Automated solutions for business partners check: today and tomorrow

Continuously changing market conditions, high decision-making speed, multitasking and the need to reduce risks require modern approaches to business partners check. Currently, the transfer of routine operations to the digital ones affects almost all business processes in companies, as a result of which labor productivity increases and the number of errors decreases.

Today, most companies firstly focus on the automation of operations that directly affect profits and revenues: finance and accounting, document management, production, inventory control. The Russian enterprises are at the very beginning of supporting processes automation, such as economic security and risk management. This means that time-consuming manual checks and screenings of business partners are still the reason for slowing down other corporate processes.

The growing complexity of customers and suppliers check makes launching the automated solution a difficult but necessary measure. There are five main trends:

- Every year the number of reasons to check your counterparty increases: credit risks, KYC, anti-corruption compliance, the anti-money laundering Russian Federal Law 115-FL, sanctions risks, and all these are against the backdrop of the economic shocks of 2020-2022.

- Open Government in Russia stimulates the growth of available sources with different information on companies. Today it is necessary to collect, process and analyze more data and it requires much more time.

- In addition to external sources, each company stores a pool of accumulated corporate data required for check and screening: lists of employees, "black" and "white" lists of customers and suppliers, payment history. Such data also need to be analyzed and compared with external sources of information.

- The structure of companies is becoming more complex, and corporate standards do not always keep pace with these changes. The lack of unified corporate regulations leads to the fact that the check of the same business partner by different departments gives conflicting results.

- Human factor. The overall result is always influenced by the qualification and motivation of the employee involved in business partners check. Therefore, the introduction of general regulations and the formation of a unified information environment is becoming the main way to improve the quality of checks.

| Globas uses over 300 sources to help you to evaluate business activities of companies. Globas analyzes and compares all available data, selects the key information and provides the result of the check in a convenient format. |

Information agency Credinform helps to minimize business risks by introducing a single standard of checks and speeding up regulatory processes. To this end, Credinform can offer two options for the automated check of customers and suppliers.

Option 1.| Instant data exchange using Globas.API allows you to integrate data from Globas into your corporate system. It may include accounting or management programs 1C, Bitrix, CRM, SAP, as well as self-developed software. |

You can automate the search and assessment of new customers and suppliers, adding up-to-date company’s details to your own database, receive reports and official papers on current clients in a few seconds, and also learn about important changes in time.

We recommend integration with Globas if you have:

-

Significant number of business partners

Automation of verification processes will help reduce risks, standardize check procedures and help avoid entering into a contract with an unreliable entity. -

Large number of procurement and tenders

Automated check of bidders will speed up the decision-making process and reduce the checking costs by delegating this procedure to the procurement department. -

Many representative offices, branches

In the case of a geographically distributed network of branches, you can ensure checks in the Far East of Russia in accordance with a single standard, while the head office in the European part of Russia is still close.

Integration with Globas.API can significantly improve the quality of management, ensure the consistency of personnel actions, reduce the number of errors, ensure the parallel execution of several tasks and quick decision-making in ordinary routine cases. However, development and integration may take several months.

Option 2.| Reports built-in Globas allow you to automate the processes of checking business partners under your corporate regulations. Reports have 350 criteria for automated check, as well as the ability to add your own parameters for manual verification. |

After completing the settings, the check will be performed automatically under your parameters when you open the company profile. To complete the report, you will need to fill the appropriate self-verification fields in, and attach documents. Documents can be stored both in Globas and on your desktop. Check results can be sent as a file to employees of other departments. Also you can share your report settings to unify the checking procedures.

Globas contains five types of pre-configured Reports to assist in building a reliable risk management system and reducing the likelihood of claims from regulators. All checking criteria comply with the requirements of the Federal Tax Service, AML / CFT legislation (Combating money laundering and financing of terrorism) under the Federal Law 115-FL, letters from the Central Bank and Rosfinmonitoring, as well as the sanctions legislation of Russia and other countries.

Reports in Globas is a reliable tool for starting the process of automated check and forming clear regulations when analyzing business partners. However, Reports should be considered as an interim phase to full API integration. Customized Reports are easier to implement, and the transition to routine checks takes less time. However, keep in mind that typical software may not fully fit the individual requirements of the company. Only an individually developed product, for example, integrated with Globas.API, can satisfy all requirements of your company.

| Information agency Credinform has rich experience in supporting the integration for companies, both in the real and financial sectors of the economy. If you are thinking about automating your business risks activities, please, request a trial access to Globas. Our experts will advise on possible ways of integration and select the best solution. |

Assessing the risk of a field tax audit using Globas

In the context of the new economic reality, the Government of the Russian Federation, in order to ensure financial stability and mitigate the consequences of restrictive measures, made a number of indulgences concerning tax audits:

- check on compliance with the currency legislation are suspended;

- IT companies accredited in the territory of the Russian Federation are exempted from field tax audits.

| You can check whether your company belongs to accredited IT organizations in Globas. |

It is important that the introduced relaxations affect only a part of organizations and do not exempt taxpayers from complying with tax laws. At the same time, the task of checking tax collection for the Federal Tax Service remains relevant. Despite the fact that the number of field tax audits has been decreasing in recent years, their effectiveness is growing.

