Russia’s isolation postponed

The global business is still ready to increase the investment in Russia. According to consulting company AT Kearney, more than a half of 500 affluent worldwide business representatives are planning to increase the investment in Russia «significantly or moderately» under the condition of recession of geopolitical intensity around Ukrainian events.

Despite the current situation, 50% of respondents still think, that Russia is the reasonable direction for investment. Some banks, including Coutts and DBS in Singapore, are noting that the shares of Russian companies are record-breaking cheap, and the ratio of price/profit is lower than dividend income indicators; this is a signal for purchasing of securities

According to the Foreign Direct Investment Confidence index (the trust index in the context of direct foreign investments), which is calculated by AT Kearney, Russia is out of TOP-25 directions for the investment for the second year in a row.

According to FDI Markets, in 2014 178 new projects, which are financed by foreign investment, were started in Russia for a total amount of 13 bln. USD. In 2011 the number of such projects amounted to 396, total value - about 23 bln. USD.

Further fall in prices of Russian assets, as expected, will increase the interest of Asian investors.

Moreover, the Russian business is also perked up, and reached much higher rates, than many global companies. And it is all because of sanctions and lack of foreign products, the Russians began to make a choice in favor of domestic products and services. Now, as a result, the Russian companies, which are trading at Moscow Exchange, are more profitable than all other companies from the index of developing markets according to MSCI by profit before tax values. Many Russian corporations surpassed its direct global competitors by growth level.

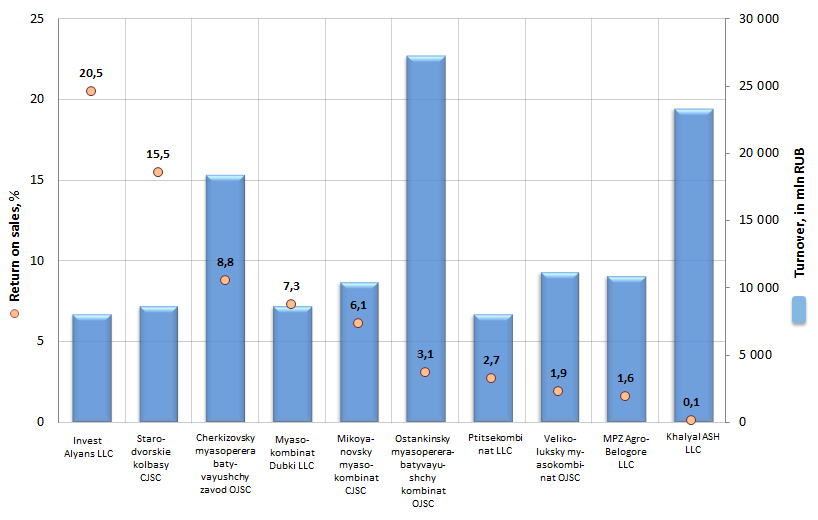

Return on sales of Russian meat processing companies

Information agency Credinform prepared a ranking of the largest meat processing enterprises of Russia.

The companies with the highest volume of revenue were selected for the ranking (according to the data from the Statistical Register for the latest available period - for the year 2013), which specialize in processing of meat and poultry, in release of ready-made products (sausages, semi-finished products, meat stuffing etc.). For each company it was calculated the return on sales and given the solvency index Globas-i® of IA Credinform.

Return on sales (%) shows the share of operating income in sales volume of a company. In other words, the return on sales is the ratio, which illustrates what share of profit contains in each ruble earned.

The ratio characterizes the efficiency of use by a company of its resources, the efficiency of company’s financial management.

The values of return on sales are specific to each organization, what can be explained by the difference of competitive strategies of companies and their assortment.

Companies should be assessed relying on the industry-average indicator.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to average values of profit, but also to all available combination of financial data.

| № | Name | Region | Revenues, in mln RUB, for 2013 | Return on sales, % | Solvency index Globas-i® |

|---|---|---|---|---|---|

| 1 | Invest Alyans LLC INN 5074028377 |

Kaluga region | 8 039,0 | 20,5 | 193 the highest |

| 2 | Starodvorskie kolbasy CJSC INN 3328426780 |

Vladimir region | 8 634,1 | 15,5 | 229 high |

| 3 | Cherkizovsky myasopererabatyvayushchy zavod OJSC INN 7718013714 |

Moscow | 18 396,9 | 8,8 | 190 the highest |

| 4 | Myasokombinat Dubki LLC INN 6432013128 |

Saratov region | 8 662,9 | 7,3 | 216 high |

| 5 | Mikoyanovsky myasokombinat CJSC INN 7722169626 |

Moscow | 10 437,1 | 6,1 | 204 high |

| 6 | Ostankinsky myasopererabatyvayushchy kombinat OJSC INN 7715034360 |

Moscow | 27 240,2 | 3,1 | 202 high |

| 7 | Ptitsekombinat LLC INN 2631029799 |

Stavropol territory | 8 083,2 | 2,7 | 251 high |

| 8 | Velikoluksky myasokombinat OJSC INN 6025009824 |

Pskovregion | 11 187,7 | 1,9 | 280 high |

| 9 | MPZ Agro-Belogore LLC INN 3123183960 |

Belgorodregion | 10 907,0 | 1,6 | 270 high |

| 10 | Khalyal ASH LLC INN 5050046264 |

Moscow region | 23 342,2 | 0,1 | 297 high |

The revenues of the leading meat processing compnaies of Russia (TOP-10), according to the latest published annual financial statement (for the year 2013) made 134,9 bln RUB, that is by 13,4% lower as in the previous period (118,4 bln RUB).

Picture. Return on sales and revenues of the leading meat processing companies of the RF (TOP-10)

The return on sales of all organizations of the TOP-10 list is in the positive zone, in other words, the leaders of the meat market have a portfolio of positive financial result behind them.

Two companies showed the return on sales being above 10%: Invest Alyans LLC (20,5%) – involved in the release of semi-finished meat - and Starodvorskie kolbasy CJSC (15,5%).

The largest enterprise of the branch – Ostankinsky myasopererabatyvayushchy kombinat OJSC - shows the average value of the return on sales (3,1%), that is an acceptable result, taking into account the size of revenues, complexity of production chain and logistics network of the company (increases the production costs).

According to the independent estimation of IA Credinform, all participants of the TOP-10 list got high and the highest solvency index. This fact points to that the market players can pay off their debts in time and fully, while risk of default is minimal or low.