Tax holidays for individual entrepreneurs have come into force

From the 1st January 2015 the legislative act on tax holidays for individual entrepreneurs has come into force. The law acts for those individual entrepreneurs, who carry out its activity in the industrial, social and scientific spheres and is registered for the first time after the law became operative. The regional authorities are appointed to be the persons in charge.

According to the adopted law, the meaning of the tax holidays is a zero tax rate. The law covers the period from the 1st January 2015 till the 1st January 2021. Types of activity, related to privileges, are set on the basis of the All-Russian Classifier of Services Rendered to the Public.

Thus, regions are granted the right to impose restrictions, including limiting the size of the income of sole traders and an average number of employees. The violations of the set restrictions could be the reason for the cancellation of a zero rate. In such case entrepreneurs will be required to pay a tax according to the relevant base rates for that tax period, in which the violation has occurred.

Besides the law set that the share of income from the sale of goods, works and services, concerning to which the zero rate was applied, shouldn't be less than 70% in a total amount of the income by the results of the tax period.

Worth reminding that in December 2014 within the message to the Federal Assembly the President proposed to freeze the growth of taxes for four years and to enter supervising holidays for a period of three years for small business.

Net profit of enterprises of aircraft and helicopter industries

Information agency Credinform prepared a ranking of companies of aircraft and helicopter industries.

The companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2013). These enterprises were ranked by decrease in net profit for the period.

Net profit/loss (in RUB) is undistributed profit / uncovered loss of the accounting period remained after payment of income tax and other similar obligatory payments. It is an integral index of company’s market activity, effectiveness of its management and financial strategy.

An increase of net profit means, that an enterprise has attracted new clients, expanded its market presence, cut costs, but its decrease and moreover being in the red signal to the management about the change of business environment or about problems inside the organization, what requires to take steps to prevent bankruptcy.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to average values of profit, but also to all available combination of financial data.

| № | Name | Region | Turnover, in mln RUB, for 2013 | Net profit, for 2013, in mln RUB | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Ulan-Udensky aviatsionny zavod OJSC INN 0323018510 |

Republic of Buryatia | 36 739 | 6 987 | 233 high |

| 2 | Kazansky vertoletny zavod OJSC INN 1656002652 |

Republic of Tatarstan | 42 290 | 5 392 | 207 high |

| 3 | Rostvertol OJSC INN 6161021690 |

Rostov region | 31 453 | 3 999 | 207 high |

| 4 | Ufimskoe motorostroitelnoe proizvodstvennoe ob’edinenie OJSC INN 0273008320 |

Republic of Bashkortostan | 37 652 | 2 554 | 192 the highest |

| 5 | Aviatsionnaya kholdingovaya kompaniya Sukhoy OJSC INN 7740000090 |

Moscow | 79 920 | 1 284 | 258 high |

| 6 | Korporatsia Irkut OJSC INN 3807002509 |

Moscow | 58 142 | 1 044 | 208 high |

| 7 | Permsky motorny zavod OJSC INN 5904007312 |

Perm territory | 16 822 | 278 | 290 high |

| 8 | Rossijskaya samoletostroitelnaya korporatsiya MiG OJSC INN 7714733528 |

Moscow | 30 338 | 50 | 286 high |

| 9 | NPO Saturn OJSC INN 7610052644 |

Yaroslavl region | 17 678 | -2 900 | 294 high |

| 10 | Grazhdanskie samolety Sukhogo CJSC INN 7714175986 |

Moscow | 20 039 | -9 986 | 293 high |

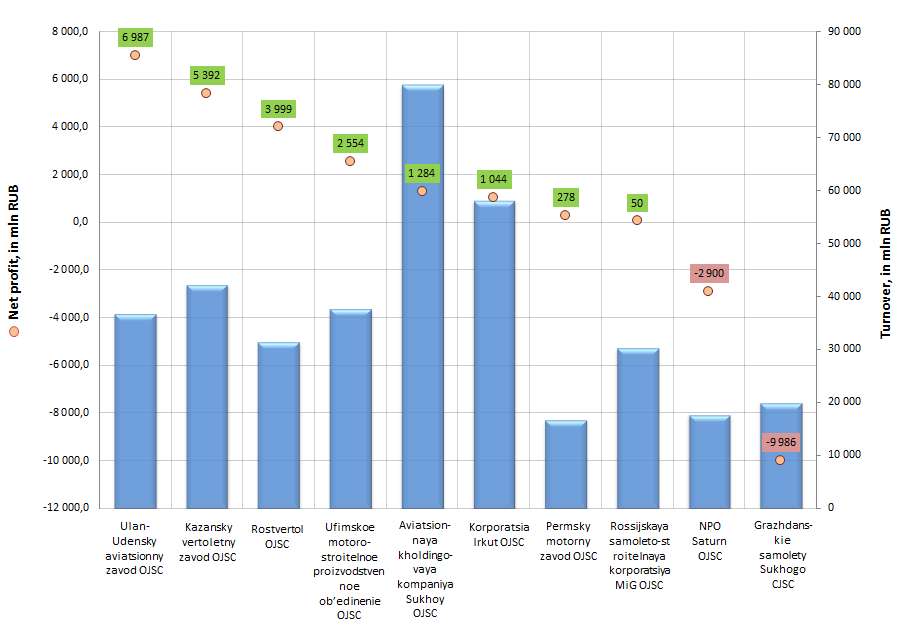

Picture. Net profit and turnover of the largest enterprises of aircraft and helicopter industries (TOP-10)

The turnover of the largest enterprises of aircraft and helicopter industries (TOP-10) made 371,1 bln RUB, according to the latest published annual financial statement, that gives about 64% of the revenue of all companies of the market.

Except NPO Saturn OJSC and Grazhdanskie samolety Sukhogo CJSC, all participants of the TOP-10 list showed the net profit for the accounting period.

The most profitable organization among the top companies is Ulan-Udensky aviatsionny zavod OJSC (Ulan-Ude Aviation Plant), the net profit ratio made approximately 7 bln RUB. The plant produces Mi-8/17 helicopters: civil models Mi-8AMT and Mi-171, and military Mi-8AMTSh and Mi-171Sh. The plant is also preparing to start production of the new upgraded helicopter Mi-171A2, one of the core models of the holding «Vertolety Rossii» in the range of medium helicopters. The production of Ulan-Udensky aviatsionny zavod is supplied to governmental and commercial customers in Russia and around the world, and is operated successfully in more than 40 countries of Europe, Asia, Africa, South America, Australia and Oceania. The amount of units of aerotechnics produced by U-UAZ approaches 10 000.

Grazhdanskie samolety Sukhogo CJSC, specializing in production of new Russian aircraft Sukhoi Superjet 100, showed the largest net loss: app. 10 bln RUB. However, considering that there are 175 aircrafts in company’s order book (as of January 2015, total units transferred to customers - 54), then the manufacturer is expected to come out to the break-even zone.

According to the independent estimation of the Information Agency Credinform, all TOP-10 companies got a high and the highest solvency index. This fact points to that the largest market players can pay off their debts in time and fully, while risk of default is minimal.