Legislation amendments

Amendments to the parts one and two of the Tax code of the Russian Federation and the certain legislative acts are made by the Federal Law No. 374-FZ dated 23.11.2020.

The Law provides a number of measures aimed at improving tax administration as well as clarifies some provisions on payment of taxes, excise taxes and state duties.

Among main changes related to the legal entities are:

- since January 1, 2020, not only property, but also property rights transferred free of charge from a subsidiary or an individual with a share of at least 50% are put out of company’s income;

- since November 23, 2020, it is established that the transport tax benefit is granted from the tax period when the payer became eligible for the benefit, not from the moment when the tax authorities learned about it;

- power of attorney standard on reporting to the tax authorities entered into force on November 23, 2020. The Federal Tax Service of the Russian Federation must approve the new form and electronic format of the power of attorney and the rules for its submission to the Inspectorate;

- since January 1, 2021, it is established that in respect of a destroyed taxable object, the calculation of property tax is terminated from the 1st day of the month of destruction on the basis of the relevant application submitted by the taxpayer to the tax authority by its own choice;

- data on movable property should be revealed in the property tax return;

- the procedure for forming the remaining value of intangible assets, which is defined as the difference between their original value and the amount of depreciation accrued during the period of operation, is established;

- the financial platform operators are exempt from VAT;

- a state fee of 35000 rubles is set for filling data on legal entities in the register of financial platform operators;

- the procedure for taxation of dividends and income from securities transaction are clarified;

- the rules for applying the investment tax deduction when paying income tax are clarified; application of extended interest rate limits on debt obligations is extended until the end of 2021;

- in order to apply the reduced rates of insurance premiums, the criteria for income share calculation for IT companies are clarified;

- since July 1, 2021, the tax returns will be considered as unreported if the fact of signing by unauthorized persons or non-complaining of their indicators with standards will be found. For such cases, the features of termination and resumption of desk audit were established.

Loan security of companies on UTII

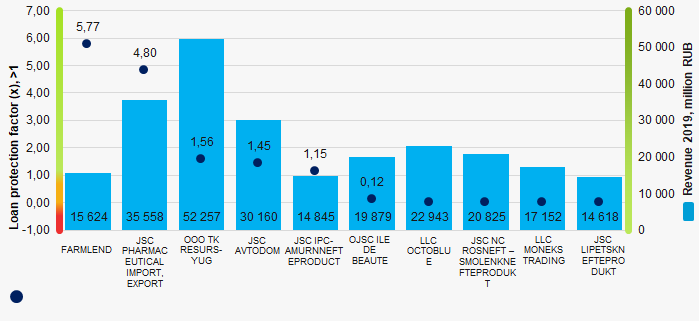

Information agency Credinform presents a ranking of Russian companies on unified tax on imputed income. The largest companies (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the available periods (2017-2019). Then the companies were ranged by loan protection factor (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Loan protection factor (x) is the ratio of pre-tax earnings and loan interest to the sum of interest payable. It characterizes the security level of creditors from non-payment of interest for the granted loan and shows how many times during the reporting period the company earned means to pay the interest on loans.

The recommended value is >1. No indicator value indicates that the company does not have borrowed funds, therefore, no interest payable to creditors. However, it may not always be the evidence of general well-being as credit resources are necessary for a successful business growth.

In order to get the most comprehensive and fair picture of the financial standing of an enterprise, it is necessary to pay attention to all combination of financial indicators and ratios.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Loan protection factor (x), >1 | Solvency index Globas | |||

| 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| FARMLEND INN 0273028277 Republic of Bashkortostan |

12 329 12 329 |

15 624 15 624 |

2 2 |

8 8 |

1,48 1,48 |

5,77 5,77 |

233 Strong |

| JSC PHARMACEUTICAL IMPORT, EXPORT INN 7710106212 Moscow |

31 118 31 118 |

35 558 35 558 |

371 371 |

417 417 |

5,43 5,43 |

4,80 4,80 |

202 Strong |

| OOO TK RESURS-YUG INN 2303024188 Moscow |

45 528 45 528 |

52 257 52 257 |

285 285 |

29 29 |

2,58 2,58 |

1,56 1,56 |

258 Medium |

| JSC AVTODOM INN 7714709349 Moscow |

23 868 23 868 |

30 160 30 160 |

-2 448 -2 448 |

334 334 |

-1,40 -1,40 |

1,45 1,45 |

247 Strong |

| JSC IPC-AMURNNEFTEPRODUCT INN 2801013238 Amur region |

17 709 17 709 |

14 845 14 845 |

21 21 |

13 13 |

1,19 1,19 |

1,15 1,15 |

272 Medium |

| OJSC ILE DE BEAUTE INN 7707061530 Moscow |

19 863 19 863 |

19 879 19 879 |

-462 -462 |

-247 -247 |

-0,77 -0,77 |

0,12 0,12 |

305 Adequate |

| LLC OCTOBLUE INN 5029086747 Moscow region |

21 989 21 989 |

22 943 22 943 |

509 509 |

202 202 |

42,58 42,58 |

220 Strong | |

| JSC NC ROSNEFT – SMOLENKNEFTEPRODUKT INN 6730017336 Smolensk region |

19 360 19 360 |

20 825 20 825 |

-514 -514 |

358 358 |

208 Strong | ||

| LLC MONEKS TRADING INN 7710323601 Moscow |

17 248 17 248 |

17 152 17 152 |

-978 -978 |

-252 -252 |

263 Medium | ||

| JSC LIPETSKNEFTEPRODUKT INN 4822000201 Lipetsk region |

14 433 14 433 |

14 618 14 618 |

21 21 |

604 604 |

296 Medium | ||

| Average value for TOP-10 companies |  22 345 22 345 |

24 386 24 386 |

-319 -319 |

147 147 |

7,30 7,30 |

2,47 2,47 |

|

| Average value for TOP-1000 companies |  1 669 1 669 |

1 721 1 721 |

33 33 |

43 43 |

340,03 340,03 |

56,75 56,75 |

|

improvement compared to prior period,

improvement compared to prior period,  decline compared to prior period

decline compared to prior period

Average value of loan protection factor of TOP-10 is lower than the average value of TOP-1000. Three companies out of six have improved their values in 2019 comparing to the previous period.

Picture 1. Loan protection factor and revenue of the largest Russian companies on UTII (TOP-10)

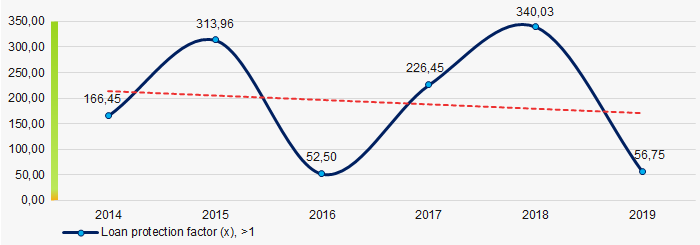

Picture 1. Loan protection factor and revenue of the largest Russian companies on UTII (TOP-10)During 6 years, average values of loan protection factor had a tendency to decrease. (Picture 2).

Picture 2. Change in average values of the loan protection factor of the largest (TOP-1000) Russian companies on UTII in 2014 – 2019

Picture 2. Change in average values of the loan protection factor of the largest (TOP-1000) Russian companies on UTII in 2014 – 2019