Legislation amendments

In accordance with the Article 31 of the Tax Code of the Russian Federation, the tax authorities have the right to suspend bank accounts transactions of the taxpayers, the payers of fees, insurance fees or the tax agents in the credit institutions and to seize property in accordance with the procedure provided for in the Article 76 of the Tax Code of the Russian Federation.

The suspension of bank accounts transactions implies termination by banks of all expenditure transactions on specific accounts or within the amounts indicated in the decisions on suspension of operations.

In accordance with the Federal Law of November 9, 2020 No. 368-FZ, the tax authorities have the right to block current accounts in the following cases:

- the requirement for payment of taxes, penalties and fines (item 2 of the Article 76 of the Tax Code of the Russian Federation) is not fulfilled, the block is carried out within the amount of the arrears;

- the tax return or the personal income tax (the 6th form) is not submitted within 20 days (from July 1, 2021, currently – 10 days) after the end of submission period (sub-item 1 of item 3, item 3.2 of the Article 76 of the Tax Code of the Russian Federation), there are no restrictions on block amount; at the same time, it is prohibited to carry out transactions with the funds on the account as well as with the incoming funds (the letter of the Ministry of Finance of the Russian Federation No. 03-02-07/1-182 dated 17.04.2007);/li>

- the e-receipt on accepting requirements or notifications was not sent to the tax office (sub-item 2 of item 3 of the Article 76 of the Tax Code of the Russian Federation).

As amended by the Law No. 368-FZ, from July 1, 2021 the tax authorities will receive the right to inform the taxpayers in advance on upcoming suspension of bank accounts. According to the letter of the Ministry of Finance of the Russian Federation No. 03-02-11/13505 dated 26.02.2021, the decision of tax authorities on suspension of bank accounts and digital cash transactions may be accepted after 14 working days from the date of such notification.

However, it should be noted, that the responsibility of tax authorities for not sending notifications on upcoming blocking is not legally established.

The ability to check information on suspended bank accounts is available in the Information and Analytical system Globas using the appropriate tool in the section «Banks. Extract on suspended bank accounts».

Sugar production profitability in 2020

Information agency Credinform presents the ranking of Russian sugar producers. The largest enterprises in terms of annual revenue (TOP-10) during the last available periods (2018 - 2020) from the State statistical bodies and the Federal Tax Service were selected for the ranking. Then they were ranked by the profitability ratio of their products (Table 1). Selection of companies and analysis were carried out on the basis of data from the Information and Analytical system Globas.

Profitability of production (%) is calculated as the ratio of profit from sales to expenses for regular activities.

In general, profitability reflects the economic efficiency of production. Analysis of the products profitability provides us with the feasibility of goods production. There are no normative values for indicators of this group as they vary greatly depending on the industry.

For the most full and fair opinion about the company’s financial position the whole set of financial indicators and ratios should be taken into account.

| Name, INN, region | Revenue, million rubles | Net profit (loss), million rubles | Product profitability, % | Globas Solvency Index | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| ATMIS SUGAR PJSC INN 5802000692 Penza region |

4 419,2 4 419,2 |

5 720,3 5 720,3 |

-190,8 -190,8 |

661,1 661,1 |

2,90 2,90 |

24,41 24,41 |

227 High |

| CHISHMINSKY SUGAR FACTORYPJSC INN 0250005763 Republic of Bashkortostan |

2 443,4 2 443,4 |

3 305,4 3 305,4 |

43,5 43,5 |

407,0 407,0 |

3,68 3,68 |

18,51 18,51 |

170 Highest |

| ULYANOVSK SUGAR FACTORY JSC INN 7322002100 Ulyanovsk region |

1 864,5 1 864,5 |

2 525,0 2 525,0 |

0,6 0,6 |

298,4 298,4 |

1,72 1,72 |

18,47 18,47 |

153 Highest |

| DOBRINSKY SUGAR FACTORY PJSC INN 4804000086 Lipetsk region |

6 991,5 6 991,5 |

7 471,1 7 471,1 |

804,8 804,8 |

361,5 361,5 |

15,91 15,91 |

17,07 17,07 |

250 High |

| BALASHOVSKY SUGAR FACTORY LLC INN 6440014975 Saratov region |

1 464,3 1 464,3 |

1 864,1 1 864,1 |

-148,3 -148,3 |

97,6 97,6 |

-4,99 -4,99 |

12,99 12,99 |

239 High |

| RAEVSAKHAR LLC INN 0202007993 Republic of Bashkortostan |

963,9 963,9 |

1 422,3 1 422,3 |

-56,4 -56,4 |

181,0 181,0 |

-7,52 -7,52 |

11,88 11,88 |

231 High |

| S-AGROTRADE LLC INN 2610019895 Stavropol territory |

0,0 |  2,8 2,8 |

-0,2 -0,2 |

0,1 0,1 |

-100,00 |  8,52 8,52 |

357 Satisfactory |

| ERA LLC INN 5033001440 Moscow region |

0,0 0,0 |

1,9 1,9 |

0,0 |  0,1 0,1 |

н/д | 7,22 | 350 Satisfactory |

| SNAB SBYT SERVICE LLC INN 5614020470 Orenburg region |

2,6 2,6 |

1,2 1,2 |

0,1 0,1 |

0,0 0,0 |

4,47 4,47 |

0,99 0,99 |

271 High |

| BELLAVISTA LLC INN 5402538373 Novosibirsk region |

21,0 21,0 |

11,1 11,1 |

0,1 0,1 |

0,0 0,0 |

0,31 0,31 |

0,56 0,56 |

313 Satisfactory |

| TOP 10 average value |  1 817,1 1 817,1 |

2 232,5 2 232,5 |

45,3 45,3 |

200,7 200,7 |

-9,28 -9,28 |

12,06 12,06 |

|

| Industry average value |  1 264,3 1 264,3 |

67,4 67,4 |

7,68 7,68 |

||||

indicator improvement for the previous period,

indicator improvement for the previous period,  indicator deterioration for the previous period

indicator deterioration for the previous period

The average profitability value of the TOP 10 companies' products for 2020 is significantly higher than in the previous year. Only one company had the average profitability value decline in 2020, while all TOP 10 companies had the average profitability value decline in 2019.

At the same time, only two companies in 2020 reduced revenue and eight companies increased net profit.

Therefore, 2020 was more successful than 2019 for the TOP 10 companies. Revenue increased by almost 23% and profit increased by more than 4 times.

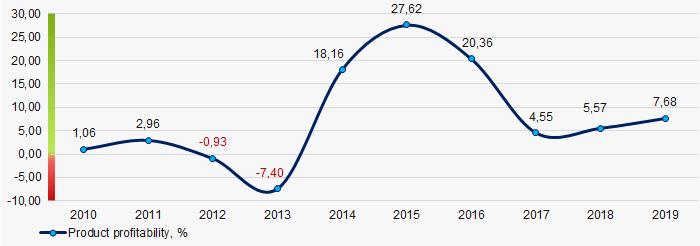

In general average industry indicators of product profitability were not stable for 10 years (Picture 1). The indicator reached the highest values in 2015 and the lowest in 2013.

Picture 1. Changes in average industry values of the profitability ratio of sugar producers ' products in 2010-2019.

Picture 1. Changes in average industry values of the profitability ratio of sugar producers ' products in 2010-2019.