Small food service businesses

According to the changes in the Tax Code of the Russian Federation, adopted by the Federal Law dated 02.07.2021 No 305-FZ, starting from 2022 food service companies are exempt from VAT. The privilege applies mainly to small businesses, whose economic situation in recent years leaves much to be desired, but return on investment continues to grow.

For this ranking the Information Agency Credinform selected the largest companies in terms of annual revenue, according to the data from the Statistical Register and the Federal Tax Service for the latest available accounting periods (2018 – 2020). These companies are registered in the Unified Register of Small and Medium-Sized Businesses of the Federal Tax Service of the Russian Federation and engaged in food service sector (TOP 10 and TOP 100). Then they were ranked by return on investment ratio (ROI ratio) (Table 1). The selection and analysis are based on the data from Globas.

Return on investment ratio is calculated as the ratio of net profit to the amount of equity and long-term liabilities and shows the return on equity involved in commercial activities and long-term attracted funds of the organization.

In order to get the most comprehensive and fair picture of the financial standing of an enterprise, it is necessary to pay attention to all the combination of financial indicators and company’s ratios.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | ROI, % | Solvency index Globas | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | 2020 | |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| LLC CENTER OF WINE TOURISM ABRAU -DURSO INN 2315152138 Krasnodar Territory Chain of hotels, restaurants, cafes and shops in Abrau-Durso |

793,8 793,8 |

878,8 878,8 |

-57,1 -57,1 |

-4,7 -4,7 |

-2 468,32 -2 468,32 |

198,22 198,22 |

298 Medium |

| PETERBURG COMMERCIAL HOUSE VENETS , LTD. INN 7808037300 Saint Petersburg Café chain “Bushe” |

1 594,1 1 594,1 |

1 328,2 1 328,2 |

120,7 120,7 |

103,7 103,7 |

55,71 55,71 |

34,58 34,58 |

192 High |

| OOO MAKBURGER INN 5047196943 Moscow Region Chain of fast food restaurants at gas stations |

954,4 954,4 |

1 040,7 1 040,7 |

543,2 543,2 |

507,8 507,8 |

47,68 47,68 |

30,83 30,83 |

262 Medium |

| OOO PROKOFII INN 5009074422 Moscow Region Café chain “Kofemaniya” |

1 390,5 1 390,5 |

936,5 936,5 |

226,7 226,7 |

187,9 187,9 |

27,85 27,85 |

18,76 18,76 |

212 Strong |

| OOO SHKOLNOE PITANIE INN 1650100830 Republic of Tatarstan Catering in educational institutions |

1 571,6 1 571,6 |

1 215,6 1 215,6 |

86,6 86,6 |

45,7 45,7 |

41,93 41,93 |

18,13 18,13 |

180 High |

| OOO SATURN-SHBS-3 INN 7727021870 Moscow Catering in educational institutions, health care, on the territory of the customer |

1 438,0 1 438,0 |

1 295,2 1 295,2 |

32,0 32,0 |

16,9 16,9 |

28,43 28,43 |

11,50 11,50 |

202 Strong |

| FILIAS INN 7729399636 Moscow Moscow café chain “Kofemaniya” |

1 647,6 1 647,6 |

1 598,2 1 598,2 |

-112,7 -112,7 |

16,8 16,8 |

-48,02 -48,02 |

6,66 6,66 |

234 Strong |

| ОOO URBAN KOFIKS RASHA INN 7728339641 Moscow International café chain “Cofix” |

1 631,0 1 631,0 |

1 310,5 1 310,5 |

12,2 12,2 |

1,0 1,0 |

23,80 23,80 |

2,00 2,00 |

277 Medium |

| AO FIRMA FLORIDAN INN 7813037232 Saint Petersburg Organization of hot meals in St. Petersburg for students of educational schools, professional schools, lyceums |

1 576,2 1 576,2 |

1 577,3 1 577,3 |

3,4 3,4 |

3,1 3,1 |

1,82 1,82 |

1,68 1,68 |

222 Strong |

| OOO FARSH SITI GRUPP INN 9710013554 Moscow Burger chain |

1 483,2 1 483,2 |

860,9 860,9 |

77,8 77,8 |

-4,4 -4,4 |

552,72 552,72 |

-30,51 -30,51 |

345 Adequate |

| Average value for TOP 10 |  1 408,1 1 408,1 |

1 204,2 1 204,2 |

93,3 93,3 |

87,4 87,4 |

-173,64 -173,64 |

29,18 29,18 |

|

| Average value for the industry |  33,1 33,1 |

29,2 29,2 |

1,6 1,6 |

2,2 2,2 |

32,41 32,41 |

46,74 46,74 |

|

improvement compared to prior period,

improvement compared to prior period,  decline compared to prior period

decline compared to prior period

In 2020 average values of ROI for TOP 10 were below the average values for the industry. Only two companies out of TOP 10 improved their values, meanwhile in 2019 there were five such companies.

Three companies out of ten increased revenue and two increased net profit. At the same time decrease in average revenue value for TOP 10 was 14% and in average industry value it was 12%. Net profit in TOP 10 decreased by 6%, but average value for the industry increased by 38%.

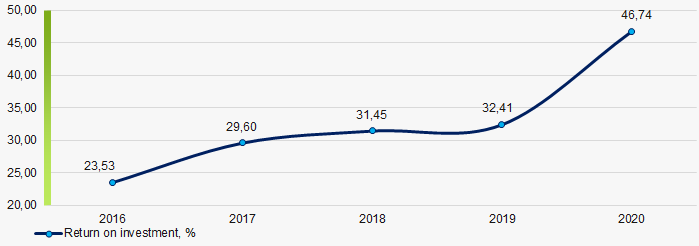

For the past five years, industry average values of ROI ratio were improving for the whole period. The highest value was achieved in 2020 and the lowest was shown in 2016. (Picture 1.).

Picture 1. Change of average industry values of ROI ratio in the food service sector in 2016 – 2020

Picture 1. Change of average industry values of ROI ratio in the food service sector in 2016 – 2020Changes in legislation

Starting from 2022, companies from food service industry such as cafes, bars, restaurants, lunch counters, canteens, snack bars etc. are granted a privilege that exempt from VAT payment. It is provided by changes in parts one and two of the Tax Code of the Russian Federation, according to the Federal Law dated 02.07.2021 No 305-FZ.

Tax exempt is limited by three restrictions:

- Annual income should not be higher than 2 billion RUB, it is also an upper limit for the company to be considered as a small and medium-size enterprise;

- 70% of the sum should be received directly from the food service industry;

- salaries and wages of the staff should not be below the average for the region.

In addition, this Law exempts cultural institutions from advance payments of income tax, and regional small business support measures are not the subject to personal income tax and VAT.

Users of Globas have the opportunity to get all available information about all companies considered small businesses, including food service sector if they use “Filters” tool.