Trends in the work of Altai companies

Information agency Credinform represents an overview of activity trends of the largest companies in the real sector of the economy of Altai territory.

The enterprises with the largest volume of annual revenue of the real sector of the economy in Altai territory (TOP-1000) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2012-2017). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net asset value is an indicator, reflecting the real value of the property of an enterprise. It is calculated annually as the difference between assets on the balance sheet of the enterprise and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

| №, Name, INN, type of activity |

Net asset value, billion RUB | Solvency index Globas | ||||

| 2013 | 2014 | 2015 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 1 PKF MARIYA-RA LLC INN 2225021331 Lease and management of own or leased non-residential real estate Negative signs of "fly-by-night" and unreliable company are detected |

2,1 2,1 |

5,0 5,0 |

12 459,9 12 459,9 |

16 328,6 16 328,6 |

20 556,8 20 556,8 |

550 Insufficient |

| 2 ROZNITSA K-1 LLC INN 2225074005 Retail trade in non-specialized stores |

31,5 31,5 |

22,5 22,5 |

11 893,6 11 893,6 |

14 524,9 14 524,9 |

15 435,9 15 435,9 |

187 High |

| 3 EVALAR NJSC INN 2227000087 Manufacture of drugs |

8 200,7 8 200,7 |

10 032,4 10 032,4 |

12 828,9 12 828,9 |

13 421,4 13 421,4 |

14 109,3 14 109,3 |

179 High |

| 4 PKF DIPOS LLC INN 7726044240 Wholesale of wood products, construction materials and technical equipment |

2 508,8 2 508,8 |

2 788,2 2 788,2 |

3 140,2 3 140,2 |

4 139,4 4 139,4 |

4 891,8 4 891,8 |

200 Strong |

| 5 ALTAI-KOKS PJSC INN 2205001753 Coke production |

5 181,2 5 181,2 |

4 629,4 4 629,4 |

5 532,2 5 532,2 |

4 197,0 4 197,0 |

4 668,0 4 668,0 |

181 High |

| 996 PAVLOVSKAYA PTITSEFABRIKA NJSC INN 2261003521 Poultry breeding Process of being wound up 04.12.2014 |

27,2 27,2 |

20,9 20,9 |

-346,0 -346,0 |

-496,7 -496,7 |

-578,4 -578,4 |

600 Insufficient |

| 997 PLANETA DETSTVA BR LLC INN 2224133018 Wholesale of toys and games Process of being wound up 22.04.2016 |

7,3 7,3 |

8,3 8,3 |

-405,7 -405,7 |

-674,5 -674,5 |

-634,3 -634,3 |

600 Insufficient |

| 998 NK ROSNEFT – ALTAINEFTEPRODUKT PJSC INN 2225007351 Retail sale of motor fuel in specialized stores |

-190,3 -190,3 |

-632,4 -632,4 |

-875,3 -875,3 |

-951,5 -951,5 |

-1 095,4 -1 095,4 |

290 Medium |

| 999 ALTAIMYASOPROM LLC INN 2277011020 Breeding of pigs Сase on declaring the company bankrupt (insolvent) is proceeding |

8,4 8,4 |

9,8 9,8 |

-1 328,2 -1 328,2 |

-2 163,0 -2 163,0 |

-2 688,0 -2 688,0 |

550 Insufficient |

| 1000 YUG SIBIRI LLC INN 2224148021 Production of oils and fats Process of being wound up 04.07.2018 |

1,2 1,2 |

5,8 5,8 |

-34,1 -34,1 |

-1 443,1 -1 443,1 |

-2 987,6 -2 987,6 |

600 Insufficient |

— growth of the indicator to the previous period,

— growth of the indicator to the previous period,  — decline of the indicator to the previous period.

— decline of the indicator to the previous period.

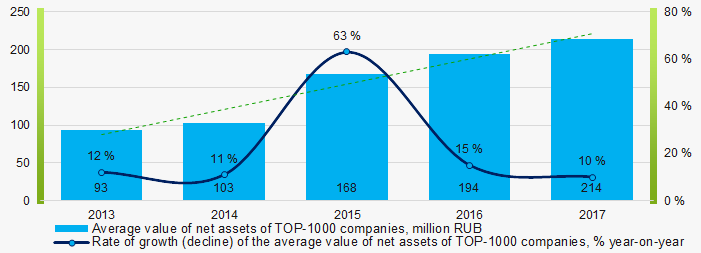

The average values of net assets of TOP-1000 enterprises tend to increase over the five-year period (Picture 1).

