Loans and assets of transportation facilities manufacturers

Information agency Credinform has prepared a ranking of the largest Russian transportation facilities and equipment manufacturers. The manufacturers of marine, railway and air carriers and equipment, excluding producers of motor vehicles and fighting vehicles, with the largest annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2014 - 2017). Then they were ranked by solvency ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Debt to assets ratio (x) is a ratio of current and non-current debt to total assets, and it indicates the share of company's assets being financed by loans.

Total recommended value of the ratio is from 0,2 to 0,5. A value that exceeds the maximum standard value indicates an excessive loan overburden that may facilitate development, but as well may have a negative impact on stability of corporate funds. A value lower than the minimum standard value may speak of a conservative financial management strategy and of an excessive caution in raising new debt funds.

A calculation of practical values of financial ratios, that might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of Information Agency Credinform, having taken into account the current situation in the economy as a whole and in the industries. Practical value of debt to assets ratio for transportation facilities and equipment manufacturers amounts from 0.32 to 0.99 in 2017.

The whole set of indicators and financial ratios is to be considered to get a full and comprehensive vision of company’s financial standing.

| Name, INN, region, type of activity | Sales revenue, billion RUB | Net profit (loss), billion RUB | Debt to assets ratio, (х) | Solvency index Globas | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| METROVAGONMASH NJSC INN 5029006702 Moscow region Manufacture of railway locomotives and rolling stock |

26,3 26,3 |

43,6 43,6 |

2,4 2,4 |

2,8 2,8 |

0,66 0,66 |

0,50 0,50 |

142 Superior |

| ZELDORREMMASH JSC INN 7715729877 Moscow Provision of services of rebuild and equipping (completion) of railway locomotives, tram motor carriages and other rolling stock |

32,7 32,7 |

41,2 41,2 |

0,1 0,1 |

0,3 0,3 |

0,51 0,51 |

0,55 0,55 |

226 Strong |

| SUKHOI CIVIL AIRCRAFT NJSC INN 7714175986 Moscow Manufacture of helicopters, aeroplanes and other aircraft |

46,8 46,8 |

55,4 55,4 |

-3,8 -3,8 |

-1,1 -1,1 |

0,54span> 0,54span> |

0,58 0,58 |

256 Medium |

| AVIATION HOLDING COMPANY SUKHOI PJSC INN 7740000090 Moscow Manufacture of helicopters, aeroplanes and other aircraft |

108,0 108,0 |

122,8 122,8 |

2,4 2,4 |

4,3 4,3 |

0,55 0,55 |

0,60 0,60 |

163 Superior |

| UNITED SHIPBUILDING CORPORATION NJSC INN 7838395215 Saint Petersburg Building of ships, vessels and floating structures |

48,6 48,6 |

44,8 44,8 |

0,6 0,6 |

0,2 0,2 |

0,65 0,65 |

0,64 0,64 |

257 Medium |

| ROSTOV HELICOPTER PRODUCTION COMPLEX ROSTVERTOL named after B.N. Slyusar PJSC INN 6161021690 Rostov region Manufacture of helicopters, aeroplanes and other aircraft |

84,3 84,3 |

99,1 99,1 |

18,6 18,6 |

16,7 16,7 |

0,73 0,73 |

0,68 0,68 |

167 Superior |

| ODK-Ufa Engine-Building Production Association INN 0273008320 Republic of Bashkortostan Manufacture of turbo-jet and turbo-prop engines and their parts |

68,8 68,8 |

73,8 73,8 |

3,5 3,5 |

12,5 12,5 |

0,77 0,77 |

0,69 0,69 |

167 Superior |

| Tikhvin Railway Car Building Plant NJSC INN 4715019631 Leningrad region Manufacture of railway locomotives and rolling stock |

41,8 41,8 |

49,7 49,7 |

2,6 2,6 |

-0,1 -0,1 |

0,72 0,72 |

0,75 0,75 |

269 Medium |

| IRKUT CORPORATION NJSC INN 3807002509 Moscow Manufacture of helicopters, aeroplanes and other aircraft |

99,9 99,9 |

84,6 84,6 |

2,2 2,2 |

3,0 3,0 |

0,90 0,90 |

0,86 0,86 |

175 High |

| Production Association SEVMASH NJSC INN 2902059091 Arkhangelsk region Building of ships, vessels and floating structures |

74,3 74,3 |

88,8 88,8 |

5,7 5,7 |

8,9 8,9 |

0,90 0,90 |

0,88 0,88 |

170 Superior |

| Total for TOP-10 companies |  631,5 631,5 |

703,7 703,7 |

34,3 34,3 |

47,4 47,4 |

|||

| Average value for TOP-10 |  63,3 63,3 |

70,4 70,4 |

3,4 3,4 |

4,7 4,7 |

0,69 0,69 |

0,67 0,67 |

|

| Industry average value |  1,41 1,41 |

1,37 1,37 |

0,04 0,04 |

0,00 0,00 |

0,75 0,75 |

0,78 0,78 |

|

— improvement compared to prior period,

— improvement compared to prior period,  — decline compared to prior period.

