Cryptocurrencies can fall under legislative control in Russia

The representatives of the Central Bank of the RF (CB of the RF) don’t preclude the legislative control of cryptocurrencies in Russia. It was announced by Georgy Luntovsky, the Deputy Chairman of the Bank of Russia, during his speech at the International Banking Congress.

As a reminder, earlier, in January of the current year, the CB of the RF warned the citizens against transactioning with the use of virtual currencies. Soon after the representatives of the main regulator and law enforcement authorities announced about planned collaborative actions on the prevention of possible violation of property rights of natural and legal persons connected with the use of cryptocurrencies. In February of the current year the Bank of Russia equated, perhaps, the best known cryptocurrency – bitcoin, with financial pyramid.

Today the rhetoric of the main regulator towards virtual currencies has become more loyal. Thus Luntovsly has announced, that at the moment they are engaged, together with the government and the Bank for international settlements, in intensive work on examination of the situation on the market of cryptocurrencies. The Deputy Chairman of the Bank of Russia has recognized, that today we must not ignore the use of this currency and close our eyes to its existence, because maybe just it is the thing of the future. However, the representative of the CB of the RF has noted, that, unfortunately, similar technologies are often used by criminality, that’s why a special care should be taken in this matter.

Cryptocurrency represents counterfeit-proof digital coins, which can be kept in electronic wallets, as well as transferred from one wallet to another. At first sight cryptocurrencies are similar to ordinary electronic payment systems, but their working principle is rather different. Their fundamental distinction is that they are decentralized, i.e. there is no unified centre, issuing and controlling this currency, and each cryptowallet – is the bank itself. A set of such wallets world-wide forms a giant distribution bank, working 24 hours a day and absolutely automatically. Functioning of cryptocurrency is guaranteed only by correctness of its algorithm and is controlled by none from outside.

Herewith this system doesn’t forgive mistakes. So, if you have sent money to a wrong address or deleted your cryptowallet, without making a back-up copy, then it would be impossible to invert the process and none would pay back your money.

The value of cryptocurrencies is not secured by any assets and is not pegged to any currency of the world, its rate is determined by demand and supply in the market. The most successful cryptocurrency at the moment is bitcoin, which is abundantly used in many countries and competes with such official currencies as USD and EUR.

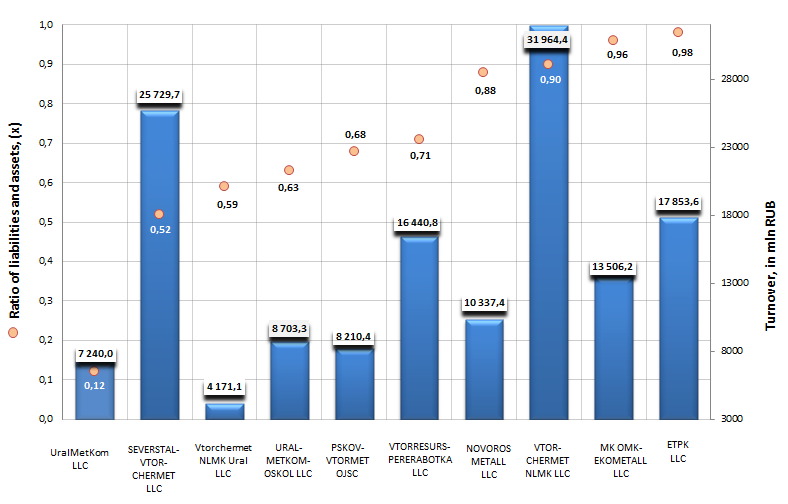

Ratio of liabilities and assets of enterprises engaged in recycling of raw materials

Information agency Credinform offers to get acquainted with the ranking of Russian companies engaged in recycling of raw materials. The companies with the highest volume of revenue involved in this activity were selected by the experts according to the data from the Statistical Register for the latest available period (for the year 2012). Then, the first 10 enterprises selected by turnover were ranked by increase of the ratio of liabilities and assets.