Picture 1. Change in the average indicators of the net asset value of TOP-1000 enterprises in 2013 – 2017

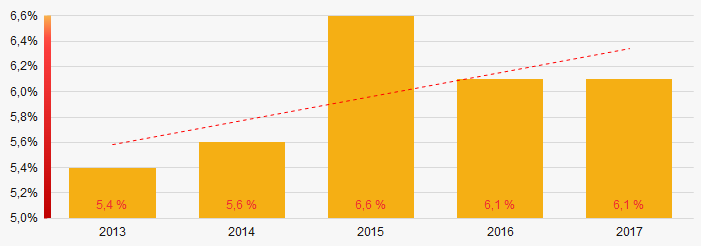

Picture 1. Change in the average indicators of the net asset value of TOP-1000 enterprises in 2013 – 2017The shares of TOP-1000 enterprises with insufficiency of assets have a tendency to increase in the last five years (Picture 2).

Picture 2. Shares of enterprises with negative values of net assets in TOP-1000

Picture 2. Shares of enterprises with negative values of net assets in TOP-1000Sales revenue

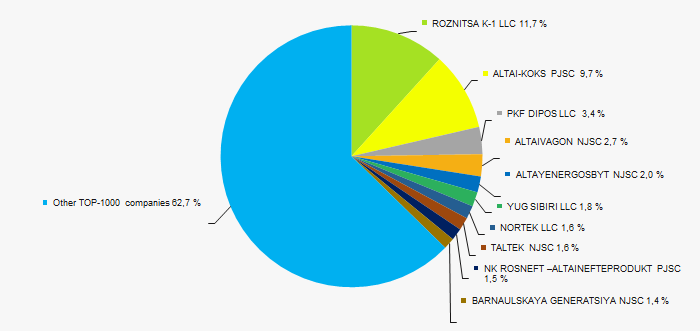

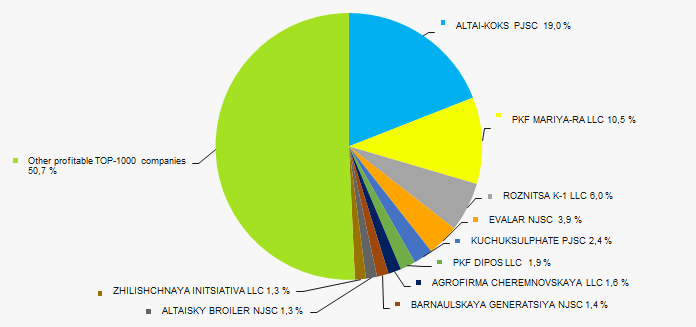

The revenue volume of 10 leading companies of the region made 37% of the total revenue of TOP-1000 in 2017 (Picture 3). It points to a high level of concentration of production in the Altai territory.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2017

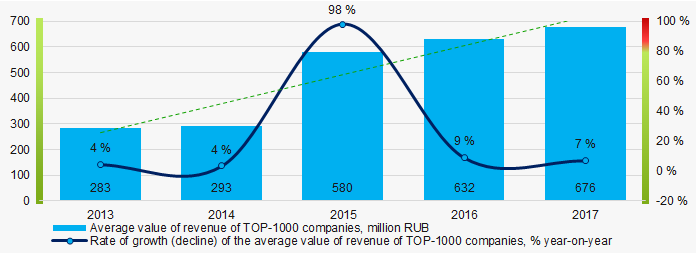

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2017In general, there is a trend towards an increase in revenue volume (Picture 4).

Picture 4. Change in the average revenue of TOP-100 enterprises in 2013 – 2017

Picture 4. Change in the average revenue of TOP-100 enterprises in 2013 – 2017Profit and losses

The net profit volume of 10 industry leaders of the region made 49% of the total profit of TOP-1000 companies in 2017 (Picture 5).

Picture 5. Shares of participation of TOP-10 companies in the total volume of net profit of TOP-1000 enterprises for 2017

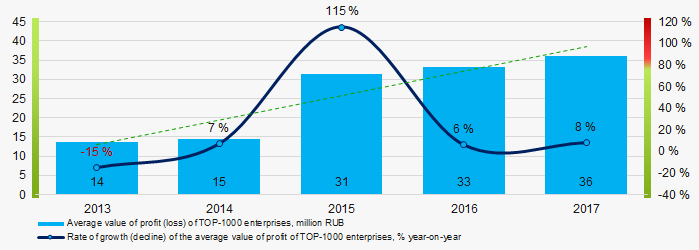

Picture 5. Shares of participation of TOP-10 companies in the total volume of net profit of TOP-1000 enterprises for 2017In general, the average profit of TOP-1000 enterprises trends to increase over the five-year period (Picture 6).

Picture 6. Change in the average values of profit of TOP-1000 enterprises in 2013 – 2017

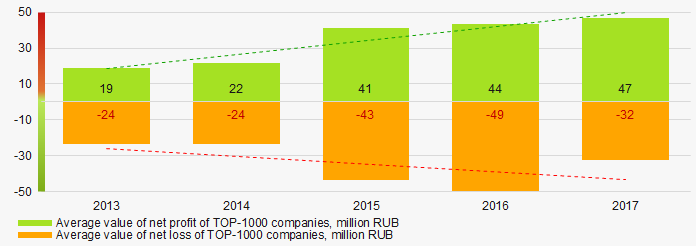

Picture 6. Change in the average values of profit of TOP-1000 enterprises in 2013 – 2017Average values of net profit’s indicators of TOP-1000 companies increase for the five-year period, at the same time also the average value of net loss increases. (Picture 7).

