Asset turnover of the largest Russian hunting farms

Information agency Credinform has prepared a ranking of the largest Russian hunting farms. The companies with the largest volume of annual revenue (TOP-10) have been selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2016 and 2015). Then they have been ranked by asset turnover ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Asset turnover is a ratio of sales revenue to average total assets for the period. It is one of the activity ratios and it indicates resource efficiency regardless of sources. This ratio shows the number of profit-bearing complete production and distribution cycles per annum.

A calculation of practical values of financial ratios, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of the Information Agency Credinform, having taken into account the current situation in the economy as a whole and in the industries. The practical value of asset turnover ratio for hunting farms amounted from 0,16 in 2016.

The whole set of financial indicators and ratios is to be considered to get the fullest and fairest opinion about the company’s financial standing.

| Name, INN, region | Revenue, mln RUB | Revenue, mln RUB | Asset turnover, times | Solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| KUR-VOSTOK-URMI LLC INN 2720022770 Khabarovsk territory |

51,3 | 69,1 | 1,9 | 1,2 | 3,18 | 3,18 | 222 Strong |

| BURAN LLC INN 2461021038 Krasnoyarsk territory |

0,0 | 77,6 | 0,0 | 1,8 | 0,02 | 3,37 | 256 Medium |

| HUNTING FARM PROMYSLOVIK LLC INN 2526004474 Primorye territory |

67,9 | 79,0 | 49,9 | 54,4 | 3,22 | 3,19 | 166 Superior |

| HUNTING STATE OWNED FARM KRASNOYARSKY NJSC INN 2464002065 Krasnoyarsk territory |

40,3 | 40,3 | 3,3 | 6,2 | 1,17 | 1,04 | 196 High |

| DUBRAVA LLC INN 3436017022 Volgograd region |

13,2 | 40,6 | 0,2 | 15,3 | 0,38 | 0,82 | 273 Medium |

| ZAPADPROMSTROY LLC INN 6714023406 Smolensk region |

125,3 | 97,6 | 0,0 | 0,1 | 2,99 | 0,80 | 254 Medium |

| MEDVED LLC INN 2922008024 Arkhangelsk region |

185,0 | 73,0 | 0,4 | 41,8 | 1,09 | 0,49 | 300 Adequate |

| HUNTING FARM OZERNOE LLC INN 4012000186 Kaluga region |

51,9 | 64,1 | 3,1 | -3,5 | 0,32 | 0,44 | 289 Medium |

| FINANCIAL AND AGROINDUSTRIAL CONCERN SAKHABULT JSC INN 1435178584 Republic of Sakha (Yakutia) |

250,4 | 259,3 | 1,3 | 8,0 | 0,40 | 0,44 | 202 Strong |

| GREENWOOD NJSC INN 6726008963 Smolensk region |

39,7 | 45,1 | 0,9 | 6,1 | 0,12 | 0,16 | 313 Adequate |

| Total for TOP-10 companies | 824,9 | 845,6 | 61,0 | 61,0 | |||

| Average for TOP-10 companies | 82,5 | 82,5 | 6,1 | 13,2 | 1,29 | 1,48 | |

| Industry average value | 1,9 | 1,2 | -0,2 | -0,5 | 0,33 | 0,16 | |

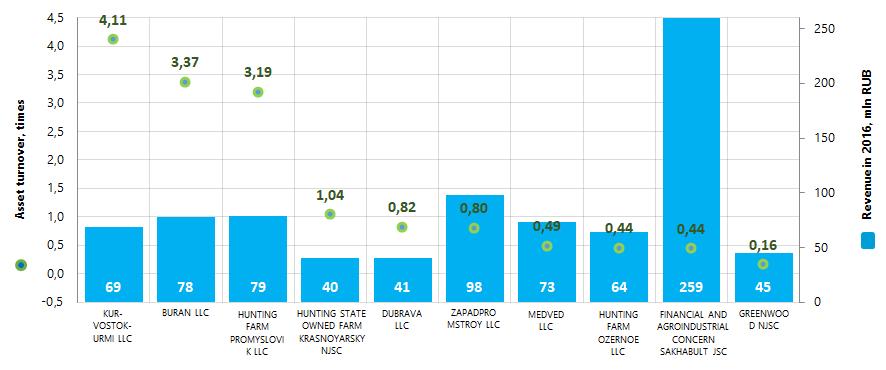

The average value of asset turnover ratio within TOP-10 companies is higher than practical and industry average values (green color in columns 6 and 7 of Table 1 and Picture 1). Five of TOP-10 companies have higher revenue and net profit compared to the prior period. The rest of the companies have a decrease in revenue or profit, or have loss (red color in columns 3 and 5 of Table 1).

