Unified biometric system

The territorial divisions of the Central Bank of the RF have begun to check credit institutions, including also their branches, for their real readiness to receive citizens' biometric data.

The program of biometric data collection in 400 banks’ branches began in July of the current year in 140 cities of the country. By early next year the possibility of collecting these data should be provided in 4 000 offices. In general, less than 3 000 units of biometric data were collected during the first 4 months of the program.

To monitor the compliance with requirements for biometric data collection, the Central Bank of the RF has prepared a corresponding regulatory act, which is currently under registration in the Ministry of Justice of the RF.

As a reminder, the obligation of credit institutions to take off biometric data by request customer is directly specified in Article 7 «Rights and obligations of organizations engaged in transactions with funds or other property» of the Federal Law №115-FZ «On Countering the Legalization (Laundering) of Proceeds from Crime and Financing of Terrorism» dated 07.08.2001, as well as in the regulatory acts of the Central Bank of the RF. Fine sanctions in the amount of up to 0,1% of the minimum size of share capital may be used against violators. They may also face restrictions on certain banking transactions.

In addition, it should be noted that the Federal Law №149-FZ (in force as of 19.07.2018) «On Information, Information Technologies and Information Protection» from 27.07.2006 treats the Unified biometric system as an unified personal data information system that ensures the collection, verification, processing and storage of biometric personal data, as well as the transfer of information on the degree of their compliance with the provided biometric personal data of a citizen of the RF.

Transformation in the global banking sector

We are witnessing a rapid transformation in the global banking sector: in Top-20 of global commercial banks by assets, first four places are held by Chinese banks (table 1). Until recently, it was difficult to imagine as the palm historically belonged exclusively to credit institutions in Western Europe, USA and partly Japan.

According to 2017 results, the total assets of the world's commercial banks amounted to 116,4 trillion USD, 33% or 3 7,9 trillion USD of total assets correspond to Top-20 banks.

As of today, the leader of banking sector is Industrial & Commercial Bank of China (The) – ICBC with assets of 3.8 trillion USD. It is almost 1.8 times ahead of the largest US Bank in terms of assets - JPMorgan Chase Bank (5th place).

The largest bank in Eastern Europe is Sberbank of Russia, it takes the 54th place.

| № | Bank name | Country | Commercial banks total assets, bln USD |

| 1 | Industrial & Commercial Bank of China (The) - ICBC | China | 3784 |

| 2 | China Construction Bank Corporation Joint Stock Company | China | 3398 |

| 3 | Agricultural Bank of China Limited | China | 3233 |

| 4 | Bank of China Limited | China | 2990 |

| 5 | JPMorgan Chase Bank, NA | USA | 2141 |

| 6 | MUFG Bank Ltd | Japan | 1999 |

| 7 | Japan Post Bank Co Ltd | Japan | 1984 |

| 8 | Bank of America, National Association | USA | 1752 |

| 9 | Wells Fargo Bank, NA | USA | 1747 |

| 10 | Sumitomo Mitsui Banking Corporation | Japan | 1610 |

| 11 | BNP Paribas | France | 1575 |

| 12 | Mizuho Bank Ltd | Japan | 1546 |

| 13 | Barclays Bank Plc | United Kingdom | 1520 |

| 14 | Deutsche Bank AG | Germany | 1478 |

| 15 | Societe Generale SA | France | 1418 |

| 16 | Bank of Communications Co. Ltd | China | 1388 |

| 17 | Citibank NA | USA | 1385 |

| 18 | Hongkong and Shanghai Banking Corporation Limited (The) | Hong Kong | 1017 |

| 19 | Toronto Dominion Bank | Canada | 996 |

| 20 | Industrial Bank Co Ltd | China | 985 |

| 54 | Sberbank | Russia | 402 |

| Total | 116419 |

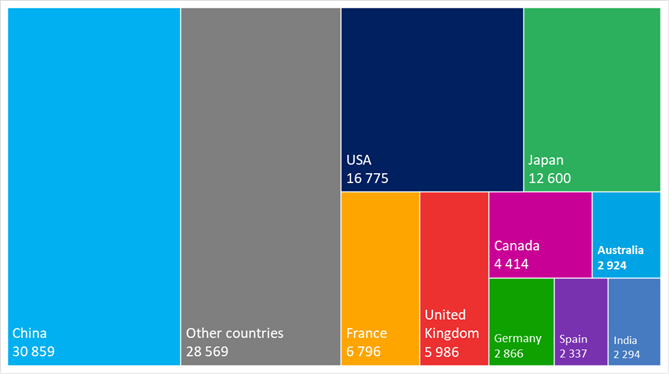

Almost 27% of total global bank assets correspond to Chinese banks - 30,9 trillion USD (picture 1). The USA share was reduced to 14% or 16,8 trillion USD. Another 15% are accumulated by banks in France (6,8 trillion USD), United Kingdom (6 trillion USD), Germany (2,9 trillion USD) and Spain (2,3 trillion USD).

Picture 1. Distribution of commercial banks total assets by countries, bln USD, 2017

Picture 1. Distribution of commercial banks total assets by countries, bln USD, 2017 Despite the fact that the assets are constantly increasing, the Russian banking sector takes the 17th place in the world. This is 1,2 trillion USD in absolute terms and it does not correspond to the size and development needs of the domestic economy and leads to a large dependence of domestic companies on international loans.