Base material sector remains the key one in the economy

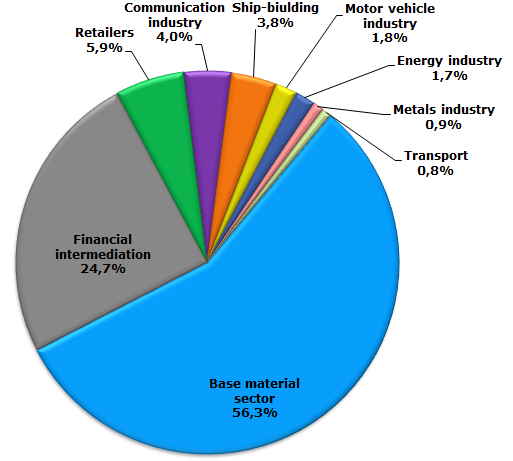

The cumulative turnover of 50 the largest companies increased in 2013 by 16,15% in comparison with the year 2012 and made 30 081 bln RUB. By that 56,3% of the total turnover of the TOP-50 enterprises is accounted for by organizations of the base material sector.

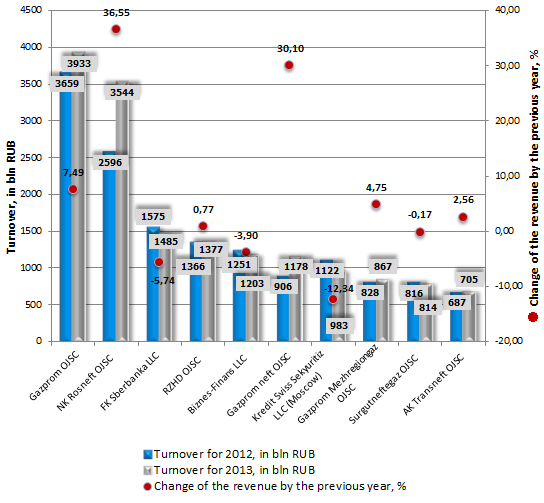

According to the results of the year 2013, the largest volume of revenue was represented by two base material giants - Gazprom OJSC and NK Rosneft OJSC. By that NK Rosneft OJSC showed the maximum revenue gain in comparison with the year 2012 among TOP-10 enterprises. Such impressive results of the previous year companies’ representatives associate with the enhancement of efficiency of geological exploration, as well as with the increase of control over operating costs. So that at year-end 2013 the operating costs on extraction made 156,76 RUB/barrels (the ruble-dollar rate as of the end of the year 2013), what is the best specific indicator among public oil companies in the world.

Picture 1. Dynamics of the turnover of the largest Russian companies, TOP-10

The largest slowdown in the volume of revenue at year-end 2013 among the first ten companies is showed by Kredit Sviss Sekyuritiz LLC (Moscow). At year-end 2013 the company’s turnover made 983 bln RUB, what is by 12,34% less, than for the similar period of the previous year. The enterprise is a part of Swiss financial conglomerate and carries out brokerage and dealer activity on the territory of Russia.

Speaking about branch differentiation, it should be noted, that more than half of the total turnover of TOP-50 is accounted for by enterprises of the base material sector (56,3%), then follow: companies engaged in financial intermediation (24,73%) and representatives of retailers (5,88%).

Picture 2. Branch differentiation

At year-end 2013 the total net profit (taken into account the loss) of 50 the largest Russian companies on turnover made 2248 bln RUB, among them 79% are accounted for by 10 the largest enterprises on the net profit volume. By that 9 from 10 firms relate to the base material sector of the economy.

Gorno-metallurgicheskaya kompaniya Norilsky nikel OJSC is the only one metals company got shortlisted in TOP-10 on the amount of net profit. Following the results of the year 2013, company’s net profit made 78 305 mln RUB, what is by 12% higher, than in the similar period of the year 2012, i.e. the growth lags behind inflationary changes. However, the enterprise succeeded in cutting of capital expenditure by 27% in the previous year.

| № | Name, INN | Activity | Net profit/loss for 2013, in mln RUB | Turnover for 2013, in mln RUB | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Gazprom OJSC INN 7736050003 |

Base material sector | 628 311 | 3 933 335 | 164 (the highest) |

| 2 | Surgutneftegaz OJSC INN 8602060555 |

Base material sector | 256 517 | 814 188 | 166 (the highest) |

| 3 | Neftyanaya kompaniya Lukoil OJSC INN 7708004767 |

Base material sector | 209 871 | 260 009 | 151 (the highest) |

| 4 | Rosneftegaz OJSC INN 7705630445 |

Base material sector | 160 947 | 254 512 | 164 (the highest) |

| 5 | Neftyanaya kompaniya Rosneft OJSC INN 7706107510 |

Base material sector | 136 279 | 3 544 443 | 224 (high) |

| 6 | Lukoil-zapadnaya Sibir LLC ООО INN 8608048498 |

Base material sector | 89 371 | 631 010 | 200 (high) |

| 7 | Gorno-metallurgicheskaya kompaniya Norilsky nikel OJSC INN 8401005730 |

Metals industry | 78 305 | 272 585 | 172 (the highest) |

| 8 | Novatek OJSC INN 6316031581 |

Base material sector | 72 259 | 245 077 | 167 (the highest) |

| 9 | Orenburgneft OJSC INN 5612002469 |

Base material sector | 69 476 | 299 511 | 218 (high) |

| 10 | Aktsionernaya neftyanaya kompaniya Bashneft OJSC INN 0274051582 |

Base material sector | 69 124 | 517 487 | 206 (high) |

The total amount of assets of TOP-50 Russian companies made 38 333 mln RUB at year-end 2013. RZHD OJSC is among leaders on the amount of assets, 12% of total volume of assets of 50 the largest enterprises of the country are accounted for by this organization.