Picture 7. Change in the average values of indicators of net profit and net loss of TOP-1000 companies in 2013 – 2017

Picture 7. Change in the average values of indicators of net profit and net loss of TOP-1000 companies in 2013 – 2017Key financial ratios

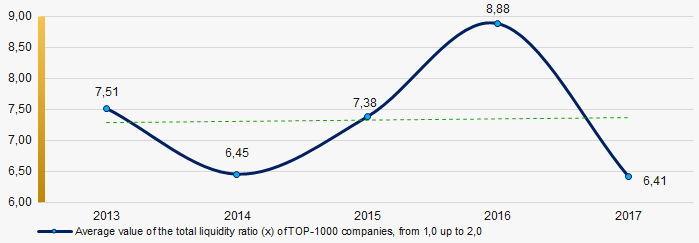

Over the five-year period the average indicators of the total liquidity ratio of TOP-1000 enterprises were above the range of recommended values - from 1,0 up to 2,0, with a tendency to increase (Picture 8).

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 8. Change in the average values of the total liquidity ratio of TOP-1000 enterprises in 2013 – 2017

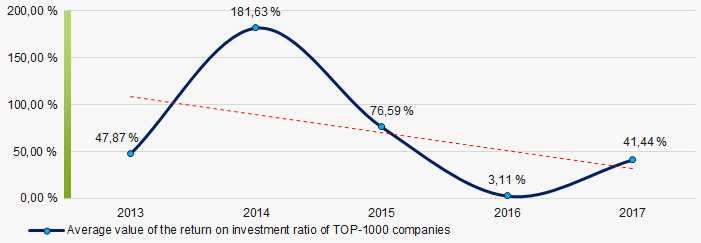

Picture 8. Change in the average values of the total liquidity ratio of TOP-1000 enterprises in 2013 – 2017There has been a high level of average values of the return on investment ratio for five years, with a tendency to decrease (Picture 9).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity of own capital involved in the commercial activity and the long-term borrowed funds of an organization.

Picture 9. Change in the average values of the return on investment ratio of TOP-1000 enterprises in 2013 – 2017

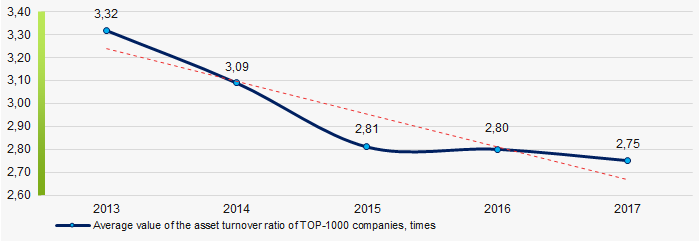

Picture 9. Change in the average values of the return on investment ratio of TOP-1000 enterprises in 2013 – 2017Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction.

The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This ratio of business activity showed a tendency to decrease over the five-year period (Picture 10).

Picture 10. Change in the average values of the asset turnover ratio of TOP-1000 enterprises in 2013 – 2017

Picture 10. Change in the average values of the asset turnover ratio of TOP-1000 enterprises in 2013 – 2017Production and service structure

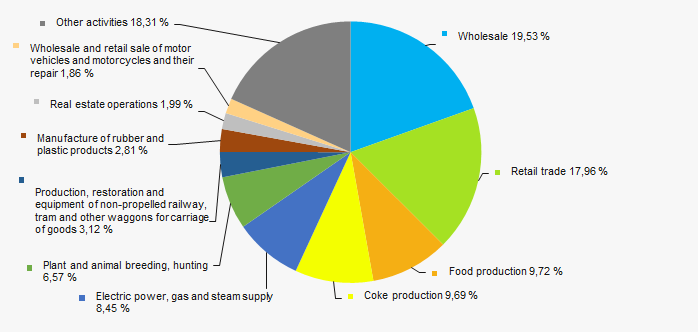

The largest shares in the total revenue of TOP-1000 are owned by companies, specializing in the wholesale and retail trade (Picture 11).

Picture 11. Distribution of types of activity in the total revenue of TOP-1000 companies

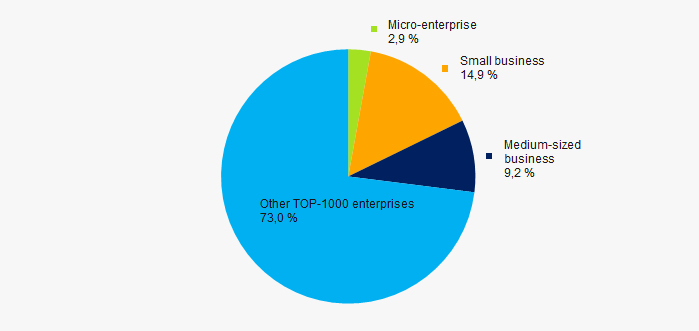

Picture 11. Distribution of types of activity in the total revenue of TOP-1000 companies79% of TOP-1000 companies are registered in the Register of small and medium-sized businesses of the Federal Tax Service of the RF. At the same time, their share in the total revenue of TOP-1000 enterprises amounted to 27%, that is higher than the national average (Picture 12).

