Russia will create own payment system

After the RF has co-opted half-island Crimea, financial system of the country feels increased pressured. The talk about sanctions and their imminent tightening excite the market. Limitations have reached those regions, which must be out of politics. So recently the leading payment systems in the world Visa and MasterCard (which belong to commercial companies) have withdrawn services of several Russian banks (including «AB «ROSSIYA», «Sobinbank»), put in the sanctions list of the Administration of the USA. These credit institutions are inside the top 100 of the largest banks, there are many our fellow citizens and legal entities among their clients. It has become apparent that the situation, when there is no own processing centre and payment system in such large economics, endangers national security.

The talk about practical realization of settlements domestically, based on national payment system, has long been having. In 2011 the Federal law «About national payment system» was adopted, which regulates the order of rendering of payment services, including remittance, using of electronic payment facilities, activity of subjects of national payment system, and also sets requirements to organizations and working of payment systems, regulatory regime and supervision in national payment system.

In the beginning of April, immediately after later limitations affected the banking system, the President V.V. Putin has demanded from financial management and the Head of the Central bank to make all reasonable efforts and report about results within a month: how will the banks realize the national payment system (NPS) in practical part, implementation phases, start data in test and real mode and other focused questions.

The Central bank has organized a working group on creation of NPS, the largest Russian banks and banking associations have joined it: «Sberbank» (Savings bank), «Bank Moskvy» (Bank of Moscow), «Uralsib», «VTB 24», «Gazprombank», «Russky standart», «TKS-bank», «Assotsiatsiya rossiiskih bankov» (Association of Russian banks) and «Assotsiatsiya regionalnyh bankov» (Association of regional banks). As examples of what the NPS could look like the Central bank considers the systems «Zolotaya korona», «PRO100» and Union Сard. Bankers could choose one of them or offer another one. For this there will be conducted a poll in the banking community.

At the suggestion of the Head of «Sberbank» German Gref, the NPS can be created on the base of «UEK» OJSC – structure, which serves Russian universal electronic cards, it is possible to solve this task within three months.

Will hope, that in the near future our internal settlements will be protected from external effects by own NPS, which also can enter a world market in the long term, as it was done by Chinese UnionPay.

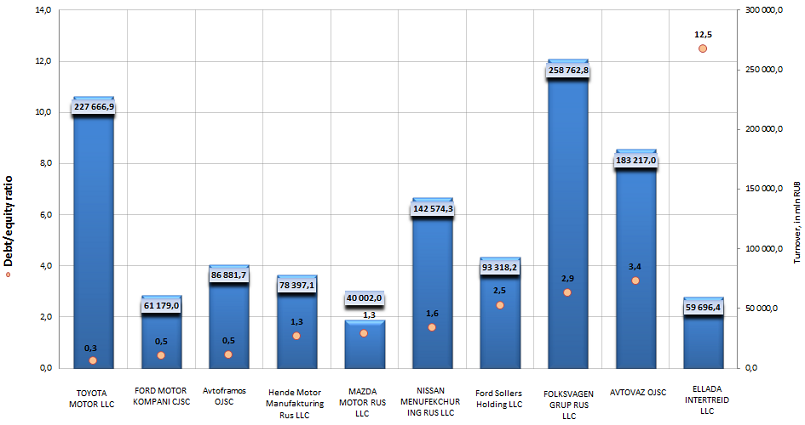

Debt/equity ratio of motor car manufacturers

Information agency Credinform prepared a ranking of motor car manufacturers in Russia.

The companies with highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). These enterprises were ranked by increase in debt/equity ratio.

Debt/equity ratio (х) shows the ratio between borrowed and own sources of company financing. Recommended value is < 1. If the ratio is > 1, it means that the volume of borrowed capital is higher, than the volume of own capital, what lays additional financial risks on a company. If the indicator is negative, this fact may testify that the equity capital of a firm is in negative area, there is uncovered loss.

However, it should be understood, that recommended values can differ essentially as well for enterprises of different branches, as for companies of the same industry, consequently, these values are absolutely of recommended character.

