All companies will file VAT returns in electronic format

Since the 1st of January 2014 the amendments to the Article 174 of the Tax Code of the RF have entered into force, according to them all organizations will be obliged to file VAT returns in electronic format from now on. As a reminder, such requirements applied earlier only to companies with the staff number more than 100 employees. The final form of the tax return and the rules of its filling are approved by the Ministry of Finance. The return is filed not later than the 20th day of the month following the tax period. There is the penalty at the rate of 200 RUB prescribed for the violation of the established procedure.

According to members of legislative body, such innovation will let speed up the administration process of tax levies and will contribute to well-timed response by origin of disputable situations. Also the experts note that the amount of organizations submitting tax reporting in electronic format is increasing annually. Thus, if in 2005 the amount of enterprises submitted electronic reporting did not reached 7%, then there were already practically 72% of such enterprises in 2012. According to the forecasts, this index will come close to 80% by the year 2015.

According to the data of the head of the Federal Tax Service of the RF (FTS) Mikhail Mishustin, about 500 taxpayers from 22 regions of the country signed up for the service access in 2013. By that the site of the FTS was visiting by more than 50 mln people during the previous year, that is by 5 mln people higher than in the year 2012.

First results of innovations can be estimated even now. Upon the application of Mikhail Mishustin, for 10 months of the year 2013 the measures taken for the improvement of the tax administration process let increase the total sum of tax collection to consolidated budget by 221,5 bln RUB, that is by 2,4% more than in the same period of the year 2012. In its turn the federal budget was refilled by 112,4 bln RUB.

According to the data of the Statistical Register, 3,859 mln companies and little more than 4 mln individual enterprises were registered on the territory of the RF at year-end 2012. The Information Agency Credinform provides you an opportunity to get the detailed information on a company you are interested in from the daily updated data base GLOBAS-i®.

Ranking «Inventory turnover ratio of manufacturers of refined oils and fats»

Information agency Credinform prepared a ranking of enterprises of the RF producing refined oils and fats.

The companies with highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). These enterprises were ranked by decrease in inventory turnover ratio.

Inventory turnover ratio (in times) is the ratio of sales revenue to average inventory value for a period.

Inventory turnover characterizes mobility of assets, which an enterprise puts into the stocking: the faster the money put into inventories return to a company as the sales revenue from finished goods, the higher is the business activity of this organization, efficiency of resources use by the company taking into account the time factor.

There is no recommended value prescribed for this ratio, because it can vary strongly depending on industry sector, where the concrete enterprise operates. However, the higher is its value the better. By the analysis of company’s activity it is expedient to take into account the industry-average indicator.

| № | Name | Region | Turnover for 2012, in mln RUB | Inventory turnover, (in times) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | KRTs EFKO-KASKAD LLC INN: 3122503751 |

Belgorod region | 39 295,6 | 27,7 | 229(high) |

| 2 | SOYuZ-TTMLLC INN: 3906099876 |

Kaliningrad region | 3 958,8 | 24,2 | 214(high) |

| 3 | Kazansky zhirovoi kombinat JSC INN: 1624004583 |

The Republic of Tatarstan | 14 993,0 | 24,1 | 216(high) |

| 4 | PishchevyeIngridientyLLC INN: 2352038521 |

Krasnodar territory | 14 948,5 | 15,1 | 253 (high) |

| 5 | ZhirovoikombinatJSC INN: 6664014643 |

Sverdlovsk region | 5 096,8 | 7,9 | 216 (high) |

| 6 | Oil ProdakshnCJSC INN: 3607006520 |

Voronezh region | 8 033,3 | 6,7 | 278 (high) |

| 7 | Selhozpostavka LLC INN: 3663075278 |

Voronezh region | 4 406,7 | 6,5 | 275 (high) |

| 8 | Aston Produkty Pitaniya i Pishchevye Ingridienty JSC INN: 6162015019 |

Rostov region | 17 083,3 | 3,3 | 233 (high) |

| 9 | Efirnoe JSC INN: 3122000300 |

Belgorod region | 14 818,0 | 3,2 | 248 (high) |

| 10 | AMURARGOTsENTR LLC INN: 2801081020 |

Amur region | 3 760,5 | 2,9 | 231(high) |

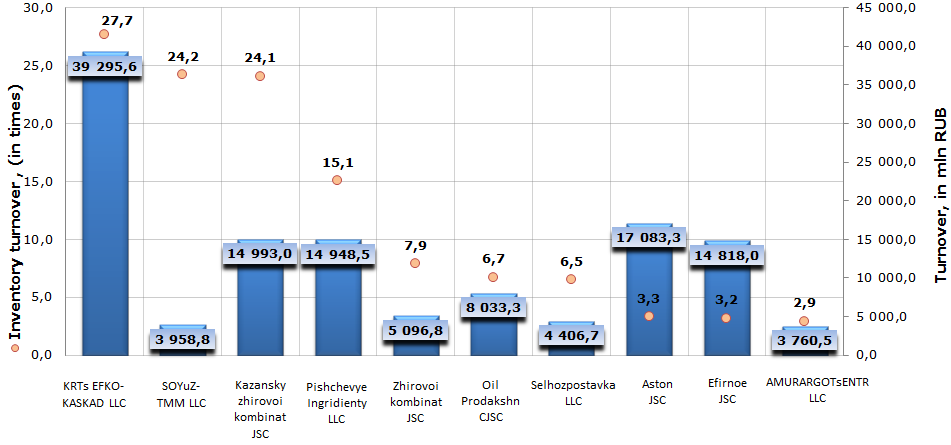

Picture. Increase of inventory turnover and annual sales of the largest manufacturers of refined oils and fats (TOP-10)

Cumulative turnover of the first TOP-10 manufacturers of refined oils and fats at year-end 2012 reached 126 394,5 mln RUB, went up by 8,4% in comparison with the year 2011. Industry leaders accumulate 77% of sales revenue of companies from the TOP-100 list.

The average value of inventory turnover ratio of TOP-100 organizations is 23,6 times.

Current sales revenue growth can be characterized as stably-moderate, there were high rates of cumulative turnover growth observed in previous periods. However, in view of the economic slowdown of the country taken as a whole and visible cooling-off in consumer demand, such figures look very encouraging. In the foreseeable future the decline in industry indicators is not expected.

Only 3 companies from the TOP-10 list showed higher rate of inventory turnover, than the average for all enterprises – these are: KRTs EFKO-KASKAD LLC (27,7 times) – being the largest player on this market, produces packed vegetable oil under brands «Sloboda», Altero and EFKO FOOD professional; SOYuZ-TMM LLC (24,2 times) – manufactures substitutes of special purpose fat; Kazansky zhirovoi kombinat JSC (24,1 times) – produces sunflower oil refined deodorized «Laska», «Chudesnaya semechka», «Bogatoe», «Miladora», «Volshebnaya semechka».

Other participants of TOP-10 showed lower rate of inventory turnover, than the branch average.

Taken as a whole, according to the independent estimation of solvency of companies, developed by the Agency Credinform, all market leaders have a high solvency index GLOBAS-i®, that can be considered as a guarantee they will pay off their debts, while risk of default is minimal or below average. From investment point of view the business cooperation with participants of the rating looks attractive.