Tax evaders will be caught abroad

Hiding from taxes will not be possible abroad now. The Ministry of Finance has prepared a number of amendments to the Tax Code, which provides the inspections and search of evaders jointly with foreign colleagues.

Russian tax representatives will be able to go abroad and verify the domestic tax evaders in cooperation with foreign colleagues. At the same time, foreign tax authorities will also have the right to seek their debtors in Russia.

The amendments made will allow the tax authorities to search for defaulters abroad by a number of articles, such as income and individual property tax, profit tax and property of the organizations tax, value-added tax, land, transport, agriculture and water taxes. Excises, tax on the extraction of commercial minerals, tax on gambling industry, tax on payments, which are relying to the budget in case of the simplified taxation system, are also included in the list.

The search of tax evaders will be based on a standard agreement about an exchange of tax information. The agreement was developed by the Ministry of Finance in association with Federal Tax Service. This agreement will form the basis for signing of bilateral arrangements with foreign countries, including offshore and low-tax areas. First of all Russia needs to ratify the Joint Council of Europe/OECD Convention on Mutual Administrative Assistance in Tax Matters, which was signed in 2011. Today our country has only the right to accept information from foreign tax authorities, but the Federal Tax Service can’t carry out checks abroad.

In situation, when many states faced the problem of budget shortfalls, such measures can significantly increase the revenue side of the budget. The exact amount which will manage to be returned to the Russian treasury during such “field checks” is difficult to predict. Experts name only hypothetical sums. According to the experts, about 30 billion dollars were brought out of Russia to the Cyprus offshore areas for the last 20 years.

Information agency Credinform offers to get acquainted with its own independent index of reliability, which allows to verify the contractor and to identify the «fly by night» company.

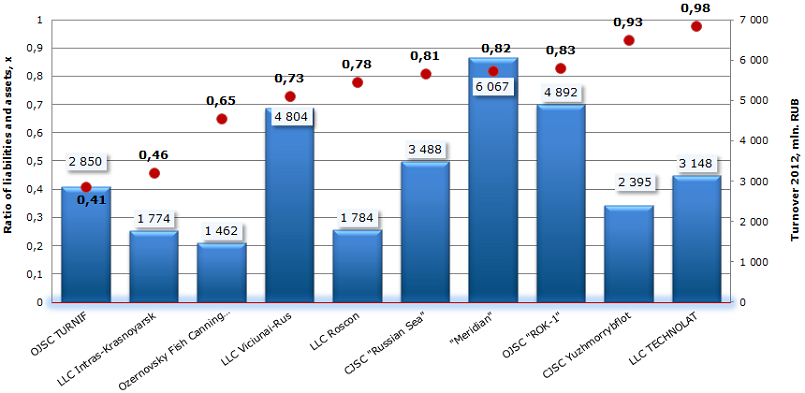

The ratio of liabilities and assets of the Russian enterprises engaged in processing and preserving of fish and seafood

Information agency Credinform prepared ranking of Russian enterprises engaged in processing and preserving of fish and seafood by the liabilities and assets ratio. Companies with this activity, largest in terms of turnover for the latest available in the Statistical Register period (2012), were selected for the ranking. The selected enterprises were ranked first in terms of turnover, and then 10 largest were sorted in an investigated factor ascending order.

The liabilities and assets ratio shows the share of borrowings in the enterprise‘s assets and is calculated as the ratio of long-term and short-term debt to total assets. This ratio refers to a group of indexes of financial stability. Its recommended value ranges from 0.2 to 0.5.

| № | Name, INN | Region | Ratio of liabilities and assets, х | Turnover 2012, mln. RUB | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | OJSC "Pacific department of fish survey and research fleet",INN 2536053382 | Primorski Krai | 0,41 | 2 850 | 184 (top) |

| 2 | LLC Intras-Krasnoyarsk,INN 2466056838 | Krasnoyarsk Territory | 0,46 | 1 774 | 241 (high) |

| 3 | Ozernovsky Fish Canning Plant 55, JSC,INN 4108003484 | Kamchatka Krai | 0,65 | 1 462 | 208 (high) |

| 4 | LLC Viciunai-Rus,INN 3911008930 | Kaliningrad region | 0,73 | 4 804 | 237 (high) |

| 5 | LLC Roscon,INN 3904067043 | Kaliningrad region | 0,78 | 1 784 | 222 (high) |

| 6 | CJSC "Russian Sea",INN 5031033020 | Moscow region | 0,81 | 3 488 | 277 (high) |

| 7 | "Meridian",INN 7713016180 | Moscow | 0,82 | 6 067 | 173 (top) |

| 8 | OJSC "ROK-1",INN 7805024462 | St. Petersburg | 0,83 | 4 892 | 221 (high) |

| 9 | CJSC Yuzhmorrybflot,INN 2508098600 | Primorski Krai | 0,93 | 2 395 | 288 (high) |

| 10 | LLC TECHNOLAT,INN 3906145113 | Kaliningrad region | 0,98 | 3 148 | 242 (high) |

Among 10 companies in the ranking, only two can boast of liabilities and assets ratio with the relevant normative values. Both companies are at the head of the ranking.

The first line is taken by OJSC "Pacific department of fish survey and research fleet" (OJSC TURNIF) with the ratio of 0.41, which corresponds to the recommended values. Additionally, the company has got the highest solvency index GLOBAS -i ®, which characterizes it as financially stable. The second line is for LLC Intras-Krasnoyarsk with the value of 0.46, which also conforms to standards. The company was given a high solvency index GLOBAS -i ®. This indicates that the balanced financial policy exists in both companies. They are able to make their financial liabilities on time.

The ratio of liabilities and assets of the Russian enterprises engaged in processing and preserving of fish and seafood. Top-10

Ozernovsky Fish Canning Plant 55, JSC and LLC Viciunai-Rus, located on the third and fourth lines, have values of 0.65 and 0.73 respectively, which is slightly deviated from the norm. This shows a trend towards the gradual equalization of borrowings and assets of the companies.

The ratio of borrowings and equity capital of the remaining enterprises is significantly higher than normative values and approaches to 1, which characterizes these enterprises as financially sensitive. However, there are leaders in terms of turnover among these companies. Moreover, all companies has got high and the highest solvency index GLOBAS -i ®, and this indicates a good solvency margin and low credit risk, in spite of the deviations of researched ratio from the norm.

Thus, the companies’ management should control the ratio of borrowings and equity capital in order to avoid financial instability. At the same time, it should be remembered that it is necessary to consider a set of financial indicators for an objective solvency assessment.