Trends in employment and recruitment

Information agency Credinform represents an overview of trends in the field of employment and recruitment.

Enterprises with the largest volume of annual revenue (TOP-10 and TOP-2000) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2015 and 2016). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Legal forms and unreliable data

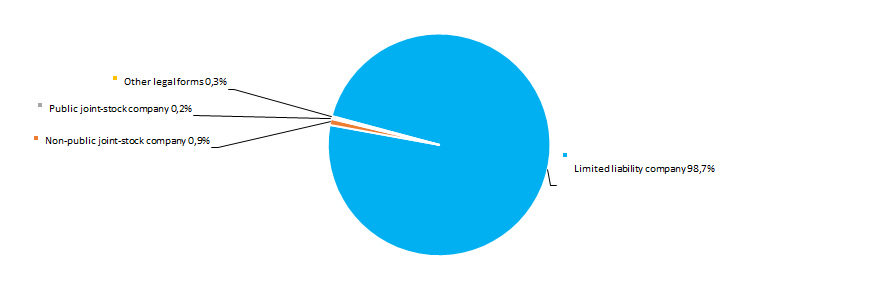

The most spread legal form of enterprises in the industry is a limited liability company. Non-public joint-stock companies also make a significant part. (Picture 1).

Picture 1. Distribution of TOP-2000 companies by legal forms

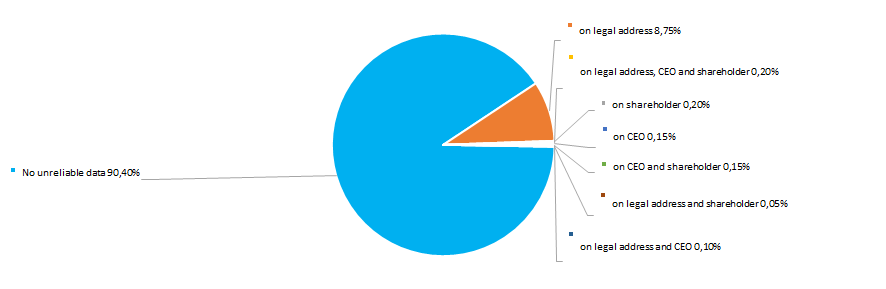

Picture 1. Distribution of TOP-2000 companies by legal formsAccording to the results of investigation of the Federal Tax Service of the RF, almost 10% of companies in the industry have records of unreliable data entered into the Unified State Register of Legal Entities (Picture 2).

Picture 2. Shares of TOP-2000 companies, having records of unreliable data in the Unified State Register of Legal Entities

Picture 2. Shares of TOP-2000 companies, having records of unreliable data in the Unified State Register of Legal Entities Sales revenue

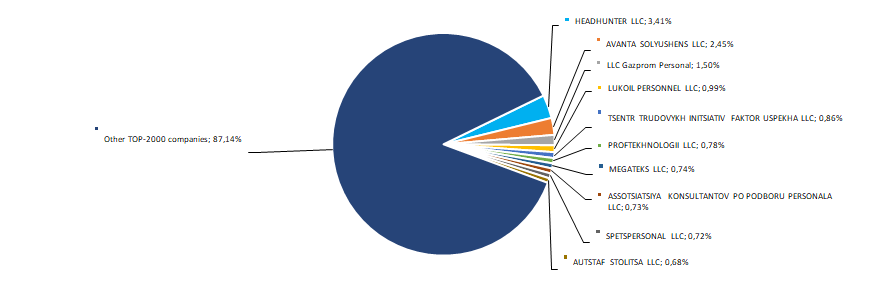

The revenue of 10 industry leaders made 13% of the total revenue of 2000 the largest companies in 2016. It points to a high level of competition in the industry. HEADHUNTER LLC - an on-line resource operator for job search and recruitment - became the largest company in terms of revenue in 2016. (Picture 3).

