss |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  10 10 |

| Increase / decrease in average values of return on investment ratio |  -5 -5 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in the region in terms of revenue being more than 22% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Industrial production index |  10 10 |

| Average value of the specific share of factors |  2,3 2,3 |

— positive trend (factor),

— positive trend (factor),  — negative trend (factor).

— negative trend (factor).