Whether the ruble started to recover the lost positions

In April, despite the correction at the beginning of this week, the ruble became significantly stronger against the US dollar. Less than a month, the monthly average ruble exchange rate rose by 17.5% in relation to an average monthly rate of January, 2015. Such prompt rise in our currency put it on the first place in the world by profitability for investors. It seems that it is worth being positive to this news, but not everything is so simple. The country’s currency, with such large economics like Russia, should not show that kind of strong and greatly speculative volatility, which is observed since the second half of last year – the period of accelerated depreciation, and till today - equally rapid recovery.

On the one hand, the strengthening of the ruble is advantageous for customers, as the country largely depends on import of products because of the absence of similar products in our country or non-meeting the necessary requirements and properties. Falling costs of imports will lead to some decrease in rates of inflation, which has already reached 16.3% in annual expression. High inflation devalues salaries and directly influences on living standards. On the other hand, cheap ruble gives new incentives for the development of import substitution and industry in general; besides, the dropping-out income of the budget is compensated by export of energy resources considerably fallen in price.

One of the most important factors, which influence on strengthening of the ruble against dollar, is the rise in oil prices and also the absence of large-scale military operations in the east of Ukraine. These factors decrease the geopolitical pressure on Russia with the corresponding confrontational rhetoric from Western leaders.

It’s time for large Russian companies to pay budget taxes. Those companies, that receive income in foreign currency, have to exchange it for rubles. As a result, it increases the demand for rubles and the cost of Russian national currency. The absence of significant foreign debt payments of Russian companies in April gives the support to ruble.

The additional factor (but not the defining) became the fact that Russians recently began to get rid of foreign cash, which was bought at the excessive demand for it.

Besides the structural problems in economy, the number of external factors will influence the ruble. Escalating conflict in Yemen, in which Saudi Arabia is involved, and lifting of sanctions against Iran, have made the oil price forecasts more uncertain. The possibility of renewal of hostilities in Donbass will continue to be used for economic impact on Moscow.

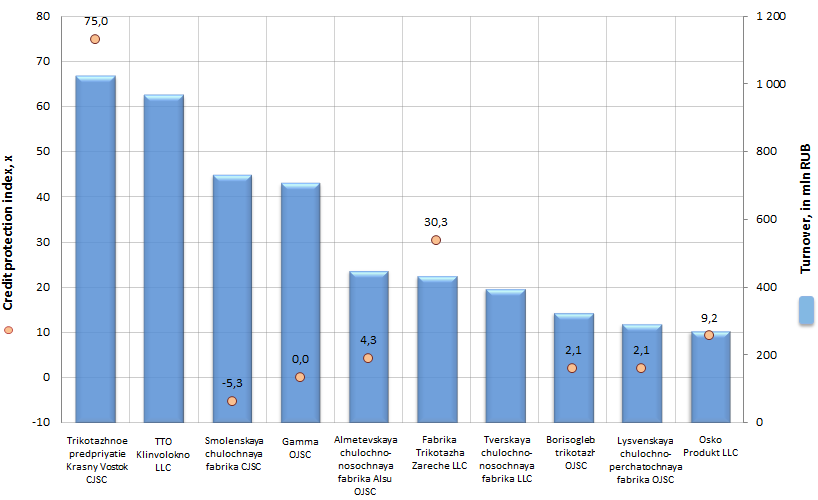

Credit protection of enterprises, producing knitted goods

Information agency Credinform prepared a ranking of companies, manufacturing knitted wear.

The companies with the highest volume of revenue were selected for the ranking according to the data from the Statistical Register for the latest available period (for the year 2013). These enterprises were ranked by decrease in turnover.

Credit protection index (x) is the relation of profit before taxes and interests on loans to the amount of interest payable. It characterizes the security degree of creditors from non-payment of interests on provided credit and shows how many times during the reporting period a company earned funds for interest payment on loans. The recommended value of the ratio is >1. If the index is not calculated (line is drawn), this indicates that a company has no interest obligations towards creditors. But if the ratio has a negative value - this, in its turn, testifies to that there is loss from the main activity.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to average values of profit, but also to all available combination of financial data.

| № | Name | Region | Revenue, in mln RUB, for 2013 | Credit protection index, х | Solvency index Globas-i® |

|---|---|---|---|---|---|

| 1 | Trikotazhnoe predpriyatie Krasny Vostok CJSC INN 7719044264 |

Moscow | 1 023 | 75,0 | 225 high |

| 2 | TTO Klinvolokno LLC INN 5020054074 |

Moscowregion | 966 | - | 315 satisfactory |

| 3 | Smolenskaya chulochnaya fabrika CJSC INN 6731008327 |

Smolensk region | 732 | -5,3 | 274 high |

| 4 | Gamma OJSC INN 5752006640 | Orel region | 706 | - | 245 high |

| 5 | Almetevskaya chulochno-nosochnaya fabrika Alsu OJSC INN 1644023111 |

Republic of Tatarstan | 448 | 4,3 | 229 high |

| 6 | Fabrika Trikotazha Zareche LLC INN 3703043765 |

Ivanovo region | 432 | 30,3 | 248 high |

| 7 | Tverskaya chulochno-nosochnaya fabrika LLC INN 6905059107 |

Tver region | 394 | - | 220 high |

| 8 | Borisoglebsky trikotazh OJSC INN 3604002599 |

Voronezh region | 324 | 2,1 | 227 high |

| 9 | Lysvenskaya chulochno-perchatochnaya fabrika OJSC INN 5918002152 |

Perm terrotiry | 291 | 2,1 | 271 high |

| 10 | Osko Produkt LLC INN 7708096599 |

Moscow region | 269 | 9,2 | 229 high |

Picture. Credit protection index and revenue of the largest companies, producing knitted goods (TOP-10)

The revenue of the largest manufacturers engaged in output of knitted wear (TOP-10), according to the latest published annual financial statement, made 5,6 bln RUB.

Two companies showed the highest values of the credit protection index (above 10): Trikotazhnoe predpriyatie Krasny Vostok CJSC (75,0) and Fabrika Trikotazha Zareche LLC (30,3); the profit significantly exceeds the available interest payable.

Three organizations from the TOP-10 list (TTO Klinvolokno LLC, Gamma OJSC, Tverskaya chulochno-nosochnaya fabrika LLC) did not have interest payable, that, on the one hand, explains the desire of enterprises to develop due to their own sources, and, on the other hand – points out to the danger of losing the competition for the market to those players, who invests heavily in technical re-equipment of its production and intelligent marketing, when it is very difficult to go without borrowed funds.

According to the independent estimation of the Information agency Credinform, nine from ten participants of the TOP-10 list got high solvency index, this fact points to that the enterprises can pay off their debts in time and fully, while risk of default is minimal.

TTO Klinvolokno LLC has satisfactory solvency index. Such fact signals as well to the management as to potential investor that there are certain financial difficulties (retaining of net loss) by the existing business model of development and that it is necessary to attract additional guarantees for the purpose of possible credit granting and cooperation.