Globalization of the world economy slowing down

Under instability of the world economy and trade wars, pace of globalization has slowed down. It is for this reason that the number and volume of M&A transactions has reduced.

Mergers and Acquisitions (hereinafter “M&A”) market crossed national borders and became an indicator of globalization process. Common outcome of the development of any large company is its intention to internationalize activities. The company must have clear competitive advantages and choose the most effective ways of business development to increase revenue and profitability. Commonly speaking, M&A transactions aim at the following:

- scale and synergy effect - comprehensive financial result of merged companies is significantly higher than if these operate independently;

- diversification of activity allows to break away from niche specialization and cover other areas of the economy;

- acquisition of effective enterprises to obtain profit or unique developments;

- simplification of production chain and internal standards enable the quality of products and services to be improved at lower or comparable price level;

- public interest, which on the one hand seeks to control of strategic properties, and on the other to allow privatization.

M&A costs are due primarily to possible monopolization of the market occurring under no government regulation. In that case, positive effects are reversed by the lack of competition. Hostile takeover and raiding are also common. It should be considered that national production characteristics disappear in a globalized economy, and it is increasingly difficult to acquire the unique product.

Major trends on the international M&A market

The international M&A market is tightly relates to condition and dynamics of the global economy, particularly of the USA and EU countries. China is proactive, purchasing assets not only in Africa and Asia, but also in Western Europe.

Peak of volume and number of cross-border M&A transactions was recorded in 2007, when over 15 thousand mergers and acquisitions at the amount exceeding 2 trillion USD were made. Since then, this result is not surpassed. According to the results of 2018, about 14 thousand M&A transactions at the amount of 1.5 trillion USD were conducted. This indicates the slowing of world economy globalization.

The biggest transaction in 2018 was the acquisition by the American telecommunications holding AT&T of one of the largest media and entertainment conglomerates WarnerMedia (СNN, Time Inc., Warner Bros, etc.). The price of transaction amounted to 130 billion USD. According to the leading electronic databases publisher Bureau van Dijk (Belgium), Credinform strategic partner, AT&T assets at the date of acquisition amounted to 444 billion USD, and 69 billion USD of WarnerMedia.

The largest cross-border transaction was acquisition by Japanese pharmaceutical corporation Takeda Pharmaceutical of Irish biochemical company Shire plc. The volume is estimated at 62 billion USD.

The Russian M&A market

The Russian M&A market stagnating under the instable situation on foreign markets. The low growth rates of the economy and consumer demand continue to have negative impact, as well as sanctions and barriers affecting business of the Russian enterprises abroad and entry of new foreign investors.

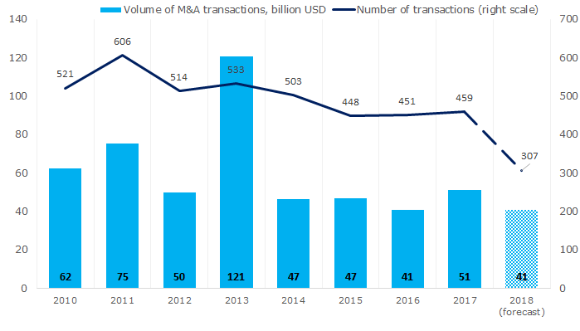

The largest volume of M&A market in Russia was recorded in 2013, when 533 transactions at the amount of 121 billion USD (or 3.8 trillion RUB) were made (see Picture 1).

Latest available figures show that 230 transactions at the amount of 31 billion USD (1.9 trillion RUB) were made in Q1-Q3 of 2018. According to tentative forecast for 2018 (taking into account the results of Q4), total amount of transactions will be 42 billion USD (2.6 trillion RUB) that is 20% less than in 2017.

Picture 1. Volume and number of M&A transactions on the Russian market, including domestic

Picture 1. Volume and number of M&A transactions on the Russian market, including domesticTable 1 contains the largest M&A transactions in Russia for Q1-Q3 of 2018. It is noteworthy that takeover JSC Promsvyazbank by the State Corporation Deposit insurance agency was a necessary measure aimed at avoiding the collapse of one of the leading commercial banks in Russia. The situation is similar with JSC Binbank , restored by the Central Bank of Russia. On January 1, 2019, Binbank was joined to FC Otkritie .

