Want to be healthy? Pay!

The Russian commercial healthcare market is up and running.

According to research results, the majority of Russians don’t rely upon for free comprehensive qualified medical attention from the state, that is why they have to turn to commercial healthcare.

Soviet heritage. The system of free public medicine existed in the USSR has been fully outlived in the post-soviet period. Ambitious public health service reforming initiated by the Government in 2010 involved significant budget savings. The main goal of the reform was to improve the compulsory health insurance system (CHI). Along with insurance payment hike from 3,1% to 5,1% it was decided to scale down types of treatment financing directly from the budget and pay for them by means of collected dues. At the same time the doctors’ average salaries began to increase – funds for these expenditures had also to be received from the CHI budget. As a result, hospital stock in many regions began to reduce, small healthcare institutions were closed and professional services began to concentrate in large medical centers; downsizing of medical workers took place later. Today the majority of Russians don’t suppose to get full range of free medical service in case of sickness.

Stand and deliver. According to the KPMG’s Views on Development of Commercial Health Care in the Russian Federation in 2017-2019, the mentioned sector increased by more than 51 bln RUB (8,2%) – following the results of 12 months its volume amounted to 622 bln RUB. The experts forecast further increase for the short-term but a little bit slower - by 6% annually. Among the factors contributing the market growth are continuing decrease of availability and quality of medical services under CHI, reduction of insurance coverage within the frameworks of corporate voluntary health insurance (VHI) policies in large companies and complete rejection of VHI in a number of medium-sized companies. State clinics continue to shut down and the share of commercial services increases in the rest of them. At the same time, disadvantages of health care sector funding are obvious. These factors altogether lead to increase in occupancy rate of healthcare centers in commercial medicine.

Innovations not only in medicine. Owners of commercial healthcare centers are of the same view with researchers and the majority of them speak about intentions to expand business: they argue that increase in customers will be ensured due to reduction in availability and quality of state services. Business models of multi-field clinics providing all necessary medical services at a single location become more and more popular in commercial healthcare. At the same time, it is commercial sector that is able to improve in accordance with medical and technological expectations of clients, such as availability of online appointment system, electronic medical records and mobile application. Increase in prices in the sector can be the factor limiting demand on commercial medical services, however even this will not be able to reduce the market development rates.

State and business. Recently the Ministry of Health of the Russian Federation initiated the discussion of new mechanism of state-commercial cooperation for budgetary healthcare institutions. The Ministry proposed to confer them a right on establishment of subsidiaries vesting real estate released during the reform in. These structures could cash on commercial services and will be controlled by the founders. Speaking long-term, this initiative can be successfully realized and improve medical services quality. However, going into action is required transparent and clear rules. Obviously, continuous reduction in state healthcare is imminently, that is why effective teamwork of the state and business on the matter becomes the most important for the whole population of the country.

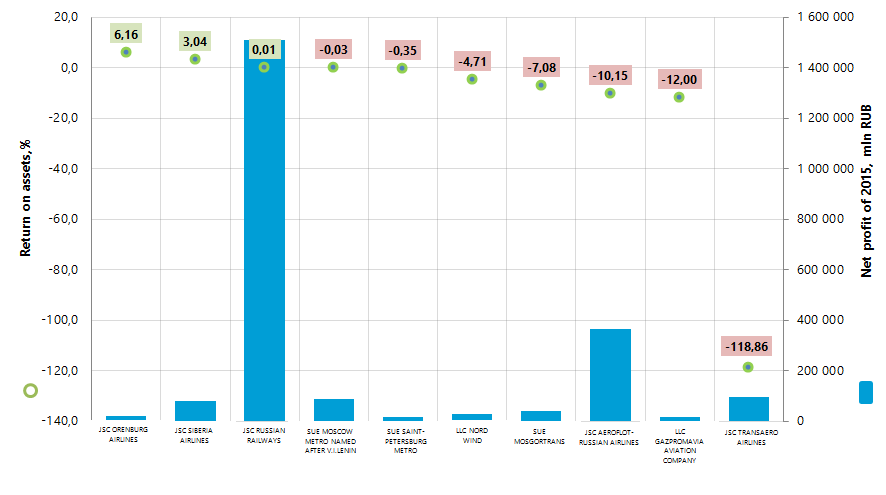

Return on assets of the largest Russian enterprises for passenger transportation

Information agency Credinform has prepared a ranking of the largest Russian enterprises for passenger transportation. The TOP-10 companies with the highest volume of revenue were selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2015 and 2014). Enterprises of the rating are ranked by return on assets (Table 1).

Return on assets ratio (%) is calculated as the relation of the sum of net profit and interest payable to the total assets value and shows how many monetary units of net profit gets every unit of total assets. The ratio characterizes the effectiveness of using of all available resources and financial management. The higher is the ratio value, the more effective is business, that is higher return per every invested in assets monetary unit.

However, it should be considered that book value of assets cannot correspond to its current market price to a great extent. For example, under inflation the book value of fixed assets with a course of time will be more and more underestimated, that leads to overestimation of return on assets. In other words, it is necessary to pay attention not only to the assets structure but also to its maturity.