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-2000 companies for 2016

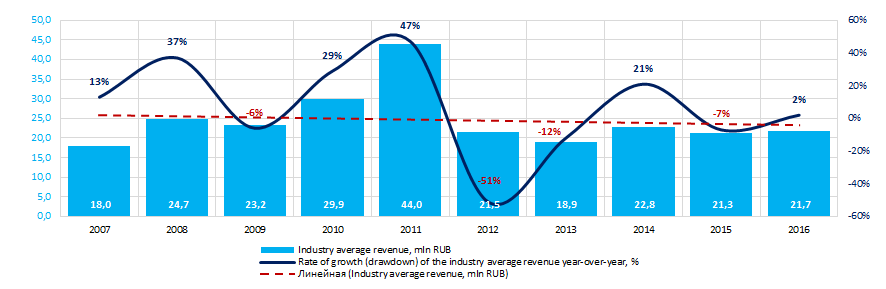

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-2000 companies for 2016The best results in the industry in terms of revenue for the ten-year period were achieved in 2011. During the crisis periods in the economy in 2009, 2012, 2013 and 2015 the industry average indicators decreased significantly. In general, there is a trend towards a decrease in volume revenue. (Picture 4).

Picture 4. Change in the industry average revenue of companies in the field of employment and recruitment in 2007 – 2016

Picture 4. Change in the industry average revenue of companies in the field of employment and recruitment in 2007 – 2016Profit and losses

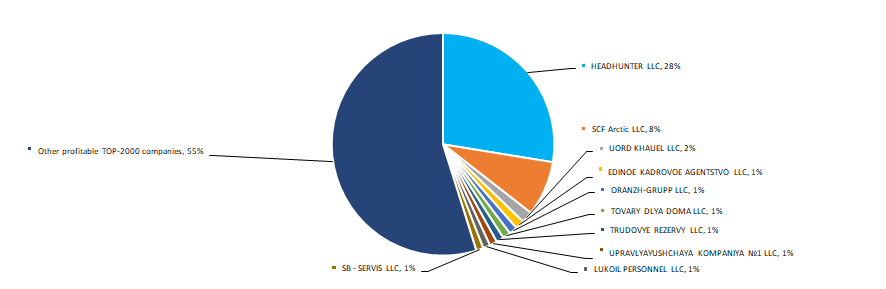

The profit volume of 10 industry leaders in 2016 made 45% of the total profit of TOP-2000 companies. The leading position in terms of profit volume in 2016 is taken also by HEADHUNTER LLC. (Picture 5).

Picture 5. Share of participation of TOP-10 companies in the total volume of profit of TOP-10 companies for 2016

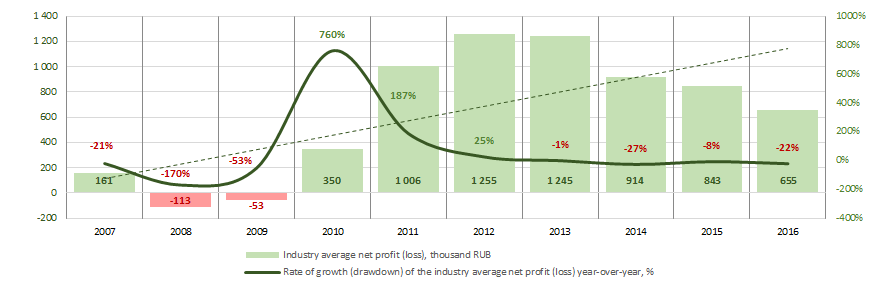

Picture 5. Share of participation of TOP-10 companies in the total volume of profit of TOP-10 companies for 2016 Industry average indicators of companies’ profit for the ten-year period are not stable. Negative values of the indicator were observed in 2008 - 2009. In general, profit’s indicators tend to increase. The industry showed the best results in 2012. (Picture 6).

