Investment climate: tax benefits at the increase in control

By the RF Government Resolution as of 27.04.2016 N365 “On amendments to certain acts of the Government of the Russian Federation on provision of state guarantees under credits or bonded loans raised for investment projects implementation”, the procedure for provision of state guarantees under credits or bonded loans raised for investment projects implementation was amended.

The primacy has the protection of the national interests in guarantees against unfair recipients of the state support.

The force of rules of provision of state guarantees under credits or bonded loans for investment projects implementation for legal entities, statutorily selected by the Government, is prolonged for the whole June. The rules were added with the methods of conducting the analyses of the recipient’s financial situation, which will be implemented by Vnesheconombank during the check of the potential recipient’s financial situation at the stage of consideration of documents. Moreover, the list of documents necessary for support granting now also contains the form with the potential recipient’s financial situation data and its compliance with other conditions for granting state guarantees.

After the granting, the recipient is obliged to notify Vnesheconombank on all amendments to the accountings. If there are amendments indicating negative financial situation of the recipient, the state guarantees will be withdrawn.

Along with the state control strengthening, the Government ordering by the President has set profit tax relief for participants of regional investment projects. They are applied by the Federal law N144-FL as of 23.05.2016 “On amendments to Part One and Part Two of the Tax Code of the Russian Federation”.

Now regional authorities are allowed to zero out the profit tax rate or reduce it to 10% for the providers invested from 50 to 500 mln RUB to the manufacturing during 3 years, or over 500 mln RUB for 5 years. In this regard the sales income has to be at least 90% of profit earned by the enterprise.

However the following categories will not be able to get tax benefits: investors already using special tax regimes, residents of special economic zones or members of consolidated group of taxpayers, banks, insurance companies, non-government pension funds, professional participants of the securities market and non-profit organizations.

These amendments to the Tax Code will come into force after a month from the date of the Federal law official publication.

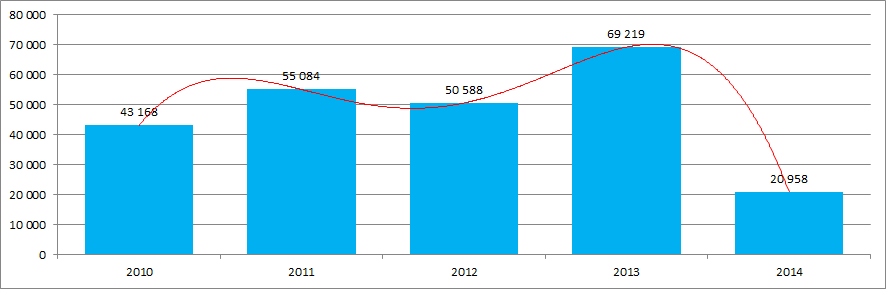

The Government pays careful attention to create favorable environment for investment to the Russian economy for a reason. Reduction in investment is an outstanding feature not only for Russia, but for the world economy in general. According to the data of the United Nations Conference on trade and development (UNCTAD), world foreign direct investment in 2014 reduced by 16,3% and amounted to 1,23 trillion USD. That reduction took place on the background of increase in the gross domestic product, trade, capital investment and employment. The reduction in direct investment to the Russian economy in 2014 was almost 70% in comparison to 2013, which is revealed by the data of the Central Bank of the RF (Picture 1).

Picture 1. Indicators of direct investment to the Russian Federation (according to the balance of payments, mln US dollars)

Federal Financial Monitoring Service is on guard for illegal financial operations

The key document aimed at the prevention, detection and suppression of acts related to illegal money circulation is the Federal Law No. 115-FZ of August 8, 2001 "On countering legalization of illegal earnings (money laundering) and financing of terrorism". The monitoring function is assigned to the Federal Financial Monitoring Service (Rosfinmonitoring).

As a result of strict work of the Central Bank of the Russian Federation and Rosfinmonitoring, the following trends have appeared on the financial market: on the one hand, the unfair clients began to move to large financial institutions with the ability to get lost among large number of clients and financial operations, on the other hand, the suspicious financial flows from the banks moved to nonbank credit institutions due to variety of operating forms.

In 2015 public annual report Rosfinmonitoring gave the following schemes of illegal activity related to money laundering and financing of terrorism:

- illegal receipt of budget funds devoted to support of economic sectors;

- cash withdrawal via consumer credit cooperatives, microfinance institutions, mail transfers;

- tax evasion during the sale of precious metals and gems on the market or through the banks;

- placement of funds in the non-State pension funds for later use in the extremely risky investment projects with the aim of no return;

- participating in the schemes of withdrawal of funds abroad under the guise of securities purchase;

- using of bank paying agents, collections agencies as a source of cash withdrawal;

- kickbacks, received for using of state and municipal orders and subsequent withdrawal of funds to offshore through affiliated structures (fly-by-night firms) etc.

Measures, which are taken by the Megaregulator for nonfulfillment of Anti-money laundering law, are as follows: strengthening of the requirements to regulated companies, license revocation, the duty of bank payment agents to make monetary transactions through the special accounts etc. For example, in 2015 licenses of 93 credit institutions were revoked, among them: 9 banks – violation of the legislation in the sphere of money laundering and financing of terrorism, 34 banks - violation of the 115-FZ, 47 banks – making of shady transactions.

Within 2015 credit institutions refused to sign a contract in 142 th cases, to make a transaction in 94 th cases, terminated bank account agreement in 2,3 th cases; that is 2-3 times higher than in 2014. In 2015 it was identified that bank payment agents and collections agencies used the scheme of funds withdrawal on total sum of 5,6 bln RUB.

The existence of fraudulent schemes, the number of measures of the Central Bank of the Russian Federation and financial institutions prove the necessity to check the counterparty for fair business entity in order to avoid fake companies and, consequently, to protect the business from possible losses.

Information and analytical system Globas-i might provide the assistance in counterparty check before signing the contract and subsequent monitoring of the counterparty’s activity. This product allows to construct the scheme of counterparty’s connections and affiliated companies by shareholder and director and to see liquidated, new and offshore companies in this structure. Globas-i system may identify the fly-by-night firm sings, future bankrupt, facts of unreliability and unfair practices by cumulative features in counterparty’s data.

The analysis of arbitration proceedings will help to know about the cases between the Federal Tax Service and counterparties regarding non-payment of VAT, charge of additional income tax, property tax, tax on income of a physical person. The section «Enforcement proceedings» of Globas-i system reflects the payment history of counterparty; enforcement order on charge of additional income tax should especially be taken into account. Besides, it is possible to identify the affiliated connection between tender participants and customers, lots’ content, to compare the competitive price of products, works and services of the winner with the market price and find out other disturbing factors in counterparty’s activity.