Dynamics of this indicator also should be considered. The subsequent decrease demonstrates decline of effectiveness in the assets use.

| Name | Net profit (loss) of 2015, mln RUB | Revenue of 2015, mln RUB | Revenue of 2015 to 2014, +/- % | Return on assets, % | Solvency index Globas-i® |

|---|---|---|---|---|---|

| JSC ORENBURG AIRLINES INN 5638057840 Orenburg region |

506,4 | 22 765,9 | 17 | 6,16 | 282 High |

| JSC SIBERIA AIRLINES INN 5448100656 Novosibirsk region |

922,9 | 82 214,5 | 16 | 3,04 | 282 Highest |

| JSC RUSSIAN RAILWAYS INN 7708503727 Moscow |

318,0 | 1 510 757,0 | 8 | 0,01 | 227 High |

| SUE MOSCOW METRO NAMED AFTER V.I.LENIN INN 7702038150 Moscow |

-505,2 | 87 471,0 | 4 | -0,03 | 249 High |

| SUE SAINT-PETERSBURG METRO INN 7830000970 Saint-Petersburg |

-270,1 | 18 831,6 | 8 | -0,35 | 234 High |

| LLC NORD WIND INN 7733646084 Moscow |

-270,8 | 26 867,4 | -34 | -4,71 | 309 Satisfactory |

| SUE MOSGORTRANS INN 7705002602 Moscow |

-5 577,6 | 41 534,2 | 3 | -7,08 | 247 High |

| JSC AEROFLOT-RUSSIAN AIRLINES INN 7712040126 г. Москва |

-18 927,8 | 366 307,5 | 52 | -10,15 | 176 Highest |

| LLC GAZPROMAVIA AVIATION COMPANY INN 7736046504 Moscow |

-4 652,5 | 16 164,8 | 2 | -12,00 | 258 High |

| JSC TRANSAERO AIRLINES INN 5701000985 Saint-Petersburg |

-98 932,7 | 97 711,1 | -17 | -118,86 | 450 Low |

| Total for TOP-10 companies (* - average value for the group) |

-127 389,6 | 2 270 625,0 | *11 | *-14.40 | |

| Total for TOP-100 companies (*- average value for the group) |

-128 780,6 | 2 447 090,6 | *12 | *-4,97 |

Average values of return on assets in 2015 are negative both in the TOP-10 and in the TOP-100 groups.

Industry average values of return on assets are shown in the Table 2.

| Type of passenger transport | 2013 | 2014 | 2015 |

|---|---|---|---|

| Maritime | -2,49 | -7,15 | 3,96 |

| Railway in suburban traffic | н/д | 0,23 | 1,14 |

| Railway backbone | 0,55 | -0,71 | 0,33 |

| Underground | н/д | 0,21 | -0,12 |

| Taxi | -10,38 | 34,05 | -0,30 |

| Inland water | 6,77 | -3,96 | -6,39 |

| Bus | -4,62 | -5,91 | -6,99 |

| Tramway | -1,86 | -14,15 | -8,96 |

| Trolley bus | -6,55 | -4,03 | -15,36 |

| Air | -3,12 | -12,10 | -31,02 |

Only three companies out of TOP-10 have got positive values of return on assets.

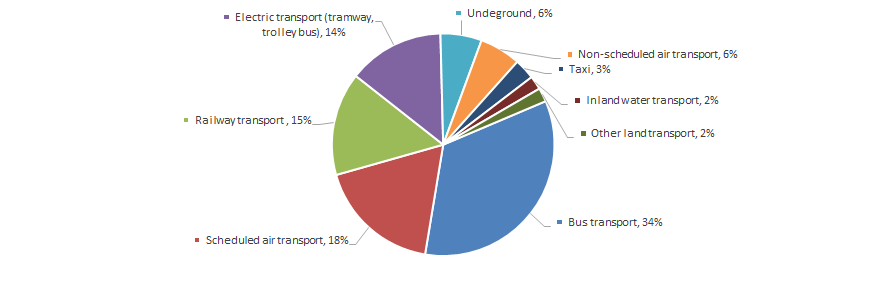

Revenue volume of the 10 largest companies is 93% of total revenue of the 100 largest companies. It shows high level of monopolization, first of all, in the area of railway passenger transportations, because share of the largest company, according to the revenue volume in 2015 - JSC RUSSIAN RAILWAYS is almost 67% of total revenue of the TOP-10 group. Besides, enterprises for bus passenger transportations have got the biggest share in the total revenue of TOP-100 companies (Picture 2).

Eight out of TOP-10 companies have got the highest or high solvency index Globas-i®, that demonstrates the ability to pay the debts in time and to the full extent.

LLC NORD WIND has got satisfactory solvency index Globas-i® because of the information about the participation as a defendant in arbitration court proceedings in terms of debt collection, unclosed enforcement orders and loss in the balance sheets. Projected growth of the index is stable.

