The CB threats senior executives of failed non-governmental pension funds and insurance companies with long-life disqualification

The Central Bank of the RF (CB of the RF) offers to extend the mechanism of long-life disqualification to senior executives of failed insurance companies and non-governmental pension funds (NPFs).

As a reminder, at the beginning of September of the current year the representatives of the committee on budget and financial markets of the Federation Council (FC) put forward an initiative to forbid the executives of failed banks to hold key positions in active banks for life term. In such a way the civil servants hope to root out a common enough practice, when the so called «criminal management» passes from one bank to another.

There are no official rules of disqualification as of today. However, according to the instruction of the CB № 109-I Russian banks are obliged to coordinate with the main regulator the candidate of their executives, deputies and members of Executive Board, chief-accountant and their deputies. In agreeing on persons the CB uses «black list of bankers», who is threatened with long-life employment ban. The agreement procedure lasts for one month, by that the regulator as well can deny to approve the appointment of a person from the black list, as also can allow.

As a rule, those executives are shortlisted into the black list of the CB, who is suspected of involvement in bankruptcy, transfer of assets out of a bank, book-cooking and other serious violations. According to the data of the CB as of June 2014, 2828 persons are in the black list, for comparison there were 2745 surnames in 2013.

At the same time, the civil servants note that in spite of the control on the hand of the CB someone succeeds to circumvent this procedure. According to experts, if the suggested initiative will be enshrined in the law, then banks won’t commit such infringements for fear of risking the license.

The representatives of the CB endorsed initiative of the FC, but spoke in favor of introduction of long-life disqualification only for those executives, who made bankrupt not just a one bank.

At the same time the CB offers to draw on experience of prevention of participation of bad-faith bankers in management and control over banks for other financial organizations, first of all for NPFs and insurance companies. By this, as well as in cases with banks the regulator offers to introduce long-life disqualification only if an organization will be made bankrupt once more.

They also assured in the CB that there are no black lists of executives of insurance companies and NPFs, but information received by the CB within regulatory and supervisory measures is examined and factored into decision making.

By this they haven’t made the final call in the administration yet, concerning the appointment mechanism of chairpersons of insurance companies. Today the agreement procedure of candidates for executive positions in insurance companies, carried out by the CB, is for indication purposes, in opposition to banks and NPF.

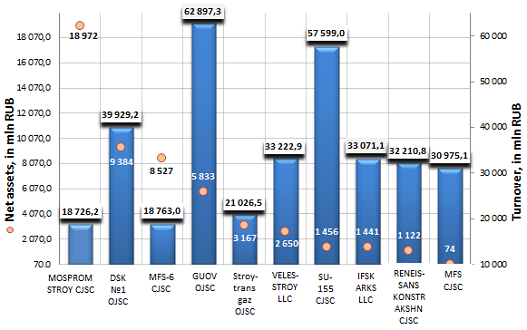

Net assets of building companies of Moscow and Moscow region

Information agency Credinform offers to get acquainted with the ranking of building companies of Moscow and Moscow region. The companies with the highest volume of revenue involved in this activity were selected in the mentioned region by the experts according to the data from the Statistical Register for the latest available period (for the year 2013). Then, the first 10 enterprises selected by turnover were ranked by decrease in net assets index.

Net assets index is one of key indicators of activity of any commercial organization. This index is calculated as a difference between total assets and total liabilities.

Net assets of a company should be at least positive. Negative net assets – it is a sign of the failure of an enterprise, pointing to that it is completely dependent on creditors and hasn’t own funds.

Net assets should be not only positive, but also should exceed the amount of the authorized capital of an enterprise. It means that in its course of business a company not only hasn’t gone through funds primarily invested by the owner, but also has ensured their gain. Net assets being less than the authorized capital is permissible only for newly founded enterprises in the first year worked. In the following years if net assets will become less than the authorized capital, the civil code and the legislation on joint-stock companies demand to reduce the authorized capital down to the value of net assets. If an organization has the authorized capital being so then at minimum level (10 000 RUB), it is opened a question about its further existence.

| № | Name, INN | Net assets, 2013, ths RUB | Authorized capital, 2013, ths RUB | Turnover, 2013, mln RUB | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Mospromstroy CJSC INN 7710034310 |

18 971 686 | 120 000 | 18 726 | 236 (high) |

| 2 | Domostroitelny kombinat №1 OJSC INN 7714046959 |

9 384 087 | 248 | 39 929 | 200 (high) |

| 3 | Mosfundamentstroy-6 CJSC INN 7711006612 |

8 526 691 | 4400 | 18 763 | 200 (high) |

| 4 | Glavnoe upravlenie obustroystva voysk OJSC INN 7703702341 |

5 833 223 | 3 013 611 | 62 897 | 251 (high) |

| 5 | Stroytransgaz OJSC INN 5700000164 |

3 166 657 | 125 269 | 21 027 | 267 (high) |

| 6 | Velesstroy LLC INN 7709787790 |

2 649 899 | 9 393 | 33 223 | 323 (satisfactory) |

| 7 | Stroitelnoe upravlenie№155 CJSC INN 7736003162 |

1 456 129 | 1203 | 57 599 | 211 (high) |

| 8 | Investitsionno-finansovaya stroitelnaya kompaniya ARKS LLC INN 7714275324 |

1 440 635 | 4000 | 33 071 | 224 (high) |

| 9 | Reneissans konstrakshn CJSC INN 7708185129 |

1 122 301 | 50 000 | 32 211 | 192 (the highest) |

| 10 | Monolit-fundamentstroy CJSC INN 7714266785 |

74 003 | 10 | 30 975 | 204 (high) |

First of all it should be noted that the amount of net assets of all TOP-10 companies conforms to the level, established under legislation of the RF, i.e. exceed the amount of their authorized capital.

Picture. Net assets of building companies of Moscow and Moscow region, TOP-10

The first place of the ranking belongs to the company Mospromstroy CJSC, which showed the highest value of net assets among building companies of Moscow and Moscow region. The enterprise is one of long-livers of Russian construction market. Going beyond Moscow, it implements actively regional projects of industrial and housing construction. Considering the combination of financial and non-financial indicators the company got a high solvency index GLOBAS-i®, what points to its ability to pay off its debt in time, with minimal risk of default.

The largest on turnover building company of the metropolitan area - Glavnoe upravlenie obustroystva voysk OJSC - took the 4th place in the ranking, with the net assets index at the rate of 5833 mln RUB, what significantly outweighs the amount of the company’s authorized capital and answers to the recommended standards. The company also got a high solvency index GLOBAS-i®, that testifies to its financial stability.

In spite of that the amount of net assets of all TOP-10 companies meets the requirements of the legislation of the RF on the combination of financial and non-financial indicators the company Velesstroy LLC got a satisfactory solvency index GLOBAS-i®. Therefore, the solvency margin of this organization doesn’t guarantee that debts will be paid off in time and fully.

Now therefore, the enterprises should control the amount of net assets to avoid the liquidation by tax authorities.