— decline compared to prior period.

Average value of debt to assets ratio of TOP-10 companies is above the recommended value, lower than the average industry value and within the range of practical values. In 2017 six of TOP-10 companies showed improvement of the indicator compared to prior period.

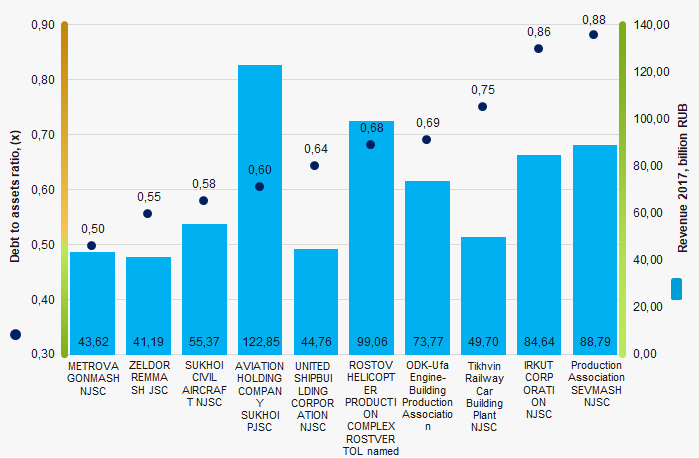

Picture 1. Debt to assets ratio and revenue of the largest Russian transport facilities and equipment manufacturers (TOP-10)

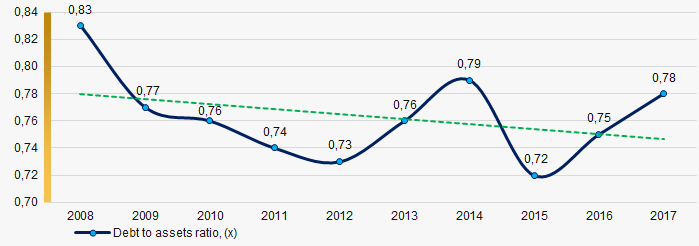

Picture 1. Debt to assets ratio and revenue of the largest Russian transport facilities and equipment manufacturers (TOP-10)During the decade, average industry values of debt to assets ratio tend to improve (Picture 2).

Picture 2. Change of industry average values of debt to assets ratio of Russian transport facilities and equipment manufacturers in 2008 – 2017

Picture 2. Change of industry average values of debt to assets ratio of Russian transport facilities and equipment manufacturers in 2008 – 2017Amendments to the Law «On financial accounts»

The Federal Law of 28.11.2018 №444-FL «On Amendments to the Federal Law «On financial accounts» have come into force, aiming at alleviation of presenting accounting statements by organizations to the state authorities.

According to the amendments, the State information resource of accounting (financial) statements will be organized in Russia. The Federal Tax Service (FTS RF) is authorized to maintain the resource.

Beginning from the financial accounts for 2019, all companies are obliged to file accounts only in electronic form. Small business entities will file accounts in electronic form since 2020.

Those are not obliged to file accounts to this resource:

- public sector organizations;

- the Central Bank of the RF;

- religious organizations;

- credit and non-credit institutions filing accounting statements to the CB RF;

- organizations that accounting statements are concerned as state secret;

- other organizations – according to the decision of the Government of the RF.

ТOtherwise, many of the above mentioned companies will file their accounts to the FTS RF in accordance with the amendments to the Article 23 of the Tax Code accepted by the Federal Law of 28.11.2018 №447-FL. In particular, public sector tax payers are obliged to present annual accounting statements to tax authorities at its location not later than 3 months following the end of accounting period.

Besides, it is provided by the Law that the CB RF presents annual accounts (balance sheet and financial results report) not later than on May 15 of the year, following the accounting period.

Alongside with these measures, an obligation to file accounting statements to the state statistics authorities is cancelled.

Interested parties can get information from the State information resource of accounting (financial) statements for a fee.

It should be reminded that, according to the data form the Information and Analytical system Globas, during 2015 – 2017 about 2,4 mln financial statements at average have been filed to the state statistics authorities annually. According to experts, after creating of the State information resource of accounting (financial) statements amount of financial statements collected by the FTS RF will be close to 4 million and be comparable to the amount of companies, entered to the Unified state register of legal entities.