Tax authorities of Russia and China will exchange the information

Ministry of Finance of the RF has endorsed a project of the bilateral agreement between Russia and China, excluding double taxation. Besides, within the new agreement it is expected the mutual exchange of tax information.

As a reminder, such agreement between Russia and China is in force since 1994, but in view of the dynamic development of economic affairs between the states, it was decided to make adjustments to the existing agreement. First of all, in the new version it is made more precise the definition of tax resident. Now, an individual is taken for a tax resident of that country, where he/she has permanent home. By having a permanent home in both countries it is considered the second criterion – closeness of economic and personal relations.

Secondly, within accepted innovations there was double taxation liquidated. Now, an income tax amount, paid by a tax resident from China in Russia for income earned on the territory of our country, may be deducted from the Chinese tax, which this resident must pay. However, the deduction amount should not exceed the amount of Chinese income tax, calculated in compliance with tax laws of China. Similar deductions are prescribed and for Russian residents, earned income in China and paid there appropriate tax.

The operation of the new agreement extends to taxes and profit (including capital increase), personal incomes, as well as to the gain from disposition of property. Besides that, the agreement assumes the introduction of a new rate of taxation of dividends equal to 5%, instead of standard 10% rate. This condition is in force in case, if an acquiring company has participation interest not less than either 25%, or 80 000 EUR.

One of important steps towards the development of economic cooperation between Russia and China is a possibility of the exchange of tax information between countries. The possibility of tax authorities of the RF to request necessary information by Chinese side will highlight additional sources of tax revenues. However, the operations of the new agreement do not extend to Hong Kong, Macao and Taiwan and are in force only in the continental part of China.

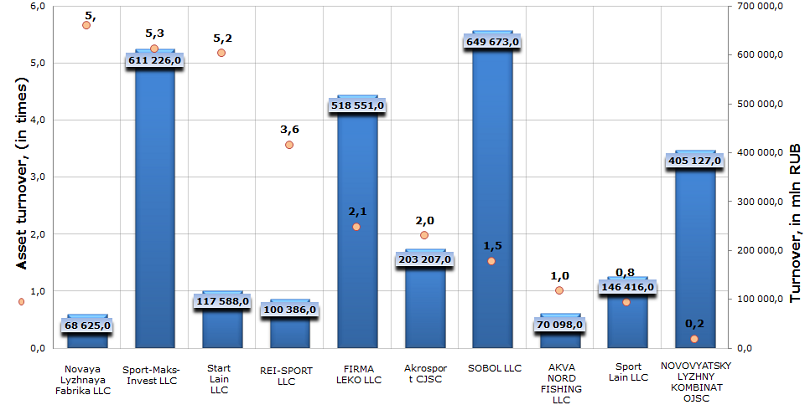

Asset turnover of manufacturers of sport articles

Information agency Credinform prepared a ranking of enterprises-manufacturers of sport articles.

The companies with highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). These enterprises were ranked by decrease in asset turnover.

Asset turnover ratio is a relation of sales proceeds to the average value of company's total assets for a period. It characterizes the efficiency of use by a company of all available resources, apart from sources of their attraction. This ratio shows how many times a year the cycle of production and circulation completes, which brings a corresponding effect in the form of profit.

There is no normative value of the ratio, however, the higher is its value, the sooner gets an enterprise a profit after the completing of the whole cycle of production and circulation, the more intensive are used the assets in company’s activity. So, the value of asset turnover ratio equal to 2 shows that in the course of a year an organization gets a profit, which is twice as much as its asset value.

The low ratio value may indicate that a company uses its assets not effective enough. Such value points by no means at financial inability of an enterprise, because the more difficult are the technological process, logistics and marketing of a product (taking into account the degree of competition in the corresponding market), the slower is its manufacture and realization. At the same time, a comparative analysis of turnover ratio of two similar enterprises of the same branch may show the differences in the effectiveness of asset management; the turnover ratio of companies from different industry segments is not to be compared.

| № | Name | Region | Turnover, in mln RUB, for 2012 | Asset turnover in times | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Novaya Lyzhnaya Fabrika LLC INN: 7743818494 |

Moscow | 68 625 | 5,7 | 254(high) |

| 2 | Sport-Maks-Invest LLC INN: 7709810706 |

Moscow | 611 226 | 5,3 | 222(high) |

| 3 | Start Lain LLC INN: 5405390990 |

Novosibirskregion | 117 588 | 5,2 | 231(high) |

| 4 | REI-SPORT LLC INN: 5018042096 |

Moscow region |

100 386 | 3,6 | 200(high) |

| 5 | FIRMA LEKO LLC INN: 7725042385 |

Moscowregion | 518 551 | 2,1 | 199(the highest) |

| 6 | Akrosport CJSC INN: 7826002396 |

Saint-Petersburg | 203 207 | 2,0 | 307(satisfactory) |

| 7 | SOBOL LLC INN: 4003011939 |

Kaluga region | 649 673 | 1,5 | 217(high) |

| 8 | AKVA NORD FISHING LLC INN: 7804437570 |

Saint-Petersburg | 70 098 | 1,0 | 299(high) |

| 9 | Sport Lain LLC INN: 7804308278 |

Saint-Petersburg | 146 416 | 0,8 | 286(high) |

| 10 | NOVOVYATSKY LYZHNY KOMBINAT OJSC INN: 4349006474 |

Kirov region | 405 127 | 0,2 | 317(satisfactory) |

Picture. Asset turnover of the largest on revenue volume enterprises, producing sport articles (TOP-10)

Cumulative annual turnover of the first 10 organizations largest on turnover, producing sport articles, made 2 890,9 mln RUB, following the results of the latest available financial statement for the year 2012. Industry leaders accumulate 81% of sales revenue of all manufacturers of similar products.

Following companies from TOP-10 list showed the asset turnover more than thrice a year: Novaya Lyzhnaya Fabrika LLC, Sport-Maks-Invest LLC, Start Lain LLC and REI-SPORT LLC. This means that these enterprises use the assets, being at their disposal, in the production cycle most effectively. According to the independent estimation of solvency of companies, developed by the Information agency Credinform, all market leaders mentioned above have a high solvency index GLOBAS-i®. It means for investors, that the organizations can pay off their debts in time and fully, while risk of default is minimal or low.

Other participants of TOP-10 showed lower enough asset turnover, that may point at that warehouses are oversupplied, the logistics network of delivery and distribution is thought out not completely.