Picture 1. Asset turnover ratio and revenue of the largest Russian hunting farms (TOP-10)

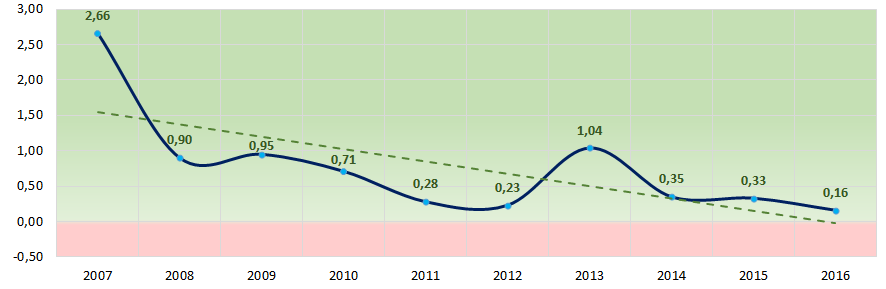

Picture 1. Asset turnover ratio and revenue of the largest Russian hunting farms (TOP-10)Industry average values of asset turnover ratio within the last 10 years were higher than the 2016 practical value. However, they follow a downward trend (Picture 2). This may indicate a certain downturn in the sector.

Picture 2. Change of industry average values of asset turnover ratio of the largest Russian hunting farms in 2007-2016

Picture 2. Change of industry average values of asset turnover ratio of the largest Russian hunting farms in 2007-2016Eight of TOP-10 companies have got from superior to medium solvency index Globas, which indicates their ability to meet debt obligations timely and in full.

MEDVED LLC has got an adequate solvency index Globas, due to the company being a defendant in debt collection arbitration proceedings and untimely fulfillment of obligations. Index development trends are stable.

GREENWOOD NJSC has also got an adequate solvency index Globas due to reorganization of the company and in view of the company being a defendant in debt collection arbitration proceedings. Index development trends are stable.

Legislation amendments on international exchange of financial information for tax purposes

In the article «Russia has acceded to the Multilateral Competent Authority Agreement on automatic exchange of Country-by-Country Reporting» as of 07.03.2017 was noted, that for complete actual use of the Agreement (Multilateral Competent Authority Agreement on Country-by-Country Reporting) it is necessary to adopt the relevant domestic law. Such law was adopted in the end of 2017.

According to the Federal Law as of 27.11.2017 №340-FZ, Chapter 14.4-1 was added to the first part of the Tax Code of the Russian Federation. Submission of documentation for multinational groups of companies.

The new chapter of the Tax Code legislatively gives the definitions of such concepts as multinational group of companies and its member, country-by-country information and reporting for a multinational group of companies, global and domestic documentation. Regulations for notification on participation in the multinational group of companies, country-by-country information, global and domestic documentation were defined.

For violation of the specified requirements the tax liability of financial market entities was imposed:

- failure to provide financial information in time - 500 th RUB penalty

- non-inclusion of financial information about the client, beneficiary party and persons directly or indirectly controlling them - 50 th RUB penalty for each act of infringing

- violation of the procedure for determining tax residency of clients, beneficiaries and persons directly or indirectly controlling them - 50 th RUB penalty for failure to take measures for each

- illegal non-presentation of the notification on participation in the multinational group of companies or submission of the notification containing false data within a specified period of time - 50 th RUB penalty

- illegal non-presentation of the country-by-country reporting or present the report containing false data within a specified period of time - 100 th RUB penalty

- late file of global documentation by tax payer

Chapter 20.1 was also added to the first part of the Tax Code of the Russian Federation. Automatic exchange of Country-by-Country Reporting with foreign countries (territories).

The following definitions are specified in the Chapter: international automatic exchange of Country-by-Country Reporting with relevant authorities of foreign states (territories); the structure of financial market and its clients; financial services; financial information; beneficiary party; person controlling the client; financial assets.

In addition to the above, the following items were determined: the rights and responsibilities of financial market entities on representation of information to the relevant federal executive authority and its powers in connection with the automatic exchange of financial reporting; restriction on the use of information contained in the Country-by-Country Reporting;

The law was published and entered into force taking into account the features of application of particular provisions.

According to the experts of Information Agency Credinform, more than 300 largest Russian holding companies, 2016 total revenue of which meet the requirements of the Agreement on exchange of Country-by-Country Reporting (according to the Information and Analytical system Globas), are obligated to submit the Country-by-Country Reporting. Among these companies are: FEDERAL GRID COMPANY OF UNIFIED ENERGY SYSTEM, GASPROM, MOSENERGO, NOVOLIPETSK STEEL, LUKOIL, Transneft, SIBERIA AIRLINES, RusHydro, URALKALI, Mining and Metallurgical Company NORILSK NICKEL.