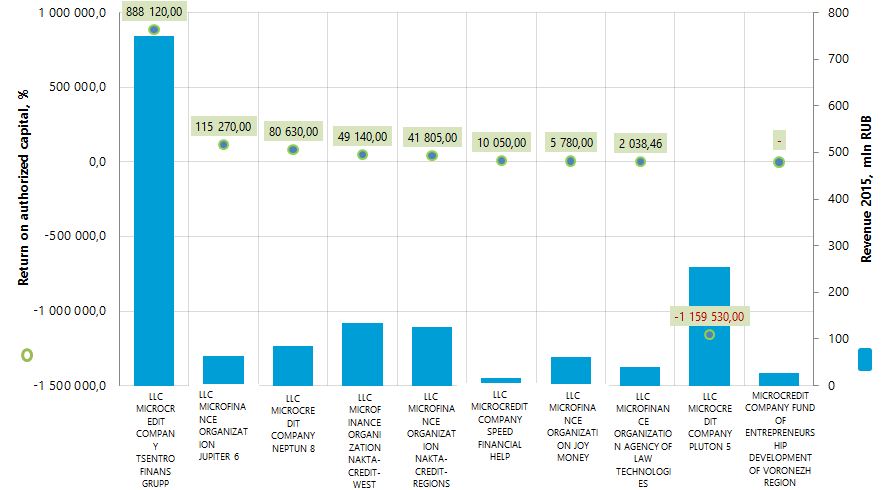

Return on authorized capital of the Russian micro finance and micro credit organizations

Information agency Credinform prepared a ranking of the Russian micro finance and micro credit organizations in term of return on authorized capital.

We’ve already spoke about legislative changes in the financial market in our publication “Microcredits for business will increase”.

The Russian micro finance and micro credit organizations (Top-10) with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2015). The enterprises were ranked by decrease in return on authorized capital (see table 1).

Return on authorized capital (%) indicates the efficiency of the authorized capital use and shows the amount of net profit accounting for one rouble of the authorized capital. The higher is the indicator, the more efficient is the usage of capital contributed to the authorized fund. However it is necessary to consider that too high indicators, exceeding in several times the average values for economy or sector may indicate low authorized capital at higher net profit.

For the most complete and objective view of the financial condition of the enterprise it is necessary to pay attention not only to the average rates in the industry, but also to the presented set of financial indicators and ratios of the company.

| Name, INN, region | Net profit 2015, mln RUB | Revenue 2015, mln RUB | Revenue 2015 to 2014, (+/- %) | Return on authorized capital, % | Solvency index Globas-i |

|---|---|---|---|---|---|

| LLC MICROCREDIT COMPANY TSENTROFINANS GRUPP INN 2902076410 Arkhangelsk region |

88,8 | 749,9 | 95,0 | 888 120,00 | 295 High |

| LLC MICROFINANCE ORGANIZATION JUPITER 6 INN 7840460408 Saint-Petersburg |

11,5 | 63,5 | 176,1 | 115 270,00 | 265 High |

| LLC MICROCREDIT COMPANY NEPTUN 8 INN 7801631988 Saint-Petersburg |

8,1 | 85,3 | 500,7 | 80 630,00 | 283 High |

| LLC MICROFINANCE ORGANIZATION NAKTA-CREDIT-WEST INN 5260319581 Nizhniy Novgorod region |

9,8 | 133,3 | 8,0 | 49 140,00 | 298 High |

| LLC MICROFINANCE ORGANIZATION NAKTA-CREDIT-REGIONS INN 5260228430 Nizhniy Novgorod region |

8,4 | 126,6 | 2,4 | 41 805,00 | 287 High |

| LLC MICROCREDIT COMPANY SPEED FINANCIAL HELP INN 0266031078 Republic of Bashkortostan |

1,0 | 16,0 | 56,9 | 10 050,00 | 236 High |

| LLC MICROFINANCE ORGANIZATION JOY MONEY INN 5407496776 Novosibirsk region |

0,6 | 61,0 | 0,0 | 5 780,00 | 304 Satisfactory |

| LLC MICROFINANCE ORGANIZATION AGENCY OF LAW TECHNOLOGIES INN 5260170290 Nizhniy Novgorod region |

0,3 | 39,2 | -38,5 | 2 038,46 | 260 High |

| LLC MICROCREDIT COMPANY PLUTON 5 INN 7801632011 Saint-Petersburg |

-116,0 | 253,9 | 16826,7 | -1 159 530,00 | 361 Satisfactory |

| MICROCREDIT COMPANY FUND OF ENTREPRENEURSHIP DEVELOPMENT OF VORONEZH REGION INN 3666144160 Voronezh region |

3,6 | 26,3 | 27,7 | * | 255 High |

*) – indicator of return on authorized capital for MICROCREDIT COMPANY FUND OF ENTREPRENEURSHIP DEVELOPMENT OF VORONEZH REGION is not calculated due to the absence of authorized capital in accordance with the “Fund” legal form.

