Trends in the financial services market

Information agency Credinform has prepared a review of trends of the largest Russian companies in the financial market.

The largest holding companies, investment funds, pawn shops, micro financial organizations (TOP-1000) in terms of annual revenue were selected for the analysis according to the data from the Statistical Register for the latest available periods (2014-2019). The analysis was based on the data of the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company in term of net assets is JSC RN HOLDING, INN 7225004092, Moscow. The company is in process of reorganization by spin-off simultaneously with the acquisition since 04.03.2020. In 2019, net assets value of the company amounted to 790 billion RUB.

The lowest net assets value among TOP-1000 belonged to JSC OTKRITIE HOLDING, INN 7708730590, Moscow region. In 2019, insufficiency of property of the company was indicated in negative value of -532 billion RUB.

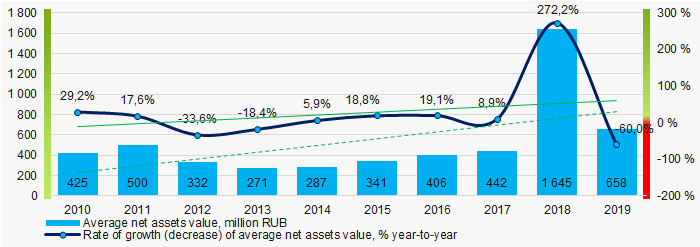

Covering the ten-year period, the average net assets values have a trend to increase with a positive dynamics of the growth rate (Picture 1).

Picture 1. Change in industry average net assets value in 2010 – 2019

Picture 1. Change in industry average net assets value in 2010 – 2019The shares of TOP-1000 companies with insufficient property have a trend to increase over the past five years (Picture 2).

Picture 2. Shares of TOP-1000 companies with negative net assets value in 2015-2019

Picture 2. Shares of TOP-1000 companies with negative net assets value in 2015-2019Sales revenue

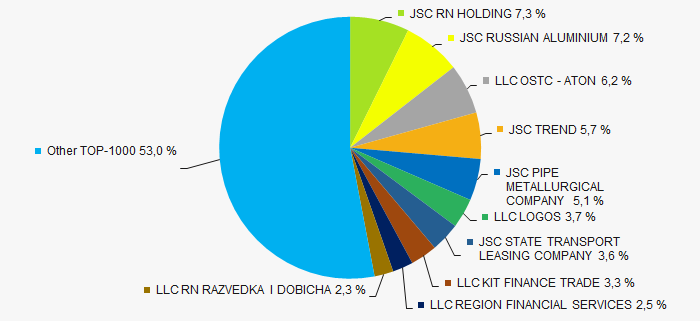

In 2019, the revenue volume of 10 largest companies of the industry was 47% of total TOP-1000 revenue (Picture 3). This is indicative of high level of monopolization in the industry.

Picture 3. The share of TOP-10 companies in total 2019 revenue of TOP-1000

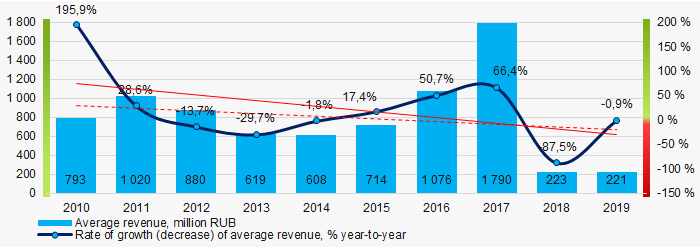

Picture 3. The share of TOP-10 companies in total 2019 revenue of TOP-1000 In general, there is a trend to decrease in revenue with negative dynamics of the growth rate (Picture 4).

Picture 4. Change in industry average net profit in 2010 – 2019

Picture 4. Change in industry average net profit in 2010 – 2019Profit and loss

The largest company in term of net profit is JSC RN HOLDING, INN 7225004092, Moscow. The company’s profit for 2019 reached 352 billion RUB.

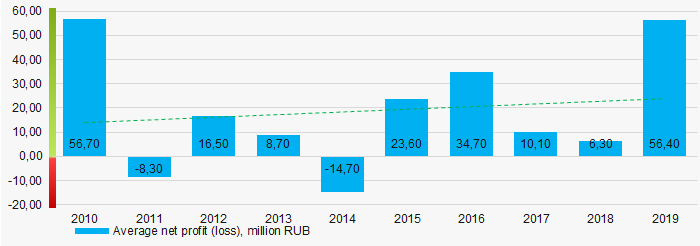

Covering the ten-year period, there is a trend to increase in average net profit (Picture 5).

