Companies with certificates of conformity

Information agency Credinform presents a ranking of the Russian manufacturing companies, declaring and certifying goods on conformity to requirements of the Russian technical regulations. Enterprises (TOP-10) with the largest annual revenue were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available accounting periods (2017 - 2019). Then they were ranked by the product profitability ratio (Table 1). The selection and analysis were based on the data from the Information and Analytical system Globas.

Product profitability ratio is calculated as the relation of sales revenue to expenses from ordinary activity. Profitability in general indicates the economic efficiency of production. The analysis of product profitability makes it possible to conclude about the efficiency and expediency of release of goods.

There are no standard values for indicators of this group, because they vary strongly depending on the industry.

In order to get the most comprehensive and fair picture of the financial standing of an enterprise, it is necessary to pay attention to all the combination of financial indicators and ratios.

| Name, INN, region, type of activity | Revenue, million RUB | Net profit (loss), million RUB | Product profitability ratio, % | Solvency index Globas | |||

| 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| JSC PIPELINE BENDS ИНН 7449044694 Chelyabinsk region Manufacture of tubes, pipes, hollow profiles and related fittings, of steel |

2 779 2 779 |

3 051 3 051 |

404 404 |

248 248 |

32,76 32,76 |

22,17 22,17 |

222 Высокий |

| ООО ОТИС ЛИФТ ИНН 7805223443 Moscow Manufacture of elevators |

12 887 12 887 |

13 203 13 203 |

1 575 1 575 |

1 691 1 691 |

17,40 17,40 |

19,04 19,04 |

215 Высокий |

| ООО ТЕХНОЛОГИЧЕСКАЯ КОМПАНИЯ ШЛЮМБЕРЖЕ ИНН 7709413265 Tyumen region Manufacture of devices, sensors, equipment and tools for measuring, control and testing |

24 790 24 790 |

26 566 26 566 |

1 104 1 104 |

2 083 2 083 |

14,50 14,50 |

15,37 15,37 |

209 Высокий |

| ООО НЕСТЛЕ КУБАНЬ ИНН 2353018969 Krasnodar territory Processing of tea and coffee |

16 357 16 357 |

17 113 17 113 |

552 552 |

836 836 |

14,05 14,05 |

н/д | 229 Высокий |

| ООО ПРОИЗВОДСТВЕННОЕ ОБЪЕДИНЕНИЕ ЕВРОЛИФТМАШ ИНН 5026015392 Moscow region Manufacture of elevators |

1 471 1 471 |

1 905 1 905 |

162 162 |

138 138 |

17,30 17,30 |

8,87 8,87 |

222 Высокий |

| ООО ПРОИЗВОДСТВЕННОЕ ОБЪЕДИНЕНИЕ НЛМ ИНН 5053045149 Moscow region Manufacture of elevators |

1 816 1 816 |

2 320 2 320 |

47 47 |

59 59 |

4,32 4,32 |

7,60 7,60 |

250 Высокий |

| НАО ЩЕРБИНСКИЙ ЛИФТОСТРОИТЕЛЬНЫЙ ЗАВОД ИНН 5051000880 Moscow Manufacture of elevators |

11 988 11 988 |

10 378 10 378 |

376 376 |

-53 -53 |

11,69 11,69 |

7,35 7,35 |

272 Высокий |

| ПАО КАРАЧАРОВСКИЙ МЕХАНИЧЕСКИЙ ЗАВОД ИНН 7721024057 Moscow Manufacture of elevators |

7 184 7 184 |

5 817 5 817 |

-93 -93 |

110 110 |

13,67 13,67 |

6,84 6,84 |

241 Высокий |

| НАО КОРПОРАЦИЯ ГЛОРИЯ ДЖИНС ИНН 6166034397 Rostov region Manufacture of other outerwear |

37 553 37 553 |

37 719 37 719 |

1 281 1 281 |

927 927 |

10,14 10,14 |

5,09 5,09 |

244 Высокий |

| ООО ЖУПИКОВ ИНН 6829004230 Tambov region Manufacture of salted, boiled, baked, smoked, dried and other meat |

720 720 |

870 870 |

5 5 |

9 9 |

2,30 2,30 |

4,03 4,03 |

206 Высокий |

| Average value for TOP-10 |  11 754 11 754 |

11 894 11 894 |

541 541 |

605 605 |

13,81 13,81 |

10,71 10,71 |

|

improvement compared to prior period,

improvement compared to prior period,  decline compared to prior period

decline compared to prior period

Four companies improved their values in 2019.

All the TOP-10 companies got Strong /Medium index Globas. This fact shows their ability to meet their obligations fully and by the due date.