Picture 6. Change in the industry average indicators of profit of companies in the field of employment and recruitment in 2007 – 2016

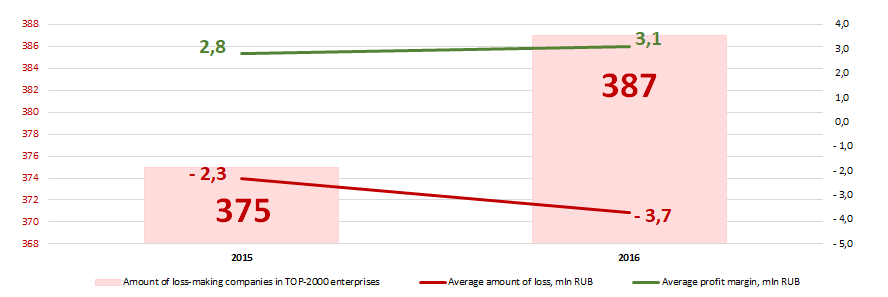

Picture 6. Change in the industry average indicators of profit of companies in the field of employment and recruitment in 2007 – 2016There were 375 loss-making enterprises observed in 2015 among TOP-2000 companies. In 2016 their number increased to 387 or by 3%. At the same time, the average size of their loss increased by 61%. For the rest of TOP-2000 companies the average profit margin increased by 11% over the same period (Picture 7).

Picture 7. Number of loss-making companies, average value of loss and profit of TOP-2000 enterprises in 2015 – 2016

Picture 7. Number of loss-making companies, average value of loss and profit of TOP-2000 enterprises in 2015 – 2016Key financial ratios

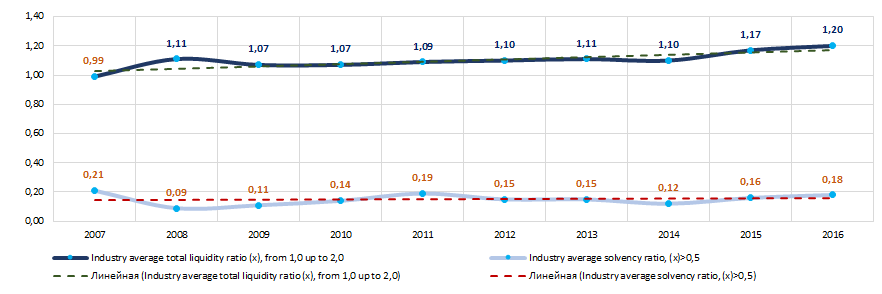

Over the ten-year period the average industry indicators of the total liquidity ratio were in the range of recommended values - from 1,0 up to 2,0, except the year 2007. In general, the ratio trends to increase.

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

The solvency ratio (the relation of the amount of own capital to the balance sum) shows the company's dependence on external borrowings. Recommended value is > 0.5. The value of the ratio below the minimum value means a strong dependence on external sources of funds.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For companies in the field of employment and recruitment the practical value of the solvency ratio ranged from 0,03 up to 0,98 in 2016.

Over the ten-year period the average industry indicators of the ratio were below the recommended value and in the interval of practical values (Picture 8).

In general, the ratio indicators has no pronounced trend.

Picture 8. Change in the average industry values of the total liquidity and solvency ratios of companies in the field of employment and recruitment in 2007 – 2016

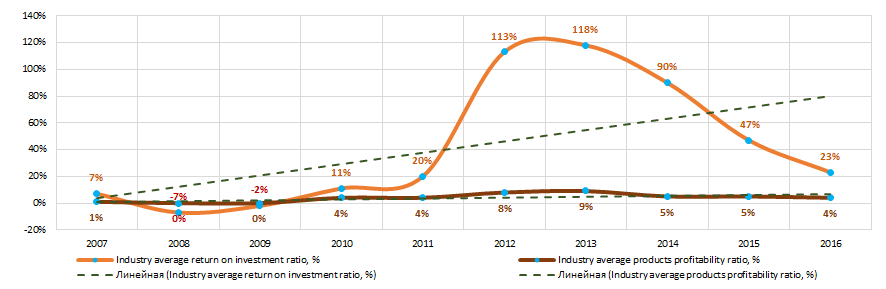

Picture 8. Change in the average industry values of the total liquidity and solvency ratios of companies in the field of employment and recruitment in 2007 – 2016There has been an instability observed in indicators of the return on investment ratio for ten years, with a tendency to increase. In 2008 - 2009 the indicators decreased to negative values (Picture 9). The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity and the long-term borrowed funds of an organization.

The indicators of the products profitability ratio were relatively stable, with a tendency to increase, in the same period (Picture 9). The ratio is calculated as the relation of profit from sales to expenses for ordinary activities. In general, profitability reflects the economic efficiency of production.