Picture 5. Change in industry average net profit (loss) values in 2010 – 2019

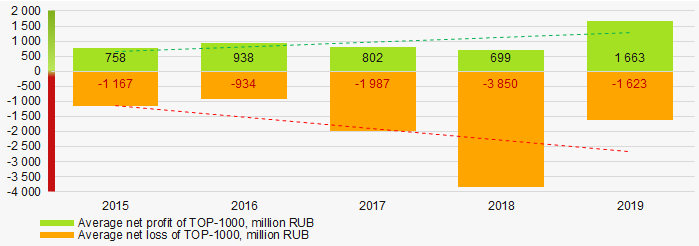

Picture 5. Change in industry average net profit (loss) values in 2010 – 2019For the five-year period, the average net profit values of TOP-1000 have the increasing trend with the increasing net loss (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP-1000 in 2015 – 2019

Picture 6. Change in average net profit and net loss of ТОP-1000 in 2015 – 2019Key financial ratios

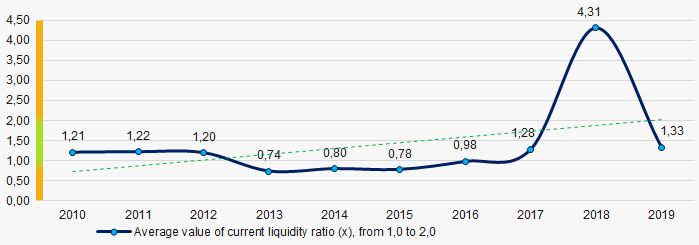

Covering the ten-year period, the average values of the current liquidity ratio were mainly within the recommended one - from 1,0 to 2,0 or slightly below with a trend to increase (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in industry average values of current liquidity ratio in 2010 – 2019

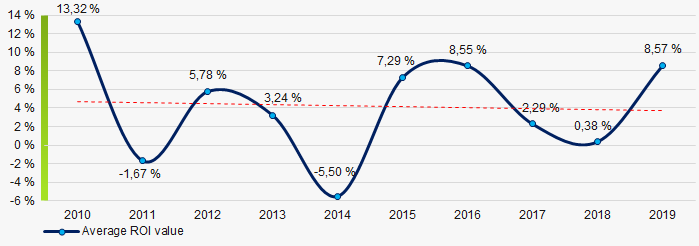

Picture 7. Change in industry average values of current liquidity ratio in 2010 – 2019Covering the ten-year period, the average values of ROI ratio have a trend to decrease (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in industry average values of ROI ratio in 2010 – 2019

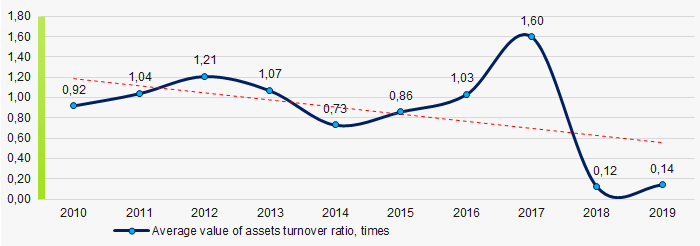

Picture 8. Change in industry average values of ROI ratio in 2010 – 2019Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Covering the ten-year period, business activity ratio demonstrated the decreasing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2010 – 2019

Picture 9. Change in average values of assets turnover ratio in 2010 – 2019Small business

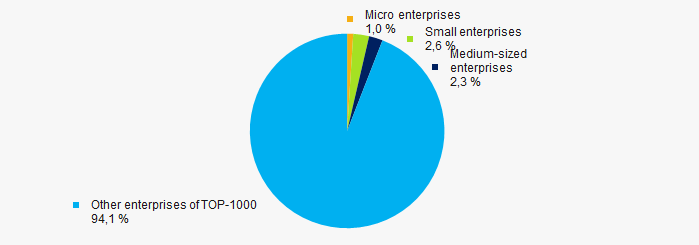

53% of TOP-1000 companies are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. Their share in total revenue of TOP-1000 is almost 6% that is three times below the national average in 2018-2019 (Picture 10).