Picture 12. Shares of proceeds of small and medium-sized businesses in TOP-1000 companies

Picture 12. Shares of proceeds of small and medium-sized businesses in TOP-1000 companiesMain regions of activity

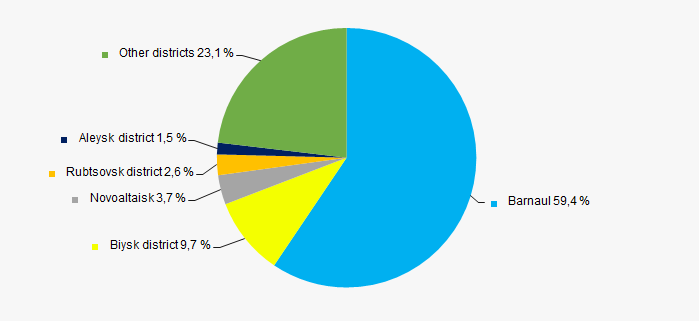

The TOP-1000 companies are distributed unequal across the region. 69% of the largest enterprises in terms of revenue are concentrated in the regional center – in Barnaul and Biysk district (Picture 13).

Picture 13. Distribution of the revenue of TOP-1000 companies by regions of Altai territory

Picture 13. Distribution of the revenue of TOP-1000 companies by regions of Altai territoryFinancial position score

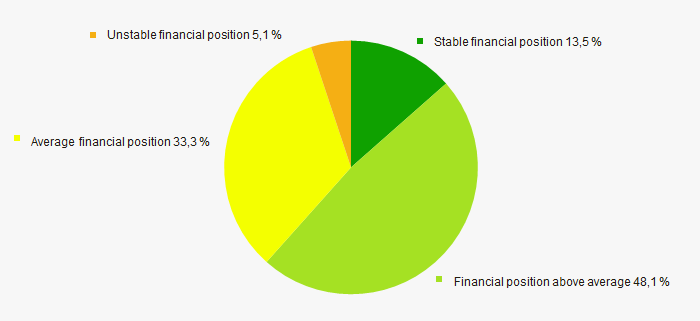

An assessment of the financial position of TOP-1000 companies shows that vast majority of them are in a stable financial position and above average (Picture 14).

Picture 14. Distribution of TOP-1000 companies by financial position score

Picture 14. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

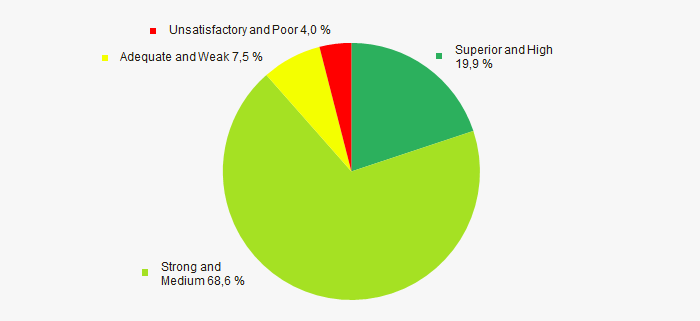

Vast majority of TOP-1000 companies got High or Strong/Medium Solvency index Globas, that points to their ability to pay off their debts in time and fully (Picture 15).

Picture 15. Distribution of TOP-1000 companies by solvency index Globas

Picture 15. Distribution of TOP-1000 companies by solvency index GlobasIndustrial production index

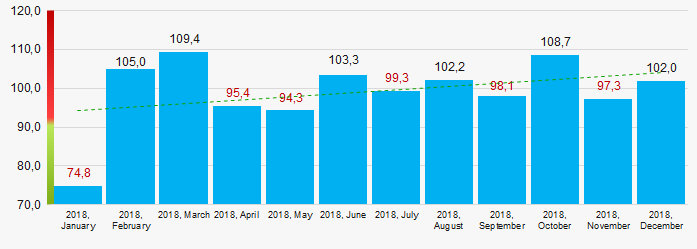

According to the Federal State Statistics Service, there is a tendency towards an increase in indicators of the industrial production index in Altai territory during 12 months of 2018 (Picture 16).

Picture 16. Industrial production index in Altai territory in 2018, month to month (%)

Picture 16. Industrial production index in Altai territory in 2018, month to month (%)According to the same information, the share of enterprises of Altai territory in the amount of revenue from the sale of goods, works, services made 0,43% countrywide for 9 months of 2018.

