Legislative changes

The Government of the Russian Federation by Resolution No. 1723 dated 09.10.2021 approved the rules for providing information from the Unified Federal Register of Population Data, the creation of which we reported in the publication dated 15.06.2020. In November, the Federal Tax Service of the Russian Federation should complete creation of a single database of all Russian citizens, and from January 1, 2022, citizens will be able to register children in any civil registration office.

Some provisions of the law will take effect from January 1, 2024 and 2025, respectively. A transition period is also envisaged until 31.12.2025.

The Federal Tax Service of the Russian Federation fully maintains the Register, including the protection of information based on data from civil registration offices since 1926. In addition, own data of the Federal Tax Service of the Russian Federation, data of the Ministry of Internal Affairs of the Russian Federation, Ministries of Defense, Science and Higher Education and state extra-budgetary funds is used.

It is important, however, to emphasize that the Register does not contain information about taxes, income, pensions, health status, including QR codes, as well as biometric data of citizens.

By the approved rules, information from the Register can be provided to:

- individuals or their legal representatives, in terms of information compiled in relation to these persons, in electronic form through the Unified Portal of State and Municipal Services (Functions);

- public administration bodies within their competence, through the system of Interdepartmental Electronic Interaction.

It is also provided that notaries have the right to receive the necessary data to perform notarial actions on behalf of the Russian Federation from 01.01.2025 through the Unified Information System of the Notary.

The Ministry of Justice proposes to change the paper certificates of the civil registation office to entries in the Register in the future.

Fertilizers production trends

From December 2021 to May 2022 according to the Russian Federation Decree of 03.11.2021 No 1910 nitrogenous fertilizers export quota is set. It is associated with world gas prices rise in compliance with rise of prices of fertilizers with proportion of gas up to 80%. This measure will help to prevent shortage of fertilizers on the Russian market, especially taking into account the negative trends in the activities of the largest domestic producers in the recent years.

The most important of them are: high level of monopolization, growth in loss and decreasing tendency in the industrial production index for the past 12 months. Among positive trends there are decrease in shares of the companies with insufficient property, growth in revenue and increase in ROI ratio.

For this analysis information agency Credinform selected the largest companies producing fertilizers and nitrogen compounds (TOP 100) in terms of annual revenue according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2015-2020). The analysis was based on the data of the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company in term of net assets is EUROCHEM - USOLSKY POTASH COMPLEX, INN 5911066005, Perm Territory. In 2020 net assets of the company exceeded 157 billion RUB.

The lowest net assets value among TOP 100 belonged to JSC UNITED CHEMICAL COMPANY URALCHEM, INN 7703647595, Moscow. Insufficient property figured out negative value -109 billion RUB.

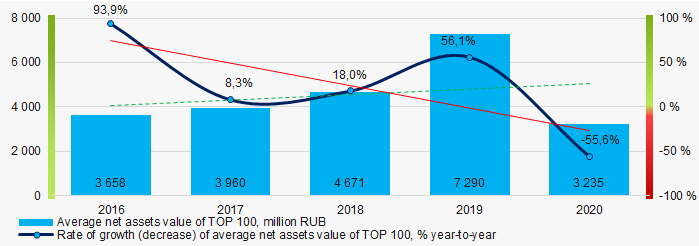

For the five-year period the average net assets values of TOP 100 tend to increase with decreasing rate of its growth. (Picture 1).

Picture 1. Change in average net assets value of TOP 100 in 2016– 2020

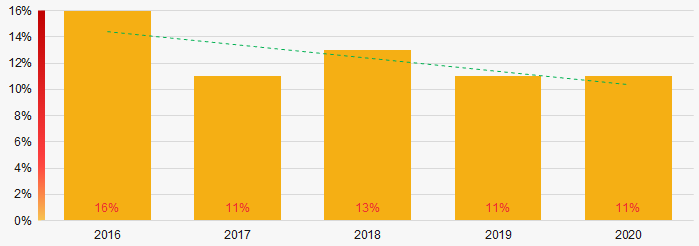

Picture 1. Change in average net assets value of TOP 100 in 2016– 2020Shares of the companies with insufficient property had a positive trend to decrease. (Picture 2).