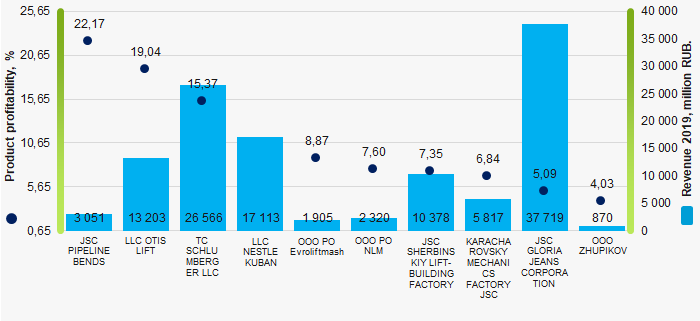

Picture 1. Product profitability ratio and revenue of the largest Russian manufacturing companies, declaring and certifying goods (TOP-10)

Picture 1. Product profitability ratio and revenue of the largest Russian manufacturing companies, declaring and certifying goods (TOP-10)Top industries by turnover dynamics of companies in 2019-2020

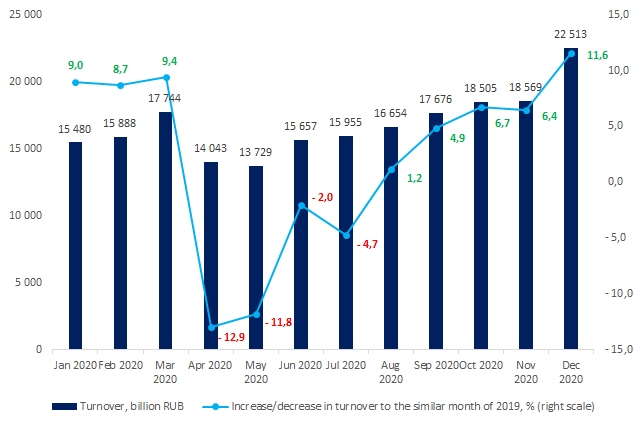

The Federal State Statistics Service (hereinafter “Rosstat”) has published information concerning 2020 turnover of companies in Russia. The COVID-19 crisis and limitations had various impact on companies in dependence to the industry. Transport enterprises, servicing and mining companies suffered the most. Pharmaceutical holdings, IT companies and delivery services had benefits.

In general, the period from April 2020 to July 2020 was the hardest for the economy. Turnover of companies have decreased for 4 months to the same period of 2019. In April and May there was recorded a 12,9% and 11,8% reduction respectively (see Picture 1).

The period of recovery started in August was at its peak in December when there was a 11,6% increase in turnover compared to December 2019. At the year end, surpassing 202 trillion RUB, the comprehensive turnover of companies exceeded the figures of 2019 by 2,4%.

Picture 1. Turnover dynamics of companies in Russia in 2020

Picture 1. Turnover dynamics of companies in Russia in 2020Speaking about industry-based figures, the turnover of companies engaged in railroad passenger transportation reduced by 58,2% in 2020, airline companies – by 41,8%, hotels – by 33%, crude oil and gas producers – by 24,2% (see Table 1).

At the same time, pharmaceutical companies increased their turnover from 633 billion RUB to 946 billion RUB (1,5%), IT companies - by 33,4% and post and delivery services – by 28,9%.

These figures prove the peculiarity of the current economic situation both inside the country and on foreign markets.

| Activity | OKVED2 code | 2019 turnover, billion RUB | 2020 turnover, billion RUB | Increase/decrease in turnover, % | Share in total turnover, % |

| Total | - | 197 733 | 202 413 | 2,4 | 100,0 |

| Production of medicines and materials | 21 | 633 | 946 | 49,3 | 0,5 |

| IT | 63 | 414 | 552 | 33,4 | 0,3 |

| Post and delivery services | 53 | 230 | 296 | 28,9 | 0,1 |

| Manufacture of tobacco products | 12 | 239 | 294 | 22,9 | 0,1 |

| Mining of metal ores | 07 | 1 550 | 1 882 | 21,4 | 0,9 |

| Metallurgical production | 24 | 6 676 | 7 796 | 16,8 | 3,9 |

| Plant growing and cattle breeding | 01 | 2 793 | 3 257 | 16,6 | 1,6 |

| Manufacture of rubber and plastic products | 22 | 1 119 | 1 295 | 15,7 | 0,6 |

| Production, transmission and distribution of steam and hot water | 35.3 | 1 275 | 1 467 | 15,0 | 0,7 |

| Water supply; sewerage, organization of waste collection and disposal | E | 1 166 | 1 336 | 14,5 | 0,7 |

| Construction | F | 7 056 | 8 068 | 14,3 | 4,0 |

| Manufacture of textiles | 13 | 253 | 284 | 12,1 | 0,1 |

| Manufacture of wearing apparel | 14 | 250 | 280 | 11,8 | 0,1 |

| Food production | 10 | 5 648 | 6 274 | 11,1 | 3,1 |

| Wholesale | 46 | 52 058 | 57 342 | 10,2 | 28,3 |

| Wood processing and manufacture of wood and cork products, excluding furniture | 16 | 647 | 711 | 9,8 | 0,4 |

| Forestry and logging | 02 | 232 | 254 | 9,3 | 0,1 |

| Manufacture of other finished goods | 32 | 244 | 266 | 9,2 | 0,1 |

| Telecommunication activities | 61 | 1 999 | 2 148 | 7,5 | 1,1 |

| Computer software development | 62 | 1 221 | 1 312 | 7,4 | 0,6 |

| Fishing and fish farming | 03 | 354 | 380 | 7,3 | 0,2 |

| Manufacture of other non-metal mineral products | 23 | 1 645 | 1 765 | 7,3 | 0,9 |

