Big problems of small business

Is the state support in power to enliven the stagnating sector?

Despite the acting measures of the state support, the small business is still in crisis. As a result, increasingly greater amount of entrepreneurs come to conclusion: doing a business in Russia is unprofitable.

Who is who? According to current legislation, the small business includes enterprises having less than 100 employees and receiving the annual revenue amounting up to 800 million RUB. The data on small business enterprises can be found in the Unified register of small and medium-sized business entities (SME), which has been working since August 1st, 2016. The Register is maintained by the Federal Tax Service. Except small business entities it has the data about medium business entities (less than 200 employees, annual revenue up to 2 billion RUB) and micro-enterprises (less than 15 employees, annual revenue up to 120 million RUB). At the moment in the Unified Register of SME there are 5,7 million business entities (including 3 million sole entrepreneurs), providing working places for 18 million citizens. In general the small business is focused upon trade and services sector. The SME share in the Russian GDP amounts to around 20%.

Benefits are not for everyone. Representatives of the small business cite as the reason of the current negative situation the following things: both appreciation of credits and influence of sanctions, but in the first place they point to low efficiency of the state support measures. According to entrepreneurs, most often the provided benefits are instantly being cancelled out by adopting the new legislative instruments, causing the increase of the tax burden, necessity to report to the Pension Fund monthly and to spend resources on contestation of cadastral values. Several benefits operate only partially, for instance quotation of the small business in 10% of purchases volume of state companies and 15% of state procurement. Thus transport technical maintenance companies successfully participate in state procurement. They get help from major international events, forums, sporting contests. At the same time wholesale distributors and IT companies complain about non-transparency and complexity of procedures in state companies’ procurement, due to which it is impossible to use the benefits operating officially. Beneficial lease of premises promoted as contingency measures is as well effective not for all.

It is for Government to decide. In June the Ministry of Economic Development represented the Strategy of SME development till 2030 and just recently the Government Project office has represented the new national project «Small business and assistance for sole entrepreneurial initiative» (approved as of December 5th). The project will be supervised by Igor Shuvalov, the First Deputy Prime Minister. Earlier the Federal Corporation for the Development of SME was established in order to support the sector. The Strategy of SME development is focused on easing access to capital for business, as well as reduction of administrative burden. Plan of measures, focused on implementation of strategy, consists of 45 items, three of which involve additional financing (grant support development, making asset contribution to the Corporation for the Development of SME for increase of access to leasing, centers of competence development in innovation sector). The strategy goal is to double the share of SME in GDP – to 40%, which conforms to level of developed countries. The national project «Small business and assistance for sole entrepreneurial initiative» is a specification of the Strategy of SME development and activity program of the Federal Corporation for the Development of SME for the near future. According to the Government plans, the project is to be implemented by March 2019. The increases in number of SME, as well as increase in share of credits to the small business in the general lending portfolio of banks are the criteria of the project success. Implementation of the project involves various measures for sole and small entrepreneur support. In particular, due to extension of business entity access to procurement of the largest customers, the annual volume of their sole and small entrepreneur procurement in 2018 is to amount to no less than 17,5%. Moreover, within project implementation it is planned to evolve the system of personnel training, retraining and development for sole or small entrepreneurship. It should increase the awareness of entrepreneurs about existing possibilities of establishment and development of business and the level of economic and financial literacy.

Survival today is for prosperity in future. Under current conditions of economic stagnation namely the small business entities could become the source of economic development, which promotes the upturn of other sectors. However today agenda of the SME is not the prosperity, but the survival. Under conditions of increasing competition and reduction of demand small entrepreneurs are forced to cut costs, pare down wages, increase the working hours of the personnel and diversify business. Low efficiency of the state support and expensive credit means are important but not the single reasons of SME stagnation. It is essential to bear in mind the problems in state procurement sector and control and supervision activity, which the business community faces every day and which prevent carrying out effective activities, primarily small enterprises (see the Article as of 06.10.2016 and Article as of 20.10.2016). There are state initiatives in solving these problems; it remains to wait its effective implementation. It appears that the representatives of the small business hope for the positive effect of the last government steps: entrepreneurs feel optimistic about the future, expecting to achieve pre-crisis indicators of 2013 in the next 12 months. Several experts make more conservative predictions, however they also agree that it is possible to achieve pre-crisis level in 2018.