Picture 2. Shares of TOP 100 companies with negative net assets value in 2016-2020

Picture 2. Shares of TOP 100 companies with negative net assets value in 2016-2020Sales revenue

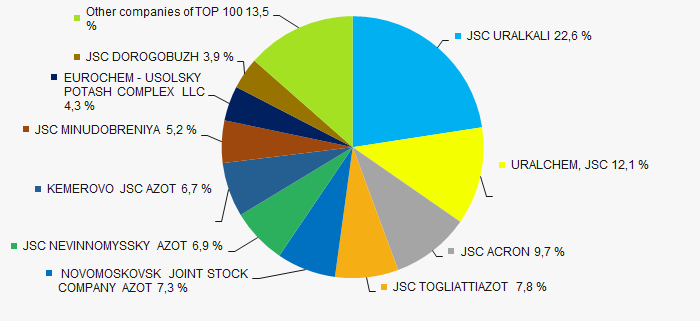

In 2020, the revenue volume of the ten largest companies was about 87% of total TOP 100 revenue (Picture 3). This indicates a high level of monopolization in the industry.

Picture 3. The share of TOP 10 companies in total 2020 revenue of TOP 100

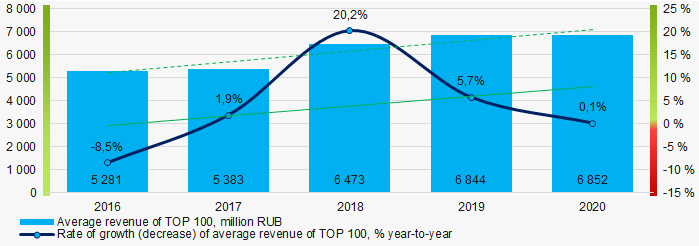

Picture 3. The share of TOP 10 companies in total 2020 revenue of TOP 100 For five years average revenue values of TOP 100 and rates of its growth increase with every year. (Picture 4).

Picture 4. Change in average net profit of TOP 100 in 2016 – 2020

Picture 4. Change in average net profit of TOP 100 in 2016 – 2020Profit and loss

In 2020, the largest organization in term of profit was also EUROCHEM - USOLSKY POTASH COMPLEX. The company’s profit exceeded 13 billion RUB.

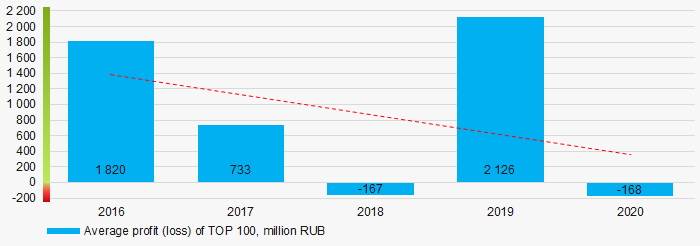

For the five-year period there is a trend to decrease in average net profit of TOP 100. (Picture 5).

Picture 5. Change in average profit (loss) of TOP 100 in 2016 - 2020

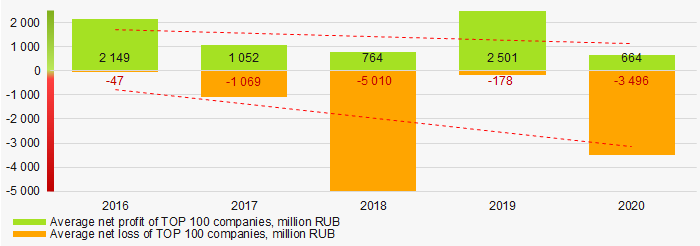

Picture 5. Change in average profit (loss) of TOP 100 in 2016 - 2020For the five-year period average net profit of TOP 100 have a decreasing trend with increasing net loss (Picture 6).