Conclusion

A comprehensive assessment of activity of the largest companies in the real sector of the economy of Altai territory, taking into account the main indices, financial indicators and ratios, points to the prevalence of positive trends (Table 2).

| Trends and evaluation factors of TOP-1000 enterprise | Specific share of factor, % |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  -10 -10 |

| Concentration level of capital |  -10 -10 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

| Growth / decline in average values of companies’ net profit |  10 10 |

| Growth / decline in average values of companies’ net loss |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  10 10 |

| Increase / decrease in average values of return on investment ratio |  -5 -5 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in the region in terms of revenue being more than 22% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Industrial production index |  10 10 |

| Average value of the specific share of factors |  2,3 2,3 |

— positive trend (factor),

— positive trend (factor),  — negative trend (factor).

— negative trend (factor).

Activity trends of telecommunications companies

Information Agency Credinform presents a review of activity trends of the largest Russian telecommunications companies.

Telecommunications companies with the largest annual revenue (TOP-10 and TOP-1000) have been selected for the analysis, according to the data from the Statistical Register for the latest available accounting periods (2015 — 2017). The analysis was based on the data from the Information and Analytical system Globas.

Net asset value indicates fair value of corporate assets and is calculated annually as assets on balance less company’s liabilities. Net asset value is negative (insufficiency of property) if liabilities are larger than the property value.

| No. in TOP-1000, Name, INN, region, activity |

Net asset value, billion RUB | Solvency index Globas | ||

| 2015 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 |

| 1 PJSC ROSTELECOM INN 7707049388 Saint Petersburg Wired telecommunications activities |

280,38 |  274,83 274,83 |

273,99 273,99 |

247 Medium |

| 2 JSC MEGAFON INN 7812014560 Moscow Wired telecommunications activities |

163,07 |  149,68 149,68 |

128,32 128,32 |

235 Strong |

| 3 Mobile TeleSystems JSC INN 7740000076 Moscow Wireless telecommunications activities In process of reorganization in the form of acquisition of other legal entities since 04.07.2018 |

37,88 |  37,23 37,23 |

114,72 114,72 |

207 Strong |

| 4 PJSC VIMPEL-COMMUNICATIONS INN 7713076301 Moscow Mobile communications services for voice transmission |

119,54 |  108,28 108,28 |

93,27 93,27 |

188 High |

| 5 JSC Moscow City Telephone Network INN 7710016640 Moscow Wired telecommunications activities Cases on declaring the company bankrupt (insolvent) are proceeding |

98,13 |  88,99 88,99 |

82,42 82,42 |

550 Insufficient |

| 996 JSC GlobalStar-Space Telecommunications INN 7717089767 Moscow Satellite telecommunications activities |

-1,45 |  -1,56 -1,56 |

-0,31 -0,31 |

269 Medium |

| 997 Trivon Networks LLC INN 5054086236 Moscow Wired telecommunications activities |

-0,33 |  -0,38 -0,38 |

-0,47 -0,47 |

334 Adequate |

| 998 MIRANDA-MEDIA LLC INN 7702527584 Republic of Crimea Data transmission and access to the Internet services |

-0,44 |  -0,51 -0,51 |

-0,53 -0,53 |

302 Adequate |

| 999 STACK DATA NETWORK LLC INN 7713730490 Moscow Telephone communication services |

-0,09 |  -0,35 -0,35 |

-0,83 -0,83 |

331 Adequate |

| 1000DATAPRO LLC INN 7704825145 Moscow Other wired telecommunications activities |

-2,12 |  -1,88 -1,88 |

-1,96 -1,96 |

339 Adequate |

— growth compared to prior period,

— growth compared to prior period,  — decline compared to prior period.

— decline compared to prior period.

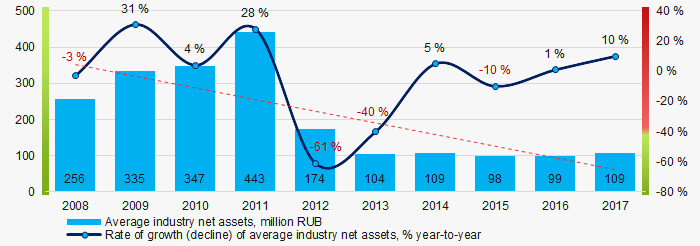

Average net assets of TOP-1000 companies tended to decrease during the last decade (Picture 1).

Picture 1. Change in average net assets of telecommunications companies in 2008 — 2017

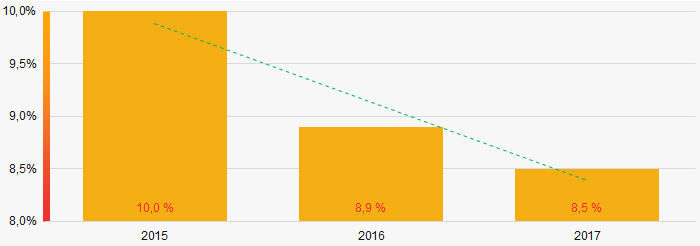

Picture 1. Change in average net assets of telecommunications companies in 2008 — 2017The share of TOP-1000 companies with insufficiency of property tends to decrease within the last 3 years (Picture 2).

