FinTech in Russia

Financial technologies, or abbreviated FinTech, are rapidly changing our live and entering into competition with traditional institutions represented by banks and intermediaries in the financial services market. It becomes possible to make a non-cash payment from a buyer to a seller, get instantly a loan at a favorable rate, invest capital successfully - and all this, bypassing an intermediary bank.

The specifics of the digitalization process in Russia is in that namely traditional banks, and not venture funds and investment companies are at the head of infrastructure projects, finance FinTech-startups, create platforms for testing of innovative solutions. Among the most active are members of the FinTech Association - Sberbank, VTB, Alfa-bank. Prospects of new technologies encourage the banking sector to modernize its business processes, improve internal information systems, enhance the quality of data analysis. As a result, technologies are developing primarily for the b2b sphere.

The specifics of the digitalization process in Russia is in that namely traditional banks, and not venture funds and investment companies are at the head of infrastructure projects, finance FinTech-startups, create platforms for testing of innovative solutions. Among the most active are members of the FinTech Association - Sberbank, VTB, Alfa-bank. Prospects of new technologies encourage the banking sector to modernize its business processes, improve internal information systems, enhance the quality of data analysis. As a result, technologies are developing primarily for the b2b sphere.

Among the popular trends in the development of new technologies the register of distributed data and the application programming interface should be highlighted. Thanks to the first technology, well-known cryptocurrencies, monetary surrogates, appeared. The second technology is a software tool that allows different systems and applications to communicate with each other and exchange data. The API technology is successfully used by users of the Information and Analysis system Globas for data integrating into corporate systems.

The downside of the use of new technologies in the absence of legal regulation is the increased risks of financial losses for services’ consumers, violation of their rights, involvement in operations on legalization of illegally received funds, participation in financial pyramids. Illegal actions become possible due to the anonymity of participants of transactions. The absence of regulatory laws gives rise to incomparably different degree of responsibility and conditions of Fintech and traditional commerce market participants.

Today two big tasks are facing Russia and the regulator: to create an infrastructure for universal access to financial technologies and ensure legal regulation. Only equal rights of conditions of developments’ financing, non-discriminatory access of market participants to technologies, as well as the protection of consumer rights and their personal data will create conditions for FinTech development, application of innovations not only in the financial sphere, but also for transformation of all sectors of the economy, and also for creation of a comfortable new reality for individuals, ultimate consumers of products and services.

In Russia, FinTech is represented in the following areas:

- investment - services that help investors manage their assets;

- loyalty - special tools for managing of customer loyalty;

- PFM (Personal Finance Management) – systems or services for effective management of personal finance;

- online accounting – service for automatization of the process of reporting activities;

- crowdfunding and crowdinvesting - alternative platforms for fundraising and tools for investment projects;

- marketplaces - aggregators of information on products and services of companies for search of a fair offer;

- neobanks - banks that do not have physical branches, operating online and on technology platforms;

- infrastructure solutions - specialized services designed to automate the following processes: work with data, credit rating, information security.

So far, there is no legal and regulatory framework in the sphere of FinTech, but as part of the implementation of the program «Digital economy of the Russian Federation» it is planned to develop and adopt regulatory legal acts by 2020 that will ensure the successful development of the innovation sector.

Until the end of 2019, several laws are to be adopted and brought into force that regulate the procedure for conducting of transactions in electronic form, laws on digital financial assets, crowdfunding (attracting of investment through electronic platforms), digital rights.

Read about the law, which comes into force on October 1, 2019 and introduces the concept of «digital right», in our next publications.

Amount of liabilities of agricultural producers

Information agency Credinform presents ranking of the largest manufacturers of agricultural products. Enterprises with the largest volume of annual revenue (TOP-10), were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2015-2017). Then they were ranked by financial liabilities amount (Table 1).The analysis was made on the basis of the data of the Information and Analytical system Globas.

Financial liabilities amount is calculated as sum of short-term and long-term liabilities of an enterprise.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| Name, INN, region, activity type | Sales revenue, billion RUB | Net profit (loss), billion RUB | Financial liabilities, billion RUB | Solvency index Globas | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| JSC SEVERNAYA INN 4706002688 Leningrad region Poultry breeding |

19,3 19,3 |

17,8 17,8 |

1,7 1,7 |

1,6 1,6 |

6,9 6,9 |

3,1 3,1 |

194 High |

| JSC Prioskolie INN 3123100360 Belgorod region Poultry breeding |

35,1 35,1 |

33,9 33,9 |

2,0 2,0 |

0,9 0,9 |

6,9 6,9 |

8,5 8,5 |

206 Strong |

| LLC MIRATORG-BELGOROD INN 3109004337 Belgorod region Cattle breeding |

15,7 15,7 |

21,2 21,2 |

5,5 5,5 |

8,3 8,3 |

19,5 19,5 |

13,2 13,2 |

203 Strong |

| LLC BELGRANKORM INN 3116003662 Belgorod region Poultry breeding |

23,8 23,8 |

23,0 23,0 |

3,9 3,9 |

4,2 4,2 |

10,4 10,4 |

14,8 14,8 |

160 Superior |

| LLC TAMBOVSKII BEKON INN 6803629911 Tambov region Pig breeding |

15,9 15,9 |

20,5 20,5 |

2,0 2,0 |

4,6 4,6 |

16,5 16,5 |

16,1 16,1 |

284 Medium |

| LLC STAVROPOLSKIY BROILER INN 2623030222 Stavropol territory Poultry breeding |