Picture 9. Change in the average industry values of the return on investment and products profitability ratios of companies in the field of employment and recruitment in 2007 – 2016

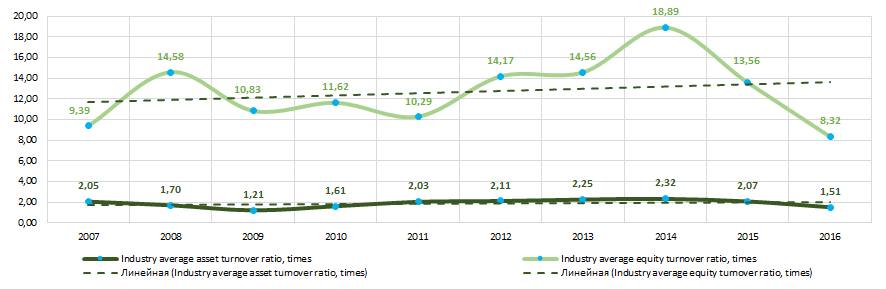

Picture 9. Change in the average industry values of the return on investment and products profitability ratios of companies in the field of employment and recruitment in 2007 – 2016Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

Equity turnover ratio is calculated as the relation of revenue to average annual amount of equity and shows the intensity of use of the whole part of assets.

Over a ten-year period both activity ratios demonstrated a tendency to increase (Picture 10).

Picture 10. Change in the industry average values of the activity ratios of companies in the field of employment and recruitment in 2007 – 2016

Picture 10. Change in the industry average values of the activity ratios of companies in the field of employment and recruitment in 2007 – 2016 Production structure

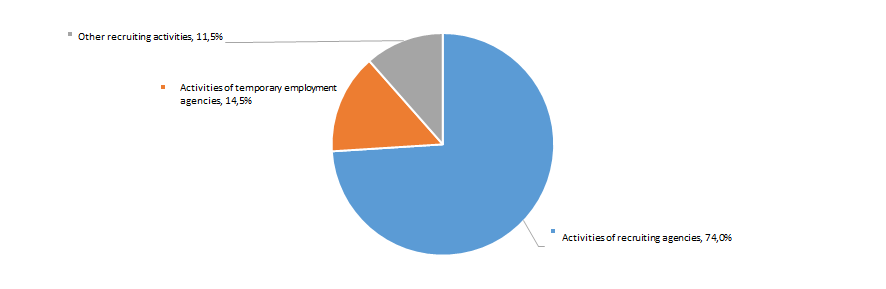

The largest part from TOP-2000 companies specializes in recruitment agency activity (Picture 11).

Picture 11. Distribution of TOP-300 companies by types of services provided, %

Picture 11. Distribution of TOP-300 companies by types of services provided, %Dynamics of business activity