| № | Name, INN | Activity | Assets for 2013, in mln RUB | Turnover for 2013, in mln RUB | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Gazprom OJSC INN 7736050003 |

Base material sector | 10 848 419 | 3 933 335 | 164 (the highest) |

| 2 | Neftyanaya kompaniya Rosneft OJSC INN 7706107510 |

Base material sector | 4 980 147 | 3 544 443 | 224 (high) |

| 3 | Rossijskie zheleznye dorogi OJSC INN 7708503727 |

Transport | 4 577 538 | 1 376 582 | 235 (high) |

| 4 | Rosneftegaz OJSC INN 7705630445 |

Base material sector | 2 550 432 | 254 512 | 164 (the highest) |

| 5 | Surgutneftegaz OJSC INN 8602060555 |

Base material sector | 2 105 126 | 814 188 | 166 (the highest) |

| 6 | Neftyanaya kompaniya Lukoil OJSC INN 7708004767 |

Base material sector | 1 296 276 | 260 009 | 151 (the highest) |

| 7 | Rossijsky kontsern po proizvodstvy elektricheskoy I teplovoy energii na atomnykh stantsiyakh OJSC INN 7721632827 |

Energy industry | 1 240 961 | 232 857 | 211 (high) |

| 8 | Aktsionernaya kompaniya po transportu nefti Transneft OJSC INN 7706061801 |

Base material sector | 930 257 | 704 714 | 159 (the highest) |

| 9 | Gazprom neft OJSC INN 5504036333 |

Base material sector | 899 540 | 1 178 064 | 200 (the highest) |

| 10 | Gorno-metallurgicheskaya kompaniya Norilsky nikel OJSC INN 8401005730 |

Metals industry | 678 532 | 272 585 | 172 (high) |

All companies under review got a high and the highest solvency index GLOBAS-i®, what characterizes them as financially stable.

The results of this investigation confirm the thesis about weak diversification of Russian economy and its raw-material orientation. Such trend can be very dangerous, especially in view of falling prices for energy carriers. However, at year-end 2013 the share of extraction of minerals in country’s GDP reduced only by 0,05%, during the share of manufacturing increased by 0,1%.

Appeared complexity in interrelationship with Western governments in view of Ukrainian crisis and introduced sanctions, create new impulses for solution of these problems. So that at the meeting with young academics in Saratov the President of the RF Vladimir Putin noticed, that western sanctions are the motivation for diversification of country’s economy and for development of non-resource sector of the economy.

Aimed at the support of economic growth and development of economy sectors of highest priority, the government approved the program of the support of investment projects, running in Russia on the basis of project financing. Within created mechanism it is planned to grant credits in the volume up to 500 bln RUB on an accrual basis at year-end 2018. Thereby state guarantees in the volume up to 125 bln RUB will be provided on credits.

Along with that many experts assign an important part in the support of economic growth to representatives of small and medium business, for whom tax holidays will come into force starting next year. However, tax privileges extend only to new enterprises of small and medium business.

Principles of taxation of business won’t be changed, but new levies will be introduced

The Government of the RF is not about to make amendments in principles of taxation of business. This was announced by the Prime Minister of the RF Dmitry Medvedev in the course of its speech at the forum of the organization «Opora Rossii», dedicated to small business. The Prime Minister stated that in spite of external-economic difficulties and tight budget, the government doesn’t plan to introduce changes in principles of taxation of business.

As a reminder, earlier the government refused the increase of VAT, PIT and move towards progressive taxation scale. Also they refused the introduction of sales tax, against which were: the Ministry of Finance, Ministry for Economic Development (MED), as well as the Deputy prime-minister Igor Shuvalov. According to the opinion of most experts, the introduction of new taxes in the current economic situation, when it is necessary to stimulate the development of small and medium business, will have a negative impact on economic and investment climate of the country.

Along with this in the course of International investment forum «Sochi-2014» Dmitry Medvedev informed about government’s intention to support regional budgets, which incur a deficit of funds, on account of the introduction of additional tax levies. Note that at year-end 2013 the amount of total consolidated debt of constituent entities of the Federation owed to the budget increased by 26,9% and as of the 1st of January of the current year made 2 trn 26 bln RUB. The most part of borrowings goes toward discharge of the budget deficit, which increases annually. Along with this the debt of municipal entities also increases. So that as of today the debt of local self-government authorities reaches 288,9 bln RUB.

The Prime Minister offered to allow regions to introduce additional taxes on trading rights, on food service, as well as tourist and visitor’s tax by themselves. Note that earlier tourist regions of the country (Krasnodar territory, Moscow and Saint-Petersburg) advanced the initiative to introduce the tourist tax.

According to preliminary estimates of the Ministry of Finance, due to new levies regions will be able to replenish the budget by 50-70 bln RUB annually. By that an effect from the introduction of sales tax is estimated at 200 bln RUB.

New levies can be introduced already since next year, but their amount isn’t determined yet. The right to impose taxes will be transferred most likely to regions, and at the federal level it will be set just the upper limit.

The experts note that suggested levies won’t help solve a problem of budget deficit of outlying regions, but will come upon small traders and taxi drivers, i.e. upon representatives of small business and individual entrepreneurs. The introduction of levy for trading rights can be considered generally as an additional administrative barrier for entrance to the market. Finally, all tax «innovations» will be paid by consumer, because the increase of tax burden will automatically have an impact on price.

As a reminder, the current Tax Code allows to collect one-time charges for providing of government services. Besides that one-time charges are collected for hunt and fishing.