Major trends on the Russian M&A market are as follows:

- the state policy on localization of production within the country and relatively low prices for assets and operating expenses make domestic companies attractive for cross-border M&A transactions in the future;

- further consolidation of domestic assets by large corporations and the state;

- domestic business will continue to search for opportunities for international development, especially in the resource-rich regions of North Africa, Middle East and Latin America;

- low economic growth and consumer demand will continue to have a negative impact on the dynamics of M&A transactions.

| № | Sector | Objest | Sellers | Acquirers | Package | Amount, million USD | Format |

| 1 | Financial institutions | JSC Promsvyazbank | Alexey Ananyev and Dmitriy Ananyev, other minor shareholders | Deposit insurance agency | 24,99% | 4 250 | Domestic |

| 2 | Construction and real estate | Stroigazkonsalting group of companies | United Capital Partners (USP) | Gazprombank group | 50% | 2 882 | Cross-border |

| 3 | Communications | Wind Tre (Italy) | Veon (parent company of JSC Vimpelcom) | CK Hutchison (Hong Kong) | 50% | 2 867 | Cross-border |

| 4 | Trade | JSC Magnit | Sergey Galitskiy | JSC VTB Bank | 29,1% | 2 410 | Domestic |

| 5 | Transport | LLC MODUM-TRANS (former LLC UVZ-Logistik) | JSC NPK Uralvagonzavod | Invest-Logistika | 100% | 2 120 | Domestic |

| 6 | Food industry and retail trade | Agrokor | Government of Croatia | JSC Sberbank JSC VTB | 39,2% 7,5% |

1 633 | Cross-border |

| 7 | Food industry | JSC Donskoy tabak | Agrokom group, Ivan Savvidi | Japan Tobacco (Japan) | 100% | 1 600 | Cross-border |

| 8 | Financial institutions | JSC Binbank | Mikhail Shishkhanov (67,97%), Mikhail Gutseriev (28,49%), other minor shareholders | Central Bank of the Russian Federation | 99,99% | 994 | Domestic |

| 9 | Mining operations | LLC GDK Baimskaya | Millhouse Capital (owned by Roman Abramovich) | Kaz Minerals (Kazakhstan) | 100% | 900 | Cross-border |

| 10 | Construction and development | JSC SEZ Production and industrial type Alabuga and JSC SEZ Innopolis | JSC Special economic zones | Ministry of Land and Property of the Republic of Tatarstan | 100% | 569 | Domestic |

| Top-10 | 20 225 | ||||||

M&A market is dynamic, and reacts quickly to global economic processes. Under the conditions of instability of the world economy and various restricted measures outside the WTO framework, mistrust between participants of economic processes is growing. That results in decrease in the number of mergers and acquisitions. Whether the idea of globalization becomes an illusion or is transformed into something new, the near future will show.

VAT for providers of electronic services

In our publication from July 20, 2016 “Foreign sellers of the Internet content will pay VAT in Russia”we informed that since January 1, 2017 the Federal law as of July 3, 2016 №244-FL came into force. The law amended the procedure governing the taxation of foreign providers of electronic services. The article 174.2 “Special aspects of tax assessment and payment for foreign enterprises rendering of services in electronic format” was introduced into the Part Two of the Tax Code of the Russian Federation. The article defines rendering of electronic services as automatic services using information technologies via information and telecommunication networks, including Internet.

The Federal law as of November 27, 2017 №335-FL “On amendments to the Part One and Part Two of the Tax Code of the Russian Federation and certain legislative acts of the Russian Federation” established that since January 1, 2019, foreign providers of electronic services for legal entities and individual entrepreneurs in Russia are obliged to pay value added tax (VAT). In this regard, all foreign providers are required to register for tax purposes until February 15, 2019.

When violating these provisions, the company will be imposed with fine up to 10% of its profits (according to paragraph 2 of article 116 of the Tax Code). Moreover, VAT, penalty and fine from 20% to 40% of unpaid tax will be charged.

Large foreign companies have already registered with tax authorities. According to the Federal tax Service , over 200 foreign companies are recorded as VAT taxpayers. Comprehensive information on their economic activities is available by subscription to the Information and Analytical System Globas.