China enhances its positions with help of the Asian Infrastructure Investment Bank

The Asian Infrastructure Investment Bank (AIIB) is an international financial institution, which is focused on promoting of financial cooperation in the Asia-Pacific region and on financing of various infrastructure projects in Asia. Foundation of AIIB was initiated by the People's Republic of China, in particular, also for increase of its role in the economic development of this territory.

According to words of the senior officials, AIIB is not treated as a potential rival to the International Monetary Fund (IMF), World Bank (WB) and the Asian Development Bank (ADB). However, low rates of reforms of existing financial organizations, as well as their focus on the USA, Japan and Europe have pushed China into creation of an alternative institution.

As a result of lengthy discussions and negotiations, 57 countries have decided to become the founders of a new bank, and signed a basic document on the establishment of AIIB on June 29, 2015. This document has secured legally the reached agreements, among them: the size of the authorized capital (100 bln $); proportions of countries in the number of votes and shares; management and structure of the bank, decision-making procedures, the fundamental conditions of functioning and operations.

The largest holders of votes and shares has become: China, India and Russia, received 26.06%, 7,5% and 5,92% of votes, respectively.

Because China is the country-founder of AIIB and holder of majority of votes and shares, so the first tasks will be focused on:

- strengthening of China’s position in the international stage and in the economy;

- response to the global influence of the USA;

- occurrence of free-trade zones in the Asia-Pacific region;

- development and construction of infrastructure in Asia, especially in border areas etc.

Along with that, China does not pretend to priority in AIIB, because the rest 73,94% of votes, distributed among the other countries, give a lot of room for maneuver. In this regard, the principles in the work of the new bank will be significantly different from the work of the IMF and WB, which are controlled by the USA and, accordingly, realize the financial policy of the USA in the world. Moreover, the Asian Development Bank (ADB) operates in Asia, which has similar functions and pursues similar aims as AIIB. However, ADB is under the control of Japan and does not meet the needs of China's implementation of modern politics in the field of economy.

AIIB was initially created as an investment bank of countries of Asian region. The Russian government has decided to enter to the new bank rather recently - in March 2015. This decision was contributed by the growing economic interest of Russia to Asian region. Within realization of the development strategy eastwards the Russian government has already signed with China more than 40 agreements on bilateral cooperation in various fields.

In particular, the Asian Infrastructure Investment Bank may participate in financing of the Russian part of «New Silk Road». And this is thousands of kilometers of high-speed highways and railways, modernization of the Black Sea and Caspian ports and much more.

Taking into account of the large scale of Russian projects with China, as well as the ban of the USA, the EU and a number of countries on credit financing of Russia in the world within sanctions, the participation of the Russian government in AIIB will have a significant geopolitical importance and may well become an effective mutually beneficial cooperation.

Return on equity of enterprises, manufacturing bakery products

Information agency Credinform prepared ranking of companies, operating in the market of bakery products.

The companies with the highest volume of revenue were selected and ranked, according to the data from the Statistical Register for the latest available accounting period (for the year 2013).

Return on equity (%) is the ratio of net profit earned by a company to its own capital. It shows how many monetary units of net profit was earned by each unit invested by company owners. It allows assessing the efficiency of use of the capital invested by the owners.

This indicator is used by investors and owners of companies to estimate their investments in it. The higher is the ratio value, the more profitable are investments. But if the return on equity is less than zero, then there is an occasion to reflect over reasonability and effectiveness of investments in this enterprise in the future. As a rule, the ratio value is compared with alternative investments in shares of other companies, bonds and, at least, in a bank.

