Changes in the legislation concerning criminal liability of entrepreneurs

The Federal Law of 19.12.2016 №436-FL «On Amendment to Article 299 of the Criminal Code of the Russian Federation and Article 151 of the Criminal Procedure Code of the Russian Federation» was signed by the President of Russia.

The Law hardened liability of law enforcement authorities for groundless pursuit of entrepreneurs and compulsion to cease activities. According to the new edition of Article 299 of the Criminal Code of the RF functionaries in the law enforcement authorities can be subjected to criminal prosecution for illegal initiation of criminal cases that are related to their self-interest in termination of business activities of an entrepreneur. Such violation is punishable for functionaries by imprisonment from 5 to 10 years.

Criminal prosecution of known to be innocent is now punishable by imprisonment for up to 7 years. The same violation related to accusation of commission of serious and particularly serious crimes or causing large-scale damage or heavy consequences, - is punishable by imprisonment from 5 to 10 years.

Besides, damage is considered large-scale when it exceeds 1,5 mln RUB.

It is worth mentioning that the Plenum of the Supreme Court of Russia has earlier adopted a regulation protecting entrepreneurs from groundless pursuit.

In the Criminal Procedure Code of the RF there are provisions prohibiting arrest during investigation of entrepreneurs accused in economic crimes. This refers to articles of fraud, assumption or waste of monetary funds, infliction of damage by abuse of trust. Besides, arrest cannot be applied to entrepreneurs accused in illegal business and banking activities; legalization of monetary funds gained by illegal means; limitation of competition. The law enforcement practice showed that above mentioned provisions need to be clarified.

Decision of the Supreme Court explains that it is forbidden to arrest entrepreneurs, previously convicted for non-economic crimes, if an economic crime was committed for the first time.

The Supreme Court prohibited to initiate criminal cases against entrepreneurs under the article «Fraud» without complainant claim.

According to experts, all of the above mentioned changes will contribute to humanization of criminal legislation concerning entrepreneurs and help to provide a background for release of pressure on business and improvement of business climate in general.

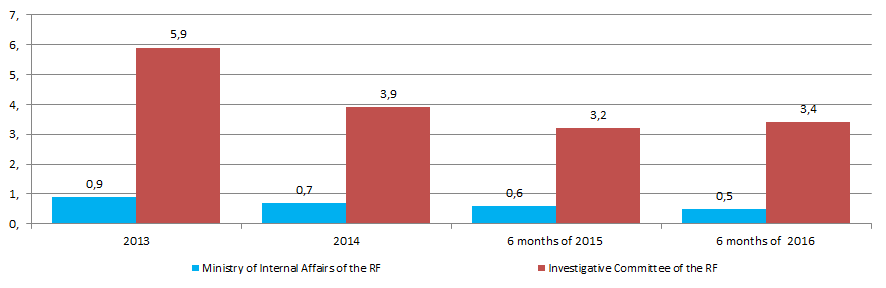

Measures on legislation improvement, taken in recent years, deliver positive results in decrease in amount of groundlessly convicted citizens. Data from the General Prosecutor`s Office of the RF approve this. (Picture 1).

Does fiscal devaluation help Russian economy?

Direct taxes are offered to decrease by means of indirect taxes increase

The Ministry of Finance has repeatedly addressed the issuue of the fiscal devaluation in 2016. New proposals for the tax system are focused on decrease in direct taxes and fees, first of all, social taxes and increase in indirect taxes – VAT and excise duties.

The fiscal devaluation is decrease in direct taxes that have impact on the production cost (insurance payments for emloyees, profit tax), by increasing of the final consumption taxes, set in the form of markup to price or tariff rate such as VAT (such taxes are called indirect). In general, the indirect taxation growth is a tool for achievement of two goals of the fiscal devaluation.

"Chasing two rabbits". First of all, the fiscal devaluation is aimed at supporting of exporters through restructuring of the tax burden in economy – export tax rates are decreasing, final consumption taxes are increasing. In international markets goods are becoming cheaper, export profitability is growing, at the same time import attraction is decreasing. Secondly, with the help of the fiscal devaluation the problem of economy with increased general tax burden can be solved. The Ministry of Finance is going to solve the problem of low competitivity of non-traditional for ¬¬the Russian economy exporter groups as well as the problem of high rate of direct taxes, primarily social fees paid by an employer, through increase in VAT. Burden on the payroll budget in Russia is currently too high and it obviously needs to be decreased. However, its decrease means reduction of budget revenue. That reduction can be compensated with indirect taxes, VAT primarily. There is no solution yet on VAT increase. The Ministry of Finance launches different initiatives, including impose of indirect tax burden on «luxurious consumption», that made by small population group and harmful products consumption (sugar contained drinks, palm oil).

Under the spotlight. The minister of Finance Anton Siluanov pays attention to one more distinct advantage that can be achieved with fiscal devaluation. According to Mr Siluanov, decrease in direct taxation by means of indirect taxation increase will help to find a wayout for grey economy for those who avoid paying taxes. Levelling of the balance between VAT and insurance payments will be profitable not only for business but also for employable population, because it will decrease tax burden on salaries.

An effective tool. Shift of tax burden from economical resources to consumption is a worldwide trend that motivates active usage of capital and labour. Besides, it is worth mentioning that the tax system is extremely sensitive, and any changes should be thought over. Latest claims of Anton Siluanov let us make a conclusion that the Ministry of Finance is not going to abandon the fiscal devaluation idea. However, it is not possible to realize the idea earlier than in 2018, otherwise it will be contrary to the moratorium on increase of business tax burden before the mentioned terms, imposed by Vladimir Putin. The head of state announced discussion for the tax system of the RF on 2017, based on the results possibilities of the system adjustment for long-term perspective will be defined. Increase of indirect taxation is long-term strategy issue that can be developed with the help of time and cooperation of several ministries. Only complex solution based on results of that cooperation could be an effective tool of the economic growth.