Picture 6. Change in average net profit and average net loss of TOP 100 companies in 2016 - 2020

Picture 6. Change in average net profit and average net loss of TOP 100 companies in 2016 - 2020Key financial ratios

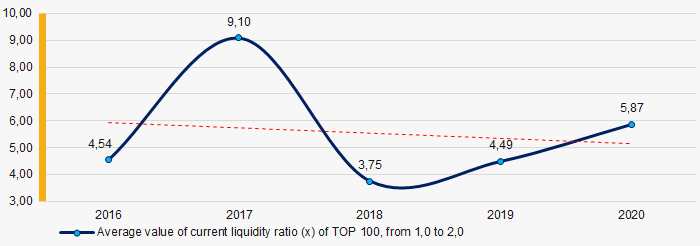

For the five-year period average values of current liquidity ratio of TOP 100 were mostly above the recommended one - from 1,0 to 2,0 with a trend to decrease. (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in average value of current liquidity ratio of TOP 100 in 2016 - 2020

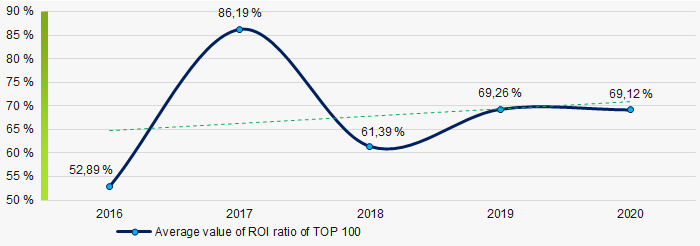

Picture 7. Change in average value of current liquidity ratio of TOP 100 in 2016 - 2020For the five-year period average values of ROI ratio of TOP 100 were on the high level and showed increasing trend. (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average value of ROI ratio of TOP 100 in 2016 - 2020

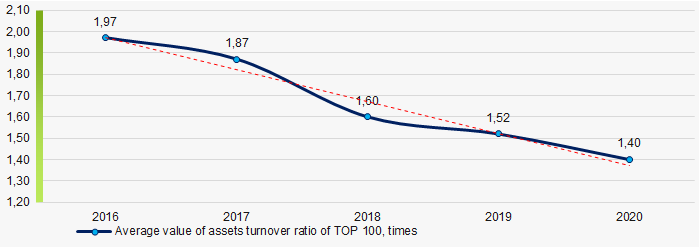

Picture 8. Change in average value of ROI ratio of TOP 100 in 2016 - 2020Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the five-year period average values of assets turnover ratio of TOP 100 had a trend to decrease. (Picture 9).

Picture 9. Change in average value of assets turnover ratio of TOP 100 in 2016 – 2020

Picture 9. Change in average value of assets turnover ratio of TOP 100 in 2016 – 2020Small business

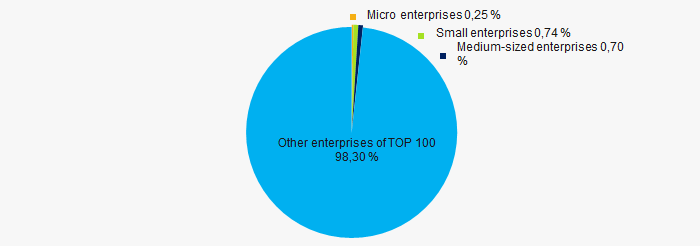

80% of the TOP 100 companies are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. Moreover their share in total revenue of the TOP 100 in 2020 is only 1,7% that is way below the average values over the country in 2018 - 2019. (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in TOP 100

Picture 10. Shares of small and medium-sized enterprises in TOP 100Main regions of activity

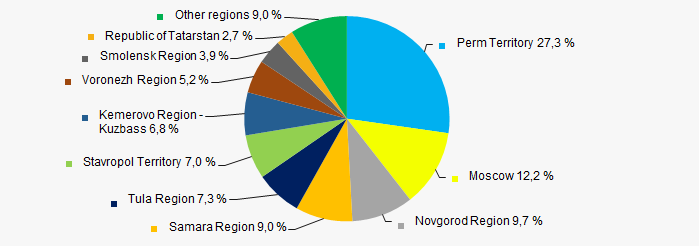

Companies of TOP 100 are registered in 38 regions of Russia (45% of the constituent entities of the Russian Federation), and unequally located across the country due to the specifics of raw materials sources geographical location. More than 49% of total revenue of TOP 100 companies in 2020 are located in Perm Territory, Moscow and Novgorod Region. (Picture 11).