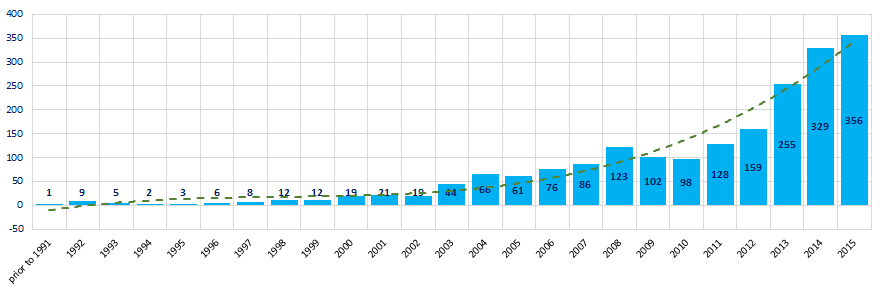

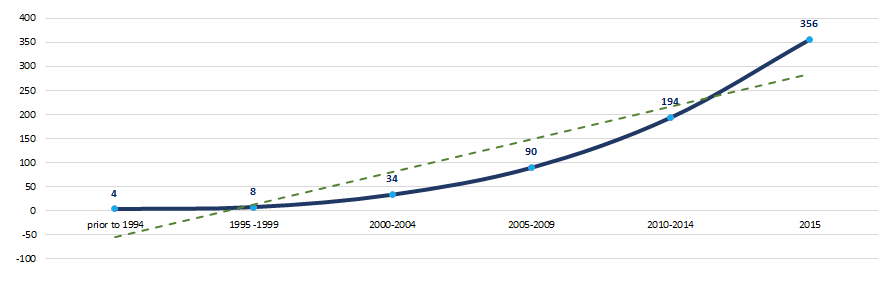

Over the 25-year period the number of registered companies from the TOP-2000 list are unequally distributed by the year of foundation. The largest number of enterprises was established in 2015. In general, there is a tendency to increase of the number of registered companies. (Picture 12).

Picture 12. Distribution of TOP-2000 companies by years of their foundation

Picture 12. Distribution of TOP-2000 companies by years of their foundationBusiness took the greatest interest to commercial services in employment and recruitment after 2004. (Picture 13).

Picture 13. Average number of TOP-2000 companies registered within the year, by periods of their foundation

Picture 13. Average number of TOP-2000 companies registered within the year, by periods of their foundationMain regions of activity

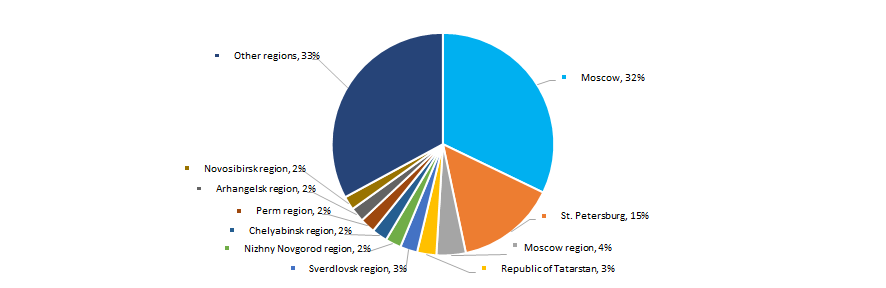

Companies of the industry are unequally distributed across the country. Their largest number is registered in Moscow and St. Petersburg – regions with the greatest concentration of labor resources (Picture 14).

TOP-2000 companies are registered in 61 regions of Russia.

Picture 14. Distribution of TOP-2000 companies by regions of Russia

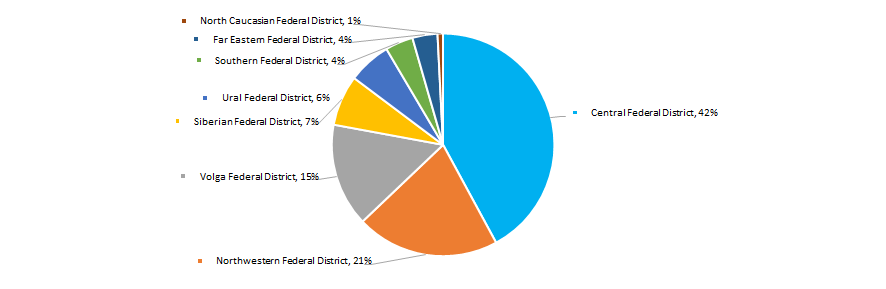

Picture 14. Distribution of TOP-2000 companies by regions of RussiaThe largest number of companies of the industry is concentrated in the Central federal district of the country (Picture 15).

Picture 15. Distribution of TOP-2000 companies by federal regions of Russia

Picture 15. Distribution of TOP-2000 companies by federal regions of RussiaThe share of companies with branches or representative offices, from TOP-2000 enterprises, is 2%.

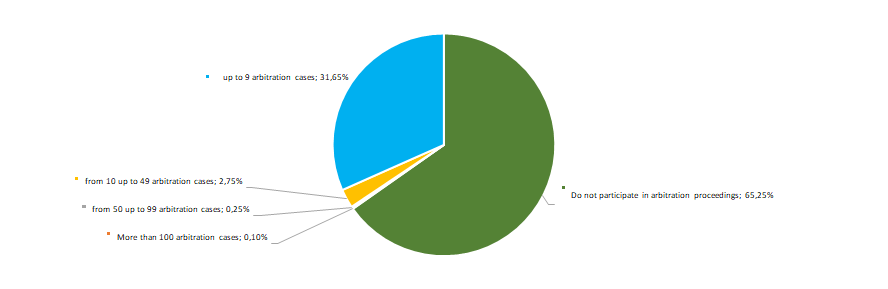

Participation in arbitration proceedings

The vast majority of companies of the industry either does not participate in arbitration proceedings at all, or participates in few cases. (Picture 16).

