Foreign experience in identifying shell companies

Shell company is an international phenomenon. Around the world and, in particular, in Europe, the issue of misuse of preferential taxation using front companies and persons is relevant. The European Commission proposes to introduce minimum requirements and criteria for the verification of signs.

IDENTIFICATION OF SHELL COMPANIES IN THE EUROPEAN UNION

Minimum requirements:

- the company must have owned or rented premises in the EU country;

- the company must have an active bank account in the EU;

- the CEO must be a tax resident of the EU or the majority of employees must be tax residents.

Negative signs:

- more than 75% of revenues come from passive income sources such as interest, dividends, leasing and real estate;

- more than 60% of assets are located outside the Member State or at least 60% of income is earned or paid out via cross-border transactions;

- administration and decision-making is outsourced.

Consequences of non-compliance with the requirements:

- denial of tax benefits, including under double tax treaties;

- shell company shareholders' income is subject to tax rules similar to Controlled Foreign Corporation, CFC

- a request for a tax residency certificate for a tax deduction in other jurisdictions will be denied.

Exceptions:

- public companies;

- companies the activities of which are governed by separate directives;

- holding companies;

- companies having passive income and at least 5 internal employees managing the activities;

- companies operating exclusively within the country.

The proposals of the European Commission to Directive 2011/16/EU on the identification of shell companies will come into effect from January 1, 2024.

The need for information on foreign companies is growing from year to year. The annual increase in requests to the Information and Analytical system Globas for obtaining up-to-date information on foreign companies is 25%.

The capabilities of Globas for checking foreign companies:

- 400+ million organizations worldwide;

- online and offline reports;

- obtaining online reports from the Orbis database by the world's leading publisher of electronic databases for the analysis of companies and markets Bureau van Dijk - Moody's Analytics;

- wide network of competent partners all over the world;

- variety of alternative sources;

- check for the affiliation and links with Russian companies;

- experts support.

Small food service businesses

According to the changes in the Tax Code of the Russian Federation, adopted by the Federal Law dated 02.07.2021 No 305-FZ, starting from 2022 food service companies are exempt from VAT. The privilege applies mainly to small businesses, whose economic situation in recent years leaves much to be desired, but return on investment continues to grow.

For this ranking the Information Agency Credinform selected the largest companies in terms of annual revenue, according to the data from the Statistical Register and the Federal Tax Service for the latest available accounting periods (2018 – 2020). These companies are registered in the Unified Register of Small and Medium-Sized Businesses of the Federal Tax Service of the Russian Federation and engaged in food service sector (TOP 10 and TOP 100). Then they were ranked by return on investment ratio (ROI ratio) (Table 1). The selection and analysis are based on the data from Globas.

Return on investment ratio is calculated as the ratio of net profit to the amount of equity and long-term liabilities and shows the return on equity involved in commercial activities and long-term attracted funds of the organization.

In order to get the most comprehensive and fair picture of the financial standing of an enterprise, it is necessary to pay attention to all the combination of financial indicators and company’s ratios.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | ROI, % | Solvency index Globas | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | 2020 | |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| LLC CENTER OF WINE TOURISM ABRAU -DURSO INN 2315152138 Krasnodar Territory Chain of hotels, restaurants, cafes and shops in Abrau-Durso |

793,8 793,8 |

878,8 878,8 |

-57,1 -57,1 |

-4,7 -4,7 |

-2 468,32 -2 468,32 |

198,22 198,22 |

298 Medium |

| PETERBURG COMMERCIAL HOUSE VENETS , LTD. INN 7808037300 Saint Petersburg Café chain “Bushe” |

1 594,1 1 594,1 |

1 328,2 1 328,2 |

120,7 120,7 |

103,7 103,7 |

55,71 55,71 |

34,58 34,58 |

192 High |

| OOO MAKBURGER INN 5047196943 Moscow Region Chain of fast food restaurants at gas stations |