| Manufacture of electrical equipment | 27 | 1 082 | 1 160 | 7,3 | 0,6 |

| Activities in the field of health and social services | Q | 2 955 | 3 146 | 6,4 | 1,6 |

| Water transport activities | 50 | 257 | 273 | 5,9 | 0,1 |

| Retail trade | 47 | 17 987 | 18 949 | 5,4 | 9,4 |

| Real estate operations | L | 2 829 | 2 974 | 5,1 | 1,5 |

| Activities in the field of culture, sports, leisure and entertainment | R | 303 | 318 | 4,8 | 0,2 |

| Production of chemicals and products | 20 | 3 040 | 3 173 | 4,4 | 1,6 |

| Manufacture of machinery and equipment | 28 | 1 390 | 1 446 | 4,1 | 0,7 |

| Manufacture of paper and paper products | 17 | 1 054 | 1 091 | 3,5 | 0,5 |

| Trade in motor vehicles and motorcycles | 45 | 6 956 | 7 157 | 2,9 | 3,5 |

| Manufacture of computers, electronic and optical items | 26 | 1 407 | 1 444 | 2,6 | 0,7 |

| Freight rail transport | 49.2 | 2 145 | 2 199 | 2,6 | 1,1 |

| Manufacturing of finished metal products | 25 | 2 680 | 2 746 | 2,5 | 1,4 |

| Furniture manufacture | 31 | 267 | 272 | 2,0 | 0,1 |

| Manufacture of other vehicles and equipment | 30 | 1 957 | 1 982 | 1,3 | 1,0 |

| Electricity production, transmission and distribution | 35.1 | 7 194 | 7 249 | 0,8 | 3,6 |

| Warehousing and auxiliary transport activities | 52 | 4 011 | 4 028 | 0,4 | 2,0 |

| Administrative activities | N | 1 613 | 1 617 | 0,2 | 0,8 |

| Professional, scientific and technical activities | M | 5 513 | 5 521 | 0,2 | 2,7 |

| Other industries | - | 3 965 | 3 919 | -1,1 | 1,9 |

| Publishing activities | 58 | 124 | 120 | -2,9 | 0,1 |

| Manufacture of leather and leather products | 15 | 80 | 77 | -4,0 | 0,0 |

| Pipeline transport activities | 49.5 | 2 858 | 2 715 | -5,0 | 1,3 |

| Beverages production | 11 | 933 | 883 | -5,3 | 0,4 |

| Manufacture of motor vehicles, trailers and semi-trailers | 29 | 2 888 | 2 735 | -5,3 | 1,4 |

| Production and distribution of gaseous fuels | 35.2 | 1 447 | 1 359 | -6,1 | 0,7 |

| Freight transport activities | 49.4 | 1 309 | 1 219 | -6,9 | 0,6 |

| Printing activities and copying of information carriers | 18 | 305 | 282 | -7,8 | 0,1 |

| Education | P | 608 | 560 | -7,9 | 0,3 |

| Extraction of other minerals | 08 | 587 | 540 | -7,9 | 0,3 |

| Coal mining | 05 | 1 415 | 1 200 | -15,1 | 0,6 |

| Restaurant services | 56 | 1 073 | 907 | -15,4 | 0,4 |

| Activities of other land passenger transport | 49.3 | 484 | 403 | -16,6 | 0,2 |

| Production of coke and petroleum products | 19 | 12 764 | 9 928 | -22,2 | 4,9 |

| Extraction of crude oil and natural gas | 06 | 12 378 | 9 377 | -24,2 | 4,6 |

| Hotel services | 55 | 278 | 186 | -33,0 | 0,1 |

| Air transport activities | 51 | 1 570 | 914 | -41,8 | 0,5 |

| Intercity and international railway passenger transportation | 49.1 | 325 | 136 | -58,2 | 0,1 |

Source: Rosstat, analysis by Credinform

Methodology:

Turnover includes the cost of own-produced shipped goods, own-performed works and services, as well as proceeds from the sale of goods purchased (excluding value added tax, excise taxes and other similar payments).

The data of current statistics on "turnover" for the full range of enterprises are formed monthly on the basis of information from the unified form of federal statistical observation No. P-1 "Information on the production and shipment of goods and services" and an additional calculation for the aggregate of enterprises for which there is no monthly data.

The Federal statistical observation form No. P-1 is provided by all legal entities that are commercial organizations, as well as non-commercial organizations of all types of ownership that manufacture goods and services for sale to other legal entities and individuals (except for small businesses, banks, insurance and other financial and credit institutions), the average number of employees of which for the previous year exceeds 15 people, including those working part-time and under civil law contracts.

The additional calculation of data is made for the aggregate of small enterprises and enterprises with the average number of employees for the previous year exceeding 15 people, including those working part-time and under civil law contracts, which are not small businesses.