Trends in machine-building industry of Volga federal district of Russia

Information agency Credinform represents an overview of activity trends of the largest machine-building enterprises in Volga federal district of Russia.

Machine-building enterprises with the largest volume of annual revenue (TOP-1000) of the federal district were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2013 - 2018). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets value is an indicator, reflecting the real value of company’s property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest machine-building enterprise of Volga federal district in terms of net assets is KAMAZ PJSC, INN 1650032058, Republic of Tatarstan. Its net assets amounted to more than 45 billion rubles in 2018.

The smallest amount of net assets in the TOP-1000 list was hold by CHEBOKSARY TRACTOR PLANT PJSC, INN 2126003074, Chuvash Republic. The insufficiency of property of this company in 2018 was expressed as a negative value of -112,6 billion rubles.

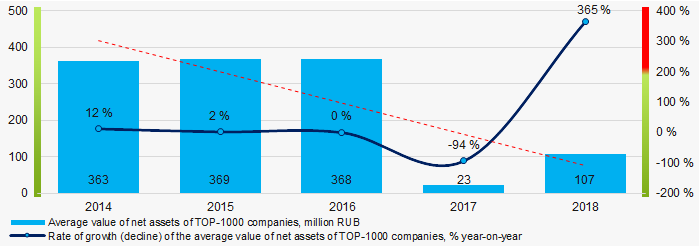

The average values of net assets tend to decrease over the five-year period (Picture 1).

Picture 1. Change in the average indicators of the net asset value of TOP-companies in 2014 – 2018

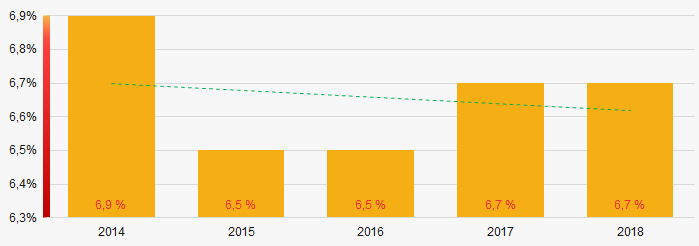

Picture 1. Change in the average indicators of the net asset value of TOP-companies in 2014 – 2018The shares of TOP-1000 enterprises with insufficiency of assets have a tendency to decrease in the last five years (Picture 2).

Picture 2. Shares of enterprises with negative values of net assets in TOP-1000

Picture 2. Shares of enterprises with negative values of net assets in TOP-1000Sales revenue

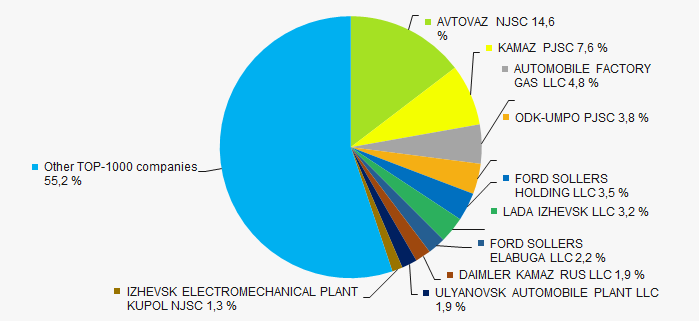

The revenue volume of 10 leading regional companies of the industry made almost 45% of the total revenue of TOP-1000 in 2018. (Picture 3). It points to a high level of monopolization in machine-building industry of Volga region.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2018

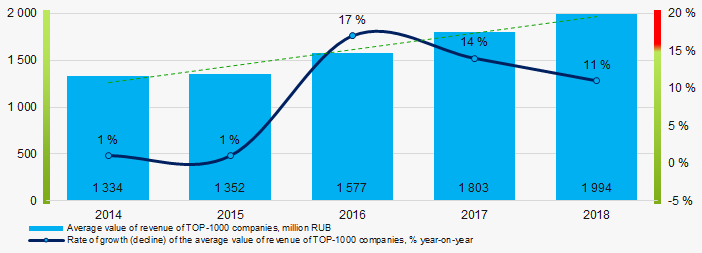

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2018In general, there is a tendency to increase in the revenue volumes (Picture 4).