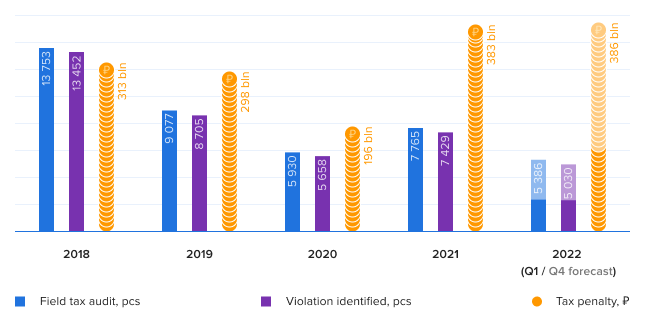

In 2021, the Federal Tax Service conducted 7,765 field audits, which is 14% less than in the pre-pandemic 2019. However, as a result of such actions, the business received additional taxes of 383 billion RUB, including penalties and fines. The average cost of audit is 50 million RUB, which is almost twice as much as in 2020. At the same time, 99% of appeals to the Federal Tax Service remain unsatisfied. In arbitration courts, the tax service also wins more often.

Picture 1. Results of field tax audit in 2018-2022

Picture 1. Results of field tax audit in 2018-2022Source: Federal Tax Service, Credinform forecast.

At the St. Petersburg International Economic Forum, the President of the Russian Federation emphasized the need to cancel most business inspections. The Federal Tax Service also took a course to reduce the number of inspections by increasing their quality. Taking into account the current trends at the end of the full 2022, the experts of the Credinform Information Agency predict a decrease in the number of inspections to the level of the pandemic 2020. At the same time, the effectiveness of tax penalties may remain at the level of the record 2021 year.

Types of tax audits

According to the Tax Code of the Russian Federation, there are two types of tax audits: on-site and field tax audits.

Office tax audit lasts no more than three months. The tax inspector remotely analyzes the submitted declaration and evaluates the correctness of the tax calculation. If inaccuracies or contradictions are found, the missing amounts are charged for payment, fines and penalties are imposed, and a requirement to prepare an adjustment declaration may also be made.

During a field audit, the tax inspector goes to the business owner's place for a thorough examination of the reporting. The correctness of tax calculation, their timely payment and possible VAT evasion are controlled, documents on transactions with counterparties are checked. The inspection has the right to examine the company, conduct conversations with employees, analyze the activities of branches and representative offices.

In addition to the Federal Tax Service, inspectors from other services can also come to the enterprise with a field inspection.

| Check in Globas whether your company or a counterparty is included in the summary plan of inspections of the Prosecutor General's Office in order to prepare in advance for the visit of government agencies. A full list of inspections is available in Globas, and conclusions of inspectors are already available for many of them. |

Risk criteria for evaluating a field tax audit

You can reduce the risk of meeting with the tax authority as part of a field audit by taking into account the criteria that FTS inspectors follow when choosing candidates for their visit. Similar criteria should be applied to evaluate your counterparties.

Here are some of them:

- The tax burden is below the industry average.

- The average monthly wage per employee is below the industry average.

If the indicators do not correspond to the average values for the industry in the region, then the likelihood of a field tax audit increases. - Excess of expenses over income for several tax periods.

If the are constant losses, the Federal Tax Service may assume that the business owners are hiding income or a wish to liquidate the organization. - Re-registration of the taxpayer in the IFTS.

'Migration' between tax authorities can be interpreted by inspectors as an attempt to avoid inspections and evade taxation. - Conclusion of a deal with dubious counterparties.

Checking the business partner before the conclusion of the contract must be carried out and carefully recorded.

These are the main criteria that the Federal Tax Service pays attention to when planning a visit with an inspection on the enterprise. However, the full list is much longer. It was approved by order No. MM-3-06/333@ of the Federal Tax Service of Russia dated May 30, 2007 in the form of a “Concept for the planning system for field tax audits”.

| Globas users have access to ready-made reports on enterprises, where, in addition to the official criteria of the Federal Tax Service, many indirect factors are analyzed, to which the tax inspector additionally pays attention. 90 criteria of the Federal Tax Service and 120 criteria of full compliance control are checked. Download a ready-made report for your own company or for your counterparties and assess the degree of risk of a field tax audit. If you are not a Globas subscriber yet, fill out an application for trial access and check if there are persons with increased risk among your counterparties, the cooperation with which is better to be reconsidered. |