Picture 2. Share of TOP-1000 companies with negative value of net assets in 2015-2017

Picture 2. Share of TOP-1000 companies with negative value of net assets in 2015-2017Sales revenue

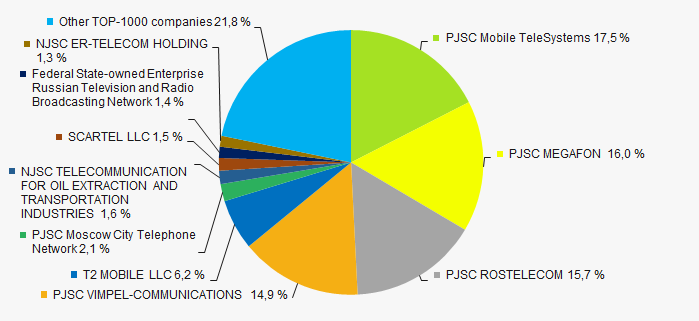

In 2017 sales revenue of 10 industry leaders amounted to 78% of total revenue of TOP-1000 companies (Picture 3). This is an indicator of a high level of monopolization within the industry.

Picture 3. TOP-10 companies by their share in 2017 total revenue of TOP-1000 companies

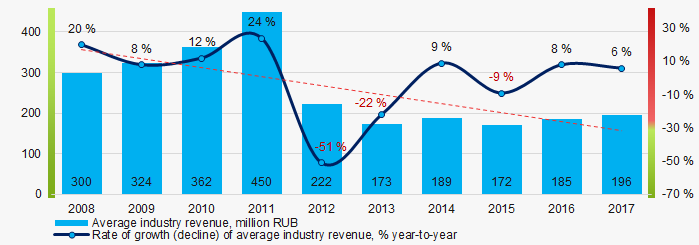

Picture 3. TOP-10 companies by their share in 2017 total revenue of TOP-1000 companiesIn general, average industry revenue tends to decrease during the decade (Picture 4).

Picture 4. Change of average industry revenue of telecommunications companies in 2008 – 2017

Picture 4. Change of average industry revenue of telecommunications companies in 2008 – 2017Profit and loss

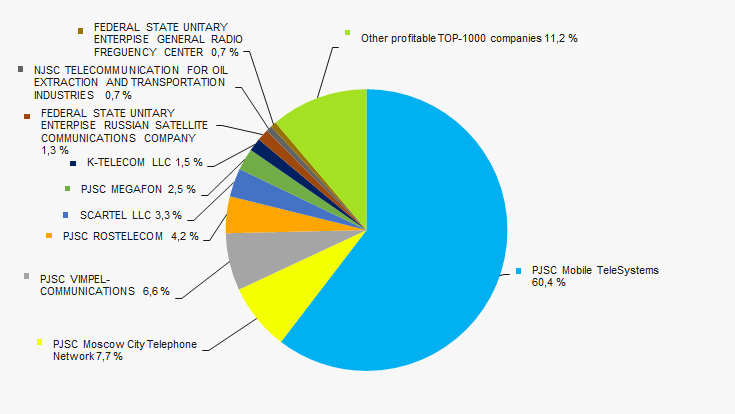

In 2017 net profit of 10 industry leaders amounted to 89% of total net profit of TOP-1000 companies (Picture 5).

Picture 5. TOP-10 companies by their share in 2017 total net profit of TOP-1000

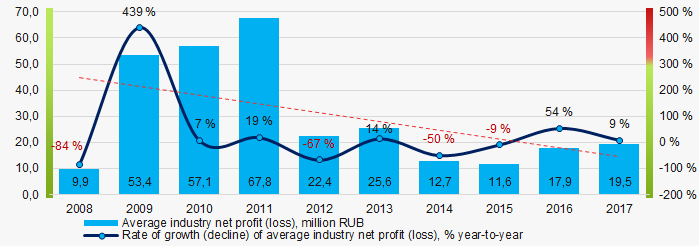

Picture 5. TOP-10 companies by their share in 2017 total net profit of TOP-1000During the last decade average industry net profit tended to decrease (Picture 6).

Picture 6. Change in average industry net profit of telecommunications companies in 2008 — 2017

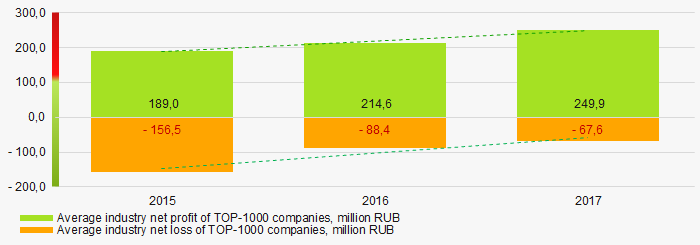

Picture 6. Change in average industry net profit of telecommunications companies in 2008 — 2017During the last 3 years average industry net profit of TOP-1000 companies increased, and the average net loss decreased (Picture 7).