Picture 4. Change in the average revenue of TOP-10 companies in 2014 – 2018

Picture 4. Change in the average revenue of TOP-10 companies in 2014 – 2018Profit and loss

The largest company of the industry in Volga region in terms of net profit value is ODK-UMPO PJSC, INN 0273008320, Republic of Bashkortostan. The company's profit amounted to 14,3 billion rubles in 2018.

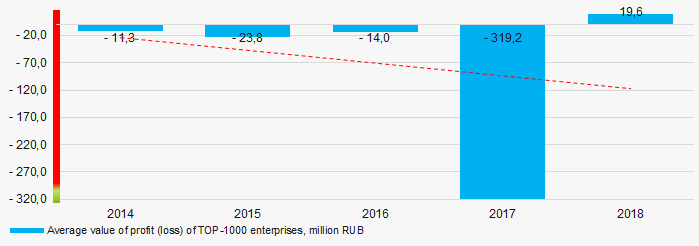

For four out of five years the TOP-1000 companies had losses with a tendency to their increase (Picture 5).

Picture 5. Change in the average indicators of profit (loss) of TOP-10 companies in 2014 – 2018

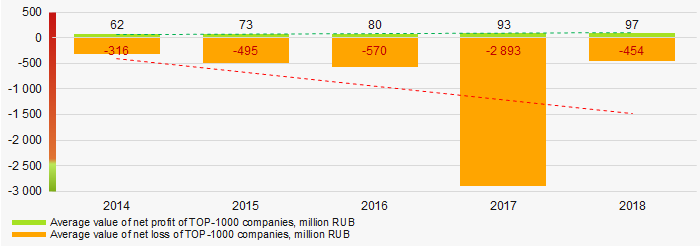

Picture 5. Change in the average indicators of profit (loss) of TOP-10 companies in 2014 – 2018Average values of net profit’s indicators of TOP-1000 enterprises have a tendency to their increase over a five-year period, at the same time the average value of net loss also increases. (Picture 6).

Picture 6. Change in the average indicators of net profit and net loss of TOP-10 companies in 2014 – 2018

Picture 6. Change in the average indicators of net profit and net loss of TOP-10 companies in 2014 – 2018Key financial ratios

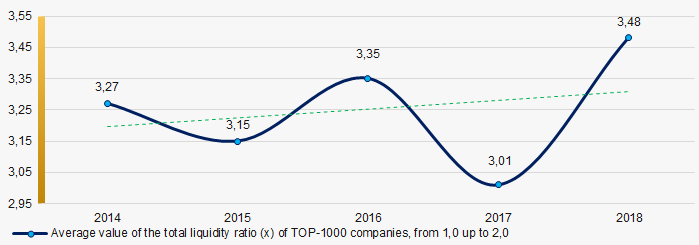

Over the five-year period the average indicators of the total liquidity were above the range of recommended values - from 1,0 up to 2,0, with a tendency to decrease. (Picture 7).

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the average values of the total liquidity ratio of TOP-10 companies in 2014 – 2018

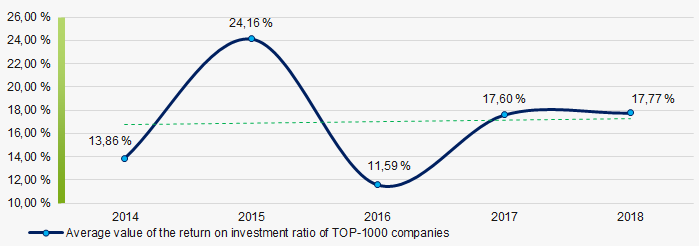

Picture 7. Change in the average values of the total liquidity ratio of TOP-10 companies in 2014 – 2018Over the course of five years, there is a relatively high level of average values of the indicators of the investment ratio, with a tendency to increase. (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity and the long-term borrowed funds of an organization.