954,4 954,4 |

1 040,7 1 040,7 |

543,2 543,2 |

507,8 507,8 |

47,68 47,68 |

30,83 30,83 |

262 Medium |

| OOO PROKOFII INN 5009074422 Moscow Region Café chain “Kofemaniya” |

1 390,5 1 390,5 |

936,5 936,5 |

226,7 226,7 |

187,9 187,9 |

27,85 27,85 |

18,76 18,76 |

212 Strong |

| OOO SHKOLNOE PITANIE INN 1650100830 Republic of Tatarstan Catering in educational institutions |

1 571,6 1 571,6 |

1 215,6 1 215,6 |

86,6 86,6 |

45,7 45,7 |

41,93 41,93 |

18,13 18,13 |

180 High |

| OOO SATURN-SHBS-3 INN 7727021870 Moscow Catering in educational institutions, health care, on the territory of the customer |

1 438,0 1 438,0 |

1 295,2 1 295,2 |

32,0 32,0 |

16,9 16,9 |

28,43 28,43 |

11,50 11,50 |

202 Strong |

| FILIAS INN 7729399636 Moscow Moscow café chain “Kofemaniya” |

1 647,6 1 647,6 |

1 598,2 1 598,2 |

-112,7 -112,7 |

16,8 16,8 |

-48,02 -48,02 |

6,66 6,66 |

234 Strong |

| ОOO URBAN KOFIKS RASHA INN 7728339641 Moscow International café chain “Cofix” |

1 631,0 1 631,0 |

1 310,5 1 310,5 |

12,2 12,2 |

1,0 1,0 |

23,80 23,80 |

2,00 2,00 |

277 Medium |

| AO FIRMA FLORIDAN INN 7813037232 Saint Petersburg Organization of hot meals in St. Petersburg for students of educational schools, professional schools, lyceums |

1 576,2 1 576,2 |

1 577,3 1 577,3 |

3,4 3,4 |

3,1 3,1 |

1,82 1,82 |

1,68 1,68 |

222 Strong |

| OOO FARSH SITI GRUPP INN 9710013554 Moscow Burger chain |

1 483,2 1 483,2 |

860,9 860,9 |

77,8 77,8 |

-4,4 -4,4 |

552,72 552,72 |

-30,51 -30,51 |

345 Adequate |

| Average value for TOP 10 |  1 408,1 1 408,1 |

1 204,2 1 204,2 |

93,3 93,3 |

87,4 87,4 |

-173,64 -173,64 |

29,18 29,18 |

|

| Average value for the industry |  33,1 33,1 |

29,2 29,2 |

1,6 1,6 |

2,2 2,2 |

32,41 32,41 |

46,74 46,74 |

|

improvement compared to prior period,

improvement compared to prior period,  decline compared to prior period

decline compared to prior period

In 2020 average values of ROI for TOP 10 were below the average values for the industry. Only two companies out of TOP 10 improved their values, meanwhile in 2019 there were five such companies.

Three companies out of ten increased revenue and two increased net profit. At the same time decrease in average revenue value for TOP 10 was 14% and in average industry value it was 12%. Net profit in TOP 10 decreased by 6%, but average value for the industry increased by 38%.

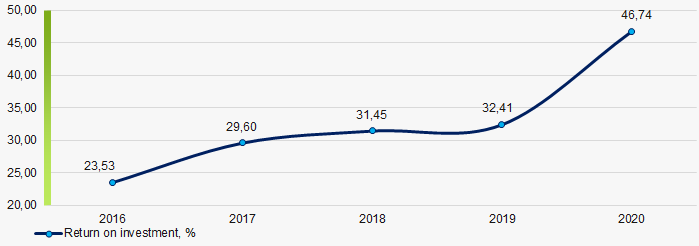

For the past five years, industry average values of ROI ratio were improving for the whole period. The highest value was achieved in 2020 and the lowest was shown in 2016. (Picture 1.).

Picture 1. Change of average industry values of ROI ratio in the food service sector in 2016 – 2020

Picture 1. Change of average industry values of ROI ratio in the food service sector in 2016 – 2020