Picture 7. Change in average net profit and loss of TOP-1000 companies in 2015 — 2017

Picture 7. Change in average net profit and loss of TOP-1000 companies in 2015 — 2017Key financial ratios

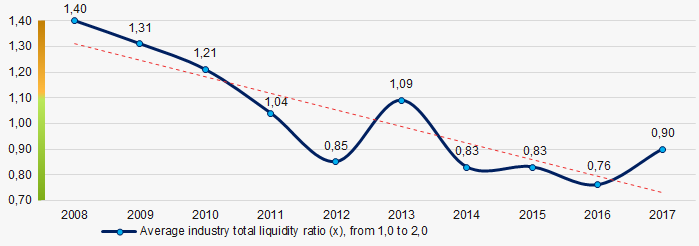

During the last decade average values of total liquidity ratio were below the recommended value — from 1,0 to 2,0, tending to decrease (Picture 8).

Total liquidity ratio (a ratio of current assets to current liabilities) reveals the sufficiency of a company’s funds for meeting its short-term liabilities.

Picture 8. Change in average values of total liquidity ratio of telecommunications companies in 2008 — 2017

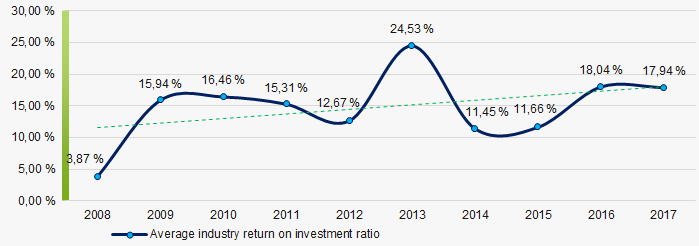

Picture 8. Change in average values of total liquidity ratio of telecommunications companies in 2008 — 2017During the last decade, average industry values of return on investment ratio tended to grow (Picture 9).

It is a ratio of net profit to total equity and noncurrent liabilities, and it demonstrates benefit from equity engaged in business activity and long-term raised funds of the company.

Picture 9. Change in average values of return on investment ratio of telecommunications companies in 2008 — 2017

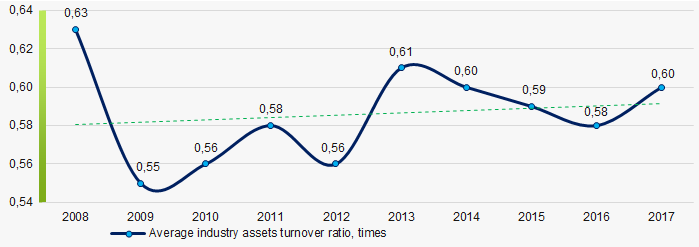

Picture 9. Change in average values of return on investment ratio of telecommunications companies in 2008 — 2017Assets turnover ratio is a ratio of sales revenue to average total assets for the period, and it measures resource efficiency regardless of the sources. The ratio indicates the number of profit-bearing complete production and distribution cycles per annum.

During the decade, this activity ratio tended to increase (Picture 10).

Picture 10. Change in average values of assets turnover ratio of telecommunications companies in 2008 — 2017

Picture 10. Change in average values of assets turnover ratio of telecommunications companies in 2008 — 2017Structure of production and services

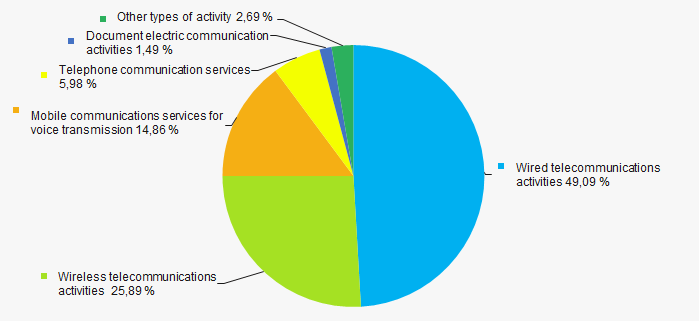

Companies that provide wired telecommunications services have the majority share in the total revenue of TOP-1000 companies (Picture 11).

Picture 11. Types of activity by their share in total revenue of TOP-1000 companies

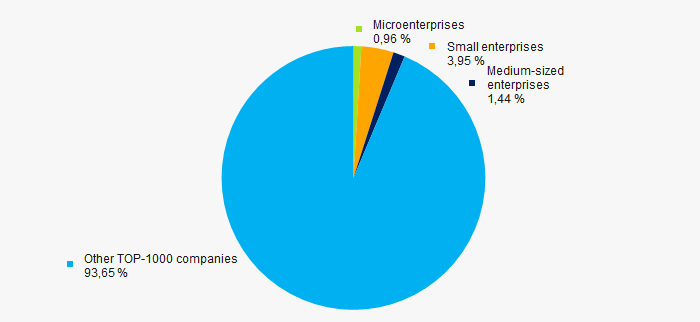

Picture 11. Types of activity by their share in total revenue of TOP-1000 companies 77% of TOP-1000 companies are included in the Register of small and medium-sized businesses of the Federal Tax Service of the Russian Federation. In general, their share in total revenue of TOP-1000 in 2017 amounted to 6% (Picture 12).

