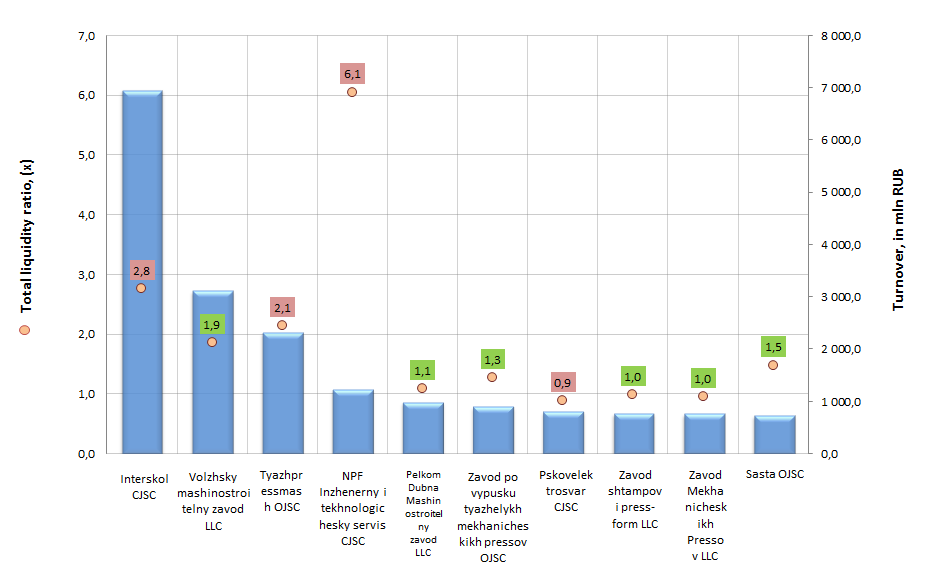

Total liquidity of enterprises of machine-tool industry

Information agency Credinform prepared a ranking of companies of machine-tool industry. The companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2013). These enterprises were ranked by decrease in consolidated revenues per annum.

Total liquidity ratio (х) is the relation of the sum of company’s current assets to short-term liabilities. It shows the sufficiency of its funds for repayment of short-terms liabilities.

Recommended value is from 1,0 to 2,0.

The ratio value, being equal to 1, assumes the equality of current assets and liabilities. However, considering that the degree of liquidity of different elements of current assets differs essentially, it is conceivable, that not all assets will be realized immediately or realized on full value, and as the result – the possibility of potential threat of improvement of financial standing of an enterprise. Moreover, the organization should have some volume of production supplies for continuing of production and economic activities after discharge of all current liabilities.

But if the ratio value essentially exceeds 1, then it can be drawn the conclusion that an enterprise has considerable volume of free resources, which were formed through owned sources. This alternative of working capital formation is the most appropriate from the opinion of company’s creditors. In the meantime, from manager’s perspective, sizable stocking at a company, diversion of funds to accounts receivable can be connected with inefficient assets management. At the same time it is possible that the firm uses its opportunities on obtaining of credits not in full.

However, it’s to be understood that recommended values can differ essentially as well for enterprises of different branches, as for organizations of the same industry, consequently, these values are exclusively of informational character.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to average indicators of profit, but also to all presented combination of financial data.

| № | Name | Region | Turnover in mln RUB, for 2013 | Total liquidity ratio (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Interskol CJSC INN 5047073660 |

Moscow region | 6 954,6 | 2,8 | 233 (high) |

| 2 | Volzhsky mashinostroitelny zavod LLC INN 6321276844 |

Samara region | 3 113,0 | 1,9 | 332 (satisfactory) |

| 3 | Tyazhpressmash OJSC INN 6229009163 |

Ryazan region | 2 327,0 | 2,1 | 198 (the highest) |

| 4 | NPF Inzhenerny i tekhnologichesky servis CJSC INN 7806013625 |

Saint-Petersburg | 1 228,8 | 6,1 | 245 (high) |

| 5 | Pelkom Dubna Mashinostroitelny zavod LLC INN 5010025437 |

Moscow region | 987,4 | 1,1 | 270 (high) |

| 6 | Zavod po vypusku tyazhelykh mekhanicheskikh pressov OJSC INN 3662118923 |

Voronezh region | 898,4 | 1,3 | 277 (high) |

| 7 | Pskovelektrosvar CJSC INN 6027076488 |

Pskov region | 806,6 | 0,9 | 321 (satisfactory) |

| 8 | Zavod shtampov i press-form LLC INN 5258040053 |

Nizhny Novgorod region | 774,3 | 1,0 | 261 (high) |

| 9 | Zavod Mekhanicheskikh Pressov LLC INN 2221202506 |

Altai territory | 762,1 | 1,0 | 292 (high) |

| 10 | Sasta OJSC INN 6232000019 |

Ryazan region | 735,3 | 1,5 | 248 (high) |

Рicture 1. Total liquidity ratio and turnover of the largest enterprises of machine-tool industry (TOP-10)

The turnover of the largest enterprises of machine-tool industry amounted to 18,6 bln RUB, following the results of the latest published annual financial statement, what gives about 45% of the revenue of all enterprises of the market.

Only 6 participants of TOP-10 uphold the standard value of total liquidity ratio: Volzhsky mashinostroitelny zavod LLC (1,9), Sasta OJSC (1,5), Zavod po vypusku tyazhelykh mekhanicheskikh pressov OJSC (1,3), Pelkom Dubna Mashinostroitelny zavod LLC (1,1), Zavod shtampov i press-form LLC (1,0), Zavod Mekhanicheskikh Pressov LLC (1,0).

These organizations uphold rationally the balance between assets and liabilities. Probability of liquidity crisis by such ratio of the analyzed indicator is below average.

The liabilities of Pskovelektrosvar CJSC exceed the assets, consequently, company’s liquidity comes down and in case of force-majeure circumstances it will be difficult for the enterprise to raise spare cash.

The rest companies conduct a moderate policy of financial management by way of their accumulation, or irrationally use available highly liquid assets in development, what not always pays by highly competitive conditions and inflation.

According to the independent estimation of the Information agency Credinform, all organizations of the TOP-10 list got a high and the highest solvency index (except Volzhsky mashinostroitelny zavod LLC and Pskovelektrosvar CJSC), what can signal to potential investors, that the largest market players can pay off their debts in time and fully, while risk of default is minimal or low.

Positive sides of deoffshorization for Russian information market

At the present time plans for deoffshorization of Russian economy are actively carrying out. Despite the complexity of this work, the experts of the Information Agency Credinform mark the positive points of adoption of laws in this field, for example, for information market.

Thus on 24 November 2014 the President of the Russian Federation signed the Federal act "On Amendments to Parts One and Two of the Tax Code of the Russian Federation (Regarding the Taxation of the Profit of Controlled Foreign Companies and the Income of Foreign Organizations)". According to the act, the Russian owners (individuals and legal entities) are obligated to provide the notifications about participation in foreign companies to the tax authorities.

Earlier, in August 2014 the Head of the Government signed the decision which approves the typical agreement on the exchange of the information on tax matters between Russia and foreign countries. In particular it is stated that foreign jurisdiction which signed the agreement is obliged to provide the following information: shareholders of offshore companies, shareholders and trusts/funds beneficiaries, and also information available for nominees and offshore banks.

At the same time the draft federal law «On Amendments to Legislative Acts of the Russian Federation» is placed for studying in mass media. In this project it is proposed to obligate legal entities to disclose information about beneficiaries. According to the draft federal law the information about beneficiaries of the legal entity should be disclosed in the financial statements.