23,5 23,5 |

22,6 22,6 |

1,7 1,7 |

0,7 0,7 |

19,9 19,9 |

18,1 18,1 |

249 Strong |

| LLC CHERKIZOVO-SVINOVODSTVO INN 4812042756 Lipetsk region Pig breeding |

16,3 16,3 |

24,6 24,6 |

1,4 1,4 |

3,3 3,3 |

24,9 24,9 |

24,7 24,7 |

246 Strong |

| JSC KOROCHA Pig-breeding farm INN 3110009570 Belgorod region Pig breeding |

45,2 45,2 |

47,1 47,1 |

-0,5 -0,5 |

-0,3 -0,3 |

42,8 42,8 |

53,1 53,1 |

299 Medium |

| JSC Agricultural Complex named after N.I.TKACHEV INN 2328000083 Krasnodar territory Mixed agriculture |

44,8 44,8 |

46,7 46,7 |

2,9 2,9 |

-2,1 -2,1 |

69,7 69,7 |

93,2 93,2 |

255 Medium |

| LLC Bryansk Meat Company INN 3252005997 Bryansk region Mixed agriculture |

13,6 13,6 |

16,1 16,1 |

9,5 9,5 |

-2,4 -2,4 |

93,3 93,3 |

110,2 110,2 |

318 Adequate |

| Total for TOP-10 companies |  253,2 253,2 |

273,5 273,5 |

30,1 30,1 |

18,7 18,7 |

310,9 310,9 |

355,0 355,0 |

|

| Average for TOP-10 companies |  25,3 25,3 |

27,4 27,4 |

3,0 3,0 |

1,9 1,9 |

31,1 31,1 |

35,5 35,5 |

|

| Average industrial value |  0,05 0,05 |

0,05 0,05 |

0,01 0,01 |

0,00 0,00 |

0,18 0,18 |

0,07 0,07 |

|

— growth of indicator to the previous period,

— growth of indicator to the previous period,  — decrease of indicator to the previous period.

— decrease of indicator to the previous period.

The average indicator of the financial liabilities amount of TOP-10 companies is significantly above the average industrial value. In 2017 five companies out of the TOP-10 have improved their indicators compared to the previous period.

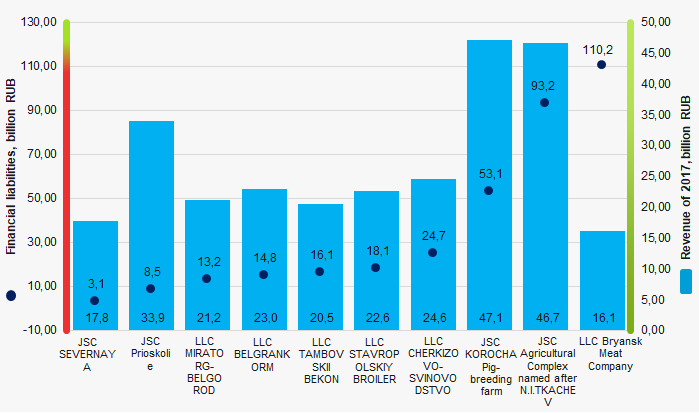

Picture 1. Financial liabilities amount and revenue of the largest agricultural producers (TOP-10)

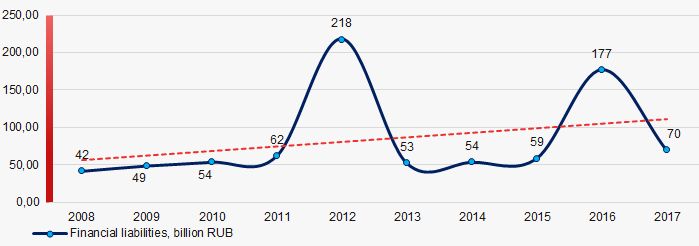

Picture 1. Financial liabilities amount and revenue of the largest agricultural producers (TOP-10)Over a 10-year period an increasing tendency in the average values of the financial liabilities amount has been observed. (Picture 2).

Picture 2. Change in average industrial values of financial liabilities amount of agricultural producers in 2008 – 2017

Picture 2. Change in average industrial values of financial liabilities amount of agricultural producers in 2008 – 2017