It is important to note that too high ratio value may have a negative affect on company’s financial stability: more profitability - more risk.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to average values of profit, but also to all presented combination of financial data. Moreover, the specifics of the analyzed industry should be taken into account, because profitability ratios for organizations, operating in various segments of the economy, have their unique features.

| № | Name | Region | Turnover, in mln RUB, for 2013 | Return on equity, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Karavay OJSC INN 7830000360 |

Saint-Petersburg | 6 256 | 5,8 | 219 high |

| 2 | Atrus JSC INN 7609002208 |

Yaroslavl region | 3 831 | 3,8 | 214 high |

| 3 | KBK Cheremushki OJSC INN 7728060368 |

Moscow | 3 532 | 0,7 | 197 the highest |

| 4 | Pervy khlebokombinat OJSC INN 7453018129 |

Chelyabinsk region | 3 287 | 23,7 | 154 the highest |

| 5 | BKK Kolomensky OJSC INN 7724766868 |

Moscow | 2 576 | 1,2 | 256 high |

| 6 | Volzhsky pekar OJSC INN 6900000501 | Tver region | 2 274 | 0,5 | 256 high |

| 7 | Chelny-Khleb CJSC INN 1650027925 |

Republic of Tatarstan | 1 791 | 11,1 | 202 high |

| 8 | Fabrika-Kukhnya Public JSC INN 3232007570 |

Bryansk region | 1 784 | 8,1 | 222 high |

| 9 | Shchelkovokhleb CJSC INN 5050007064 |

Moscow region | 1 769 | 5,9 | 184 the highest |

| 10 | Pokrovsky khleb OJSC INN 5904004368 |

Perm territory | 1 754 | 17,5 | 173 the highest |

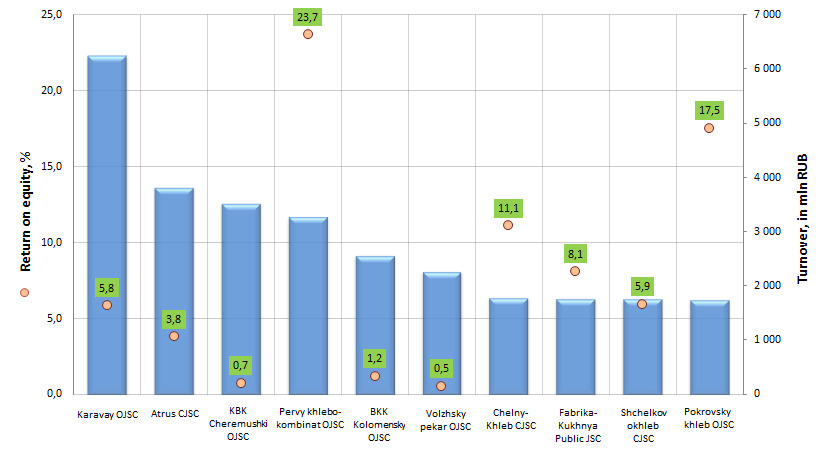

The picture below represents the enterprises of the branch being largest on revenue, also it shows their return on equity.

Picture. Return on equity and turnover of the largest enterprises, operating on the market of bakery products (TOP-10)

Cumulative turnover of the largest companies (TOP-10), operating in the market of bakery products, made 371,1 mln RUB, according to the latest published annual financial statement, that is by 17,7% higher than the indicator of the previous period.

All participants of the ranking demonstrate positive values of the return on equity, in other words, companies generate net profit to investors (owners). At the same time, the efficiency of work is different by organizations: Chelyabinsk company Pervy khlebokombinal OJSC reached the highest profitability (23,7%), Tver manufacturer of bakery products Volzhsky pekar OJSC – the lowest one (0,5%).

Among the market leaders, three firms are operating in Moscow and Moscow region: Konditersko-bulochny kombinat «Cheremushki» OJSC (0,7%), Bulochno-konditersky kombinat «Kolomensky» CJSC (1,2%) and Shchelkovokhleb CJSC (5,9%), that is caused by a large size of population of metropolitan agglomeration, and it generates the large market volume and the high demand for bread and bread products.

St.Petersburg company Karavay OJSC (5,8%) takes the first place of the TOP-10 list on the volume of annual turnover among all producers of bakery products and is the absolute leader in St. Petersburg market: the holding company already includes 4 factories.

According to the independent estimation of the Information agency Credinform, all TOP-10 enterprises got high and the highest solvency index. This fact testifies to a good level of financial standing and solvency of the analyzed companies, that, in its turn, can give a signal to potential investors for the development of cooperation with them.