Picture 8. Change in the average values of the return on investment ratio of TOP-10 companies in 2014 – 2018

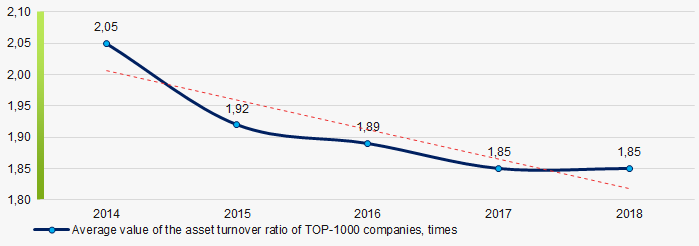

Picture 8. Change in the average values of the return on investment ratio of TOP-10 companies in 2014 – 2018Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This ratio of business activity showed a tendency to decrease over the five-year period (Picture 9).

Picture 9. Change in the average values of the asset turnover ratio of TOP-10 companies in 2014 – 2018

Picture 9. Change in the average values of the asset turnover ratio of TOP-10 companies in 2014 – 2018Small business

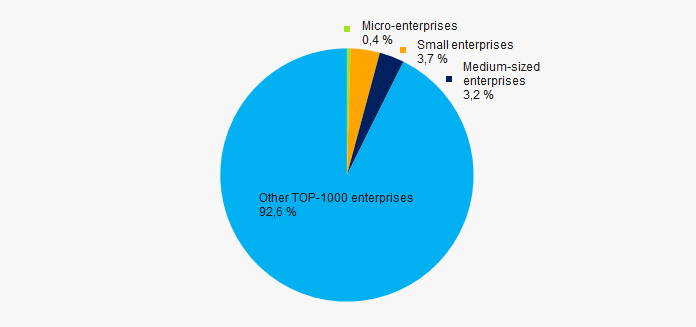

63% of TOP-1000 companies are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the RF. At the same time, their share in the total revenue of TOP-1000 enterprises mounts to 7% that is significantly lower than the national average (Picture 10).

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-1000 companies

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-1000 companiesMain regions of activity

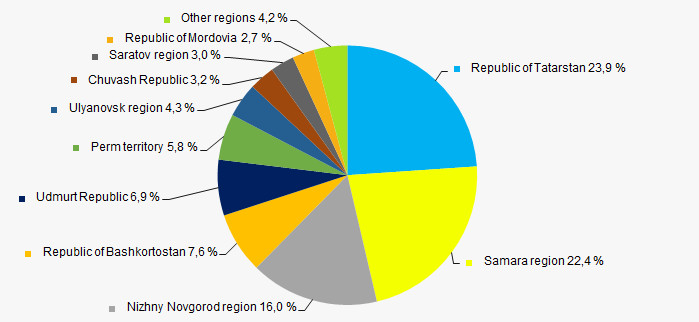

The TOP-1000 companies are registered in 14 regions and distributed unequal across the federal district. More than 62% of the largest machine-building enterprises in terms of revenue are concentrated in the Republic of Tatarstan, Samara and Nizhny Novgorod regions (Picture 11).

Picture 11. Distribution of the revenue of TOP-1000 companies by regions of the Volga federal district of Russia

Picture 11. Distribution of the revenue of TOP-1000 companies by regions of the Volga federal district of RussiaFinancial position score

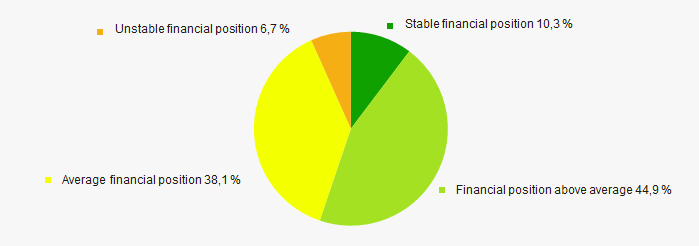

An assessment of the financial position of TOP-1000 companies shows that most of them are in above average financial position (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