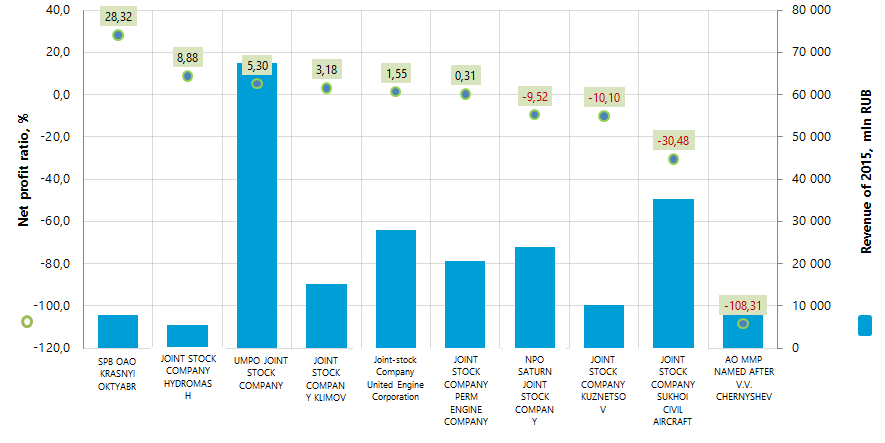

Net profit ratio of the largest manufacturers of aviation equipment

Information agency Credinform presents a ranking of the largest manufacturers of aviation equipment in terms of net profit ratio.

The largest Russian enterprises (TOP-10) with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (2015). These enterprises were ranked by decrease in net profit ratio. (Table 1).

Net profit ratio (%) is calculated as the ratio of net profit (loss) to sales revenue. The ratio shows sales profit rate of companies.

There is no prescribed value. It is advisable to compare companies within one industry or analyze change of ratio in time on particular enterprise.

Negative value of an indicator shows that there is net loss. Higher value reflects high efficiency of enterprise operation.

For the most full and fair opinion about the company’s financial position the whole set of financial indicators and ratios should be taken into account.

| Name, INN, region | Net profit of 2015, mln RUB | Revenue of 2015, mln RUB | Revenue of 2015 to 2014, (+/- %) | Net profit ratio, % | Solvency index Globas-i |