For getting of more comprehensive and fair picture of financial standing of an enterprise it is necessary to pay attention not only to average indicator values in a branch, but also to all presented summation of financial indicators and ratios of a company.

| № | Name | Region | Turnover,in mln RUB, for 2012 | Debt/equity ratio, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | TOYOTA MOTOR LLC INN: 7710390358 |

Moscow region | 227 666,9 | 0,3 | 155(the highest) |

| 2 | FORD MOTOR KOMPANI CJSC INN:4703038767 |

Leningrad region | 61 179,0 | 0,5 | 197(the highest) |

| 3 | Avtoframos OJSC INN: 7709259743 |

Moscow | 86 881,7 | 0,5 | 145(the highest) |

| 4 | Hende Motor Manufakturing Rus LLC INN:7801463902 |

Saint-Petersburg | 78 397,1 | 1,3 | 202(high) |

| 5 | MAZDA MOTOR RUS LLC INN:7743580770 |

Moscow | 40 002,0 | 1,3 | 283(high) |

| 6 | NISSAN MENUFEKCHURING RUS LLC INN:7842337791 |

Saint-Petersburg | 142 574,3 | 1,6 | 219(high) |

| 7 | Ford Sollers Holding LLC INN: 1646021952 |

Republic of Tatarstan | 93 318,2 | 2,5 | 287(high) |

| 8 | FOLKSVAGEN GRUP RUS LLC INN:5042059767 |

Kaluga region | 258 762,8 | 2,9 | 188(the highest) |

| 9 | AVTOVAZ OJSC INN: 6320002223 |

Samara region | 183 217,0 | 3,4 | 203(high) |

| 10 | ELLADAINTERTREID LLC INN: 3906072056 |

Kaliningrad region | 59 696,4 | 12,5 | 204(high) |

Picture 1. Debt/equity ratio, turnover of the largest manufacturers of motor cars (TOP-10)

Cumulative turnover of the largest manufacturers of motor cars (TOP-10) made 1 231 695,3 mln RUB at year-end 2012. The average ratio value is 2,7; most companies have the value of borrowed capital being higher, than the equity.

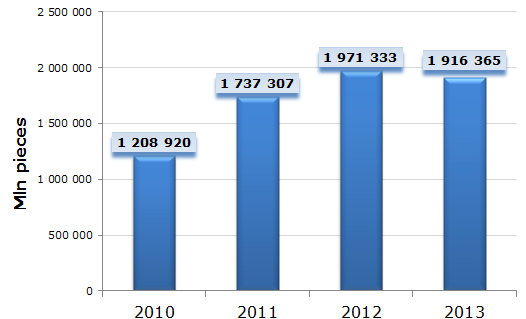

Car market is very sensitive to economic fluctuations in the country. The slowdown in the GDP growth rate in 2013 provoked the decline in production volume by 2,8%. In the current year it is expected further decrease in the market of car manufacture and temporary suspension of conveyers. All this will have an impact on the increase of borrowed capital.

Picture 2. Dynamics of the manufacture of motor cars in the RF

At the present time many the largest auto groups in the world have opened their factories or organized assembly areas on the territory of Russia. Our market is treated as very attractive one, and also because we are visibly behind leading countries in the world on the level of automobilization per capita.

TOYOTA MOTOR LLC, FORD MOTOR KOMPANI CJSC, Avtoframos OJSC (mark Renault) show the ratio < 1 – borrowed capital is less than equity, that maintains additionally their financial stability. It is confirmed by the solvency index GLOBAS-i® of the Information agency Credinform: it is at the highest level by all mentioned organizations, what guarantees, that they can pay off their debts in time. Investment attractiveness of these enterprises is at a high level, now therefore, the decision of possible business cooperation will be informed.

All other companies of the branch have borrowed funds being higher, than own capital. Here it is important to take into account, that it takes a lot of investments to sweep market and organize production. It doesn’t matter, if the capital doesn’t secure loans, what is most important is that the management works out correctly all probable consequences of the «game on credit». A high rating of solvency GLOBAS-i® confirms indirectly, that approved business strategy yields its results, organizations are able to pay off their debts in time, only a breakdown of macroeconomic situation in the country could have an impact on their financial standing.