Picture 10. Shares of revenue of small and medium-sized enterprises in TOP-1000

Picture 10. Shares of revenue of small and medium-sized enterprises in TOP-1000Main regions of activity

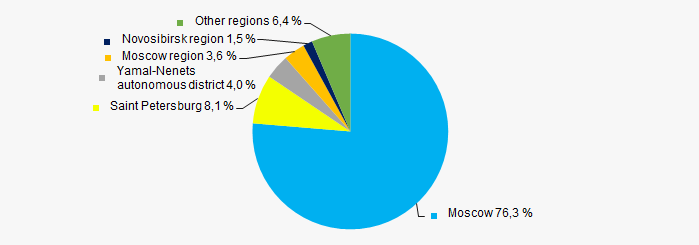

Companies of TOP-1000 are registered in 70 regions of Russia, and unequally located across the country. Over 84% of companies largest by revenue are located in Moscow and Saint Petersburg (Picture 11).

Picture 11. Distribution of TOP-1000 revenue by regions of Russia

Picture 11. Distribution of TOP-1000 revenue by regions of RussiaFinancial position score

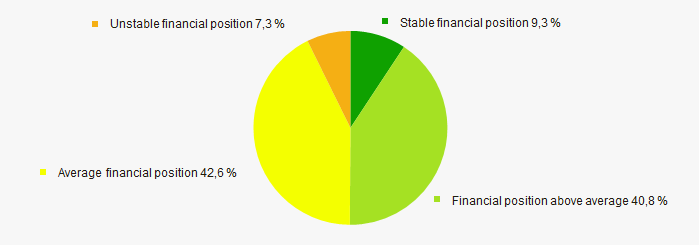

Assessment of the financial position of TOP-1000 companies shows that the majority of them have average financial position (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

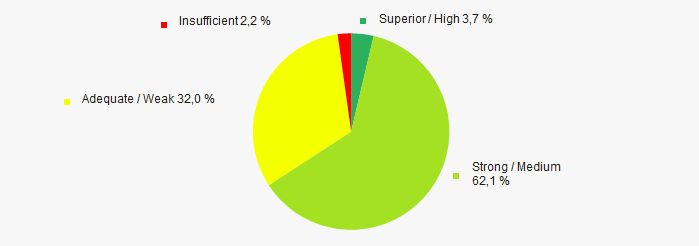

Most of TOP-1000 companies got Superior / High and Strong / Medium index Globas. This fact shows their ability to meet their obligations fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasConclusion

Complex assessment of activity of the largest Russian companies in the financial market, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of negative trends (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Dynamics of the average net assets value |  10 10 |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  -10 -10 |

| Level of competition / monopolization |  -10 -10 |

| Dynamics of the average revenue |  -10 -10 |

| Rate of growth (decline) in the average size of revenue |  -10 -10 |

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

| Growth / decline in average values of companies’ net profit |  10 10 |

| Growth / decline in average values of companies’ net loss |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  10 10 |

| Increase / decrease in average values of return on investment ratio |  -10 -10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in terms of revenue being more than 20% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  5 5 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  -1,6 -1,6 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).

Changes in legislation

In accordance with the Order of the President of the Russian Federation, the Ministry of Economic Development has formed a Register of socially oriented non-profit organizations receiving additional support measures (hereinafter “the Register”).

The Register includes organizations that from 01.01.2017 were:

- recipients of subsidies and grants under the programs of executive bodies of all levels;

- recipients of grants of the President of the Russian Federation;

- providers of social services and services of public utility.

The Register is made up of information provided by executive authorities, the Ministry of Justice, and the Presidential Grants Fund.

The following support measures are provided for organizations included in the Register:

- subsidized concessional lending to pay part of wages to employees in accordance with the Decree of the Government of the Russian Federation of May 16, 2020 No. 696;

- 6-month increase in the deadlines for paying insurance premiums to state extra-budgetary funds, taxes and advance payments of taxes, excluding VAT, in accordance with the Decree of the Government of the Russian Federation of 05.15.2020 No. 685;

- exemption from taxes and advance payments on them, income tax levies - regarding monthly advance payments payable in the 2nd quarter of 2020;

- extension of tax incentives for legal entities participating in charitable assistance to organizations included in the register.

For example, when determining the tax base for income tax, legal entities that donated property or cash to non-profit organizations will be able to include these operations in non-operating expenses.

Information in the register is verified with the data of the Federal Tax Service.

Subscribers of the Information and Analytical system Globas can check for counterparties in the Register of socially oriented non-profit organizations using the “Lists we recommend”. Currently, the Register contains over 24 thousand entries.