Average value of return on authorized capital for the Top-10 companies amounted to 3 700,38% in 2015. Average value without extreme values in Top-35 amounted to 9 596,22%.

Eight of ten companies in the Top got high solvency index Globas-i indicating their ability to timely and fully fulfill the debt liabilities.

LLC MICROFINANCE ORGANIZATION JOY MONEY and LLC MICROCREDIT COMPANY PLUTON 5 got satisfactory index due to the short time of activity.

Total revenue of the Top-10 companies for 2015 amounted to 1,6 bln RUB that is by 3% higher than in 2014. At the same time total net profit reduced by 56%. Four companies in the Top-10 (marked with red color in the Table 1) have reduction in net profit or loss in comparison with the previous period.

Increase in total revenue of Top-35 for the same period was 1% at decrease in total net profit by 53%.

Nine companies in Top-10 as well as for Top-35 have positive values of return on authorized capital.

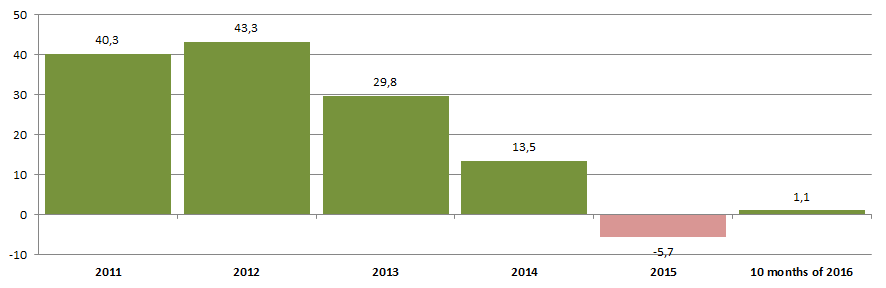

Micro finance and micro credit organizations demonstrate super high values of this indicator, speaking about extremely high amounts of net profit to funds invested in the authorized capital. According to the experts, on the background of complicated economic situation, reduction in borrowings in banks by general public (Picture 2) and taking into account social significance of micro finance and micro credit organizations, the current situation may raise questions on perfection of legislative regulation of this activity.

Data for 10 months of 2016 are presented in comparison with the relevant period of 2015.

At the same time, total volume of borrowings and deposits to natural persons and other invested assets amounted to 10,6 tln RUB for 10 months of 2016.

For now this indicator exceeds fast growing volumes of micro crediting. According to the National bureau of credit histories, the volume of micro credits granted by 700 micro finance companies of Russia for IIIQ 2016 amounted to 109,8 bln RUB, 60,3 bln RUB of which were granted for consumer goods purchasing and 49,5 bln RUB as micro loans. For 9 months of 2016 the volume of micro credits increased by 23,2%.

As of October 1, 2016, 7,97 mln active loans were recorded. That is by 33,3% higher than in the second quarter of the current year. 45% in the structure of micro finance institutions’ portfolio account for micro loans, and 55% - for consumer goods credits. For the first time for three years overdue payment for micro credits have increased – from 21,2% to 21,9%; the average amount of these borrowings has decreased firstly for consumer goods from 21,1 th RUB to 18,3 th RUB. Currently about 10 mln people in Russia took micro credits.

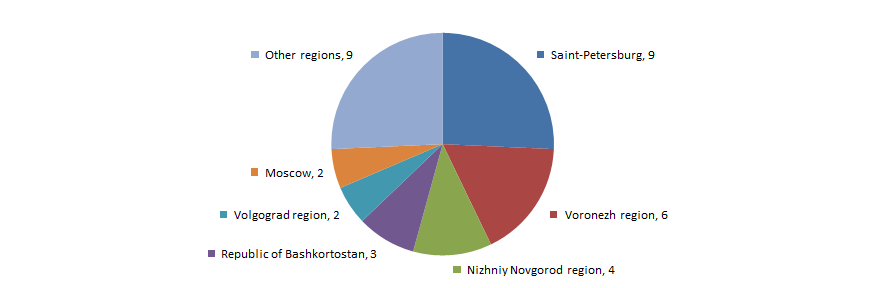

There is no strongly marked concentration of micro finance and micro credit companies in the regions of Russia. However a few of them is observed in Moscow being the largest financial center of the country. According to the Information and analytical system Globas-i 35 of companies in the sector with the highest volume of revenue for 2015 are located in 15 regions of Russia (Picture 3).