Picture 16. Distribution of TOP-2000 companies by the activity of participation in arbitration proceedings

Picture 16. Distribution of TOP-2000 companies by the activity of participation in arbitration proceedingsReliability index

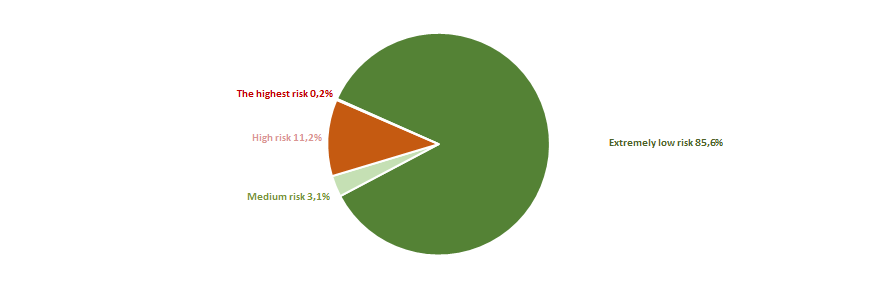

In terms of the presence of signs of «fly-by-night companies» or unreliable organizations, the great majority of enterprises of the industry demonstrate an extremely low risk of cooperation (Picture 17).

Picture 17. Distribution of TOP-2000 companies by reliability index

Picture 17. Distribution of TOP-2000 companies by reliability indexFinancial position score

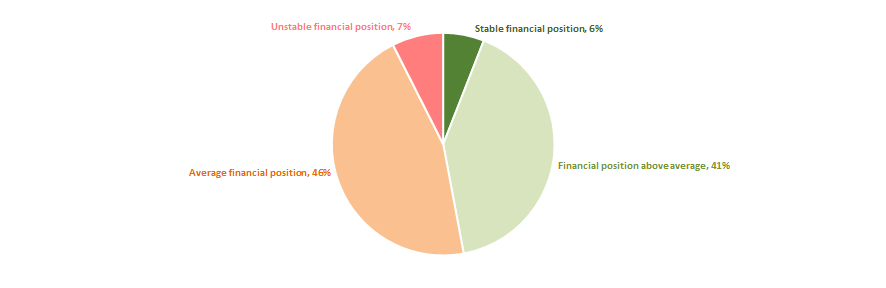

An assessment of the financial position of companies in the industry shows that the largest number of enterprises are in average financial position (Picture 18).

Picture 18 Distribution of TOP-2000 companies by financial position score

Picture 18 Distribution of TOP-2000 companies by financial position scoreLiquidity index

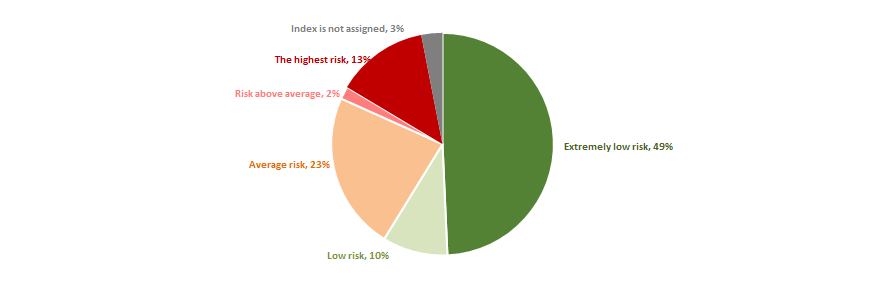

More than a half of companies of the industry show a minimal or insignificant levels of bankruptcy risk in the short-term period. (Picture 19).