Picture 11. Distribution of TOP 100 revenue by regions of Russia

Picture 11. Distribution of TOP 100 revenue by regions of RussiaFinancial position score

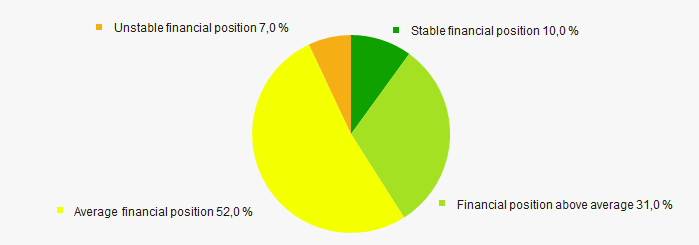

Assessment of the financial position of TOP 100 companies shows that the majority of them have average financial position (Picture 12).

Picture 12. Distribution of TOP 100 companies by financial position score

Picture 12. Distribution of TOP 100 companies by financial position scoreSolvency index Globas

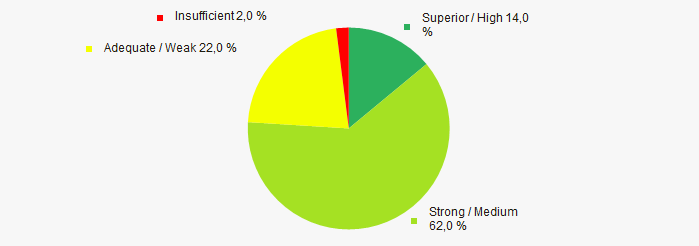

Most of TOP 100 companies got Superior / High indexes Globas. This fact shows their ability to meet their obligations on time and in full (Picture 13).

Picture 13. Distribution of TOP 100 companies by Solvency index Globas

Picture 13. Distribution of TOP 100 companies by Solvency index GlobasIndustrial production index

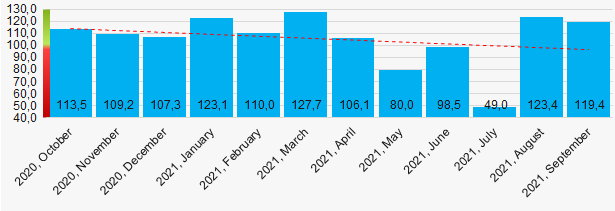

According to the Statistical Register data, for 12 months in 2020 – 2021 there is a decrease in values of pesticides and agrochemicals industrial production index. (Picture 14). However, average value of the index month over month was 105.6%.

Picture 14. Pesticides and agrochemicals industrial production index in 2020 - 2021, month over month (%)

Picture 14. Pesticides and agrochemicals industrial production index in 2020 - 2021, month over month (%)Conclusion

Complex assessment of activity of the largest fertilizers producers demonstrates the prevalence of negative trends in 2016 - 2020 (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Dynamics of the average net assets value |  10 10 |

| Rate of growth (decline) in the average size of net assets |  -10 -10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  10 10 |

| Level of competition / monopolization |  -10 -10 |

| Dynamics of the average revenue |  10 10 |

| Rate of growth (decrease) in the average size of revenue |  10 10 |

| Dynamics of the average profit (loss) |  -10 -10 |

| Growth / decline in average values of companies’ net profit |  -10 -10 |

| Growth / decline in average values of companies’ net loss |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  -5 -5 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in terms of revenue being more than 20% |  -10 -10 |

| Regional concentration |  -5 -5 |

| Financial position (the largest share) |  5 5 |

| Solvency index Globas (the largest share) |  10 10 |

| Average industrial production index for 12 months, month over month more than 100% |  10 10 |

| Dynamics of the industrial production index for 12 months |  -10 -10 |

| Average value of relative share of factors |  -0,8 -0,8 |

positive trend (factor),

positive trend (factor),  negative trend (factor)

negative trend (factor)