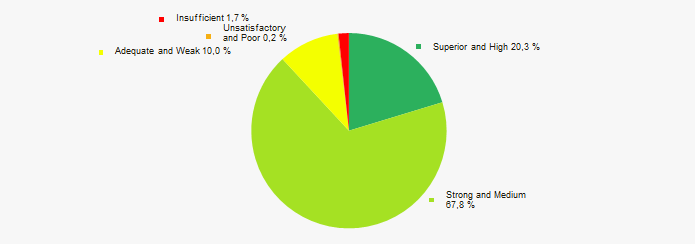

The vast majority of TOP-1000 enterprises got Superior/High or Strong/Medium Solvency index Globas, that points to their ability to pay off their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasIndustrial production index

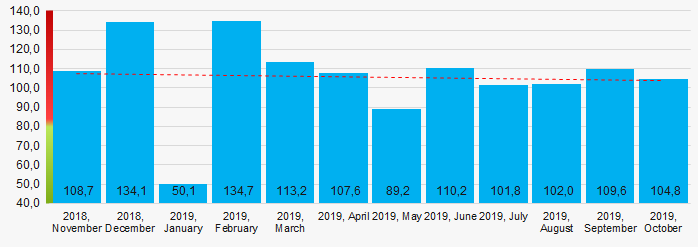

According to the Federal State Statistics Service, there is a decrease in indicators of the industrial production index in the machine-building industry in the Volga federal district during 12 months of 2018 – 2019 (Picture 14). At the same time, the calculated average index month-over-month amounted to 105,5%.

Picture 14. Industrial production index in the machine-building industry of the Volga federal district in 2018 - 2019, month-over-month (%)

Picture 14. Industrial production index in the machine-building industry of the Volga federal district in 2018 - 2019, month-over-month (%)Conclusion

A comprehensive assessment of activity of the largest machine-building enterprises of the Volga federal district, taking into account the main indices, financial indicators and ratios, points to the absence of a pronounced general trend (Table 1).

| Trends and evaluation factors, TOP-1000 | Specific share of factor, % |

| Rate of growth (decline) in the average size of net assets |  -10 -10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  10 10 |

| Level of competition / monopolization |  -10 -10 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Rate of growth (decline) in the average size of profit (loss) |  -10 -10 |

| Growth / decline in average values of net profit of TOP-1000 companies |  10 10 |

| Growth / decline in average values of net loss of TOP-1000 companies |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  5 5 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized enterprises in the region in terms of revenue being more than 22% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Industrial production index |  5 5 |

| Average value of the specific share of factors |  0,0 0,0 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).

Changes in enforcement proceedings

According to the Federal Law of 12 December 2019 No 375-FZ, starting from 1 January 2020 the amendments to the Law «On enforcement proceedings» will come into force.

ЗThe State Duma signed the bill into law in December 2018; however, the Federation Council defeated it on 16 January 2019. Afterwards the finalization of the bill continued in the conciliatory committee. During this process, the following regulations were appeared: the lock of access to third parties to data on overdue debts and multiple appeals on bankruptcy cases by different bankruptcy creditors and authorized bodies. Besides, according to the amendments, the provision of information through the personal account is available; moreover, the creditors are obligated to notify the debtors about attraction of third parties (collectors) to debt repayment. The creditor must send the notice within 30 working days from the date of attraction of the collector. The relevant information should be placed in the Unified Register. The Unified Register should contain the data on creditors, collectors, numbers and dates of contracts on their attraction to debt collection as well as passport data and debtor’s tax number. At the same time, the specified data cannot be available on the open Internet.

The data on all enforcement proceedings starting from January 2012 is available in the relevant section of the Information and Analytical system Globas.