Picture 19. Distribution of TOP-2000 companies by liquidity index

Picture 19. Distribution of TOP-2000 companies by liquidity indexSolvency index Globas

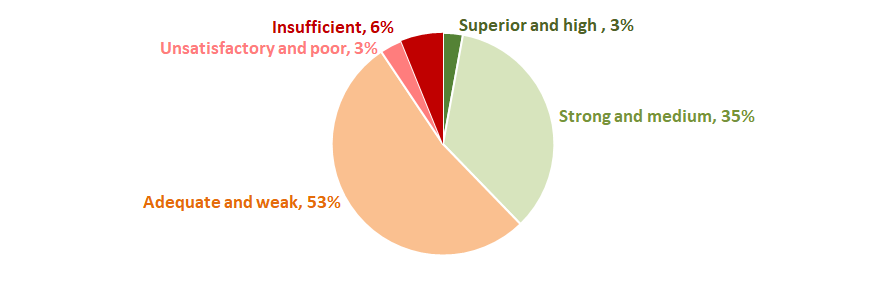

Most of companies of the industry among 2000 the largest got the Superior/High or Strong/Medium Solvency index Globas. (Picture 20).

Picture 20. Distribution of TOP-2000 companies by Solvency index Globas

Picture 20. Distribution of TOP-2000 companies by Solvency index GlobasThus, a comprehensive assessment of enterprises in the field of employment and recruitment, taking into account the main indices, financial indicators and ratios, points to prevalence of relatively favorable trends in the industry.

Profitability of services of the largest Russian recruitment agencies

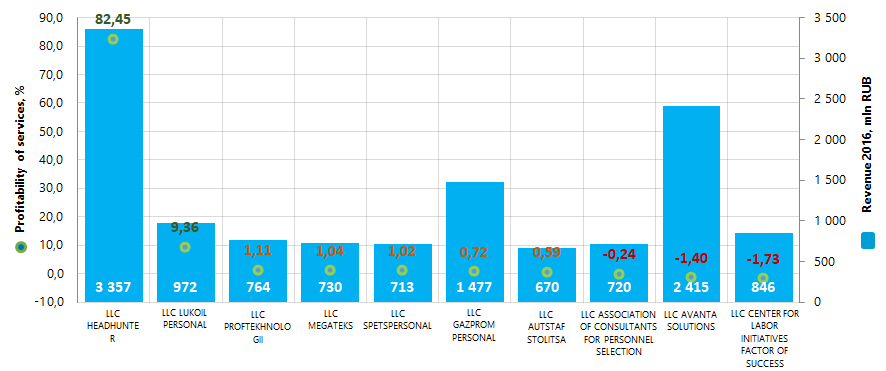

Information agency Credinform prepared a ranking of profitability of services of the largest Russian recruitment agencies. Companies with the highest volume of revenue (TOP-10) were selected for this ranking according to the data from the Statistical Register for the latest available periods (2016 and 2015). The enterprises were ranked by decrease in profitability of services (Table 1). The analysis was based on data from the Information and Analytical system Globas.

Profitability of services or goods (%) is sales profit to expenses from ordinary activities. Profitability in general indicates production efficiency. The analyses of profitability of services allows to conclude about expediency of one or another kind of services. There is no standard value for profitability indicators, because they change in accordance with the industry the company operates in.

Taking into account the actual situation both in economy in general and in the sector, the experts of the Information agency Credinform have developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios, which can be recognized as normal for a particular industry. The practical value for companies engaged in recruitment in 2016 is from 2,29%.

For the most complete and objective view of the financial condition of the enterprise it is necessary to pay attention to the complex indicators and financial ratios of the company.

| Name, INN, region | Revenue, mln RUB | Net profit, mln RUB | Profitability of services, % | Solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| LLC HEADHUNTER INN 7718620740 Moscow |