The mentioned ratio refers to a group of indexes of financial stability and is calculated as the relation of long-term and short-term borrowings to total assets. This ratio presents what share of assets of an enterprise is funded with loans. The recommended value of the analyzed ratio is from 0,2 up to 0,5.

| № | Name, INN | Region | Turnover,2012, mln RUB | Ratio of liabilities and assets, (х) | Solvency index GLOBAS-i |

|---|---|---|---|---|---|

| 1 | Uralskaya metallolomnaya kompaniya LLC INN 5607019072 |

Orenburg region | 7 240 | 0,12 | 210 (high) |

| 2 | SEVERSTAL-VTORCHERMET LLC INN 3528165743 |

Vologda region | 25 730 | 0,52 | 332 (satisfactory) |

| 3 | Vtorchermet NLMK Ural LLC INN 6674342481 |

Sverdlovsk region | 4 171 | 0,59 | 320 (satisfactory) |

| 4 | URALMETKOM-OSKOLLLC INN 5607021177 |

Belgorod region | 8 703 | 0,63 | 220 (high) |

| 5 | PSKOVVTORMET OJSCINN 6027007501 | Pskov region | 8 210 | 0,68 | 219 (high) |

| 6 | VTORRESURS-PERERABOTKALLC INN 4217126359 |

Kemerovo region | 16 441 | 0,71 | 248 (high) |

| 7 | NOVOROSMETALL LLC INN 2315057727 |

Krasnodar territory | 10 337 | 0,88 | 248 (high) |

| 8 | VTORCHERMETNLMKLLC INN 7705741770 |

Sverdlovsk region | 31 964 | 0,90 | 301 (satisfactory) |

| 9 | METALLOLOMNAYA KOMPANIYA OMK-EKOMETALL LLC INN 7705937571 |

Moscow | 13 506 | 0,96 | 289 (high) |

| 10 | Ekaterinburgskaya torgovo-promyshlennaya kompaniya LLC INN 6670025354 |

Sverdlovsk region | 17 854 | 0,98 | 275 (high) |

The first place of the ranking belongs to Uralskaya metallolomnaya kompaniya LLC with the ratio value 0,12, what points to that company’s management tries not to misappropriate borrowed funds. Herewith the enterprise got a high solvency index GLOBAS-i®, what points to a quite good solvency level and low credit risk.

SEVERSTAL-VTORCHERMET LLC is the only one company from the list, which ratio of liabilities and assets is within normal range (from 0,2 up to 0,5). However, based on the combination of financial and non-financial indicators, the enterprise got a satisfactory solvency index GLOBAS-i®, what testifies to a low probability of financial inability in the nearest 12 months.

Ratio of liabilities and assets of enterprises engaged in recycling of raw materials in Russia, TOP-10

The enterprises Vtorchermet NLMK Ural LLC (0,59), URALMETKOM-OSKOL LLC (0,63), PSKOVVTORMET OJSC (0,68) and VTORRESURS-PERERABOTKA LLC (0,71) have the value of the ratio of liabilities and assets being a little higher than recommended values. But only Vtorchermet NLMK Ural LLC got a satisfactory solvency index GLOBAS-i®, because there are losses in the structure of company’s balance sheet ratios. Other organizations got a high solvency index GLOBAS-i®, what points to stable financial standing of the enterprises.

TOP-10 companies, which took the places from 7 to 10 in the ranking, showed the value of the ratio of liabilities and assets close to 1. Such results point to that the sum of loans, credits and accounts payable is almost equal to all assets of the enterprises, what can impair financial stability of companies in the future. However, based on the combination of financial and non-financial indicators, only VTORCHERMET NLMK LLC got a satisfactory solvency index GLOBAS-i®, because there are losses in the structure of company’s balance sheet ratios. The rest enterprises got a high solvency index GLOBAS-i®.

In summary it’s important to note, that executives should follow closely the ratio of assets and all their loans and credits, because a substantial surplus of liabilities can dent the financial stability of an enterprise.

See also: Net profit of enterprises engaged in secondary processing of raw materials