Picture 12. Shares of small and medium-sized enterprises in TOP-1000 companies' revenue, %

Picture 12. Shares of small and medium-sized enterprises in TOP-1000 companies' revenue, %Key regions of activity

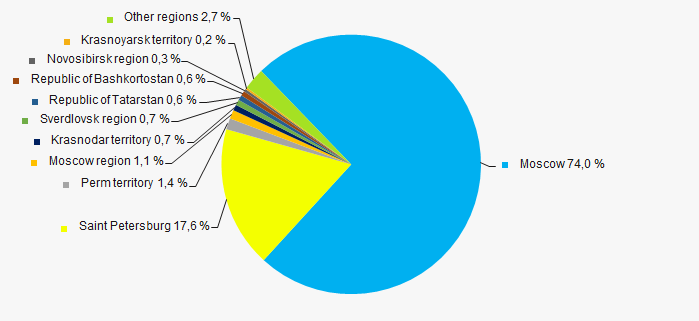

TOP-1000 companies are unevenly located throughout Russian territory and are registered in 79 regions. The largest revenue shares are concentrated in the major cities - Moscow and Saint Petersburg (Picture 13).

Picture 13. Revenue of TOP-1000 companies by Russian regions

Picture 13. Revenue of TOP-1000 companies by Russian regionsFinancial position score

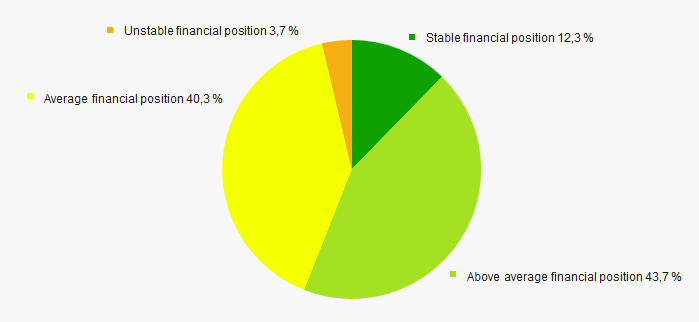

Assessment of financial state of TOP-1000 companies indicates that most of the companies have an above average financial position (Picture 14).

Picture 14. TOP-1000 companies by their financial position score

Picture 14. TOP-1000 companies by their financial position scoreSolvency index Globas

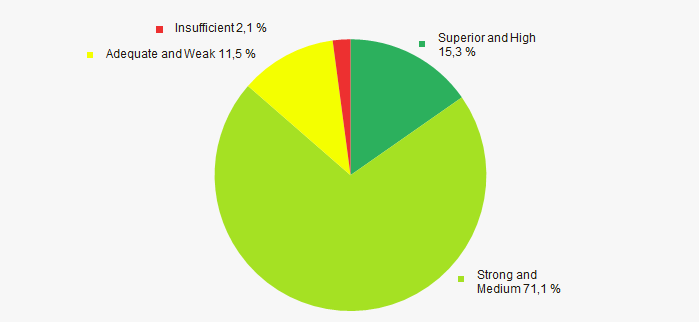

The majority of TOP-1000 companies have got a superior, high, strong or medium Solvency index Globas, that indicates their capability to meet liabilities timely and in full (Picture 15).

Picture 15. TOP-1000 companies by Solvency index Globas

Picture 15. TOP-1000 companies by Solvency index GlobasConclusion

A comprehensive assessment of the largest telecommunications companies, that considers key indexes, financial figures and ratios, is indicative of lack of clearly defined trends within the sector (Table 2).

| Trends and assessment factors | Relative share of the factor, % |

| Rate of growth (decline) of average industry net assets |  -10 -10 |

| Increase/ Decrease of share of companies with negative net assets |  10 10 |

| Rate of growth (decline) of average industry revenue |  -10 -10 |

| Level of competition / monopolization |  -10 -10 |

| Rate of growth (decline) of average industry net profit (loss) |  -10 -10 |

| Increase/ Decrease of average industry net profit of TOP-1000 companies |  10 10 |

| Increase/ Decrease of average industry net loss of TOP-1000 companies |  10 10 |

| Increase/ Decrease of average industry total liquidity ratio |  -10 -10 |

| Increase/ Decrease of average industry return on investment ratio |  10 10 |

| Increase/ Decrease of average industry assets turnover ratio |  10 10 |

| Share of small and medium-sized business within the industry by revenue over 22% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial standing (majority share) |  10 10 |

| Solvency index Glogas (majority share) |  10 10 |

| Average factors' value |  0,0 0,0 |

— positive trend (factor),

— positive trend (factor),  — negative trend (factor).

— negative trend (factor).