Big problems of small business

Is the state support in power to enliven the stagnating sector?

Despite the acting measures of the state support, the small business is still in crisis. As a result, increasingly greater amount of entrepreneurs come to conclusion: doing a business in Russia is unprofitable.

Who is who? According to current legislation, the small business includes enterprises having less than 100 employees and receiving the annual revenue amounting up to 800 million RUB. The data on small business enterprises can be found in the Unified register of small and medium-sized business entities (SME), which has been working since August 1st, 2016. The Register is maintained by the Federal Tax Service. Except small business entities it has the data about medium business entities (less than 200 employees, annual revenue up to 2 billion RUB) and micro-enterprises (less than 15 employees, annual revenue up to 120 million RUB). At the moment in the Unified Register of SME there are 5,7 million business entities (including 3 million sole entrepreneurs), providing working places for 18 million citizens. In general the small business is focused upon trade and services sector. The SME share in the Russian GDP amounts to around 20%.

Benefits are not for everyone. Representatives of the small business cite as the reason of the current negative situation the following things: both appreciation of credits and influence of sanctions, but in the first place they point to low efficiency of the state support measures. According to entrepreneurs, most often the provided benefits are instantly being cancelled out by adopting the new legislative instruments, causing the increase of the tax burden, necessity to report to the Pension Fund monthly and to spend resources on contestation of cadastral values. Several benefits operate only partially, for instance quotation of the small business in 10% of purchases volume of state companies and 15% of state procurement. Thus transport technical maintenance companies successfully participate in state procurement. They get help from major international events, forums, sporting contests. At the same time wholesale distributors and IT companies complain about non-transparency and complexity of procedures in state companies’ procurement, due to which it is impossible to use the benefits operating officially. Beneficial lease of premises promoted as contingency measures is as well effective not for all.

It is for Government to decide. In June the Ministry of Economic Development represented the Strategy of SME development till 2030 and just recently the Government Project office has represented the new national project «Small business and assistance for sole entrepreneurial initiative» (approved as of December 5th). The project will be supervised by Igor Shuvalov, the First Deputy Prime Minister. Earlier the Federal Corporation for the Development of SME was established in order to support the sector. The Strategy of SME development is focused on easing access to capital for business, as well as reduction of administrative burden. Plan of measures, focused on implementation of strategy, consists of 45 items, three of which involve additional financing (grant support development, making asset contribution to the Corporation for the Development of SME for increase of access to leasing, centers of competence development in innovation sector). The strategy goal is to double the share of SME in GDP – to 40%, which conforms to level of developed countries. The national project «Small business and assistance for sole entrepreneurial initiative» is a specification of the Strategy of SME development and activity program of the Federal Corporation for the Development of SME for the near future. According to the Government plans, the project is to be implemented by March 2019. The increases in number of SME, as well as increase in share of credits to the small business in the general lending portfolio of banks are the criteria of the project success. Implementation of the project involves various measures for sole and small entrepreneur support. In particular, due to extension of business entity access to procurement of the largest customers, the annual volume of their sole and small entrepreneur procurement in 2018 is to amount to no less than 17,5%. Moreover, within project implementation it is planned to evolve the system of personnel training, retraining and development for sole or small entrepreneurship. It should increase the awareness of entrepreneurs about existing possibilities of establishment and development of business and the level of economic and financial literacy.

Survival today is for prosperity in future. Under current conditions of economic stagnation namely the small business entities could become the source of economic development, which promotes the upturn of other sectors. However today agenda of the SME is not the prosperity, but the survival. Under conditions of increasing competition and reduction of demand small entrepreneurs are forced to cut costs, pare down wages, increase the working hours of the personnel and diversify business. Low efficiency of the state support and expensive credit means are important but not the single reasons of SME stagnation. It is essential to bear in mind the problems in state procurement sector and control and supervision activity, which the business community faces every day and which prevent carrying out effective activities, primarily small enterprises (see the Article as of 06.10.2016 and Article as of 20.10.2016). There are state initiatives in solving these problems; it remains to wait its effective implementation. It appears that the representatives of the small business hope for the positive effect of the last government steps: entrepreneurs feel optimistic about the future, expecting to achieve pre-crisis indicators of 2013 in the next 12 months. Several experts make more conservative predictions, however they also agree that it is possible to achieve pre-crisis level in 2018.