2 696,2 | 3 357,4 | 1 142,9 | 1 349,3 | 95,45 | 82,45 | 205 Strong |

| LLC LUKOIL PERSONAL INN 7707320456 Moscow |

748,3 | 972,1 | 12,2 | 51,3 | 1,22 | 9,36 | 168 Superior |

| LLC PROFTEKHNOLOGII INN 4027107319 Moscow |

723,3 | 763,8 | 7,4 | 2,6 | 1,49 | 1,11 | 273 Medium |

| LLC MEGATEKS INN 7807307628 Saint-Petersburg |

594,3 | 594,3 | 2,1 | 1,1 | 0,19 | 1,04 | 218 Strong |

| LLC SPETSPERSONAL INN 6685049037 Moscow |

749,6 | 713,4 | 9,9 | 1,1 | 1,76 | 1,02 | 292 Medium |

| LLC GAZPROM PERSONAL INN 7728794168 Moscow |

1 163,0 | 1 476,7 | 5,5 | -8,3 | -0,80 | 0,72 | 275 Medium |

| LLC AUTSTAF STOLITSA INN 7714743371 Moscow |

854,5 | 669,9 | 7,2 | 1,2 | 1,71 | 1,71 | 279 Medium |

| LLC Association of Consultants for Personnel Selection INN 7728700875 Moscow |

1,7 | 719,9 | 0,0 | 0,0 | -4,67 | -0,24 | 550 Insufficient |

| LLC AVANTA SOLUTIONS INN 7707309438 Moscow |

2 343,8 | 2 415,1 | -129,4 | -62,7 | -4,94 | -1,40 | 285 Medium |

| LLC CENTER FOR LABOR INITIATIVES FACTOR OF SUCCESS INN 7743794420 Moscow |

364,2 | 364,2 | 0,1 | 1,2 | -7,95 | -1,73 | 550 Insufficient |

| Total for TOP-10 | 10 239,0 | 12 664,7 | 1 057,8 | 1 336,9 | |||

| Average value for TOP-10 companies | 1 023,9 | 1 266,5 | 105,8 | 133,7 | 8,35 | 9,29 | |

| Average value for industry | 21,3 | 21,7 | 0,8 | 0,7 | 4,92 | 4,43 | |

Average value of profitability of services ratio for TOP-10 is above the practical and industry average. However only two companies in TOP-10 have values higher than practical in 2016, five – lower, and three companies have negative value (marked with green, orange and red in columns 6 and 7 of Table 1 and on Picture 1). Three companies in the top of the ranking have increased revenue and net profit figures in 2016 compared to the previous period. The rest of companies decreased revenue or net profit, or have losses (filled with red in columns 3 and 5 of Table 1).

Picture 1. Profitability of services ratio and revenue of the largest Russian recruitment agencies (TOP-10)

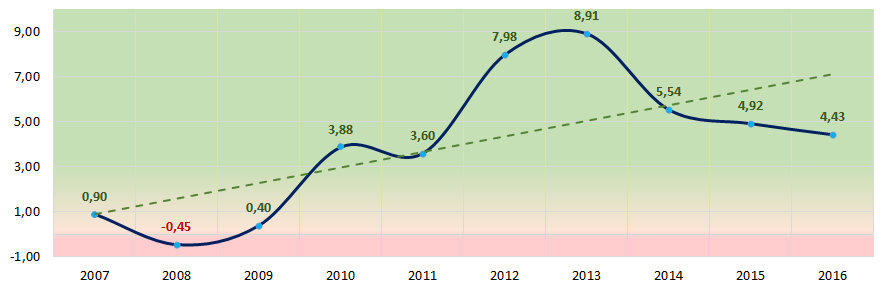

Picture 1. Profitability of services ratio and revenue of the largest Russian recruitment agencies (TOP-10)The average industry indicators of profitability of services ratio over the past 7 years were above practical value (Picture 2). This may indicates a relatively positive trend in in this field.

Picture 2. Change in average industry values of profitability of services ratio of the largest Russian recruitment agencies in 2007 – 2016

Picture 2. Change in average industry values of profitability of services ratio of the largest Russian recruitment agencies in 2007 – 2016Eight companies in TOP-10 got high, strong, medium and superior indexes Globas, that indicates their ability to timely and fully fulfill debt liabilities.

LLC ASSOCIATION OF CONSULTANTS FOR PERSONNEL SELECTION and CENTER FOR LABOR INITIATIVES FACTOR OF SUCCESS have got insufficient Solvency index Globas, due to negative signs peculiar to fly-by-night and unreliable companies. Index development forecast is negative.