JSC TRANSAERO AIRLINES has got low solvency index Globas-i® due to the information about claim for recognition of the company bankrupt, listing in the blacklist of suppliers, unclosed enforcement orders and loss in the balance sheets. Projected growth of the index is negative.

Seven out of TOP-10 companies decreased indicators of revenue compared to the previous period or have loss in 2015 (marked with red shading in Table 1).

In the TOP-100 group 53 lossmaking companies were observed in 2014, and in 2015 the amount insignificantly decreased to 52.

In general, monetary indicators of passenger transportations in 2016 have grown compared to 2010 (except for taxi transportations), that is confirmed by data from the Federal State Statistics Service (Table 3).

| Type of passenger transportation | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2016 to 2010, % |

|---|---|---|---|---|---|---|---|---|

| Scheduled air transport | 383 468 090 | 462 801 843 | 555 009 646 | 647 696 800 | 647 734 812 | 800 879 312 | 943 788 636 | 146 |

| Other scheduled land transport | 221 218 593 | 243 591 843 | 262 093 658 | 275 516 742 | 299 906 865 | 315 496 370 | 344 539 442 | 56 |

| Railway backbone transport | 126 339 471 | 168 499 283 | 225 403 027 | 238 174 601 | 232 785 908 | 231 417 020 | 269 024 137 | 113 |

| Urban electric transport | 105 132 380 | 122 574 362 | 134 769 343 | 134 123 195 | 149 231 508 | 160 869 125 | 176 806 915 | 113 |

| Automobile (bus) scheduled transport | 115 371 219 | 120 476 784 | 126 953 757 | 138 283 128 | 148 558 682 | 151 403 886 | 152 226 256 | 32 |

| Intra-urban automobile (bus) scheduled transportations | 93 011 551 | 97 243 721 | 104 052 116 | 115 099 278 | 126 488 948 | 129 472 148 | 131 675 112 | 42 |

| Underground | 71 877 854 | 82 852 474 | 93 357 108 | 92 309 091 | 105 082 890 | 111 479 422 | 131 326 069 | 83 |

| Nonscheduled air transport | 21 314 554 | 14 801 226 | 11 563 326 | 18 956 009 | 54 171 380 | 65 995 239 | 46 968 613 | 120 |

| Other land transport | 26 105 409 | 25 322 227 | 30 280 212 | 36 059 091 | 47 300 396 | 49 030 510 | 38 541 742 | 48 |

| Tramway transportations | 19 250 939 | 20 029 252 | 21 089 025 | 23 249 932 | 23 344 031 | 29 340 618 | 25 717 386 | 34 |

| Trolley bus transportations | 13 506 290 | 15 936 329 | 16 696 068 | 15 089 821 | 17 093 400 | 15 716 685 | 15 711 528 | 16 |

| Inland water transport | 1 539 154 | 4 211 332 | 4 186 707 | 4 722 625 | 3 945 674 | 2 903 341 | 14 440 178 | 838 |

| Suburban scheduled automobile (bus) transportations | 10 289 459 | 12 568 305 | 13 333 307 | 13 200 025 | 13 863 063 | 13 205 285 | 11 215 752 | 9 |

| Funicular, ropeway and elevator transportations | 199 593 | 198 876 | 362 254 | 663 858 | 1 818 415 | 2 792 303 | 4 606 756 | 2 208 |

| Intra-urban and suburban railway transportations | 489 372 | 3 746 914 | 3 578 382 | 3 465 622 | 3 363 348 | 3 703 046 | 4 051 932 | 729 |

| Maritime transport | 772 271 | 364 609 | 564 708 | 316 833 | 299 127 | 311 548 | 3 691 043 | 378 |

| Taxi | 3 045 371 | 2 930 484 | 2 424 045 | 1 714 089 | 758 524 | 1 251 386 | 933 488 | -69 |

| *) In Table 3 decrease of revenue is marked with red shading and growth with green. | ||||||||

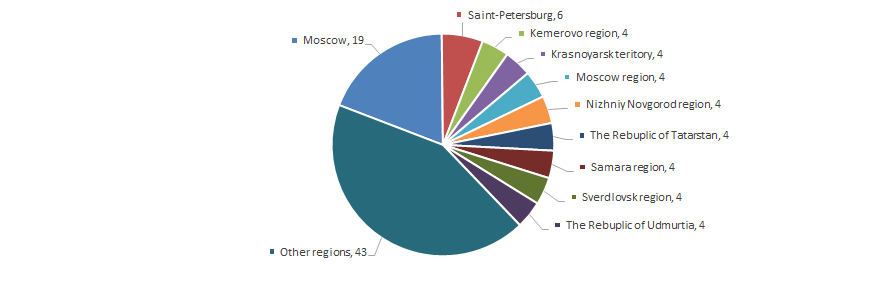

The enterprises for passenger transportation are distributed on the territory of the country equally, attracting to the thickly populated regions because of specific activity. It is confirmed by data from the Information and Analytical system Globas-i®, according to that the 100 largest companies in terms of revenue volume for 2015 are registered in 42 regions of Russia. (Picture 3).