|---|---|---|---|---|---|

| SPB OAO KRASNYI OKTYABR INN 7830002462 Saint-Petersburg |

2 201,0 | 7 772,8 | 16,2 | 28,32 | 136 The highest |

| JOINT STOCK COMPANY HYDROMASH INN 5262008630 Nizhny Novgorod region |

480,4 | 5 409,3 | 13,9 | 8,88 | 177 The highest |

| UMPO JOINT STOCK COMPANY INN 0273008320 The Republic of Bashkortostan |

3 577,3 | 67 511,0 | 38,1 | 5,30 | 199 The highest |

| JOINT STOCK COMPANY KLIMOV INN 7802375335 Saint-Petersburg |

484,0 | 15 211,8 | 53,8 | 3,18 | 200 High |

| Joint-stock Company United Engine Corporation INN 7731644035 Moscow |

434,8 | 28 027,9 | 25,5 | 1,55 | 232 High |

| JOINT STOCK COMPANY PERM ENGINE COMPANY INN 5904007312 Perm territory |

63,9 | 20 699,2 | 3,3 | 0,31 | 226 High |

| NPO SATURN JOINT STOCK COMPANY INN 7610052644 Yaroslavl region |

-2 287,4 | 24 039,0 | 33,1 | -9,52 | 264 High |

| JOINT STOCK COMPANY KUZNETSOV INN 6319033379 Samara region |

-1 036,8 | 10 267,6 | 2,1 | -10,10 | 282 High |

| JOINT STOCK COMPANY SUKHOI CIVIL AIRCRAFT INN 7714175986 Moscow |

-10 788,0 | 35 396,7 | 21,9 | -30,48 | 270 High |

| AO MMP NAMED AFTER V.V. CHERNYSHEV INN 7733018650 Moscow |

-10 890,7 | 10 055,1 | 40,4 | -108,31 | 281 High |

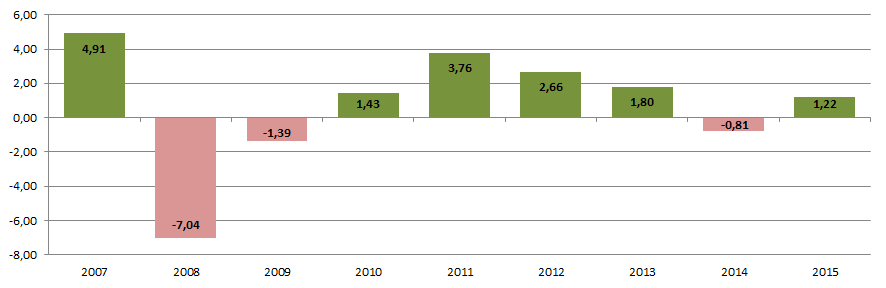

The average net profit ratio among TOP-10 companies in 2015 is marked with negative value and is equal to -11,8. The same indicator among TOP-30 companies is 0,22, at industry average value of 1,22. Besides, dynamics of industry average values (Picture 1) has reference to the macroeconomic situation, while enterprises of the industry to a large extent use the Government assistance.

All of TOP-10 companies have got the highest and high solvency index Globas-i that shows their ability to pay off the debts in time and to the full extent.

Total revenue of TOP-10 companies in 2015 was 224,4 bln RUB that is 27% more than in 2014. Besides, total net loss in this group decreased by 15 %. Seven companies of TOP-10 (marked with red colour in Table 1) have got decrease in net profit values or loss at year-end 2015 compared to the previous period.

In the TOP-30 group increase in revenue for the same period was 23%, with decrease in total net loss by 21%.

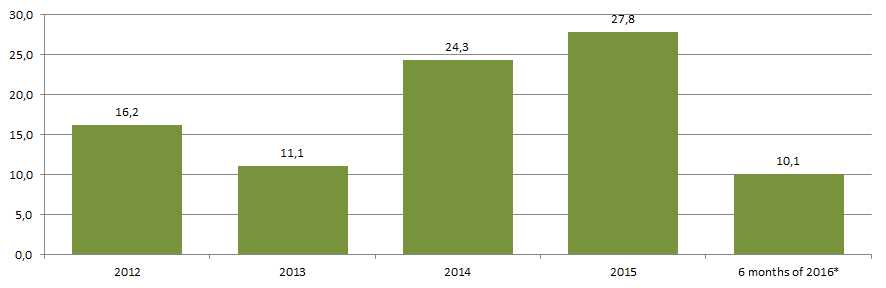

Six companies of TOP-10, as in the industry in general, are observed to have positive values of net profit ratio. On the back of economic turbulence, the industry has positive prospects for further development, taking into account constant support from the Government. This is confirmed by estimated indicators of increase in flying vehicles sales revenue (Picture 3), based on data of the Federal State Statistics Service.

*) – data for 6 months of 2016 are given to the corresponding period of 2015.

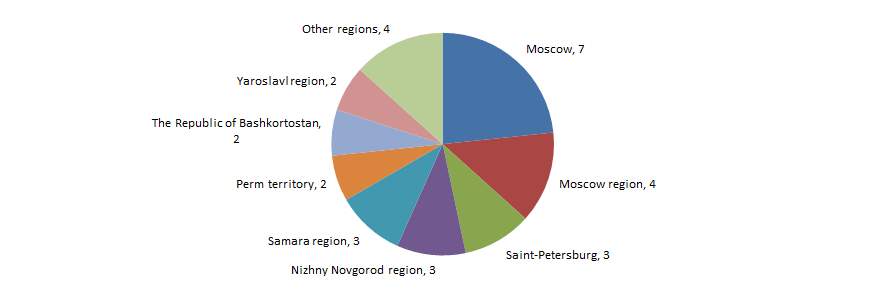

Manufacture of aviation equipment is significantly attracted to regions with prominent productive and scientific potential – Moscow and Moscow region, Saint-Petersburg, Nizhny Novgorod and Samara regions. This is confirmed by data of the Information and analytical system Globas-i, according to that 30 largest enterprise of the industry in terms of revenue volume for 2015 are concentrated in 12 regions of Russia (Picture 4).